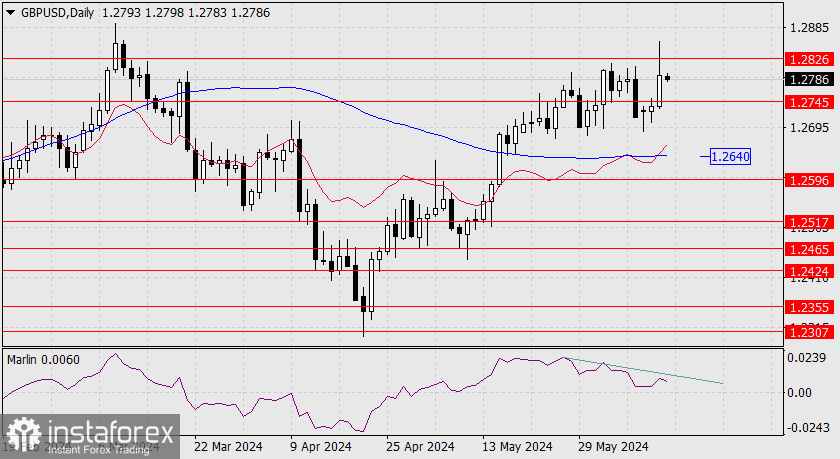

Ek bullish trend mein, traders aksar buying opportunities dhoondhte hain, khaaskar price dips ya recent highs ke breakouts par. GBP/USD currency pair ke liye, dekhne ke liye key level 1.2700 hai. Agar yeh pair is level ki taraf pull back karta hai aur upar rehne ke asaar dikhata hai, to yeh long positions mein enter karne ka ek waqti mauqa paish kar sakta hai, mazeed upward movement ki umeed ke saath. 1.2700 level ek psychological aur technical support zone ke taur par kaam karta hai. Traders is level ko closely monitor karte hain kyunki agar price iske upar rehta hai, to yeh apni significance ko strong support ke taur par reinforce karta hai, jo traders ke confidence ko bullish trend ke continuation mein barhata hai. Historically, 1.2700 GBP/USD ke liye ek pivotal level raha hai, jo aksar strong buying interest ke areas ko mark karta hai. Yeh level pullbacks ke dauran hold karne ki ability signal karti hai ke yahan par robust demand zone hai jahan traders positions accumulate karna chahtay hain, mazeed upward momentum ke resume hone ki umeed mein.

Jab price 1.2700 ke qareeb hota hai, traders stability aur potential reversal patterns jaise ke bullish engulfing candles, hammer formations, ya doosre bullish candlestick patterns ke asaar dhoondhte hain. Yeh patterns yeh indicate kar sakte hain ke buyers price ko support karne ke liye aage aa rahe hain, jo suggest karta hai ke pullback temporary ho sakta hai aur bullish trend continue ho sakta hai. Market sentiment is scenario mein bohot ahm hai. UK se positive economic data, jaise ke strong GDP growth, low unemployment rates, aur stable inflation, pound ke liye bullish outlook ko reinforce kar sakte hain. Iske baraks, koi bhi economic weakness ya political instability ke asaar sentiment ko weigh kar sakte hain aur 1.2700 ke neeche break hone ka lead de sakte hain.

Jo traders bullish trend ka faida uthana chahte hain, unke liye 1.2700 level ke ird-gird long positions enter karna ek strategic move ho sakta hai. Strategy yeh hogi ke price action ko closely monitor kiya jaye jab yeh level ke qareeb aaye. Agar price hold karne aur base form karne ke asaar dikhaye, to traders long positions initiate kar sakte hain, aur stop-loss orders 1.2700 ke thoda neeche place kar sakte hain unexpected downside risks se bachne ke liye. Aisi long positions ka target recent highs ya current price ke upar significant resistance levels par set kiya ja sakta hai. Yeh ek favorable risk-reward ratio ko ensure karta hai, jo successful trading ka ek critical component hai. 1.2700 par potential buying opportunity ke bawajood, traders ko cautious rehna zaroori hai. Agar price is level ke neeche girta hai, to yeh potential shift in trend ya deeper retracement ko indicate kar sakta hai. Aisi movement signal karegi ke bullish momentum weak ho sakta hai, aur mazeed downside expect kiya ja sakta hai. Is case mein, traders ko apni positions ko reassess karne ke liye tayar rehna chahiye aur shayad defensive stance shift karna chahiye.

Jab price 1.2700 ke qareeb hota hai, traders stability aur potential reversal patterns jaise ke bullish engulfing candles, hammer formations, ya doosre bullish candlestick patterns ke asaar dhoondhte hain. Yeh patterns yeh indicate kar sakte hain ke buyers price ko support karne ke liye aage aa rahe hain, jo suggest karta hai ke pullback temporary ho sakta hai aur bullish trend continue ho sakta hai. Market sentiment is scenario mein bohot ahm hai. UK se positive economic data, jaise ke strong GDP growth, low unemployment rates, aur stable inflation, pound ke liye bullish outlook ko reinforce kar sakte hain. Iske baraks, koi bhi economic weakness ya political instability ke asaar sentiment ko weigh kar sakte hain aur 1.2700 ke neeche break hone ka lead de sakte hain.

Jo traders bullish trend ka faida uthana chahte hain, unke liye 1.2700 level ke ird-gird long positions enter karna ek strategic move ho sakta hai. Strategy yeh hogi ke price action ko closely monitor kiya jaye jab yeh level ke qareeb aaye. Agar price hold karne aur base form karne ke asaar dikhaye, to traders long positions initiate kar sakte hain, aur stop-loss orders 1.2700 ke thoda neeche place kar sakte hain unexpected downside risks se bachne ke liye. Aisi long positions ka target recent highs ya current price ke upar significant resistance levels par set kiya ja sakta hai. Yeh ek favorable risk-reward ratio ko ensure karta hai, jo successful trading ka ek critical component hai. 1.2700 par potential buying opportunity ke bawajood, traders ko cautious rehna zaroori hai. Agar price is level ke neeche girta hai, to yeh potential shift in trend ya deeper retracement ko indicate kar sakta hai. Aisi movement signal karegi ke bullish momentum weak ho sakta hai, aur mazeed downside expect kiya ja sakta hai. Is case mein, traders ko apni positions ko reassess karne ke liye tayar rehna chahiye aur shayad defensive stance shift karna chahiye.

تبصرہ

Расширенный режим Обычный режим