USD/JPY ka Technical Analysis

H-4 Timeframe Analysis

Japanese yen ne pichle trading week mein upar ki taraf ki gayi lehar ko poora kiya aur kamzor hota raha, ek naye all-time low tak pahunch gaya. Doosre range ke upper limit ka ek aur test ke baad, price ne barrier ko paar kiya aur jaldi se 154 ke mark ke upar chadh gaya, jahan par ab trading ho rahi hai. Yeh aapko target ko sahi tarah se hit karne aur ant mein assessment scenario par bharosa karne ki anumati deta hai. Iske alawa, price chart super-trend green zone mein hai, jo buyers ke continued control ko confirm karta hai.

Technical taur par, price over-bought level par hai do indicators ka istemaal karke. RSI aur stochastic indicators price ko 156.88 ke all-time high level par le jaayenge. Inka breakout price ko 160.20 level tak pahunchayega. In dono RSI aur Stochastic indicators ke girne se humara bullish trend badal jaayega. Hum 151.30 aur 149.30 levels ke retesting ko dekhenge uske bullish reversal se.

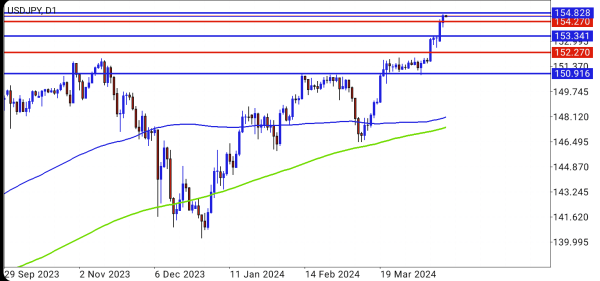

Daily Timeframe Analysis

Prices abhi apne haftay ke high ke kafi ooper hain. Mukhya support areas ko abhi tak test nahi kiya gaya hai aur wo apni integrity ko banaye rakhte hain upward vector ke favor mein. Iske liye, price ko ek naye price area ko todna hoga, jo shayad 153.35 level ke aas-paas ek local correction ko zaroori banayega, jo abhi main support area se border karta hai. Is level ka retest agle upward wave ka vikaas aur subsequent rebound ke liye mauka dega jiska target 155.68 aur 156.63 ke beech ka area hai.

Agar support break hota hai aur price 151.80 ke reversal level ke neeche gir jaata hai, toh current scenario ko cancel karne ka signal mil jaayega. Chart neeche dekhein:

H-4 Timeframe Analysis

Japanese yen ne pichle trading week mein upar ki taraf ki gayi lehar ko poora kiya aur kamzor hota raha, ek naye all-time low tak pahunch gaya. Doosre range ke upper limit ka ek aur test ke baad, price ne barrier ko paar kiya aur jaldi se 154 ke mark ke upar chadh gaya, jahan par ab trading ho rahi hai. Yeh aapko target ko sahi tarah se hit karne aur ant mein assessment scenario par bharosa karne ki anumati deta hai. Iske alawa, price chart super-trend green zone mein hai, jo buyers ke continued control ko confirm karta hai.

Technical taur par, price over-bought level par hai do indicators ka istemaal karke. RSI aur stochastic indicators price ko 156.88 ke all-time high level par le jaayenge. Inka breakout price ko 160.20 level tak pahunchayega. In dono RSI aur Stochastic indicators ke girne se humara bullish trend badal jaayega. Hum 151.30 aur 149.30 levels ke retesting ko dekhenge uske bullish reversal se.

Daily Timeframe Analysis

Prices abhi apne haftay ke high ke kafi ooper hain. Mukhya support areas ko abhi tak test nahi kiya gaya hai aur wo apni integrity ko banaye rakhte hain upward vector ke favor mein. Iske liye, price ko ek naye price area ko todna hoga, jo shayad 153.35 level ke aas-paas ek local correction ko zaroori banayega, jo abhi main support area se border karta hai. Is level ka retest agle upward wave ka vikaas aur subsequent rebound ke liye mauka dega jiska target 155.68 aur 156.63 ke beech ka area hai.

Agar support break hota hai aur price 151.80 ke reversal level ke neeche gir jaata hai, toh current scenario ko cancel karne ka signal mil jaayega. Chart neeche dekhein:

تبصرہ

Расширенный режим Обычный режим