usd/jpy price overview:

greeting and good morning dear friends mujhe umeed hai ap sab thek hongy aur ap ki trading bhi bohut achi chal rahi hogi aj ham bat karen gay usd/jpy pair ky bary main aur ju price move hoi hai us ky bary main jesy ky ap janty hain yeh december ka month chal raha hai is month main ju movement hoti hai kafi ziada hoti hai jis ki wajah say hamen kabhi kabhi na he tehnicaly move samjh main ati hai aur na hi hamen fundamental move samjh main ati hai jesy ky usd/jpy pair main hoi hai usd/jpy pair ki price takriban 600 pips nechy down ai hai aur us ky bad phir say up side recovery hony ky ky qareeb hai jahn say price giri thy ap dekh bhi sakty hain price ky girny ky bad ju recovery hoti hai wo unexpected hai is lie hamen is month main kafi care ky sath soch samjh kar kam karna ho ga phir hi ham loss say bach kar achi income earn kar sakty hain.

Technical analysis usd/jpy:

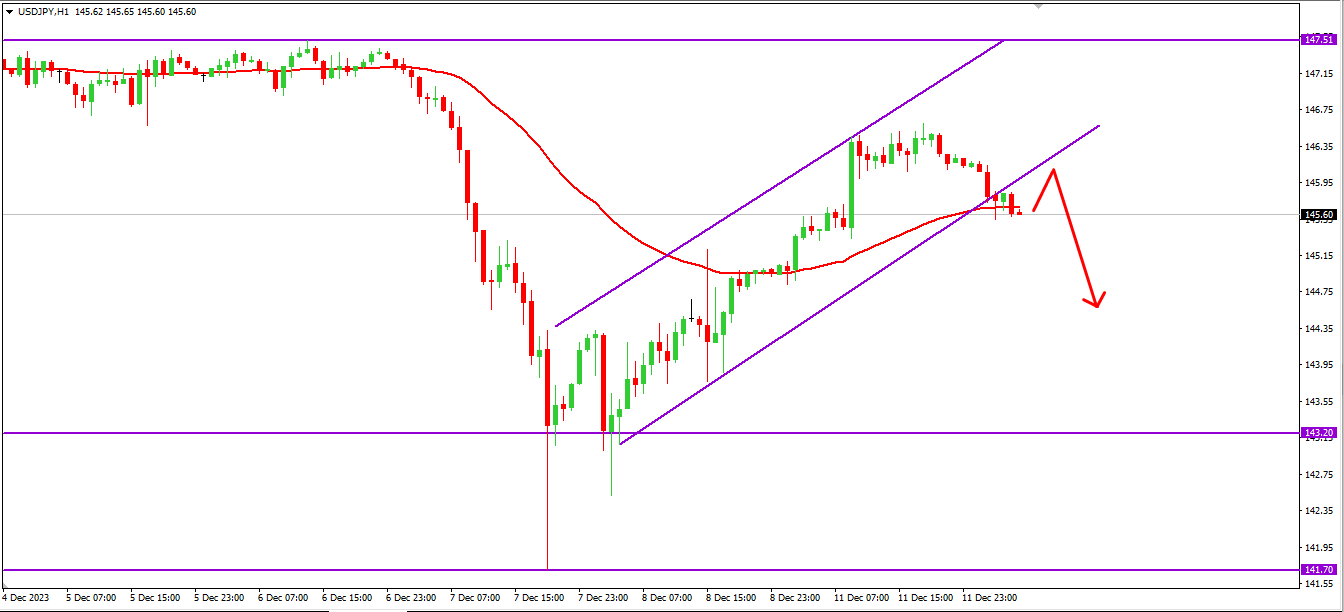

usd/jpy pair main last low 141.70 laga hai ju k ap dekh sakty hain market yahn tak girny ky bad apni recover bhi half say ziada kar chuki hai mager aj ky din ki ager bat kai jaye aur trade find ki jaye tu market ny apna iak channel break kia hai ju ky ap mere chart main dekh sakty hain is channel ko break karny ky bad market main ju samjh main bat aa rahi hai wo yehi hai ky ky is main kuhc mazeed selling aa sakti hai kyon ky 50 ki moving average ny bhi is bat ki nishan dahi ki hai ky is main abhi tak mazed selling presure aa sakta hai is lie hamen ager sell ki koi confirmation milti hai tu mazeed isko sell kar ky acha fiada lay sakty hain aur 200 pips tak is main profit bana sakty hain kyon ky aik support level 143.20 bhi hai jisko market respect kar rahi hai.

aur again market ky wahn tak jany ky chanses hain is lie hamen is main selling ki tarf dekhny say aik risk free trade bhi mil sakti hai aur acha reward bhi mil sakti hai ju hamen acha profit day kar ja sakta hai.

greeting and good morning dear friends mujhe umeed hai ap sab thek hongy aur ap ki trading bhi bohut achi chal rahi hogi aj ham bat karen gay usd/jpy pair ky bary main aur ju price move hoi hai us ky bary main jesy ky ap janty hain yeh december ka month chal raha hai is month main ju movement hoti hai kafi ziada hoti hai jis ki wajah say hamen kabhi kabhi na he tehnicaly move samjh main ati hai aur na hi hamen fundamental move samjh main ati hai jesy ky usd/jpy pair main hoi hai usd/jpy pair ki price takriban 600 pips nechy down ai hai aur us ky bad phir say up side recovery hony ky ky qareeb hai jahn say price giri thy ap dekh bhi sakty hain price ky girny ky bad ju recovery hoti hai wo unexpected hai is lie hamen is month main kafi care ky sath soch samjh kar kam karna ho ga phir hi ham loss say bach kar achi income earn kar sakty hain.

Technical analysis usd/jpy:

usd/jpy pair main last low 141.70 laga hai ju k ap dekh sakty hain market yahn tak girny ky bad apni recover bhi half say ziada kar chuki hai mager aj ky din ki ager bat kai jaye aur trade find ki jaye tu market ny apna iak channel break kia hai ju ky ap mere chart main dekh sakty hain is channel ko break karny ky bad market main ju samjh main bat aa rahi hai wo yehi hai ky ky is main kuhc mazeed selling aa sakti hai kyon ky 50 ki moving average ny bhi is bat ki nishan dahi ki hai ky is main abhi tak mazed selling presure aa sakta hai is lie hamen ager sell ki koi confirmation milti hai tu mazeed isko sell kar ky acha fiada lay sakty hain aur 200 pips tak is main profit bana sakty hain kyon ky aik support level 143.20 bhi hai jisko market respect kar rahi hai.

aur again market ky wahn tak jany ky chanses hain is lie hamen is main selling ki tarf dekhny say aik risk free trade bhi mil sakti hai aur acha reward bhi mil sakti hai ju hamen acha profit day kar ja sakta hai.

تبصرہ

Расширенный режим Обычный режим