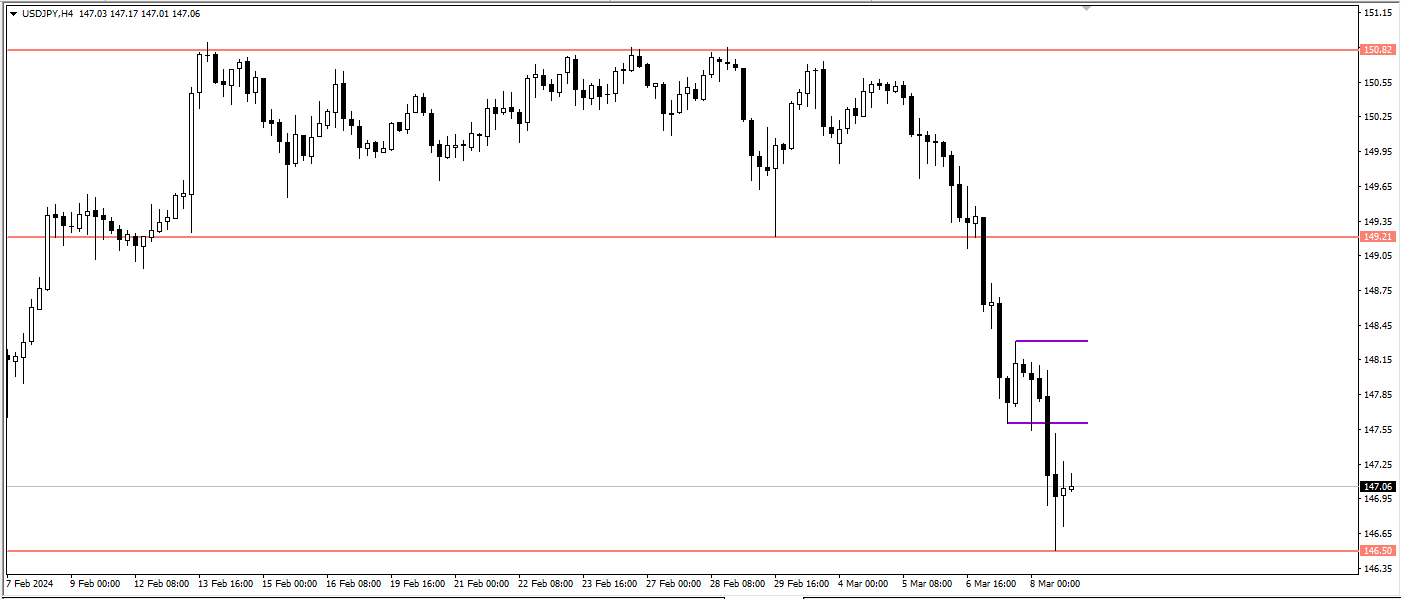

USD/JPY H-4 Subha bakhair sab ko!!! Sab markets hafte ke akhri din ke liye band hain aur hum USD/JPY currency pair ke kuch price results ka jayeza le sakte hain. Haan, humari ummeed ke mutabiq neeche ki taraf girawat ho sakti hai, lekin pehle toh humein iska intezar lamba samay tak karna pada, aur doosri taraf, yeh sirf ek neeche ki taraf correction lagta hai. Beshak, agle naye trading week mein humein is ke bare mein sab kuch pata chal jayega, ke yeh haqeeqat mein ek girawat ka ibtida hai ya sirf aik correction hai. Trading week takriban 147.05 ke qareeb khatam hua, takreeban 300 points ka girao. Yahan, USD/JPY currency pair ke tamam ye price girawat japani currency, yen, ki taqatbari ko mazid barhane ke baa'd hai, jo ke Bank of Japan ke head ke bayan ke baa'd hai, na ke greenback ka. Kab yeh japani currency, yen, apne hairatangez inharaf karay ga, yeh batana mushkil hai. Is USD/JPY currency pair ke future prospects kis rukh mein hain? Mujhe shak hai, kyunke kahi bhi isko point karenge toh yeh asmaan ki taraf ishara karega. Aap samajh sakte hain ke agar 146.67 ke support level ko upside se tor diya jaye, toh neeche ki taraf aur girawat hogi, aur phir bina dekhe upar ki taraf bhaag jayega. Toh main shakhsan guess nahi karunga. Kya main naye trading week mein USD/JPY trading instrument ka trade karna chahiye? Main abhi soch raha hoon aur sachai yeh hai ke mujhe nahi pata ke kis rukh mein trade karna chahiye?

Behtareen waqt pe dakhilay ke kirdar aur strategy se khatarnak moqay uthane ka kirdar. Tajarba kar daraz bazaar ke manzar ko behtareen tareeqay se samajhne ke liye, statisticsi data aur trend volatility par mustaqil nazar rakhna zaroori hai. Ye proactive iqdaam uthakar, investors bazaar ke dynamics ka mukammal samajh paate hain, jo unhe apni strategies ko behter banane aur nihayat mein apni munafa ko behtar banana mein madad karta hai. Harkat kartay huyay averages investors ke liye ek qaabil-e-atbar tool ka kaam karti hain jo ke maliye bazaar ke complexities ko samajhne aur growth opportunities ka faida uthane ke liye talash karte hain. Lekin, bazaar mein corrective harkaaton ka samna karte waqt ehtiyaat baratna zaroori hai. Khoi hui munafa ko hasil karne ki fitri mushkilat ahamiyat-e-khaas par pesh karte hain aur sahi waqt pe dakhilay ke kirdar aur strategic risk-taking ka ahem hota hai. Mushtamil chunao ke saath bazaar ke peshawar manzar mein kamiyabi se guzarna, investors ko statisticsi data aur trend volatility par mustaqil nazar rakhna chahiye. Ye proactive iqdaam na sirf bazaar ke dynamics ko gehraai se samajhne mein madad karte hain balkay investors ko apni strategies ko behter banane mein bhi taqat dete hain, jisse munafa ziada ho.

Tajziyati strategies mein harkat kartay huyay averages ka istemal maliye bazaar mein potential izafa ko support karne mein aham kirdar ada karta hai. Lekin, investors ko bazaar ki correctioni harkaaton ka sahi nazar se samna karne aur juriye huay khatron ka ahtiyaat se samajhna zaroori hai. Waqt pe dakhilay ke kirdar ke baghair khoi hui munafa ko hasil karna ka mushkil asar strategic risk-taking ki ahmiyat ko zor-o-shor se zahir karta hai. Mustaqil taur par statisticsi data aur trend volatility ki nazar rakhna behtareen fazool faide ke faislon ke liye zaroori ban jata hai jab ke bazaar ke tez manzar mein guzarish ka faisla karna hota hai. Ye proactive iqdaam na sirf bazaar ke dynamics ki samajh ko barhate hain balkay investors ko apni strategies ko munafa ko barhane ke liye optimize karne ki taqat dete hain.

Behtareen waqt pe dakhilay ke kirdar aur strategy se khatarnak moqay uthane ka kirdar. Tajarba kar daraz bazaar ke manzar ko behtareen tareeqay se samajhne ke liye, statisticsi data aur trend volatility par mustaqil nazar rakhna zaroori hai. Ye proactive iqdaam uthakar, investors bazaar ke dynamics ka mukammal samajh paate hain, jo unhe apni strategies ko behter banane aur nihayat mein apni munafa ko behtar banana mein madad karta hai. Harkat kartay huyay averages investors ke liye ek qaabil-e-atbar tool ka kaam karti hain jo ke maliye bazaar ke complexities ko samajhne aur growth opportunities ka faida uthane ke liye talash karte hain. Lekin, bazaar mein corrective harkaaton ka samna karte waqt ehtiyaat baratna zaroori hai. Khoi hui munafa ko hasil karne ki fitri mushkilat ahamiyat-e-khaas par pesh karte hain aur sahi waqt pe dakhilay ke kirdar aur strategic risk-taking ka ahem hota hai. Mushtamil chunao ke saath bazaar ke peshawar manzar mein kamiyabi se guzarna, investors ko statisticsi data aur trend volatility par mustaqil nazar rakhna chahiye. Ye proactive iqdaam na sirf bazaar ke dynamics ko gehraai se samajhne mein madad karte hain balkay investors ko apni strategies ko behter banane mein bhi taqat dete hain, jisse munafa ziada ho.

Tajziyati strategies mein harkat kartay huyay averages ka istemal maliye bazaar mein potential izafa ko support karne mein aham kirdar ada karta hai. Lekin, investors ko bazaar ki correctioni harkaaton ka sahi nazar se samna karne aur juriye huay khatron ka ahtiyaat se samajhna zaroori hai. Waqt pe dakhilay ke kirdar ke baghair khoi hui munafa ko hasil karna ka mushkil asar strategic risk-taking ki ahmiyat ko zor-o-shor se zahir karta hai. Mustaqil taur par statisticsi data aur trend volatility ki nazar rakhna behtareen fazool faide ke faislon ke liye zaroori ban jata hai jab ke bazaar ke tez manzar mein guzarish ka faisla karna hota hai. Ye proactive iqdaam na sirf bazaar ke dynamics ki samajh ko barhate hain balkay investors ko apni strategies ko munafa ko barhane ke liye optimize karne ki taqat dete hain.

تبصرہ

Расширенный режим Обычный режим