hai. Tawajju trading opportunities ko pehchaanne par hai, aur alternative scenarios ke liye perfect planning zaroori hai. Kal ke price movements ki gehri tehqeeq aaj ke munafa ki potential ka jaiza lene ka buniyadi basis hai. Filhal, USDCHF currency pair par zyada tawajju hai, jo ke pehle ek kafi zyada decline dekha gaya. Yeh decline trading shuru karne ka ek ahem signal hai, magar yaad rahe ke transaction execution tab hi karna chahiye jab pakki tasdeeq ho Waqe jo northern territory mein hai. Tou, yahan sales kaise open karte hain? Nahi, main thora option ko admit kar sakta hoon; thora aur neechay, koshish karo ke decline belt 0.9100+ tak le aao. Aur agar yeh hota hai, tou main doosra purchase phir se open karunga. Aaj ke liye operating ranges. Sell zone (0.9020–0.9085) or buy zone (0.9095–0.9175). Current price USDCHF 0.9128 hai. Tumne kaisa kiya? Main purchases mein hoon; keh sakte hain ke main ne order 0.9125 par open kar liya (stop 0.9085). Budh ko, increase ke steps the 0.9135, 0.9155, aur 0.9175. Pehla target lenge, aur main foran sin se aage barh kar bina loss ke move karunga. Mujhe lagta hai ke humein main movement American shift ke doran milegi. Europe hamesha humein distances se khush nahi karta. Agar main ghalat nahi hoon tou M30 ke lower half par mere paas ek head aur shoulders figure hai. Sirf ulta, aur hamare legs upar hain. Tajurba se, aisi figure hamesha movement ko paon ki taraf le kar jaati hai. Hamare case mein, north ki taraf. Yaq

`

X

Collapse

new posts

-

#5311 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5312 Collapse

currency pair par zyada tawajju hai, jo ke pehle ek kafi zyada decline dekha gaya. Yeh decline trading shuru karne ka ek ahem signal hai, magar yaad rahe ke transaction execution tab hi karna chahiye jab pakki tasdeeq ho Waqe jo northern territory mein hai. Tou, yahan sales kaise open karte hain? Nahi, main thora option ko admit kar sakta hoon; thora aur neechay, koshish karo ke decline belt 0.9100+ tak le aao. Aur agar yeh hota hai, tou main doosra purchase phir se open karunga. Aaj ke liye operating ranges. Sell zone (0.9020–0.9085) or buy zone (0.9095–0.9175). Current price USDCHF 0.9128 hai. Tumne kaisa kiya? Main purchases mein hoon; keh sakte hain ke main ne order 0.9125 par open kar liya (stop 0.9085). Budh ko, increase ke steps the 0.9135, 0.9155, aur 0.9175. Pehla target lenge, aur main foran sin se aage barh kar bina loss ke move karunga. Mujhe lagta hai ke humein main movement American shift ke doran milegi. Europe hamesha humein distances se khush nahi karta. Agar main ghalat nahi hoon tou M30 ke lower half par mere paas ek head aur shoulders figure hai. Sirf ulta, aur hamare legs upar hain. Tajurba se, aisi figure hamesha movement ko paon ki taraf le kar jaati hai. Hamare case mein, north ki taraf. Yaqeen se kehna mushkil hai ke bar kitni upar uthayi jaayegi. Magar mujhe lagta hai ke 0.9220 ka update hoga, aur phir hum bulls ke pressure ko dekhenge Main sab ko mashwara doon ga ke daily aur weekly charts ke bare mein soch kar naye trading days ke liye ek unique sig

nal hasil karen. Khabron ka asar kal aur mangal tak reh sakta hai. Is liye, humein bullish concept ko follow karne ki koshish karni chahiye. Iske liye, humein buy entry leni chahiye aur take profit level 0.9009 par set karna chahiye. Yeh strategy current market trends ke mutabiq hai aur US dollar ke momentum ko leverage karti hai. Mujhe lagta hai ke US dollar ke Non-Farm Employment Rate news ka asar ane wale dinon mein barqarar rahega. Tareekhi tor par, yeh news market movements par kafi asar daalti hai, aur is se yeh expect kiya ja sakta hai ke yeh asar barqarar rahega. Isko madde nazar rakhtay hue, market pehle do din buyers ke haq mein rahega. Is trend ko monitor karke profitable trades mil sakti hain. Take-profit level 0.9009 par set karke, hum gains maximize kar sakte hain aur risk ko manage kar sakte hain. Overall, USDCHF par bullish stance barqarar rakhna ek aqalmandana strategy lagti hai, current strength of the

USD/CHF pair ek continued bullish trend ki taraf ishara karti hai, supported by solid technical indicators. Jo support range 0.8862 aur 0.8830 ke darmiyan hai, jo 0.8853 tak extend hoti hai, yeh trend ke liye ek strong foundation provide karti hai. 0.8863-0.8836 support zone se breakout further reinforce karta hai is outlook ko, jo ke potential rally ko indicate karta hai. Humari strategy, jo ke in market movements ke sath align karti hai, is upward momentum ka faida uthane ke liye positioned hai. Aage barhte hue, in key levels ko monitor karna essential hoga taake humari approach market dynamics ke sath aligned

-

#5313 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

samajh aur forecasting movements ke liye ehtiyaat ki darkaar hoti hai. USD/CHF pair, jo US dollar aur Swiss franc ke darmiyan exchange rate ko represent karta hai, apni volatility aur domestic aur global economic factors ke liye sensitive hone ki wajah se mashhoor hai. Filhal, traders mukhtalif nazaryat ka samna kar rahe hain is currency pair ke potential direction ke bare mein, jo ke informed trading decisions banane mein complexities aur challenges ko ubhar kar laata hai USD/CHF pair ke liye mixed outlook ke peeche kai factors hain. Ek key factor hai US Federal Reserve aur Swiss National Bank (SNB) ki mukhtalif monetary policies. Federal Reserve ka interest rates aur monetary tightening ya easing par stance US dollar ki strength ko significant tor par impact kar sakta hai. Doosri taraf, SNB ki policies, jo ke aksar franc ki appreciation ko curb karne aur export-driven Swiss economy ko support karne ke liye low interest rates ko maintain karne par focus karti hain, franc ki value ko influence kar sakti hain. In policies mein divergences USD/CHF pair mein volatility create kar sakti hain Iske ilawa, global economic events aur geopolitical developments USD/CHF pair ke direction ko shape karne mein crucial role ada karti hain. Masalan, economic data releases jaise GDP growth rates, employment figures, aur inflation rates dono United States aur Switzerland se market sentiment ko sway kar sakti hain. Geopolitical tensions, trade disputes, aur risk appetite mein tabdiliyan bhi pair ki fluctuations mein contribute karti hain. Swiss franc ko aksar ek safe-haven currency mana jata hai, jo uncertainty

nty ke daur mein investment ko attract karta hai, jo ke US dollar ke against sudden appreciation ka sabab ban sakta hai

Technical analysis USD/CHF pair ke potential movements par valuable insights offer karta hai. Abhi, pair ki price action bullish aur bearish signals ka mix reflect karti hai. Masalan, daily chart par candlestick patterns ka mutala potential reversal ya continuation signals ko reveal kar sakta hai. Indicators jaise Moving Averages (MA), Relative Strength Index (RSI), aur MACD (Moving Average Convergence Divergence) ko aksar pair ke momentum aur trend strength ko gauge karne ke liye use kiya jata hai. Moving Averages support aur resistance levels ko identify karne mein madad kar sakti hain, jo ke potential entry aur exit points ke bare mein clues provide karti hain. Agar USD/CHF pair apni moving averages ke upar trade kar rahi hai, to yeh bullish trend ka ishara ho sakta hai, jabke neeche trade karna bearish momentum ko suggest kar sakta hai. RSI, jo ke price movements ki speed aur change ko measure karta hai, overbought ya oversold conditions ko signal kar sakta hai, jo potential reversals ko anticipate karne mein madadgar hota hai. Iske saath, MACD, jo ke short-term aur long-term momentum ko compare karta hai, crossover signals provide kar sakta hai jo trend direction mein shifts ko indicate karte hain

In technical tools ke bawajood, traders ke darmiyan divergent views forex market ki inherent uncertainty aur complexity ko reflect karte hain. Kuch analysts US economy ki strength par zor de sakte hain aur Federal Reserve ko hawkish stance maintain karne ki umeed karte hain, jo ke US dollar ko boost kar sakta hai. Doosre Swiss franc ki safe-

-

#5314 Collapse

USD/CHF currency pair ne pichle trading session mein notable decline experience ki, aur din ke lowest point ke qareeb close hui. Market sentiment uncertain hai aur koi immediate clear targets nazar nahi aa rahe, siwaye kuch door ke high points ko revisit karne ke. US dollar ko mixed economic signals ke beech challenges ka samna tha, jisme ek positive non-farm payroll report rising unemployment figures se overshadow ho gayi. Federal Reserve Chair Jerome Powell ke scheduled speeches throughout the week se markets mein volatility expect ki ja rahi hai, jo USD/CHF pair ko 0.9081 region ki taraf le ja sakti hain, jahan selling pressure intensify ho sakti hai.

Pichle hafte USD/CHF pair mein significant depreciation dekhi gayi, primarily Swiss franc ki robust performance aur US dollar ki concurrent weakness ki wajah se. Franc ki strength kuch factors ki wajah se boost hui, jo pair ke notable decline ka sabab bani.

Recent market movements analyze karte hue, yeh evident hai ke USD/CHF pair ne considerable selling pressure face kiya. Yeh downtrend economic data releases aur geopolitical developments ki combination ki wajah se hua jo investor sentiment par asar dalti hai towards US dollar. Despite positive non-farm payroll numbers ke jo traditionally market expectations ko influence karti hain, US mein escalating unemployment rates ke concerns ne greenback par downward pressure exert kiya

Aage dekhte hue, market participants closely monitor kar rahe hain upcoming speeches by Federal Reserve Chair Jerome Powell. Yeh scheduled addresses near-term market sentiment ko shape karne mein pivotal ho sakti hain aur currency markets, including USD/CHF pair, mein increased volatility ko lead kar sakti hain. Traders aur investors particularly attentive hain kisi bhi hints ya signals regarding future monetary policy decisions from the Federal Reserve ke liye, jo further US dollar ki trajectory ko impact kar sakti hain against the Swiss franc

-

#5315 Collapse

USD/CHF Price Overview:

Iss waqt, hum USD/CHF currency pair ki price performance ka analysis kar rahe hain. Bollinger index ka istemal karte hue, hum USD/CHF currency pair ko dissect karenge aur perpendicular volumes ke sath situation ko assess karenge. Pair abhi 0.89853 pe trade kar raha hai, aur long position kholna ek acha mauqa lag raha hai. Potential target index ki upper boundary pe, 0.89875 par hai. Kyunki yeh position index ke realignment ke wajah se thodi adjust ho sakti hai, isliye minor price adjustments zaroori honge. Price movement ko average index 0.89817 ke relative monitor karna bhi bohot zaroori hai. Agar reversal pattern form hota hai aur current quotation 0.89817 se neeche girta hai, toh main long position ko minor loss ke sath close karne ka sochunga aur sell trade initiate karunga, khaaskar agar sellers apni positions ko strengthen karte hain aur decline ko 0.89817 ke neeche confirm karte hain. Is scenario mein, sell target lower band's border 0.89759 pe hoga. Market ke volatility aur participant activity ko dekhte hue, ek flexible strategy aur quick response to changes trading ke liye bohot important hain

Ab D1 period chart ko consider karte hain. Surge structure ne continue kiya, aur MACD index lower sell zone mein phir se fall hua. Pehle, price descending resistance line tak pohonch gayi thi jo last do peaks ke along bani thi. Isliye, yahaan se sell trades ko downwards reaction ke liye consider kiya gaya tha. Aap isse catch kar sakte hain lower period, jaise M5 pe switch kar ke aur glass level observe kar ke, jahan support resistance mein change hota hai. Jaise ke nazar aa raha hai, yeh reaction significant tha kyunki RSI index upper overheating zone se drop hua. Overall, pichle trading week mein US dollar ka major world currencies ke against decline hua. Price directly vertical support level 0.8983 tak gir gayi thi. Yeh level, jo pehle upwards break hua tha, price decline ko contain kar sakta hai aur phir se descending line tak growth initiate kar sakta hai, jo phir se upwards break ho sakti hai

-

#5316 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hamari current exploration mein USD/CHF currency pair ki price action analysis par focus hai. USD/CHF pair stable hai aur koi fundamental changes nahi hain, lekin aaj thoda sa growth show ho raha hai. Volatility low hai, jo bearish trend-based direction mein pressure indicate karta hai. Is ke bawajood, short initiative persist kar rahi hai jisse current growth pullback ke roop mein ho sakti hai, jahan potential targets highs par hain. Ek favorable index report ke baad dollar ko significant support mila, jis se uski value increase hui hai. Main abhi short-term strategies par concentrate kar raha hoon, specifically instances par jahan price 0.9051 ko exceed karti hai. Ek clear chart structure ke liye wait kar raha hoon. USD/CHF currency pair mein uptrend hai. Char ghante ki chart par technical analysis indicate karta hai ke price Kijun-sen aur Tenkan-sen signal lines aur Ichimoku cloud ke upar trade kar raha hai. Chikou-span line price chart ke upar hai, aur "golden cross" bhi active hai. Bollinger bands aur stochastic oscillator lines upar ki taraf point kar rahe hain, relative strength index 50 ke upar hai, aur trend filter oscillator green hai, jo bullish market sentiment signal karte hain. Is ke mutabiq, buying abhi priority hai. Upward movement ke liye nearest potential target resistance level 0.8958 hai, jahan price approach kar rahi hai. Isliye, caution advise karta hoon. Agar price is level se upar jaati hai, to hum 0.8988 tak further growth dekh sakte hain. Conclusion mein, analysis USD/CHF ke liye bullish outlook indicate karti hai, jahan key resistance levels watch karne hain. Traders alert rahen aur technical indicators aur market conditions ko consider karen. In dynamics ko sahi tareeqe se interpret karna successful trading ke liye zaroori hai.

-

#5317 Collapse

CHF currency pair ne daily (D1) timeframe chart par dilchasp patterns dikhai hain, khaaskar 0.8923 level ke qareeb aik aham selling zone samne aya hai. Yeh level traders aur analysts dono ke liye aik focal point ban gaya hai, kyun ke yeh forex market mein bullish aur bearish forces ke darmiyan chal rahi jang mein aik key area of interest ko represent karta hai. Hali trading sessions mein, USD/CHF ek period of heightened volatility se guzar raha hai, aur price action broader economic aur geopolitical factors ko reflect kar raha hai. 0.8923 level aik critical resistance point sabit hua hai, jahan sellers ne consistently step in kiya hai aur price ko lower drive kiya hai. Is 0.8923 mark par repeated selling pressure ne 'key selling zone' banaya hai.

Is key selling zone ki formation technical aur fundamental factors ki confluence ki wajah se hai. Technical side par, 0.8923 level bohot se indicators aur chart patterns ke sath align karta hai jo bearish bias suggest karte hain. For instance, moving averages, Fibonacci retracement levels, aur previous support aur resistance zones sab is price point ke qareeb converge karte hain, jo iski significance ko aik potential turning point ke tor par reinforce karte hain.

Fundamentally, USD/CHF pair ki movements US dollar aur Swiss franc ke relative strength se influenced hain, jo ke economic data releases, central bank policies, aur geopolitical developments se affected hoti hain. Hali data United States se, including employment figures, inflation rates, aur GDP growth, ne economy ka aik mixed picture paint kiya hai, jo Federal Reserve ke monetary policy ke future direction ke bare mein uncertainty ko lead karta hai. Yeh uncertainty USD/CHF pair mein choppy price action ko contribute kiya hai

[ATTACH=CONFIG]n13027255[/ATTACH]

In technical aur fundamental factors ke darmiyan interplay ne USD/CHF pair ke liye aik dynamic trading environment create kiya hai. Traders 0.8923 level ko closely monitor kar rahe hain, signs dekh rahe hain ya to aik breakout ka ya phir current bearish trend ke continuation ka. Agar yeh level ke ooper breakout hota hai, toh yeh market sentiment mein aik shift ko signal kar sakta hai, jo higher resistance levels ki taraf rally lead kar sakta hai. Conversely, agar yeh resistance ko break karne mein fail hota hai, toh bearish outlook reinforce ho sakta hai, aur pair ke lower support levels ko retest karne ka likely hai

Kal USD/CHF par, ek choti si southern pullback ke baad, price ne reverse kiya aur ek confident bullish impulse ki wajah se north ki taraf push hui, jiske natije mein ek full bullish candle bani, jo ke resistance level ke upar consolidate hone mein kaamyab hui, jo ke mere markings ke mutabiq 0.89934 par hai, aur pichle daily range ke maximum ke bhi upar, southern direction mein jaati turning candle ko tod diya. Moujooda surat-e-haal mein, mujhe poora yakeen hai ke aaj price northern direction mein push hoti rahegi, aur, jaise ke maine baarha kaha hai, is surat mein, main resistance level ko jo ke 0.91572 par hai, apne nazar mein rakhoon ga. Is resistance level ke qareeb do scenarios ho sakte hain. Pehla scenario yeh hai ke price is level ke upar consolidate ho jaye aur northern movement barh jaaye. Agar yeh plan kaamyab hota hai, to main price ko resistance level 0.92244 par move hota dekhne ka intezar karoonga. Is resistance level ke qareeb, main ek trading setup ke formation ka intezar karoonga, jo ke aage ki trading direction ka tayun karne mein madad karega. Zaroori nahi ke yeh northern target ka plan door tak kaam kare, lekin main abhi is option ko consider nahi kar raha hoon, kyunki mujhe iski quick implementation ki umeed nahi. Ek alternative option jab price resistance level 0.91572 ke qareeb hoti hai, to ek reversal candle banne ka plan aur downward price movement ka resumption ho sakta hai. Agar yeh plan kaamyab hota hai, to main expect karoonga ke price support level 0.89934 par ya support level 0.89132 par wapas aaye. In support levels ke qareeb, main bullish signals ki talash karta rahoon ga, aur upward price movement ka intezar karoonga. Ek option southern targets ka bhi hai, lekin main abhi isko consider nahi kar raha hoon, kyunki mujhe iski quick implementation ki umeed nahi.

- 0.8885 USDCHF

- Mentions 0

-

سا0 like

-

#5318 Collapse

USD/CHF Jumeraat ke early European session mein, USD/CHF pair qareeb 0.8945 ke qareeb recover hua. Ye harkat ahem maaliyat data aur market ke tajarbat ke baad ki gayi. Pair par asar dalne wala aik ahem factor US Producer Price Index (PPI) ka kamzor hona tha jo ki umeed se kam nikla. PPI aam tor par woh average price change ko measure karta hai jo domestically produce hone wale maal par waqt ke saath hota hai. Is maaliyat data ke bawajood, USD/CHF pair ki giravat ko had se zyada tabah karne wale strong stance se roka gaya jo Federal Reserve (Fed) ke taraf se aya. Fed ki nazar mein, jo ke monetary policy ke liye zyada aggressive approach ko indicate karta tha, ye amreeki dollar ko madadgar sabit hua. Aik hawkish stance aam tor par inflation ko control karne ke liye monetary conditions ko tight karne ki tayyari ko zahir karta hai, jo keemat ko mazboot kar sakta hai.

Switzerland ki taraf se, May ke Producer aur Import Prices ke report ne pichle mahine ke comparison mein 0.3% giravat dikhayi. Ye giravat April mein 0.6% ke izafay ke baad aayi thi aur market ki umeed se kam thi. Producer aur import prices ki kam hona kabhi kabar slow economic activity ya Switzerland ke andar inflationary pressures mein kami ko zahir karta hai, jo Swiss franc ki mazbooti ko dosri currencies jaise ke amreeki dollar ke muqablay mein asar andaz hota hai. Trading Idea: Kul mila kar, USD/CHF pair ke qareeb 0.8945 level par movement US maaliyat data, Federal Reserve ki policies ke umeed, aur Swiss maaliyat indicators ke mutabiq aik complex interaction ko reflect karta tha. Traders aur analysts aage bhi in factors ko nazdeek se nazar andaz karte rahenge taake pair ke future direction ke baray mein mazeed insights hasil ki ja sake. Mere khayal mein agar 0.8863 ke neechay girne ka scenario banay, toh selling business open hoga aur investors apni selling lot push karne mein dilchaspi rakhenge.

-

#5319 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Haal hi ki market analysis ke mutabiq USD/CHF currency pair ne downward trend ka samna kiya hai. Ab tak, pair ek well-defined descending channel ke lower boundary ke qareeb aa raha hai, aur umeed hai ke near term mein yeh 0.8896 ke aas paas pohonch sakta hai. Monday se shuru hotay hi, market observers yeh anticipate karte hain ke yeh downward movement current selling pressure se driven hai. Agar pair waqai descending channel ke lower border 0.8896 par pohonch jata hai, to yeh level support zone ka kaam kar sakta hai, jo price direction mein reversal ko prompt kar sakta hai.

Agar reversal hota hai, to analysts suggest karte hain ke pair upper boundary of the descending channel ki taraf upward movement dekh sakta hai, jo ke 0.8952 mark ke qareeb projected hai. Yeh upper boundary ek potential resistance level ko represent karta hai jahan selling pressure dobara intensify ho sakta hai.

USD/CHF currency pair ke overall primary trend ko significant selling pressure characterize karta hai. Local support levels jaise ke 0.8896 ke aas paas buyers ke occasional attempts ke bawajood, predominant sentiment bearish hi rehta hai.

Technical standpoint se, traders ko price action closely monitor karne ka mashwara diya jata hai. Primary downtrend ke aligned potential short positions ke liye ek crucial entry point tab emerge ho sakta hai agar sellers price ko support level 0.8894 ke neeche push karne mein kamyab ho jate hain. Yeh scenario likely sellers ke momentum ko maintain karne ki strength ko confirm karega, khaaskar agar price is critical level ke neeche consolidate hoti hai.

Is anticipated price behavior scenario mein, analysts ek aur significant level 0.8889 ko closely dekh rahe hain. Yeh level recent downward movements ki maximum extent ko reflect karta hai. Traders aur investors yeh dekhne ke liye keen hain ke yeh level support ke tor par hold karta hai ya selling pressure ke aur intensify hone par breach hota hai.

-

#5320 Collapse

Technical analysis of the USDCHF pair

Daily chart

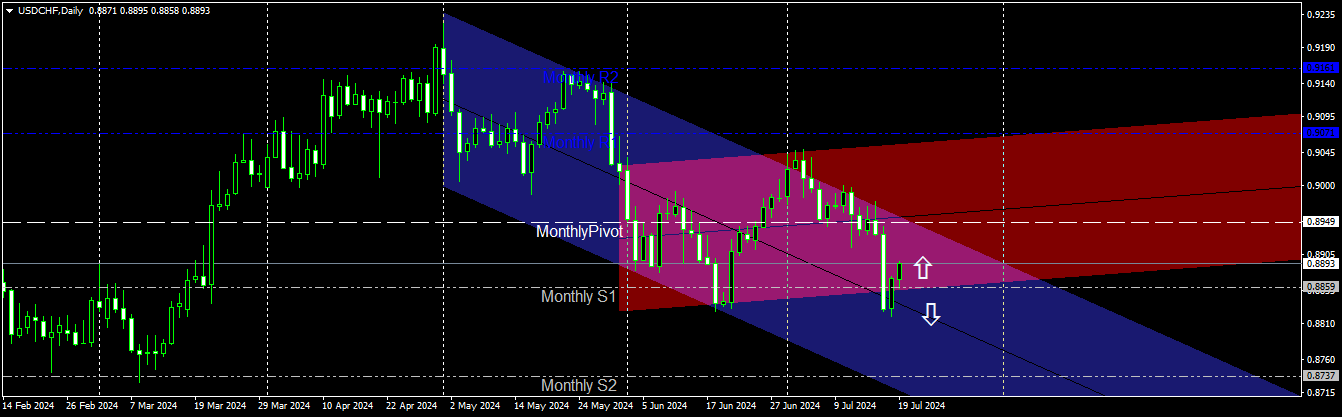

Dainik chart par pair ke liye, humein ek neeley channel hai jo neeche ki taraf hai, jo pichle do mahino ke dauraan ke price movement ko darshata hai, aur ek laal channel hai jo ek mahine ke dauraan ke price movement ko darshata hai aur ismein, ek price triangle bana tha, jismein price ab tak chala aaya hai, jab price ne is mahine shuru karne par triangle ko neeche todne ki koshish ki, lekin usne resistance ka samna kiya, aur ek price peak bana aur giravat hui, aur badhne aur girne wale dinon ke beech, price triangle ke range ke andar hi raha.

Aakhri neeche ki lehar mein, price ko safalatapoorvak triangle ko neeche todne mein safal ho gaya lekin triangle ke neeche sthir nahin hua, jab price ne kal triangle ke andar wapas aane ke liye kiya, aur aaj price lower triangle line se aur mahine ke star 0.8859 se samarthan prapt kar raha hai.

Isliye yah ummeed ki jaati hai ki nazdeeki samay mein price movement oopar ki or hoga mahine ke pivot level tak ke upper triangle line par, aur mahine ke pivot level 0.8949 par price ke vyavahar pair ke agle price disha ka nirnayak hoga, jaise hi hamein price movement ke do sambhavna hain.

Pehli sambhavna hai ki price upper triangle line aur mahine ke pivot level se samarthan karega, jisse giravat shuru hogi, jo pair ke neeche ke trend ke jariye jaari rakhne ki bhi suchna hogi.

Jab price triangle aur mahine ke pivot level ko tod dega, to yah ek oopar ki lehar ka sanket hoga aur do mahino pahle price ne neeche ki sudhar ke shuruat ki thi, tab tak oopar ke trend mein lautega.

Isliye vyapaar salah yah hogi ki nimn staron par dhyan kendrit kiya jaye

Pehla, mahine ke pivot star

Is ke neeche beari shikayat ya keemat ke vishesh rukh ke baad aap upar se upar kar sakte hain.

Is ke baad is ke oopar sthiti ka sthayi ho jaane par mahine ke pivot star ke oopar bechne.

Dusra star hai sahayak star 0.8859, yahaan aap is star se neeche aane par pravesh kar sakte hain aur sahayak star 0.8737 tak bechne -

#5321 Collapse

USD/CHF ke mutabiq, kal buyers ne price ko northern direction mein correct karne ki koshish ki, magar peechle daily range ke maximum tak nahi pohanch paye, aur phir ek reversal hua aur ek candle form hui jo ke south ko indicate karti hai. Aaj, Asian session mein, sellers ne nearest support level ko test kiya jo ke meri estimation ke mutabiq 0.88809 par hai, aur ab tak us support se rebound kiya hai. Mujhe kuch khaas interesting nazar nahi aa raha aur main designated support level aur support level jo ke meri measurements ke mutabiq 0.88396 par hai, par apni observations continue karne ka plan bana raha hoon. Jaise ke maine kaha, in support levels ke near do scenarios develop ho sakte hain. Pehla scenario candle formation aur development ko resume karne se mutaliq hai. Agar ye plan implement hota hai, to main price ka mirror resistance level par return ka intezar karunga jo ke meri estimation ke mutabiq 0.89934 par hai. Agar price is resistance level ke upar trade karti hai, to main expect karunga ke ek aur northward move ho resistance level tak jo ke 0.91572 par hai, ya phir resistance level jo ke 0.92244 par hai. In resistance levels par, main ek trade setup form hone ka intezar karunga jo ke next direction of trade ko determine karne mein madad karega. Bilkul, ek option more distant northern targets ko implement karne ka bhi hai, magar jab tak main us par focus nahi kar raha, mujhe iski immediate implementation ke prospects nazar nahi aa rahe. Ek alternative option jab price 0.88810 ya support level 0.88396 ko test kar raha ho, to price ke in levels se niche settle hone aur further south move hone ka plan ho sakta hai. Agar ye plan implement hota hai, to main price ka 0.87426 par support level ko break karne ka intezar karunga. Is level of support par, main bullish signals ko dhoondhta rahunga taake price gains ko resume karne ka expect kar sakoon. Agar main baat karoon, mujhe kuch khaas interesting nazar nahi aa raha. Main northern movement ko revive karne par focus kar raha hoon, isliye main nearest support levels se bullish signals ko dhoondh raha hoon

Eurodollar ke performance ke technical aspects par ghoor karte hue, daily chart ek wave formation ko reveal karta hai jo ke downward continuation ka clear pattern establish kar raha hai. Ye technical pattern traders aur analysts ke liye crucial hai kyunki ye market ke behavior aur potential future movements ka visual representation provide karta hai. Downward wave formation sustained bearish sentiment towards the Eurodollar ko indicate karta hai, jo ke suggest karta hai ke currency pair near term mein selling pressure face kar sakta hai. Fundamental perspective se dekha jaye, mukhtalif elements Euro ki weakness ko influence kar sakte hain. Eurozone se economic data releases, jaise ke lower-than-expected GDP growth ya disappointing employment figures, Euro par heavy weigh kar sakte hain. Iske ilawa, political developments, jaise ke European Central Bank (ECB) ke policy decisions par uncertainties ya ongoing geopolitical tensions, Euro ke decline ko exacerbate kar sakte hain

-

#5322 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/CHF

Is haftay ke shuru mein USD/CHF pair thoda sa barh raha tha. Aam tor par hum ek global uptrend mein hain, is liye mein yeh expect karta hoon ke price north ki taraf move karegi aur apne highs ko renew karegi. Magar pichle haftay USD/CHF pair ne decline kiya, jo ke most likely ek correction ka hissa tha, aur ab yeh 0.8975 ke resistance level ka samna kar rahi hai, jahan ab yeh trade ho rahi hai. Agar kal franc is level ke upar move karta hai, to phir long positions open karna safe hoga, bilkul jab yeh 0.8975 ke level se bounce kare. Iski probability kaafi high hai, kyunki hum dekh sakte hain ke price ne apne descending channel ko bhi break kar liya hai. Magar agar pair is level ke upar rehne mein fail hoti hai, to phir purchases mein jaldbazi mat kijiyega, kyunki ek aur trading signal jaldi hi mil sakta hai.

-

#5323 Collapse

USD/CHF pair abhi 0.8935 pe trade kar raha hai, jo din ke shuruati position ke qareeb hai, aur W1 chart pe 0.8957 pe hai, jahan volume aam tor pe kam hota hai. Agar price W1 chart pe 0.8928 level ke upar rehta hai, to yeh apni upward movement jari rakh sakta hai aur 0.8949 tak pahunch sakta hai, aur shayad 0.8967 tak bhi. Filhal zyada buying pressure dikh raha hai aur yeh level support provide kar raha hai.

Lekin agar price 0.8904 se neechay girta hai, to zyada chances hain ke pair aur zyada giray, shayad 0.8960 aur shayad 0.8970 tak bhi. Yeh scenario bearish sentiment dikhata hai aur sellers ke control lene ke chances barh jate hain. Traders ko in developments ko closely monitor karna chahiye taake market movements ko samajh saken aur apni trading strategies accordingly adjust kar saken. Agar price girta hai, to selling pressure barhne ke zyada chances hain. Main bullish signals dhoond raha hoon aur upward price movement ke wapas aane ka intezar kar raha hoon

Khulasah yeh hai ke main expect kar raha hoon ke price agle haftay north ki taraf move karay, qareebi resistance level ko test karte hue. USD/CHF pair ke movement ki explanation se yeh zahir hota hai ke crucial support aur resistance levels important hain. Agar price 0.8928 ke upar rehta hai, to upward trend jari reh sakti hai aur price 0.8949 aur 0.8967 tak pahunch sakti hai. Jabke agar price 0.8904 se neechay girti hai, to downward movement ka possibility hai jo 0.8960 aur 0.8970 tak pohanch sakti hai. Traders ko in levels ko closely monitor karna chahiye aur market sentiment ko samajh kar apni positions accordingly manage karni chahiye. Risk management strategies implement karna zaroori hai taake losses ko reduce aur profits ko maximize kar saken

Price abhi initial growth phase mein hai, haali mein 38.3 resistance ko reach karke consolidation dikhata hai. Aaj ki activity USD/CHF resistance ki taraf ja rahi hai chote impulses ke sath, jahan yeh steady hai. Ek reversal aur buying opportunity 14.7 ke around arise ho sakti hai. Yeh bhi mumkin hai ke USD/CHF 50 tak barhay aur phir gire

- 0.8886 USDCHF

- Mentions 0

-

سا1 like

-

#5324 Collapse

USD/CHF currency pair ke dynamic pricing behavior ka tajziya kar raha hoon. 15-minute chart par, price aksar TF minimum ko test karti rahi hai aur 0.8921 se upar ki taraf correction karne ki koshish kar rahi hai. Ek green zone ban raha hai, jo darshata hai ke price ko resistance levels ko test karna hoga. Inmein MA (Moving Average) 0.8966 aur mid-trend level 0.8991 shamil hain. Price ko mid-trend level ko todna hoga aur double top 0.9001 ki taraf barhna hoga taake extended green zone ko poori tarah se engage kiya ja sake. Wave structure niche ki taraf ban raha hai, aur MACD indicator zero ke qareeb hai. Pehle, price ne last two peaks ke along descending resistance line ko reach kiya. Shayad is line se sales hui hain jisse potential downward rebound ho sakta hai. Is situation ko M5 period par switch karke dekhna chahiye aur mirror level ko observe karna chahiye, jahan support resistance mein tabdeel hua. RSI indicator ka upper overheating zone se girna is downward rebound ko confirm karta hai.

Pichle hafte, US dollar major world currencies ke muqablay mein kamzor hua, jisne price ko 0.8997 ke horizontal support level tak giraya. Pehle yeh level upward break hua tha, lekin yeh mirror level price decline ko rok nahi paaya, jo ke descending line ki taraf barh gaya. Market ne price ko is level se neeche push kiya, aur is se upar hone ki koshishen naakas hui, jo ke aage ke downward movement ki taraf le gayi. Fibonacci grid par pehli wave ka 161.9 level possible lagta hai. Jab yeh target almost pura hua, corrective growth shuru hui, jo yeh darshata hai ke price phir se is wave ke bottom ke qareeb aa sakti hai, aur shayad Fibonacci grid par 200 level tak bhi pohnch sakti hai. Agar aap downward trade kar rahe hain to stops ka istemal zaroori hai, kyunki situation smoothly nahi chal sakti. Euro-dollar pair already high climb kar chuka hai aur gir sakta hai, jo ke USD/CHF pair ke growth ko cause kar sakta hai.

USD/CHF pair dollar ki demand mein zyada samanya niche ki taraf ka trend dikhata hai. MACD indicator negative territory mein gaya hai, jisse ek continued downward movement signal hota hai, aur price ne Kijun H-4 line ko cross kiya hai. Halaanki, main sirf in bearish signals par pura bharosa nahi rakhta. Agar pair agle haftay bhi girta rahega, to sellers ko 0.8911 (Murray 2.9) par strong support ka saamna karna hoga aur main yakeen rakhta hoon ke wo is mazboot support level ko challenge nahi karenge.

Dollar-franc pair ke weekly time frame ko analyze karte hue, main sthiti ki local raah ko samajhne ki koshish kar raha hoon. Price late April aur early May ke highs ke baad niche giri hai, jo ek trend channel ko dikhata hai. Screenshot mein dikhaye gaye do extreme candlesticks is bearish wave ka hissa hain. Yeh dekhna abhi bhi mushkil hai ke agle haftay bearish movement jaari rahega ya nahi. Is tarah ki situations mein, main generally market ki raah ka pata lagne tak sirf bids karta hoon.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5325 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/CHF currency pair ke price movements aur analysis ka hum aaj discussion karenge. Aaj, USDCHF currency pair main long position ke liye kuch interesting trading opportunities hain. Magar, current price 0.89842 par enter karna behtar ho sakta hai. Yeh zyadah faidemand hai ke limit orders lower levels par place kiye jayen. Do key support levels 0.89419 aur 0.89414 par hain, jo ke buy trades initiate karne ke liye optimal points hain. Stop order 0.89389 ke qareeb hona chahiye taake potential losses ko minimize kiya ja sake. Sabse attractive profit target resistance level 0.90254 par hai. Pehle, yeh pair 0.91060 ke resistance ke upar trade kar chuki thi, jahan sellers ne is range mein volume accumulate kiya tha. 4-hour chart par ek divergence ne suggest kiya ke yeh pair decline karegi. Maine anticipate kiya tha ke yeh support level 0.89751 tak giregi, jo ke eventually breach kiya. Jab sellers ne volume gain karna continue kiya, maine project kiya ke yeh aur giregi support 0.88237 tak

Is support ke qareeb, sellers aur buyers ne volume accumulate kiya, jo mujhe yeh believe karne par majboor kiya ke market pair ko aur neeche push karegi support 0.87288 tak. Unexpectedly, pair thoda higher move hui, jo ke previous limits tak pohanchi jo sellers ne set ki thi. In levels se subsequent decline yeh indicate karta hai ke sellers dobara volume accumulate kar rahe hain. Main predict karta hoon ke yeh support 0.87288 tak decline karegi. Meri strategy yeh hai ke pair ko sirf short-term gains ke liye buy karoon. Market trends ko carefully analyze karke, strategic entry points set karke aur support aur resistance levels ko closely monitor karke, traders USDCHF currency pair ke complexities ko navigate kar sakte hain. Market movements ke base par strategies ko adjust karna aur flexibility rakhna successful trading ke liye crucial hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:25 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим