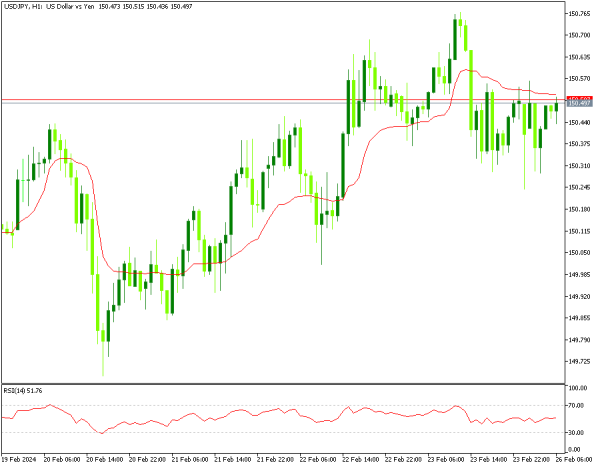

Usd Jpy H1 Time Frame :

aayiyae japani yan aur Amrici dollar ki currency ke jore se mutaliq mojooda market ki harkiyaat ka jaiza letay hain. jab ke mein ne pehlay bunyadi noiyat ko chhoo liya hai, mojooda haalat ki jame Tafheem ke liye yeh iada karne ke qabil hai. yomiya aur hafta waar chart dono par ghalib dhancha mazboot ho gaya hai, agarchay aaraam da raftaar se ho. nateejatan, makhsoos ahdaaf ko haasil karne ke liye aik ahem time frame ki zaroorat hoti hai, jis mein dinon se le kar hafton tak, aur yahan tak ke mahino tak ka waqt hota hai .

hum ne japani yan ke sath aik umeed afzaa hadaf ki nishandahi ki hai, jis ki qeemat bohat ziyada imkaan ke sath haasil karne ke liye tayyar hai. yeh hadaf hafta waar chart par qaim kardah support level se munsalik hai, jo 138 yan fi dollar ke qareeb mandala raha hai. is makhsoos zone ne hamaray haliya oopar ki taraf bherne ke liye aik اتپریرک ke tor par kaam kya aur ab mustaqbil mein yan ki naqal o harkat ke liye aik ahem hawala ke tor par khara hai. taham, hamara muqami rujhan is waqt neechay ki taraf hai, aur usay rivers karne ke liye, hamein kharidaron ki kamzoree ke wazeh isharay par nazar rakhni chahiye. aisa lagta hai ke is terhan ke isharay zahir honay lagey hain .

انسٹرومنٹ ki haliya karkardagi ne pichlle haftay ke muqablay mein numaya kami zahir ki hai, jo khredar ki kamzoree ki raftaar ko zahir karta hai aur mustaqbil qareeb mein qeemat mein mumkina kami ki paish goi karta hai. market ke halaat ka bakhoobi andaza laganay ke liye, hum hema system, rsi rujhan, aur magnetic_levels_color samait mutadid asharion ka faida uthayen ge .

ہاما aur are s aayi trained andikitrz dono surkh rang mein muntaqil ho gaye hain, jo wazeh mandi ke jazbaat aur market mein farokht knndgan ki bartari ka ishara dete hain. is isharay ke jawab mein, hum mukhtasir farokht ki tijarat shuru karne ka intikhab karen ge. hamari bahar niklny ki hikmat e amli maqnateesi satah ke isharay se rahnumai kere gi, jo fi al haal 142, 979 par hai. aik baar jab market is pehlay se tay shuda satah par pahonch jaye to, hum chart par dukhaay gaye bearish range ke andar izafi hadaf ki sthon ko talaash karne par ghhor karen ge .

agar qeemat apni girty hui raftaar ko musalsal jari rakhti hai, to hum –apne munafe ko behtar bananay ke liye ٹریلنگ stop order nafiz karen ge. mutabadil tor par, hum apni farokht ke aik hissay ko mehfooz karne ka intikhab kar satke hain, jis ka maqsad tijarat ke baqiya hissay ko bhi torna hai .

utaar charhao mein kami ka mushahida karte hue, hum muahiday ko band karne ka faisla karte hain, ab tak haasil honay walay munafe ke sath mawaad, aur aik naye tanazur aur hikmat e amli ke sath market mein dobarah daakhil honay ke liye aglay wazeh signal ka intzaar karte hain. yeh mohtaat andaz fikar khatray ke intizam ko yakeeni banata hai aur hamein mustaqbil ki market ki naqal o harkat ka muaser tareeqay se faida uthany ki position mein rakhta hai .

aayiyae japani yan aur Amrici dollar ki currency ke jore se mutaliq mojooda market ki harkiyaat ka jaiza letay hain. jab ke mein ne pehlay bunyadi noiyat ko chhoo liya hai, mojooda haalat ki jame Tafheem ke liye yeh iada karne ke qabil hai. yomiya aur hafta waar chart dono par ghalib dhancha mazboot ho gaya hai, agarchay aaraam da raftaar se ho. nateejatan, makhsoos ahdaaf ko haasil karne ke liye aik ahem time frame ki zaroorat hoti hai, jis mein dinon se le kar hafton tak, aur yahan tak ke mahino tak ka waqt hota hai .

hum ne japani yan ke sath aik umeed afzaa hadaf ki nishandahi ki hai, jis ki qeemat bohat ziyada imkaan ke sath haasil karne ke liye tayyar hai. yeh hadaf hafta waar chart par qaim kardah support level se munsalik hai, jo 138 yan fi dollar ke qareeb mandala raha hai. is makhsoos zone ne hamaray haliya oopar ki taraf bherne ke liye aik اتپریرک ke tor par kaam kya aur ab mustaqbil mein yan ki naqal o harkat ke liye aik ahem hawala ke tor par khara hai. taham, hamara muqami rujhan is waqt neechay ki taraf hai, aur usay rivers karne ke liye, hamein kharidaron ki kamzoree ke wazeh isharay par nazar rakhni chahiye. aisa lagta hai ke is terhan ke isharay zahir honay lagey hain .

انسٹرومنٹ ki haliya karkardagi ne pichlle haftay ke muqablay mein numaya kami zahir ki hai, jo khredar ki kamzoree ki raftaar ko zahir karta hai aur mustaqbil qareeb mein qeemat mein mumkina kami ki paish goi karta hai. market ke halaat ka bakhoobi andaza laganay ke liye, hum hema system, rsi rujhan, aur magnetic_levels_color samait mutadid asharion ka faida uthayen ge .

ہاما aur are s aayi trained andikitrz dono surkh rang mein muntaqil ho gaye hain, jo wazeh mandi ke jazbaat aur market mein farokht knndgan ki bartari ka ishara dete hain. is isharay ke jawab mein, hum mukhtasir farokht ki tijarat shuru karne ka intikhab karen ge. hamari bahar niklny ki hikmat e amli maqnateesi satah ke isharay se rahnumai kere gi, jo fi al haal 142, 979 par hai. aik baar jab market is pehlay se tay shuda satah par pahonch jaye to, hum chart par dukhaay gaye bearish range ke andar izafi hadaf ki sthon ko talaash karne par ghhor karen ge .

agar qeemat apni girty hui raftaar ko musalsal jari rakhti hai, to hum –apne munafe ko behtar bananay ke liye ٹریلنگ stop order nafiz karen ge. mutabadil tor par, hum apni farokht ke aik hissay ko mehfooz karne ka intikhab kar satke hain, jis ka maqsad tijarat ke baqiya hissay ko bhi torna hai .

utaar charhao mein kami ka mushahida karte hue, hum muahiday ko band karne ka faisla karte hain, ab tak haasil honay walay munafe ke sath mawaad, aur aik naye tanazur aur hikmat e amli ke sath market mein dobarah daakhil honay ke liye aglay wazeh signal ka intzaar karte hain. yeh mohtaat andaz fikar khatray ke intizam ko yakeeni banata hai aur hamein mustaqbil ki market ki naqal o harkat ka muaser tareeqay se faida uthany ki position mein rakhta hai .

تبصرہ

Расширенный режим Обычный режим