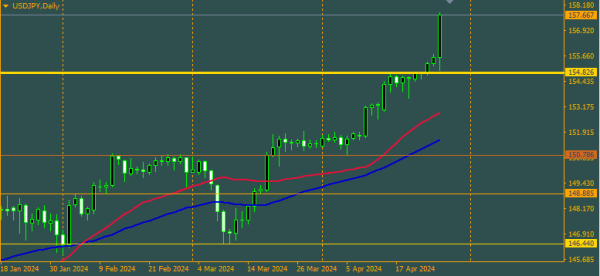

USD/JPY technical analysis

Hello everyone!

Yahan bahut zyada paisa kamaana mumkin hai agar aap apne dakhilay ka sahi jagah pe talash karte hain. Haalaanki, yeh Jumeraat hai, lekin main farokht karne ka khayal bhi nahi soch raha hoon. Kal, sher aagey aglay support level tak gir sakte the. Jis din bullish candle phir se bana, woh 157.25 se mudey. Lagta hai kharidne wale abhi bhi shaant nahi honge, lekin aaj ke Asian session mein unhone pichle daily range ke uchaiyon ko dubara hasil kar liya hai. Mazaaq nahi hai muqaablay se, aur behrahaal, sail karna resistance se behtar hai. Kul milake, main sthir 157.80 ke muqami muqablay ko samjhta hoon. Jab qeemat us muqami muqablay tak pohanchti hai, main dekhoonga ke yeh kya maani hai. Mere amal ka aham hissa, main do mansoobay tayyar karta hoon ke tijarat ke maahol ka kaise taraqqi kar sakta hai.

Pehle mansoobe ke mutabiq, muqami muqablay pe qeemat ke tajziye ke aadhar par, main umeed karta hoon ke qeemat mazeed faida haasil karne ki koshish mein is se oopar uth jaayegi. Agar yeh mansooba kamyab hota hai, to qeemat 157.30 ke muqami muqablay ki taraf chalayegi. Yeh muqami muqablay paar hone ke baad aik tijarat ka dhancha bana hoga, jo tijarat ka rukh taay karega.

157.85 ke muqami muqablay ke natayej mein, aik oopar ki taraf mutawajjah candle banti hai; agar 21 EMA ya 155.10 ke support qeemat ke oopar rahein to main umeed karta hoon ke qeemat 156.20 ke muqami muqablay tak lautegi. In support ke imkaanat hain ke in levels ke aas paas aik ulta chhaap signal banega aur oopri harkat jald se jald phir se shuru hogi. Mera aakhri maqsad yeh hai ke taraqqi karte rahun, aur agar main atak jaata hoon, to agle mein zarurat pade to kisi ke liye North Signal dhoondh sakta hoon agar zarurat pade.

Hello everyone!

Yahan bahut zyada paisa kamaana mumkin hai agar aap apne dakhilay ka sahi jagah pe talash karte hain. Haalaanki, yeh Jumeraat hai, lekin main farokht karne ka khayal bhi nahi soch raha hoon. Kal, sher aagey aglay support level tak gir sakte the. Jis din bullish candle phir se bana, woh 157.25 se mudey. Lagta hai kharidne wale abhi bhi shaant nahi honge, lekin aaj ke Asian session mein unhone pichle daily range ke uchaiyon ko dubara hasil kar liya hai. Mazaaq nahi hai muqaablay se, aur behrahaal, sail karna resistance se behtar hai. Kul milake, main sthir 157.80 ke muqami muqablay ko samjhta hoon. Jab qeemat us muqami muqablay tak pohanchti hai, main dekhoonga ke yeh kya maani hai. Mere amal ka aham hissa, main do mansoobay tayyar karta hoon ke tijarat ke maahol ka kaise taraqqi kar sakta hai.

Pehle mansoobe ke mutabiq, muqami muqablay pe qeemat ke tajziye ke aadhar par, main umeed karta hoon ke qeemat mazeed faida haasil karne ki koshish mein is se oopar uth jaayegi. Agar yeh mansooba kamyab hota hai, to qeemat 157.30 ke muqami muqablay ki taraf chalayegi. Yeh muqami muqablay paar hone ke baad aik tijarat ka dhancha bana hoga, jo tijarat ka rukh taay karega.

157.85 ke muqami muqablay ke natayej mein, aik oopar ki taraf mutawajjah candle banti hai; agar 21 EMA ya 155.10 ke support qeemat ke oopar rahein to main umeed karta hoon ke qeemat 156.20 ke muqami muqablay tak lautegi. In support ke imkaanat hain ke in levels ke aas paas aik ulta chhaap signal banega aur oopri harkat jald se jald phir se shuru hogi. Mera aakhri maqsad yeh hai ke taraqqi karte rahun, aur agar main atak jaata hoon, to agle mein zarurat pade to kisi ke liye North Signal dhoondh sakta hoon agar zarurat pade.

تبصرہ

Расширенный режим Обычный режим