150.80 ke range mein mukhaalifat ho sakti hai, jahan se giraawat jaari rahegi. Agar hum 150.40 ke range ko toorna aur iske neeche mazbooti se qaim ho jaayein, to yeh bechnay ka signal hoga. 150.40 ke trade ke range ko toorna aur iske neeche mazbooti se qaim ho jaayein, to yeh bechnay ka acha signal hoga. Halat ki halki izaafat ke baad mubadilat mein izafa ho sakta hai. 150.70 ke range mein qeemat ko giraawat karne mein madad milegi. Ab ke mukable se, hum girawat kar sakte hain aur 149.90 ke trade ko toor sakte hain. Shayad hum uske neeche jaama karein, phir yeh bechnay ka signal hoga.

150.90 ke range mein trade abhi tak toota nahi hai, aur is se ooper ki darja mumkin hai. Jab hum us ko toren aur uske ooper mazbooti se qaim ho jaayein, to yeh barhne ka signal hoga. Shayad 150.80 ke range ko toor kar ooper jaama karein, phir yeh kharidnay ka signal hoga. Ab ke mukable se, girawat ho sakti hai, aur hum 150.10 ke range ko toor sakte hain aur uske neeche jaama kar sakte hain, phir yeh bechnay ka acha signal hoga. Jab hum 150.10 ke trade ke range ko toren aur uske neeche jaama karein, to yeh bechnay ka signal hoga. Main samajhta hoon ke yeh pair apne peechle kammoun ki taraf ja sakta hai.

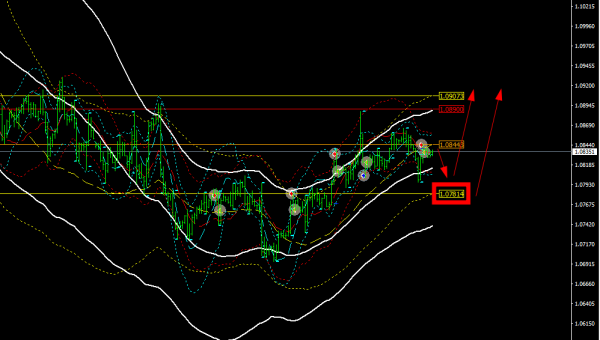

EUR/USD ke baray mein guftagu jaari hai. Sikkay dheron kaafi chotay rang ki giraawat se guzar rahe hain. Market dheron ki takmeel ko dekh rahi hai aur iss tajurbaati tajziya ke silsilay mein barqarar rehna bhi mushkil ho raha hai. Market ke tehqeeqati hisso ki samajh aur aik gehraafi dhaanchay ka hona zaroori hai taake traders ko mukhtalif jazbat mein trading karne ke liye koshish kar sakein. Mukhtalif indicators ke istemal se, traders ko EUR/USD ki price trends aur potential reversal points ka andaza lagane mein madad milti hai. Fibonacci retracements, moving averages, aur chart patterns bhi traders ko price movements ki samajh mein madad dete hain. Yeh tools traders ko support aur resistance ke ahem darjayi nishaanat aur trading ke points ka pehchan karne mein madad karte hain.

Sikke mein baazari tabdeeliyon ko tawaqo karte hue, technical analysis ke sath sath fundamental analysis ka istemal karna ahem hai. Monetary policy decisions, economic indicators, aur geopolitical tensions bhi currency valuations aur market sentiment par asar daal sakte hain. Monetary policy ke tabdeeliyan, economic indicators, aur geopolitical events currency ke values par asar daal sakte hain aur market sentiment ko mutasir kar sakte hain.

Trend lines, price action, aur candlestick patterns bhi traders ko price movements aur market trends ke baray mein maloomat faraham karte hain. EUR/USD pair ko dekhte hue, bullish trades ke liye aik mazid mukhtasar dalail ki tafseel aur asbaab ke tor par tafseeli jaaiza ki zaroorat hai. 1.0720 ke primary target tak giraawat ke indication aur bullish movement ka intezaar karne wale traders apne strategy ko barqarar rakh sakte hain. Halaanke, traders ko yaad rakhna hoga aur teyar rehna hoga ke 1.0970 jaise ahem darjayi nishaanat, jin ka asar price action par ho sakta hai, ko nazar andaaz na karen. Maharat aur sound trading strategies ke istemal ke zariye traders EUR/USD pair ke market dynamics ko behter tareeqay se samajh sakte hain aur is par kamyab trading kar sakte hain.

150.90 ke range mein trade abhi tak toota nahi hai, aur is se ooper ki darja mumkin hai. Jab hum us ko toren aur uske ooper mazbooti se qaim ho jaayein, to yeh barhne ka signal hoga. Shayad 150.80 ke range ko toor kar ooper jaama karein, phir yeh kharidnay ka signal hoga. Ab ke mukable se, girawat ho sakti hai, aur hum 150.10 ke range ko toor sakte hain aur uske neeche jaama kar sakte hain, phir yeh bechnay ka acha signal hoga. Jab hum 150.10 ke trade ke range ko toren aur uske neeche jaama karein, to yeh bechnay ka signal hoga. Main samajhta hoon ke yeh pair apne peechle kammoun ki taraf ja sakta hai.

EUR/USD ke baray mein guftagu jaari hai. Sikkay dheron kaafi chotay rang ki giraawat se guzar rahe hain. Market dheron ki takmeel ko dekh rahi hai aur iss tajurbaati tajziya ke silsilay mein barqarar rehna bhi mushkil ho raha hai. Market ke tehqeeqati hisso ki samajh aur aik gehraafi dhaanchay ka hona zaroori hai taake traders ko mukhtalif jazbat mein trading karne ke liye koshish kar sakein. Mukhtalif indicators ke istemal se, traders ko EUR/USD ki price trends aur potential reversal points ka andaza lagane mein madad milti hai. Fibonacci retracements, moving averages, aur chart patterns bhi traders ko price movements ki samajh mein madad dete hain. Yeh tools traders ko support aur resistance ke ahem darjayi nishaanat aur trading ke points ka pehchan karne mein madad karte hain.

Sikke mein baazari tabdeeliyon ko tawaqo karte hue, technical analysis ke sath sath fundamental analysis ka istemal karna ahem hai. Monetary policy decisions, economic indicators, aur geopolitical tensions bhi currency valuations aur market sentiment par asar daal sakte hain. Monetary policy ke tabdeeliyan, economic indicators, aur geopolitical events currency ke values par asar daal sakte hain aur market sentiment ko mutasir kar sakte hain.

Trend lines, price action, aur candlestick patterns bhi traders ko price movements aur market trends ke baray mein maloomat faraham karte hain. EUR/USD pair ko dekhte hue, bullish trades ke liye aik mazid mukhtasar dalail ki tafseel aur asbaab ke tor par tafseeli jaaiza ki zaroorat hai. 1.0720 ke primary target tak giraawat ke indication aur bullish movement ka intezaar karne wale traders apne strategy ko barqarar rakh sakte hain. Halaanke, traders ko yaad rakhna hoga aur teyar rehna hoga ke 1.0970 jaise ahem darjayi nishaanat, jin ka asar price action par ho sakta hai, ko nazar andaaz na karen. Maharat aur sound trading strategies ke istemal ke zariye traders EUR/USD pair ke market dynamics ko behter tareeqay se samajh sakte hain aur is par kamyab trading kar sakte hain.

تبصرہ

Расширенный режим Обычный режим