USD/CHF currency pair

Maine USD/CHF currency pair ka daily time frame par technical analysis kiya hai. Mere analysis ke natije mein yeh zahir hota hai ke bullish pressure bohot zyada hai, jo is currency pair ki kamyabi ko darust karta hai ke wo 0.88755 ke ahem resistance level ko tod chukka hai. Yeh breakout chal rahi bullish trend ki mazboot tasdeeq deta hai. Iske alawa, 50 EMA aur 100 EMA ke darmiyan ek crossover bhi hai, jo is bullish trend ki kabil-e-etemaad hone mein meri yaqeen ko barha deta hai. Lekin, haalanki, mujhe abhi bhi peechle uchit level 0.908785 se neeche ek neeche ki taraf correction nazar aati hai. Jabki yeh correction peechle ahem qeemat ke barhne ka ek fitri jawab ho sakta hai, main taqreeban ek moqadamat mein trend mein aik waqti tabdeeli ke imkan par bhi mutawajjah rehta hoon. Lekin, main samajhta hoon ke aik neeche ki taraf correction hamesha bullish trend ka ikhtitam darust nahi karta. Ek trader ke tor par, mujhe samajh mein aata hai ke aisi corrections aksar qeemat ki asal trend ko dobara shuru hone se pehle waqti mushtamilat ka hissa hote hain.

Agla qadam intezar karne ke liye, main chhote time frames, jaise H1 chart, ka jaanch karoonga. Chhote time frames par ki gayi tafseelati analysis qeemat ke patterns mein aur mujhe moqay ke achhe dakhli ya nikalne ke points ke pehchan mein madad faraham kar sakti hai.

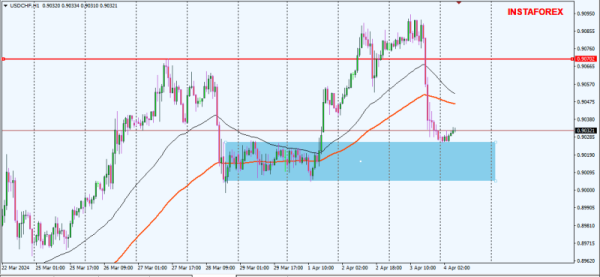

USD/CHF ANALYSIS H1

USD/CHF currency pair ki kal ki movement mein 0.90904 ke uchit level se ek numaya giravat ka samna kiya gaya. Yeh giravat bazar mein mazboot farokht dabav ko darust karti hai. Lekin, agar hum overall trend dekhein, toh yeh pata chalta hai ke yeh currency pair ab bhi ek bullish trend mein hai. Yeh khaaskar 0.90049 se lekar 0.90257 ke qeemat range mein ek ahem demand area ka wujood se zahir hai. Is area mein farokht karne wale logon ko tangdasti mehsoos hoti hai, jo ke ishaara karta hai ke wahan kafi mazboot kharidari ke dilchaspi hai jo ke mazeed qeemat girawat ko bardasht kar sakti hai. Halankeh qeemat ne 50 EMA aur 100 EMA ko paar kar liya hai, jo ke aam tor par bullish signal samjha jata hai, lekin abhi tak dono moving averages ke darmiyan ek crossover nahi hua hai. 50 EMA aur 100 EMA ke darmiyan ek crossover ko aksar trend mein tabdeeli ka tajurba maqbool samjha jata hai, aur jab tak crossover nahi hota, yeh mumkin hai ke bullish trend jari rahe.

In sharton ko mad-e-nazar rakhte hue, meri trading strategy yeh hogi ke main bullish signals ke liye dekhoonga. Main kisi bhi mazboot bullish mombatiyon ka intezar karunga jo farokht karne ki dilchaspi ko wapas dekhati hai. Yeh khaaskar ahem hai kyunke abhi qeemat woh demand area mein hai jo phir se uthne ki nishaniyan dikhata hai.

Maine USD/CHF currency pair ka daily time frame par technical analysis kiya hai. Mere analysis ke natije mein yeh zahir hota hai ke bullish pressure bohot zyada hai, jo is currency pair ki kamyabi ko darust karta hai ke wo 0.88755 ke ahem resistance level ko tod chukka hai. Yeh breakout chal rahi bullish trend ki mazboot tasdeeq deta hai. Iske alawa, 50 EMA aur 100 EMA ke darmiyan ek crossover bhi hai, jo is bullish trend ki kabil-e-etemaad hone mein meri yaqeen ko barha deta hai. Lekin, haalanki, mujhe abhi bhi peechle uchit level 0.908785 se neeche ek neeche ki taraf correction nazar aati hai. Jabki yeh correction peechle ahem qeemat ke barhne ka ek fitri jawab ho sakta hai, main taqreeban ek moqadamat mein trend mein aik waqti tabdeeli ke imkan par bhi mutawajjah rehta hoon. Lekin, main samajhta hoon ke aik neeche ki taraf correction hamesha bullish trend ka ikhtitam darust nahi karta. Ek trader ke tor par, mujhe samajh mein aata hai ke aisi corrections aksar qeemat ki asal trend ko dobara shuru hone se pehle waqti mushtamilat ka hissa hote hain.

Agla qadam intezar karne ke liye, main chhote time frames, jaise H1 chart, ka jaanch karoonga. Chhote time frames par ki gayi tafseelati analysis qeemat ke patterns mein aur mujhe moqay ke achhe dakhli ya nikalne ke points ke pehchan mein madad faraham kar sakti hai.

USD/CHF ANALYSIS H1

USD/CHF currency pair ki kal ki movement mein 0.90904 ke uchit level se ek numaya giravat ka samna kiya gaya. Yeh giravat bazar mein mazboot farokht dabav ko darust karti hai. Lekin, agar hum overall trend dekhein, toh yeh pata chalta hai ke yeh currency pair ab bhi ek bullish trend mein hai. Yeh khaaskar 0.90049 se lekar 0.90257 ke qeemat range mein ek ahem demand area ka wujood se zahir hai. Is area mein farokht karne wale logon ko tangdasti mehsoos hoti hai, jo ke ishaara karta hai ke wahan kafi mazboot kharidari ke dilchaspi hai jo ke mazeed qeemat girawat ko bardasht kar sakti hai. Halankeh qeemat ne 50 EMA aur 100 EMA ko paar kar liya hai, jo ke aam tor par bullish signal samjha jata hai, lekin abhi tak dono moving averages ke darmiyan ek crossover nahi hua hai. 50 EMA aur 100 EMA ke darmiyan ek crossover ko aksar trend mein tabdeeli ka tajurba maqbool samjha jata hai, aur jab tak crossover nahi hota, yeh mumkin hai ke bullish trend jari rahe.

In sharton ko mad-e-nazar rakhte hue, meri trading strategy yeh hogi ke main bullish signals ke liye dekhoonga. Main kisi bhi mazboot bullish mombatiyon ka intezar karunga jo farokht karne ki dilchaspi ko wapas dekhati hai. Yeh khaaskar ahem hai kyunke abhi qeemat woh demand area mein hai jo phir se uthne ki nishaniyan dikhata hai.

تبصرہ

Расширенный режим Обычный режим