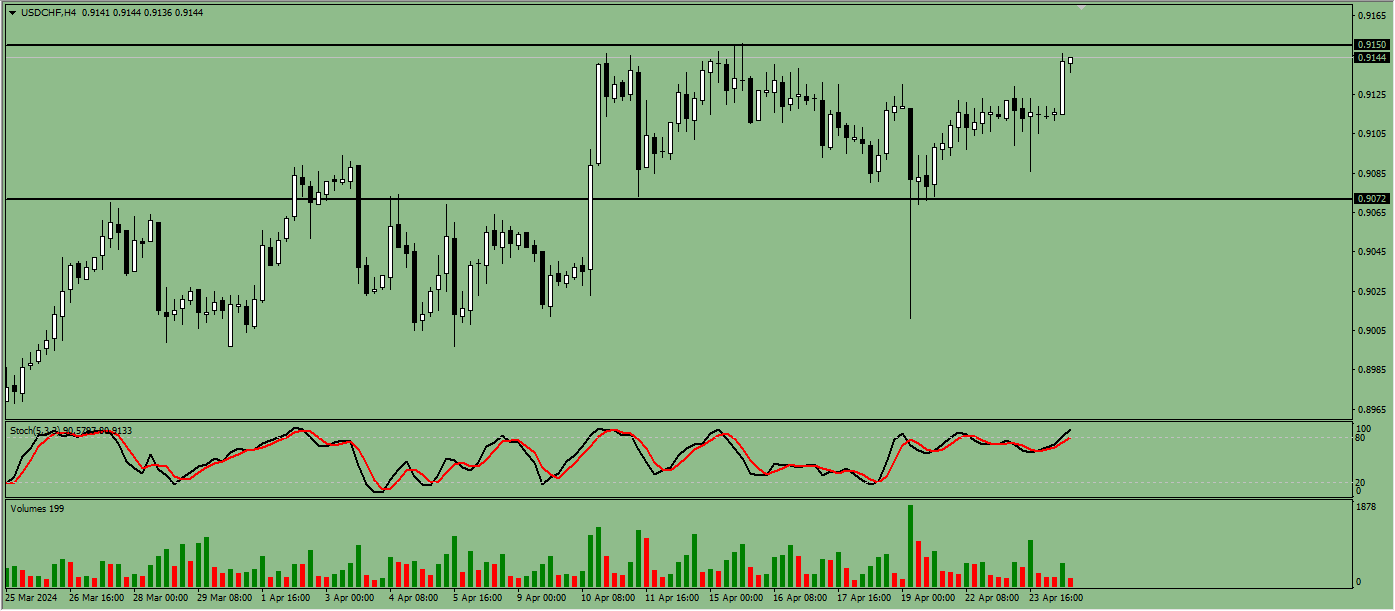

USD/CHF currency pair abhi 0.9137 zone ke aas paas ghoom raha hai, jahan kharidarain mareezan se ummedwar hain incoming news data ke mutaliq jo ke US dollar se taluq rakhta hai. Tawajjo barhti ja rahi hai resistance level 0.9143 ko torne ke mumkin hone ki taraf, jo ke jor paiwardi ka ek ishara hai pair mein ek mumkin ooper ki taraf ka harkat ko.

Jaise ke market ki shiraa'kat taraqqi karti hai aur news releases qareeb hote hain, traders jo bechne ki taraf muqarrar hain unhein buniyadi hoshmandi se ghor karna chahiye ke manzar-e-am ka barhtay hue pehluon ke mutabiq apni exit strategy ko tarmeem karne ka ghoor o fikar karna chahiye.

Ek qareeb anay wala waqiya jo ke USD/CHF market ko nihayat mutasir kar sakta hai Chairman Jordan ka taqreer hai. Unke tajziyaat naye idaray aur nazaryat dikhane ki surat mein ho sakti hain jo currency markets ko, jese ke USD/CHF ko bhi, muntazir kar sakti hain. Traders aur investors ko kisi bhi ishara ya policy signal ko qareeb se monitor karna hoga jo Swiss franc ki exchange rate ko US dollar ke saath mutasir kar sakta hai.

Swiss National Bank (SNB) ke monetary policy aur economic outlook par daira-e-faisala bhi ek ahem factor hai jo ke market ki jazbat ko aur trading strategies ko mutasir kar sakta hai. SNB se koi ishara ya elaan hone ka gehra asar USD/CHF pair par ho sakta hai, trading activity ke rukh ko shakal de kar.

Market ke sharikun ko maloom aur mukhtalif rehna zaroori hai takay woh USD/CHF ke halat ko tajziya kar sakein. Pair mein tabdiliyon ka asar global financial markets par asar andaz hota hai, khaaskar currency trading aur international investments mein. Musbat khatra nigrani aur strategy se mutaliq faislay is ahem dour mein zaroori hain taake opportunities ka faida uthaya ja sake jab ke potential risks ko kam kiya ja sake.USD/CHF trading mein aitmaad ka barqarar rakhna ahem hai. Takneeki nishanat aur bunyadi taraqqiyan dono ka jaeza lene ka markazi hissa hoga jo ke opportunities ko pehchanne aur khatron ko moqa'fion se niptane ke liye zaroori hai. Market ki jazbat par tawajjo aur jawabdeh rehkar, traders apne aap ko USD/CHF market ke tabdeel hone wale manzar mein faida mand taur par muqarrar kar sakte hain.

Kharidarain ke liye ek mustaqbil mein nijaat bhara mahol ki umeed ke saath, aane wale ghanton mein 0.9151 zone ko chhuna ka imkan nazdeek hai. Magar, shaqo shubh bharay hain, aur market ke sharikun ko badalte halaat ke mutabiq apne aap ko nazar-andaaz karte rehna chahiye aur moqa'fion ko hasil hone par faida uthana chahiye.

Akhri taur par, USD/CHF market mein safar karne ke liye 24 ghante ki khabar, tabdeeliyon ka samajh, aur proactive khatra nigrani ke strategies ka istemal zaroori hai. Traders khud ko is dharakta hua aur hamesha badalte forex manzar mein kamiyabi ke liye muqarrar kar sakte hain.

ZURICH

Fundamental outlook.

Swiss National Bank ne kaha ke woh 2023 mein 132.9 arab Swiss francs ($149.51 arab) ke qeemti foreign currency bech chuki hai, aaj Mangal ko central bank ne kaha, jis se Swiss franc ko imported inflation ke khilaf ek shield ke tor par support dene par ziada zor diya gaya.

Yeh shumara ek barri izafa hai SNB ki taraf se 2022 mein 22.3 arab francs ke qeemti foreign currencies ke farokht ke muqable mein, jab bank ne apne bohot se foreign currency holdings ko bechna shuru kiya tha.SNB ka strategy kaamyaab raha hai, jis ki wajah se Swiss inflation 9 mahinay tak 0-2% ki hadood mein rahi."SNB ke foreign currency sales ne pehle to Swiss franc ko doosre mulkon ke inflation ke farq ke mutabiq taqreeban izafa kiya," SNB ne Mangal ko kaha.

"Is tarah, woh Swiss franc ke haqeeqi tor par kamzor honay ko rokne mein madad ki aur is tarah monetary conditions ko tight karne mein madad mili," isay aur zyada ke sath woh shumara kaha. "Saal ke akhir mein, inflation rate nay aham taur par gir gaya."SNB ne kaha ke woh apni maqsad ko haasil karne ke baad ab foreign currency sales par tawajju nahi denge. Markazi bank ko apne agle monetary policy decisions ko Jumeraat ko announce karna hai.

Jaise ke market ki shiraa'kat taraqqi karti hai aur news releases qareeb hote hain, traders jo bechne ki taraf muqarrar hain unhein buniyadi hoshmandi se ghor karna chahiye ke manzar-e-am ka barhtay hue pehluon ke mutabiq apni exit strategy ko tarmeem karne ka ghoor o fikar karna chahiye.

Ek qareeb anay wala waqiya jo ke USD/CHF market ko nihayat mutasir kar sakta hai Chairman Jordan ka taqreer hai. Unke tajziyaat naye idaray aur nazaryat dikhane ki surat mein ho sakti hain jo currency markets ko, jese ke USD/CHF ko bhi, muntazir kar sakti hain. Traders aur investors ko kisi bhi ishara ya policy signal ko qareeb se monitor karna hoga jo Swiss franc ki exchange rate ko US dollar ke saath mutasir kar sakta hai.

Swiss National Bank (SNB) ke monetary policy aur economic outlook par daira-e-faisala bhi ek ahem factor hai jo ke market ki jazbat ko aur trading strategies ko mutasir kar sakta hai. SNB se koi ishara ya elaan hone ka gehra asar USD/CHF pair par ho sakta hai, trading activity ke rukh ko shakal de kar.

Market ke sharikun ko maloom aur mukhtalif rehna zaroori hai takay woh USD/CHF ke halat ko tajziya kar sakein. Pair mein tabdiliyon ka asar global financial markets par asar andaz hota hai, khaaskar currency trading aur international investments mein. Musbat khatra nigrani aur strategy se mutaliq faislay is ahem dour mein zaroori hain taake opportunities ka faida uthaya ja sake jab ke potential risks ko kam kiya ja sake.USD/CHF trading mein aitmaad ka barqarar rakhna ahem hai. Takneeki nishanat aur bunyadi taraqqiyan dono ka jaeza lene ka markazi hissa hoga jo ke opportunities ko pehchanne aur khatron ko moqa'fion se niptane ke liye zaroori hai. Market ki jazbat par tawajjo aur jawabdeh rehkar, traders apne aap ko USD/CHF market ke tabdeel hone wale manzar mein faida mand taur par muqarrar kar sakte hain.

Kharidarain ke liye ek mustaqbil mein nijaat bhara mahol ki umeed ke saath, aane wale ghanton mein 0.9151 zone ko chhuna ka imkan nazdeek hai. Magar, shaqo shubh bharay hain, aur market ke sharikun ko badalte halaat ke mutabiq apne aap ko nazar-andaaz karte rehna chahiye aur moqa'fion ko hasil hone par faida uthana chahiye.

Akhri taur par, USD/CHF market mein safar karne ke liye 24 ghante ki khabar, tabdeeliyon ka samajh, aur proactive khatra nigrani ke strategies ka istemal zaroori hai. Traders khud ko is dharakta hua aur hamesha badalte forex manzar mein kamiyabi ke liye muqarrar kar sakte hain.

ZURICH

Fundamental outlook.

Swiss National Bank ne kaha ke woh 2023 mein 132.9 arab Swiss francs ($149.51 arab) ke qeemti foreign currency bech chuki hai, aaj Mangal ko central bank ne kaha, jis se Swiss franc ko imported inflation ke khilaf ek shield ke tor par support dene par ziada zor diya gaya.

Yeh shumara ek barri izafa hai SNB ki taraf se 2022 mein 22.3 arab francs ke qeemti foreign currencies ke farokht ke muqable mein, jab bank ne apne bohot se foreign currency holdings ko bechna shuru kiya tha.SNB ka strategy kaamyaab raha hai, jis ki wajah se Swiss inflation 9 mahinay tak 0-2% ki hadood mein rahi."SNB ke foreign currency sales ne pehle to Swiss franc ko doosre mulkon ke inflation ke farq ke mutabiq taqreeban izafa kiya," SNB ne Mangal ko kaha.

"Is tarah, woh Swiss franc ke haqeeqi tor par kamzor honay ko rokne mein madad ki aur is tarah monetary conditions ko tight karne mein madad mili," isay aur zyada ke sath woh shumara kaha. "Saal ke akhir mein, inflation rate nay aham taur par gir gaya."SNB ne kaha ke woh apni maqsad ko haasil karne ke baad ab foreign currency sales par tawajju nahi denge. Markazi bank ko apne agle monetary policy decisions ko Jumeraat ko announce karna hai.

تبصرہ

Расширенный режим Обычный режим