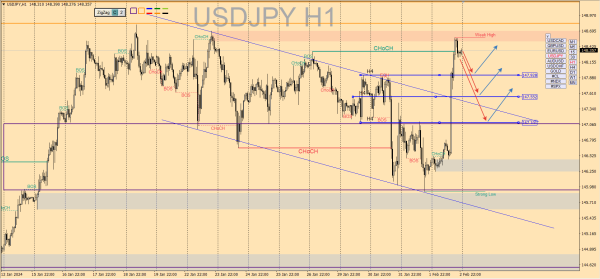

USD/JPY ko Monday ko, meri aankh ka sab se ahem kaam ye hai ke pullback ki gehrai ko tay karen, jo ya to haftay ke shuru mein ya thoda baad ho sakti hai agar keemat turant girne na lage. Mumkin hai ke maareezon ka bounce-back zone kafi wide ho, jo kaam ko mushkil bana deta hai, lekin hum is nazar se kuch levels ka tasawwur kar sakte hain jo is muqam se sab se zyada mumkin hain. 147.10 sab se gehra level hai, jo pehle bhi bar-bar react hua hai aur mumkin hai ke is dafa bhi market ise support ke tor par darust kare. 147.55 wo average trading level hai jo keemat ke bohat qareeb hai, aur ye mumkin hai ke yeh most market participants ke liye interest ki jagah banay, is pullback mein possible support level ke tor par.

Ab waqt par, trading 147.12 par ho rahi hai, intermediate levels ki manzil mein. Market mein khareedne ka faisla, mojooda harkat par bharosa karke, tab kiya jayega jab currency Maximum - 148.35, kal ke range, ke upar consolidate ho jaye. Is ke liye is ke price behavior ke liye stop order Minimum - 146.61 par set kiya jayega. Kamai aur take lene ka maqsad aglay Maximum price - 149.90 hoga.

Main aik neeche ki surat-e-haal ko bhi mad-e-nazar rakha ja raha hai. Jab pair wapas aaye, support range - 146.45 ke paar, to ye Bullish rally ki complexity ko dikhayega. Is halat mein, moving average indicator ko Sell signal draw karna chahiye. Price Bollinger Channel mein wapas lautne par, development pehle level ki taraf barh jayegi, jo Line 145.98 hai. Acha din guzre.

Ab waqt par, trading 147.12 par ho rahi hai, intermediate levels ki manzil mein. Market mein khareedne ka faisla, mojooda harkat par bharosa karke, tab kiya jayega jab currency Maximum - 148.35, kal ke range, ke upar consolidate ho jaye. Is ke liye is ke price behavior ke liye stop order Minimum - 146.61 par set kiya jayega. Kamai aur take lene ka maqsad aglay Maximum price - 149.90 hoga.

Main aik neeche ki surat-e-haal ko bhi mad-e-nazar rakha ja raha hai. Jab pair wapas aaye, support range - 146.45 ke paar, to ye Bullish rally ki complexity ko dikhayega. Is halat mein, moving average indicator ko Sell signal draw karna chahiye. Price Bollinger Channel mein wapas lautne par, development pehle level ki taraf barh jayegi, jo Line 145.98 hai. Acha din guzre.

تبصرہ

Расширенный режим Обычный режим