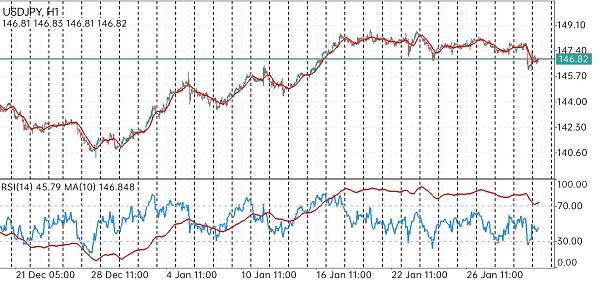

Hourly chart par USD/JPY currency pair mein southern correction dikha raha hai aur ye 146.73 position par hai. Instaforex company ke indicator ke mutabiq, jo is forum par mojood hai, pehle hisse mein buyers ke liye thoda sa faida dikhata hai jo 51.97% ke darmiyan hai. Dusre hisse mein, indicator ek chhote se samay tak ke southward trend ko dikhata hai. Aaj sab kahan ja raha hai? Japan se koi ahem aur dilchaspi paida karne wari khabar nahi anay wali, lekin US se: aj ki tadaad shuru hone wale berozgaari ke maqool arzoon aur imalat se mutalliq fael namon ki hai. Mujhe lagta hai ke ye basic analysis ke liye kafi hai. Technical chezein mat bhoolen. Chhodo toh asaasaan, kya umeed hai? Main ummeed rakhta hoon ke pair 145.60 level par southern correction karega, aur phir uttar ki taraf murnay ke liye 147.80 position par palat jayega.

Daily time window mein Moving Average indicator ki madad se dekha gaya hai ke bechne wale ne kamyabi hasil ki hai USDJPY pair ke qeemat ko control karne mein, Blue 100 MA area ke neeche ghus kar ek bohot taqatwar bearish candlestick ke sath, jo ke qeemat ko mazeed kamzor karne ki ijaazat deta hai. Bechne wala apne mojooda bearish momentum ko barqarar rakhne ki koshish karega, dobara bari dakhilat kar ke qeemat ko neeche le jane mein dabaw banaye rakhne ke liye, jise apna maqsad maqami tor par barqarar rakhna hai, ya'ni ke MA 50 Red area ki taraf, jo ke 145.70-145.60 ke qeemat par hai, jo USDJPY pair ki aglay harkat ke liye aham hai.

Daily time window mein Moving Average indicator ki madad se dekha gaya hai ke bechne wale ne kamyabi hasil ki hai USDJPY pair ke qeemat ko control karne mein, Blue 100 MA area ke neeche ghus kar ek bohot taqatwar bearish candlestick ke sath, jo ke qeemat ko mazeed kamzor karne ki ijaazat deta hai. Bechne wala apne mojooda bearish momentum ko barqarar rakhne ki koshish karega, dobara bari dakhilat kar ke qeemat ko neeche le jane mein dabaw banaye rakhne ke liye, jise apna maqsad maqami tor par barqarar rakhna hai, ya'ni ke MA 50 Red area ki taraf, jo ke 145.70-145.60 ke qeemat par hai, jo USDJPY pair ki aglay harkat ke liye aham hai.

تبصرہ

Расширенный режим Обычный режим