GBP/USD ka Technical Analysis

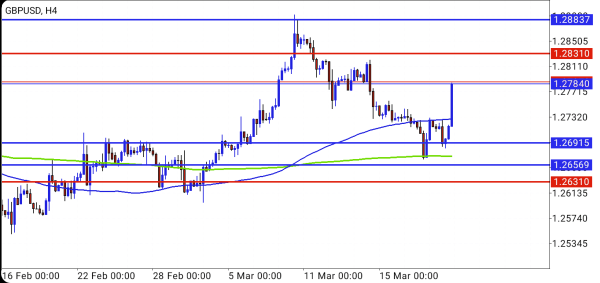

H-4 Timeframe Analysis

Asslam-o-Alaikum Bahi, mera aj analysis GBP pr jb ke FOMC ne apna result dekha diya. FOMC ke impact se pound filhal ke liye upper ja raha hy lekin next week tk ho sakta hy price nechy drop ho. GBP phir se pichle haftay ki ghabrahat mein phansa hua hai aur badhne ki koshish kar raha hai. Price ne 1.2624 par ruk kar ek adha raasta tay kiya, phir is level ko choo kar ek upar ki correction shuru ki, 1.2767 ke resistance ko torne ki koshish ki. Lekin, yeh koshish asar andaz nahi hui, aur jald hi, price signal area ke seema ke neeche laut aayi, pehle ki growth ko poori tarah se palat diya. Is doran, price chart jo pehle green supertrend zone mein tha, wapas red ho gaya hai, jisse dikh raha hai ke sellers dobara control mein aa rahe hain.

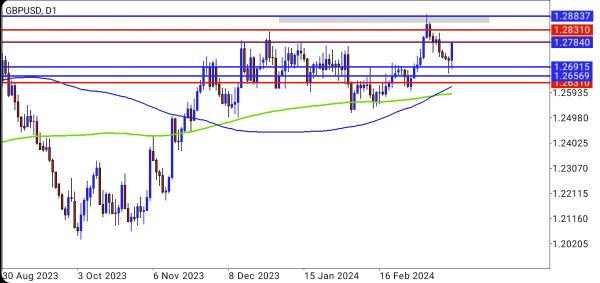

D-1 Timeframe Analysis

Pair abhi mixed lekin overall neutral har haftay mein hai. Isi dauran, key resistance areas ko test kiya gaya hai aur unki integrity ko banaye rakha gaya hai, jabki prices kam hain, jo downward vector ki ahmiyat ko dikhata hai. Is stage par, ek local correction phir se appear ho sakta hai, jo mukhya resistance zone ke border ke saath seemit hoga, jo iski taqat aur aage ke price ke mauke tay karega. Aur ek aur girawat ka confirm rebound is area mein hone par hoga, jo ek neeche ki movement ko banane ki anumati dega, target hoga 1.2501 aur 1.2475 ke beech ka area.

Agar uptrend jari rahe aur 1.2928 ke reversal level aur resistance ko tor diya jaye, toh maujooda situation palat jayega. Chart neeche dekhein:

H-4 Timeframe Analysis

Asslam-o-Alaikum Bahi, mera aj analysis GBP pr jb ke FOMC ne apna result dekha diya. FOMC ke impact se pound filhal ke liye upper ja raha hy lekin next week tk ho sakta hy price nechy drop ho. GBP phir se pichle haftay ki ghabrahat mein phansa hua hai aur badhne ki koshish kar raha hai. Price ne 1.2624 par ruk kar ek adha raasta tay kiya, phir is level ko choo kar ek upar ki correction shuru ki, 1.2767 ke resistance ko torne ki koshish ki. Lekin, yeh koshish asar andaz nahi hui, aur jald hi, price signal area ke seema ke neeche laut aayi, pehle ki growth ko poori tarah se palat diya. Is doran, price chart jo pehle green supertrend zone mein tha, wapas red ho gaya hai, jisse dikh raha hai ke sellers dobara control mein aa rahe hain.

D-1 Timeframe Analysis

Pair abhi mixed lekin overall neutral har haftay mein hai. Isi dauran, key resistance areas ko test kiya gaya hai aur unki integrity ko banaye rakha gaya hai, jabki prices kam hain, jo downward vector ki ahmiyat ko dikhata hai. Is stage par, ek local correction phir se appear ho sakta hai, jo mukhya resistance zone ke border ke saath seemit hoga, jo iski taqat aur aage ke price ke mauke tay karega. Aur ek aur girawat ka confirm rebound is area mein hone par hoga, jo ek neeche ki movement ko banane ki anumati dega, target hoga 1.2501 aur 1.2475 ke beech ka area.

Agar uptrend jari rahe aur 1.2928 ke reversal level aur resistance ko tor diya jaye, toh maujooda situation palat jayega. Chart neeche dekhein:

تبصرہ

Расширенный режим Обычный режим