gbpusd

US currency mushkil waqt ka samna kar rahi hai. Pichle kuch hafton se, US dollar ki demand mein khas tor par US data ke bais giravat aayi hai. Tamam ahem reports ne bazaar ki tawqat se kam tar honay ka sabab sabit hua. Is liye, Federal Reserve ka mazboot hawkish stand bhi US dollar ki madad nahi kar saka. To sawal yeh hai, agla kya hai? Kya US currency giravat jaari rahegi, aur kya ab dono instruments ke liye mojooda wave tasawur toot jayega?

US kuch ahem reports jaari karega. Bas is liye ke pichle do hafton mein, tamam ahem indicators pehle se hi jaari kar diye gaye hain. Main University of Michigan Consumer Sentiment Index ko highlight karunga, jo Jumma ko jaari kiya jayega, jabke baqi tamam reports bazaar aur dollar ke liye bohot kam ahmiyat rakhte hain. Itna pesimistic tasawur hone ke bawajood, main ab bhi yeh manta hoon ke waves 3 ya c mukammal honge. Market pichle kai hafton se weak US data ka jawab de rahi hai, lekin agle paanch dinon mein koi reports na hon to dollar par naye short positions ke liye koi wajah nahi hogi.

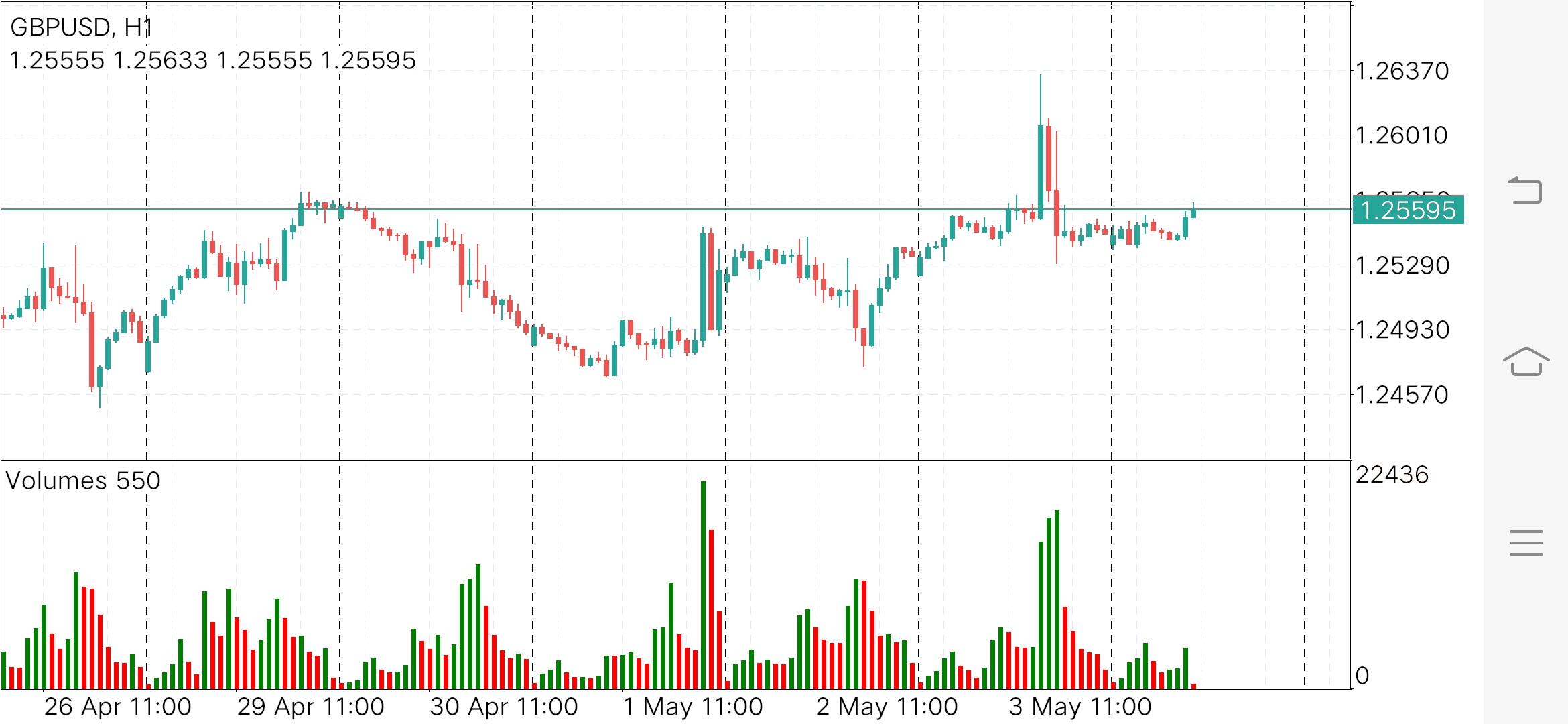

Jumma ko, British pound thori dair ke liye 100 pips se zyada barh gayi, lekin jald hi apni asal jagah par wapas aa gayi, din ko sirf 12 pips ke ooper band hui. Uper ka saaya descending channel ki line ke mutabiq tha. Kul milake, qeemat 1.2525 ke darja par stable ho gayi hai, lekin chunancha woh pehle se hi dono bullish targets (channel ki line aur level 1.2596) tak pohanch chuki hai, to qeemat support ke neeche wapas aa sakti hai aur 1.2427 ki taraf bhi ja sakti hai. Marlin oscillator urooj halat mein hai lekin apni chadhav ko kaafi kam kar chuka hai.

4 ghante ka chart dekhte hue, qeemat balance indicator line par ruki hui hai. Marlin oscillator zero neutral line par hai. Uska manfi shetani mein jaana qeemat ko 1.2525 ke support ko paar karne mein madad faraham kar sakta hai. Agey, qeemat ko MACD line (1.2495) se support milega. Is support ko mukammal tor par toornay se rasta khulta hai 1.2427 ki taraf.

US currency mushkil waqt ka samna kar rahi hai. Pichle kuch hafton se, US dollar ki demand mein khas tor par US data ke bais giravat aayi hai. Tamam ahem reports ne bazaar ki tawqat se kam tar honay ka sabab sabit hua. Is liye, Federal Reserve ka mazboot hawkish stand bhi US dollar ki madad nahi kar saka. To sawal yeh hai, agla kya hai? Kya US currency giravat jaari rahegi, aur kya ab dono instruments ke liye mojooda wave tasawur toot jayega?

US kuch ahem reports jaari karega. Bas is liye ke pichle do hafton mein, tamam ahem indicators pehle se hi jaari kar diye gaye hain. Main University of Michigan Consumer Sentiment Index ko highlight karunga, jo Jumma ko jaari kiya jayega, jabke baqi tamam reports bazaar aur dollar ke liye bohot kam ahmiyat rakhte hain. Itna pesimistic tasawur hone ke bawajood, main ab bhi yeh manta hoon ke waves 3 ya c mukammal honge. Market pichle kai hafton se weak US data ka jawab de rahi hai, lekin agle paanch dinon mein koi reports na hon to dollar par naye short positions ke liye koi wajah nahi hogi.

Jumma ko, British pound thori dair ke liye 100 pips se zyada barh gayi, lekin jald hi apni asal jagah par wapas aa gayi, din ko sirf 12 pips ke ooper band hui. Uper ka saaya descending channel ki line ke mutabiq tha. Kul milake, qeemat 1.2525 ke darja par stable ho gayi hai, lekin chunancha woh pehle se hi dono bullish targets (channel ki line aur level 1.2596) tak pohanch chuki hai, to qeemat support ke neeche wapas aa sakti hai aur 1.2427 ki taraf bhi ja sakti hai. Marlin oscillator urooj halat mein hai lekin apni chadhav ko kaafi kam kar chuka hai.

4 ghante ka chart dekhte hue, qeemat balance indicator line par ruki hui hai. Marlin oscillator zero neutral line par hai. Uska manfi shetani mein jaana qeemat ko 1.2525 ke support ko paar karne mein madad faraham kar sakta hai. Agey, qeemat ko MACD line (1.2495) se support milega. Is support ko mukammal tor par toornay se rasta khulta hai 1.2427 ki taraf.

تبصرہ

Расширенный режим Обычный режим