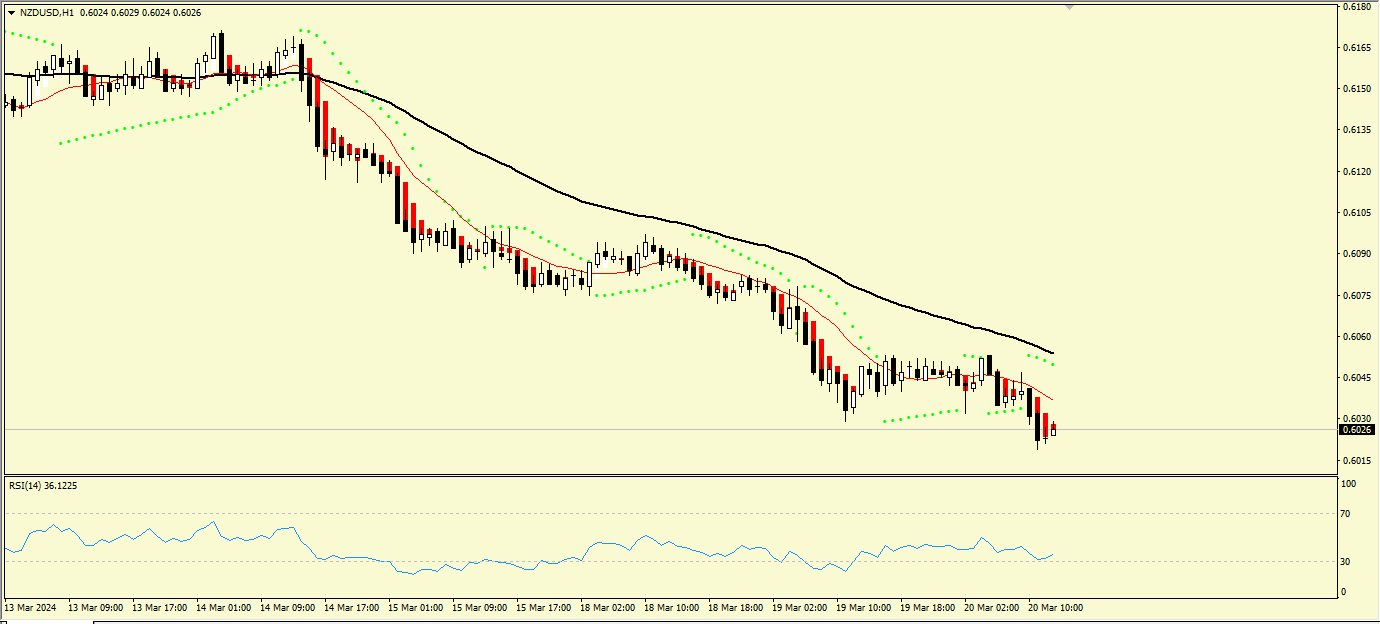

NZD/USD ke qeemat ka amal. Pichle Mangalwar, hamara asaalai madhyam pehle dakshin ki taraf jane ki koshish ki lekin ise door tak jane ki ijaazat nahi di gayi. Unka tezi se taraqqi karna shuru hua, aur is waqt New Zealand dollar-American dollar currency pair ke liye mukhtalifat 0.6045 ke aspaas hain. Ghanton ki chart par set kiye gaye indicators ke mutabiq, faida ab bhi bikroon ki taraf hai. Magar main samajhta hoon ke hamara asaalai madhyam aane wale Budhwar ka aksar waqt kisi halat mein guzrega. Raat mein American Federal Reserve se maloomat hogi. Press conference mein unka kya kahenge yeh bara sawal hai. Aur main samajhta hoon ke yeh hamare currency pair ka rukh kis taraf hoga yeh tay karega. Hamne pehle is pair ke saath kaam karne ke do options dekhe. Ek option ne neeche ki taraf ka movement mukammal kiya aur qeemat ke range mein wapas ane ki koshish ki. Yahan pe humne support level ke neeche jhoota band kiya aur qeemat ke range mein waapas aane ke saath ek rukh ko mazboot kiya. NZD/USD pair ke liye kal, giravat ke natijay mein, beron ne qeemat ko ahem support level 0.6038 tak kheencha; lekin phir unke paas is level ko torne ki taqat nahi thi, halankeh volumes barhate rahe aur kaafi uchh muqam par bane rahe, jo aane wali giravat ki kami ke baawajood, beron se kuch kamzori ka ahsaas hota hai.

Ek bara cluster limit buy orders 0.6038 ke qareeb tha, jo beron ko unke giravat ko jari rakhne nahi diya. Ye tabdeel hone wala manzar bazaar ki dynamics mein ek mumkinah mukhalif nukta dikhata hai. Karobarion ko ihtiyaat aur sabr ikhtiyar karte hue mazeed bullish trend reversal ki tasdeeq ka intezar karna chahiye. Is se pehle ke karobarion ko karobar shuru karne se pehle tafseelati tajziya karna aur mukhtalif factors ko madde nazar rakhna zaroori hai. Is ke ilawa, karobarion ko bazaar ke poray manzar ko aur baahri asrat ko yaad rakhna chahiye jo qeemat ki harkat ko mutasir kar sakte hain. Maeeshati indicators, markazi bank ke faislay, siyasi waqiat, aur bazaar ki jazbaat sab karobar ke nateejay ko bhaari taur par mutasir kar sakte hain. Ikhtitami tor par, haal ki mumkin candle patterns aur indicator signals ek bullish reversal ke liye mumkinah moqa ka ishara dete hain, lekin ihtiyaat ke saath amal karna zaroori hai. Bazaar ki dynamics ko nazar andaaz karna aur mazeed tasdeeq ka intezaar karna qabal-e-amal hai, karobarion ko karobar faislon se pehle. Mamooli aur badlavpazeeri ke saath reh kar, karobarion ko bazaar ke pechidgiyon ka samna karne mein kamyabi haasil kar sakte hain aur faida mand moqaat ko istemal kar sakte hain jabke khatre ko kam karte hain.

Ek bara cluster limit buy orders 0.6038 ke qareeb tha, jo beron ko unke giravat ko jari rakhne nahi diya. Ye tabdeel hone wala manzar bazaar ki dynamics mein ek mumkinah mukhalif nukta dikhata hai. Karobarion ko ihtiyaat aur sabr ikhtiyar karte hue mazeed bullish trend reversal ki tasdeeq ka intezar karna chahiye. Is se pehle ke karobarion ko karobar shuru karne se pehle tafseelati tajziya karna aur mukhtalif factors ko madde nazar rakhna zaroori hai. Is ke ilawa, karobarion ko bazaar ke poray manzar ko aur baahri asrat ko yaad rakhna chahiye jo qeemat ki harkat ko mutasir kar sakte hain. Maeeshati indicators, markazi bank ke faislay, siyasi waqiat, aur bazaar ki jazbaat sab karobar ke nateejay ko bhaari taur par mutasir kar sakte hain. Ikhtitami tor par, haal ki mumkin candle patterns aur indicator signals ek bullish reversal ke liye mumkinah moqa ka ishara dete hain, lekin ihtiyaat ke saath amal karna zaroori hai. Bazaar ki dynamics ko nazar andaaz karna aur mazeed tasdeeq ka intezaar karna qabal-e-amal hai, karobarion ko karobar faislon se pehle. Mamooli aur badlavpazeeri ke saath reh kar, karobarion ko bazaar ke pechidgiyon ka samna karne mein kamyabi haasil kar sakte hain aur faida mand moqaat ko istemal kar sakte hain jabke khatre ko kam karte hain.

تبصرہ

Расширенный режим Обычный режим