Re: Eur/nzd

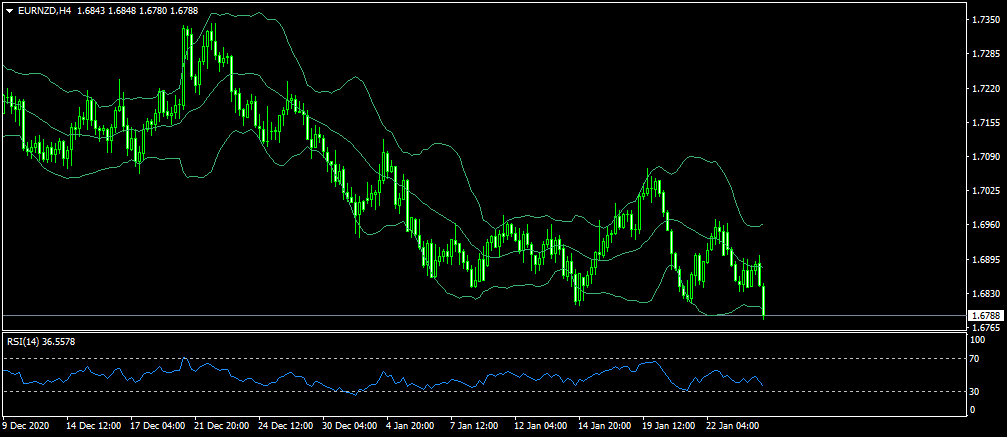

EUR/NZD ki qeemat is waqt 1.6788 hai, 4H chart ke mutabiq is ka down trend hai aur ye is ko continue rakh sakta per jese ke price bollinger band ke neche wale band ko touch kar rahi hai aur ye kuch ziyada hi bik chuka hai aur abhi mazeed girna band kar sakta hai lihaza jinho ne EUR/NZD ko short kia hua hai wo muhtat ho jae aur apni trades ka khayal rakhe.

EUR/NZD ki qeemat is waqt 1.6788 hai, 4H chart ke mutabiq is ka down trend hai aur ye is ko continue rakh sakta per jese ke price bollinger band ke neche wale band ko touch kar rahi hai aur ye kuch ziyada hi bik chuka hai aur abhi mazeed girna band kar sakta hai lihaza jinho ne EUR/NZD ko short kia hua hai wo muhtat ho jae aur apni trades ka khayal rakhe.

تبصرہ

Расширенный режим Обычный режим