Hello everyone!

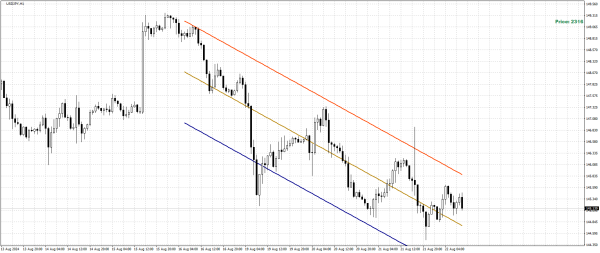

The downward slope of the linear regression channel suggests strong selling pressure, with the market aiming for the target level of 144.351. We anticipate a potential slowdown at this target level, where the current downtrend might decelerate. Given the prevailing volatility, a pullback is likely, necessitating a reassessment before taking further action. It is advisable not to consider selling within the lower part of the channel. Instead, wait for a correction up to 145.608 before exploring any selling opportunities. If the price consolidates above 145.608, it could signal a bullish shift, prompting a potential upward movement. In such a scenario, selling would need to be deferred.

The steepness of the channel’s slope reflects the intensity of the selling pressure; a steeper slope typically indicates more aggressive bearish activity, often driven by market news or events. The primary channel under analysis is the linear regression channel on the hourly chart, which guides my assessment of market movements. Additionally, the M15 channel serves as a secondary tool that supports the overall bearish outlook. Since both channels are aligned in their direction, the prevailing sentiment for this instrument is bearish.

If a signal is breached on the lower timeframe, anticipate a potential price increase towards 145.869. At this level, reassessing selling opportunities towards the 143.662 mark might be prudent. Currently, I am cautious about initiating any trades in the lower part of the channel, both for selling and buying, due to the associated risks. My trading strategy focuses on aligning trades with the direction of the H1 channel, as it is my primary guide. It is advantageous to refine entry points using the lower timeframe channels and to trade during periods of strong momentum when corrections are minimal.

In summary, while the bearish trend remains dominant, monitoring for corrections and aligning trades with the H1 channel’s direction is crucial. Patience and careful analysis will be key in identifying optimal trading opportunities.

The downward slope of the linear regression channel suggests strong selling pressure, with the market aiming for the target level of 144.351. We anticipate a potential slowdown at this target level, where the current downtrend might decelerate. Given the prevailing volatility, a pullback is likely, necessitating a reassessment before taking further action. It is advisable not to consider selling within the lower part of the channel. Instead, wait for a correction up to 145.608 before exploring any selling opportunities. If the price consolidates above 145.608, it could signal a bullish shift, prompting a potential upward movement. In such a scenario, selling would need to be deferred.

The steepness of the channel’s slope reflects the intensity of the selling pressure; a steeper slope typically indicates more aggressive bearish activity, often driven by market news or events. The primary channel under analysis is the linear regression channel on the hourly chart, which guides my assessment of market movements. Additionally, the M15 channel serves as a secondary tool that supports the overall bearish outlook. Since both channels are aligned in their direction, the prevailing sentiment for this instrument is bearish.

If a signal is breached on the lower timeframe, anticipate a potential price increase towards 145.869. At this level, reassessing selling opportunities towards the 143.662 mark might be prudent. Currently, I am cautious about initiating any trades in the lower part of the channel, both for selling and buying, due to the associated risks. My trading strategy focuses on aligning trades with the direction of the H1 channel, as it is my primary guide. It is advantageous to refine entry points using the lower timeframe channels and to trade during periods of strong momentum when corrections are minimal.

In summary, while the bearish trend remains dominant, monitoring for corrections and aligning trades with the H1 channel’s direction is crucial. Patience and careful analysis will be key in identifying optimal trading opportunities.

تبصرہ

Расширенный режим Обычный режим