GBP/USD

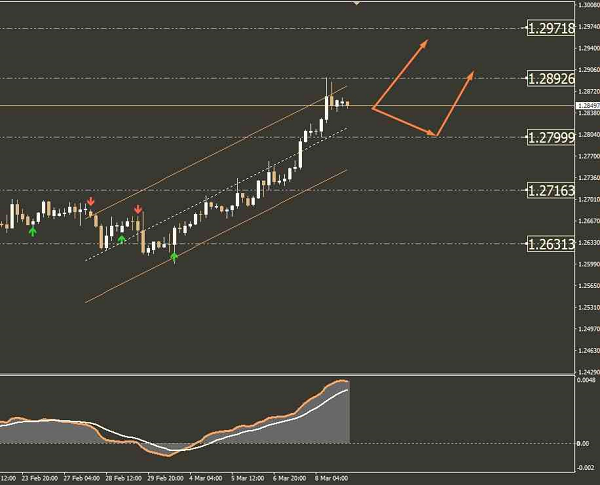

Assalam Alaikum! Market me kam utar-chadhaw ke darmiyan pound/dollar ka joda filhal 4-ghante ke chart par chadhte hue channel ke andar niche ki taraf trade kar raha hai. MACD indicator zyada kharidari ke ilaqe me hai. MA Crossover Arrows indicator qimat me izafe ka ishara karta rahta hai.

Is surat me, munafa kamane ka behtarin tariqa 1.2892 ki satah tak izafe par aitemad karte hue long positions shamil karna hai. Agar qimat is nishan se toot jata hai to, Bartanwi pound faide ko badhayega aur 1.2971 ki taraf badhega. Mutabadil ke taur par, sterling faide ko dobara shuru karne se pahle mandi ki islah ke hisse ke taur par 1.2799 ki satah tak gir sakta hai.

Assalam Alaikum! Market me kam utar-chadhaw ke darmiyan pound/dollar ka joda filhal 4-ghante ke chart par chadhte hue channel ke andar niche ki taraf trade kar raha hai. MACD indicator zyada kharidari ke ilaqe me hai. MA Crossover Arrows indicator qimat me izafe ka ishara karta rahta hai.

Is surat me, munafa kamane ka behtarin tariqa 1.2892 ki satah tak izafe par aitemad karte hue long positions shamil karna hai. Agar qimat is nishan se toot jata hai to, Bartanwi pound faide ko badhayega aur 1.2971 ki taraf badhega. Mutabadil ke taur par, sterling faide ko dobara shuru karne se pahle mandi ki islah ke hisse ke taur par 1.2799 ki satah tak gir sakta hai.

تبصرہ

Расширенный режим Обычный режим