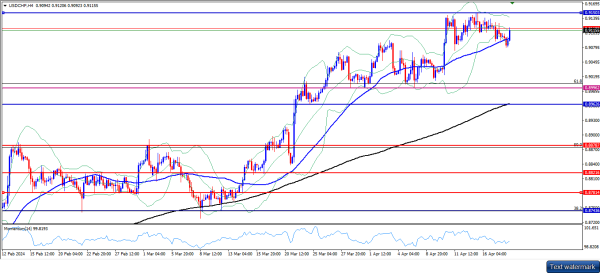

H-4 Timeframe Analysis

USD/CHF ke pair aaj do mahinay ki kamzori par hai. Is waqt koi ishaara nahi hai ke bearish wave is stage par rukay ga, aur prices 200-day simple moving average ki taraf ja rahi hain. Momentum indicators mazeed nuksan ki sambhavna ko tasdeeq karte hain. USD/CHF ne tab se nihayat mazboot girawat darj kar rahi hai jab yeh 13-mahinay ki uchch tar record 0.91503 tak pahunchi thi. Is ke ilawa, pair ne aaj subah do mahinay ki kamzori par lagi hai aur lagta hai ke yeh jald hi 200-day simple moving average ko test karega. Pair jald hi 0.91000 ilaqe ke qareeb 200-day simple moving average ka saamna kar sakta hai jab ke momentum indicators kehte hain ke price mein mazeed girawat ka ishara hai. Agar yeh akhri cheez nichay ki dabao ko rokne mein na kaamyaab hoti hai, to 0.89962 ke liye koi wazeh support na hoga. Is ilaqe ko torne se raste mein mazeed girawat ki raah khuli hai jis se April ki kam se kam 0.8878 tak mazeed girawat ka raasta ban sakta hai.

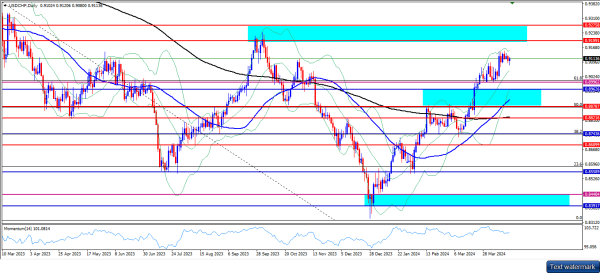

Daily Timeframe Analysis

Dusri taraf, agar pair ko momentum milta hai, to yeh 0.91503 par resistance ko test kar sakta hai. Is line ko torne ke baad, pair 0.91991 par resistance ka samna kar sakta hai. Phir yeh 0.92758 ke qareeb bulandiyon par ruk sakta hai. Mukhtasir tor par, USD/CHF currency pair ab majboot nichayi dabao ke neeche hai, jis se ek silsila bearish lows ka nateeja nikalta hai. Abhi, 200-day moving average ka imtehaan yeh tay karega ke girawat jaari rakh sakti hai ya nahi. Pair ne is haftay 0.91150 dollar ke leye rukh kiya hai. Amreeki maheyaar aur rozgar ke data mahez umeedon se mazid mazboot nikle, jo ye sabit karta hai ke Federal Reserve jaldi interest rates ko kam karne ki jaldi na kare. Main umeed karta hoon ke amooman dollar ko CHF ke khilaaf qeemat mein izafa jari rahega jab tak maqbool nizam ke saath maheyaari policies hain. Yeh raha chart neeche:

USD/CHF ke pair aaj do mahinay ki kamzori par hai. Is waqt koi ishaara nahi hai ke bearish wave is stage par rukay ga, aur prices 200-day simple moving average ki taraf ja rahi hain. Momentum indicators mazeed nuksan ki sambhavna ko tasdeeq karte hain. USD/CHF ne tab se nihayat mazboot girawat darj kar rahi hai jab yeh 13-mahinay ki uchch tar record 0.91503 tak pahunchi thi. Is ke ilawa, pair ne aaj subah do mahinay ki kamzori par lagi hai aur lagta hai ke yeh jald hi 200-day simple moving average ko test karega. Pair jald hi 0.91000 ilaqe ke qareeb 200-day simple moving average ka saamna kar sakta hai jab ke momentum indicators kehte hain ke price mein mazeed girawat ka ishara hai. Agar yeh akhri cheez nichay ki dabao ko rokne mein na kaamyaab hoti hai, to 0.89962 ke liye koi wazeh support na hoga. Is ilaqe ko torne se raste mein mazeed girawat ki raah khuli hai jis se April ki kam se kam 0.8878 tak mazeed girawat ka raasta ban sakta hai.

Daily Timeframe Analysis

Dusri taraf, agar pair ko momentum milta hai, to yeh 0.91503 par resistance ko test kar sakta hai. Is line ko torne ke baad, pair 0.91991 par resistance ka samna kar sakta hai. Phir yeh 0.92758 ke qareeb bulandiyon par ruk sakta hai. Mukhtasir tor par, USD/CHF currency pair ab majboot nichayi dabao ke neeche hai, jis se ek silsila bearish lows ka nateeja nikalta hai. Abhi, 200-day moving average ka imtehaan yeh tay karega ke girawat jaari rakh sakti hai ya nahi. Pair ne is haftay 0.91150 dollar ke leye rukh kiya hai. Amreeki maheyaar aur rozgar ke data mahez umeedon se mazid mazboot nikle, jo ye sabit karta hai ke Federal Reserve jaldi interest rates ko kam karne ki jaldi na kare. Main umeed karta hoon ke amooman dollar ko CHF ke khilaaf qeemat mein izafa jari rahega jab tak maqbool nizam ke saath maheyaari policies hain. Yeh raha chart neeche:

تبصرہ

Расширенный режим Обычный режим