EUR/JPY

Meri guzarishein, mere tajurba kar traders ke liye hain jinhein dikh raha hai ke Asian market ke harkatein aksar mood tay karti hain, jinhein European market ke amal phoolon ka jawab dete hain. Aaj, yeh trend samne aaya, jo ek chhoti arzi kharidari ka moqa signal kar raha tha. Lekin, mogheya faiday ke bawajood, asli khatron ka tasleem karna zaroori hai.

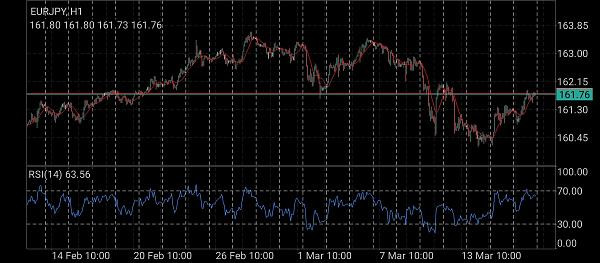

Moujooda doran, chaar ghanton ke time frame par, bechnay walay bazaar mein qaabu hai. Halankeh yeh seedha bechnay ka manzar saabit ho sakta hai, magar haalat zyada tanazur mein hain. Aaj ke qeemat ke range mein ek bechnay ka ilaqa (160.65 - 162.50) aur ek kharidari ka ilaqa (162.60 - 164.50) tajwez kiye gaye hain. Jabke EUR/JPY 161.69 par trade kar raha hai, maine 161.64 par ek long position shuru kiya (161.30 par ek stop loss ke sath) jis ka nishana ooper ke ilaqon 162.00 aur 162.50 tak tha.

Lekin, in darustiyon ke baad bhi shakayatein hain. 162.50 ke ooper se guzar jana ek bullish trend ki jari rahne ka tasdeeqi saboot ho sakta hai, jo 163.60 tak jaa sakta hai. Magar aise buland maqasid tajwezati hain. Shakhsan, main 162.50 ke qareeb ek wapasat ka intezar karta hoon, jahan main aise short positions ke liye dobara jaa'ez karunga.

Din ke chart mein dobara zoom karne par, moujooda neeche girawat ek bara uptrend ke andar correctiv lagti hai. Magar bullish rahnumai seema takk hoti hai. Agar qeemat 159.50 ke neeche jaati hai, to ek bearish palat sakta hai. Abhi ke liye, main mazeed ooper ki harkat ka intezar karta hoon, lekin sambhal kar.

Tijarat mein, tabdili ka tarika eham hai. Halankeh meri short-term strategy immediate trends ka istifada karne par mabni hai, lekin main bazar ke baray dynamics ka khayal rakhta hoon. Jab main aaj ke qeemat ke amal ka intezar karta hoon, to mujhe emerge hone wale signals ke buniyad par apna approach badalne ke liye tayyar rakhta hoon.

Mukhtasir, aaj ka mansooba chhoti arzi kharidari ke moqaat ka faida uthane par mabni hai ek zyadatar bearish bazaar environment ke andar. Lekin, main mutawasit hoon, ek gehri tashweesh ya trend ka palatne ka imkan ko pehchante hue. Aakhir mein, tijarat mein kamiyabi ka makhsoos amal intution, tajziya aur khatron ka nigrani tarkib ka ek misal hota hai.

Mujhe khawateen aur mard traders ke tamaam ke liye kamiyabi ke arzoo karta hoon, jinhein main waisi tarah sheyr aur she-wolves ke talash karne ki mukhlis khawahish ke taur par tasweer karta hoon – chust, strateegi aur hamesha taiyar ma'ishat ke moqaat ko qabz karne ke liye.

Meri guzarishein, mere tajurba kar traders ke liye hain jinhein dikh raha hai ke Asian market ke harkatein aksar mood tay karti hain, jinhein European market ke amal phoolon ka jawab dete hain. Aaj, yeh trend samne aaya, jo ek chhoti arzi kharidari ka moqa signal kar raha tha. Lekin, mogheya faiday ke bawajood, asli khatron ka tasleem karna zaroori hai.

Moujooda doran, chaar ghanton ke time frame par, bechnay walay bazaar mein qaabu hai. Halankeh yeh seedha bechnay ka manzar saabit ho sakta hai, magar haalat zyada tanazur mein hain. Aaj ke qeemat ke range mein ek bechnay ka ilaqa (160.65 - 162.50) aur ek kharidari ka ilaqa (162.60 - 164.50) tajwez kiye gaye hain. Jabke EUR/JPY 161.69 par trade kar raha hai, maine 161.64 par ek long position shuru kiya (161.30 par ek stop loss ke sath) jis ka nishana ooper ke ilaqon 162.00 aur 162.50 tak tha.

Lekin, in darustiyon ke baad bhi shakayatein hain. 162.50 ke ooper se guzar jana ek bullish trend ki jari rahne ka tasdeeqi saboot ho sakta hai, jo 163.60 tak jaa sakta hai. Magar aise buland maqasid tajwezati hain. Shakhsan, main 162.50 ke qareeb ek wapasat ka intezar karta hoon, jahan main aise short positions ke liye dobara jaa'ez karunga.

Din ke chart mein dobara zoom karne par, moujooda neeche girawat ek bara uptrend ke andar correctiv lagti hai. Magar bullish rahnumai seema takk hoti hai. Agar qeemat 159.50 ke neeche jaati hai, to ek bearish palat sakta hai. Abhi ke liye, main mazeed ooper ki harkat ka intezar karta hoon, lekin sambhal kar.

Tijarat mein, tabdili ka tarika eham hai. Halankeh meri short-term strategy immediate trends ka istifada karne par mabni hai, lekin main bazar ke baray dynamics ka khayal rakhta hoon. Jab main aaj ke qeemat ke amal ka intezar karta hoon, to mujhe emerge hone wale signals ke buniyad par apna approach badalne ke liye tayyar rakhta hoon.

Mukhtasir, aaj ka mansooba chhoti arzi kharidari ke moqaat ka faida uthane par mabni hai ek zyadatar bearish bazaar environment ke andar. Lekin, main mutawasit hoon, ek gehri tashweesh ya trend ka palatne ka imkan ko pehchante hue. Aakhir mein, tijarat mein kamiyabi ka makhsoos amal intution, tajziya aur khatron ka nigrani tarkib ka ek misal hota hai.

Mujhe khawateen aur mard traders ke tamaam ke liye kamiyabi ke arzoo karta hoon, jinhein main waisi tarah sheyr aur she-wolves ke talash karne ki mukhlis khawahish ke taur par tasweer karta hoon – chust, strateegi aur hamesha taiyar ma'ishat ke moqaat ko qabz karne ke liye.

تبصرہ

Расширенный режим Обычный режим