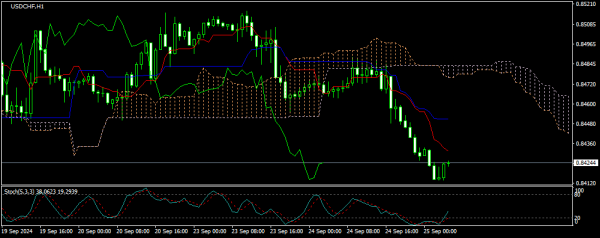

Aaj humari guftagu USD/CHF currency pair ke price action analysis par hogi. USD/CHF ke hawalay se ek challenge hai, aur iska direction abhi tak clear nahi ho raha. Aaj subha ek initial upward movement dekhne ko mili thi, magar yeh zyada der tak nahi chal saki kyunke buyers growth ko sustain karne mein nakam rahe. Natija yeh hua ke price neeche gir gaya, magar baad mein daily low se thoda rebound kar gaya. Chart par ek noticeable internal pattern hai, lekin iski development abhi tak unclear hai. Fibonacci retracement target 61.9% abhi door hai, aur buyers ke chances ke hawalay se koi solid indication nahi hai.

Sab se reliable signal jo growth ke mazid strong hone ka saboot dega, woh 4-hour chart par 200-period moving average ke upar break hoga. Agar price 0.8483 ke upar break karta hai, to yeh 0.8491 tak chadh sakta hai aur 0.8511 ka target achieve kar sakta hai. Magar agar price 0.8476 ke neeche girta hai, to main iske 0.8465 tak ya phir 0.8451 tak descend karne ki umeed karta hoon.

Pichlay haftay ke price action ke basis par, main ne Friday ko growth ki umeed ki thi, jahan pair ne support ko 0.84692 par test kiya aur wapis se resistance 0.85199 ki taraf pull back kiya. Magar, price ne dobara us resistance ko retest nahi kiya, aur main ne Monday ko ispar mazeed testing ka intezar kiya tha. Meri umeed ke baraks, pair ne dobara decline kiya aur 0.84692 support ko test kiya. Halanke, price is level ke neeche close nahi hui, main ab bhi bullish outlook rakhta hoon. Aaj ka forecast bhi galat sabit hua jab price ne 0.84692 ke neeche close kiya aur ek bearish candle banayi. Agar price is level ke neeche close hoti hai, to agla target 0.84027 support ki taraf decline hoga. Magar, agar pullback 0.84692 ke upar close karta hai, to growth ka naya priority target USD/CHF ke liye 0.85199 resistance hoga.

Sab se reliable signal jo growth ke mazid strong hone ka saboot dega, woh 4-hour chart par 200-period moving average ke upar break hoga. Agar price 0.8483 ke upar break karta hai, to yeh 0.8491 tak chadh sakta hai aur 0.8511 ka target achieve kar sakta hai. Magar agar price 0.8476 ke neeche girta hai, to main iske 0.8465 tak ya phir 0.8451 tak descend karne ki umeed karta hoon.

Pichlay haftay ke price action ke basis par, main ne Friday ko growth ki umeed ki thi, jahan pair ne support ko 0.84692 par test kiya aur wapis se resistance 0.85199 ki taraf pull back kiya. Magar, price ne dobara us resistance ko retest nahi kiya, aur main ne Monday ko ispar mazeed testing ka intezar kiya tha. Meri umeed ke baraks, pair ne dobara decline kiya aur 0.84692 support ko test kiya. Halanke, price is level ke neeche close nahi hui, main ab bhi bullish outlook rakhta hoon. Aaj ka forecast bhi galat sabit hua jab price ne 0.84692 ke neeche close kiya aur ek bearish candle banayi. Agar price is level ke neeche close hoti hai, to agla target 0.84027 support ki taraf decline hoga. Magar, agar pullback 0.84692 ke upar close karta hai, to growth ka naya priority target USD/CHF ke liye 0.85199 resistance hoga.

تبصرہ

Расширенный режим Обычный режим