USD CHF Outlook Technical H1 Time Frame

Bullish momentum jaari hai, jo USD/CHF jodiya ko lamba upri raasta par dhaakela raha hai. Yeh bullish jazbaat ka ubhaar ek mojooda optimism ko dikhata hai jo market mein hai, jahan traders mazeed faida hasil karne ka besabri se intezar kar rahe hain Sabhi nigahein ab ahem resistance levels par band hai, jo market ke raah ka tajziya karne aur jari upri harkat ke liye sargaram markaz hain. Bunyadi tor par, market itminan aur bullish umeedein se bhari hui hai, jo USD/CHF jodiya ke mojooda upri harkat ke zariye chalti hai Ye umeed afroz manzur pehlu mein tijarati manzar ko ghairati hai, tajziya ko barhawa deti hai aur traders ke darmiyan intekhabi moqon ko bhartne ka bahana banti hai Magar, mojooda optimism ke darmiyan, traders ehtiyaat se chal rahe hain, jinhe mojooda market dynamics mein posheeda complexities ka ilm hai Jabke upri harkat mazboot nazar aati hai, lekin ahem resistance levels ke ahmiyat ko samjha gaya hai jo jodiya ke mustaqbil ke rukh ko shakl dene mein madad karte hain

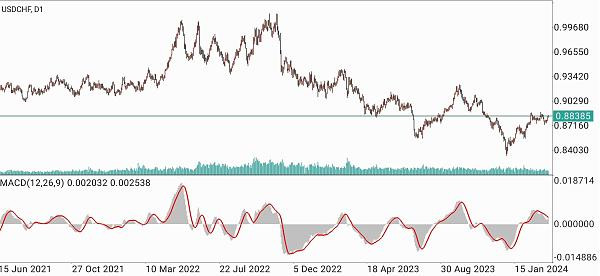

USD CHF Outlook Technical Daily Time Frame

Yaqeenan, ye ahem resistance levels traders ke zehnon mein wazeh hai, jo market ki taqat aur khatarnakgi ke ahem daromadar hain Market ke is taluqat kaam karne ka tajziya agle qadam ko darust karega, jahan nae uchayon tak ka raasta ya ek ulatne wale manzar ka imkan hai Traders is mulayam mawazan ka daftar hain, jo munafa ke imkanat ko sath le kar mawajooda khatron ka tawazun karte hain Resistance levels ka kamyab tor par paar karne ka ishara mazeed upri potential ka hosakta hai, jabke in rukawaton ko paar na karne se jodiya ke harkat mein ikhtilaf ya mukhalif manzar ka peishkash hosakta hai Is tarah, traders ehtiyaat bartaraf kar rahe hain aur is dynamic manzar ko mustaqbil mein tezi se samajhne ke liye mukhtalif strategies istemal kar rahe hain Kuch hosakta hai hifazati approaches ko pasand karen, jab tak ke unhe mustaqil breakthrough ki tasdeeq hasil na ho, positions mein dakhil hone se pehle. Dosre hosakta hain zyadati tactics apnayen, jise wo short-term fluctuations aur intraday opportunities par faida hasil karne ke liye istemal karte hain

تبصرہ

Расширенный режим Обычный режим