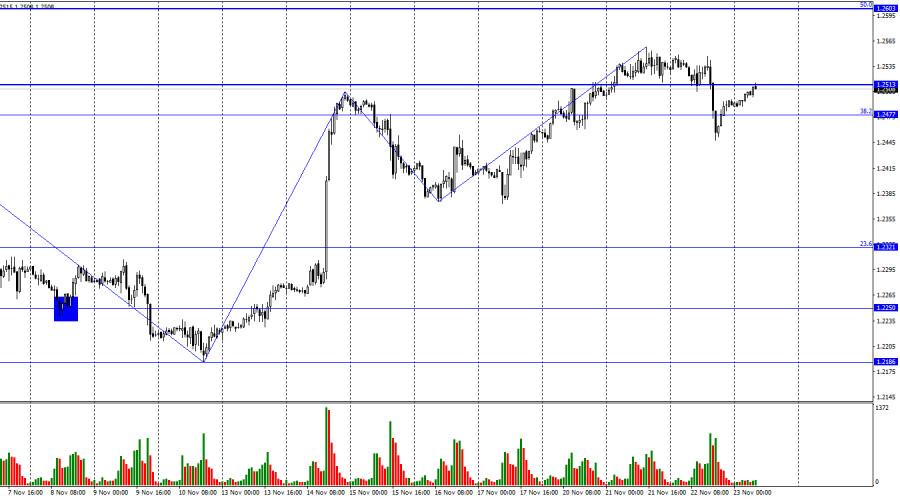

GBP/USD pair ke hourly chart par, Budh ko US currency ke favor mein palat gaya aur 38.2% (1.2477) tak correction level ke neeche consolidate hua. Lekin is bandish ne bears ko kuch nahi diya, kyun ke aaj pair ne fir se 1.2477 aur 1.2513 ke darmiyan zone mein laut aaya hai. Agar is zone se ek rebound hota hai, toh bohot zyada chance hai ki quote girawat jari rakhega aur 23.6% (1.2321) tak correction level ki taraf jaayega. Agar is zone ke upar band hota hai, toh traders ko ummeed ho sakti hai ki growth 50.0% (1.2603) Fibonacci level ki taraf badhegi.

Wave scenario ab saral aur saaf ho gaya hai. Waves ab bhi kaafi bade hain, jo trading mein takleef laa sakte hain. Lekin trend abhi "bullish" hai aur isey pura karne ke liye 1.2372 par aakhri kamzori ki breakthrough chahiye hogi. Is case mein, pair "bearish" trend mein transition karne ki signs dikhayega, jo ki ek kaafi majbooth uthaan ke baad adhik logic lagta hai. Lekin abhi ke liye, "bullish" trend bana hua hai aur bears apni positions ko mazbooti se sthapit nahi kar pa rahe hain.

US mein Budh ke raat ko, pichhle FOMC meeting ke minutes jaari kiye gaye. Report mein kaha gaya ki regulator aane wale information par adharit faisley karta rahega. FOMC ke sadasyon ki lagbhag sabhi ne sehmati se saaf kiya ki monetary policy ko sirf unsatisfactory inflation dynamics ke case mein hi tight kiya jaana chahiye. Har policymaker ko yeh bhi bharosa nahi hai ki sufficient restrictive policy se inflation ko 2% tak laaya ja sakta hai. Kisi bhi FOMC member ne interest rate mein badhane ya ghatane ke liye vote nahi kiya. Is tarah, Fed ne fir se "darwaza khula chhod diya" lekin future ke faislon ke baare mein koi signal nahi diya. US mein October mein inflation kam hui, jo "hawkish" sentiment ko aur bhi kamzor kar sakta hai.

Technical Outlook

Pound ki khareedari karein jab wo 1.2562 (chart par hari line) tak pahunchega aur take profit 1.2604 (chart par mote hari line) par karein. Growth hogi, lekin European session ke dauraan ki tarah tezi nahi hogi.

Khareedne ke samay, yaad rakhein ki MACD line zero ke upar ho ya zero se oonchi ho. Pound ko 1.2524 ke do consecutive price tests ke baad bhi khareed sakte hain, lekin MACD line oversold area mein honi chahiye, kyunki tabhi market 1.2562 aur 1.2604 par reverse hoga.

Bechne ke liye, pound ko 1.2524 (chart par laal line) tak pahunchne par bechein aur take profit 1.2474 par karein. Dabav badhega ek nakamyab consolidation ke baad jo naye daily high ke upar hoga.

Bechne ke samay, yaad rakhein ki MACD line zero ke neeche ho ya zero se neeche aaye. Pound ko 1.2562 ke do consecutive price tests ke baad bhi bech sakte hain, lekin MACD line overbought area mein honi chahiye, kyunki tabhi market 1.2524 aur 1.2474 par reverse hoga.

Wave scenario ab saral aur saaf ho gaya hai. Waves ab bhi kaafi bade hain, jo trading mein takleef laa sakte hain. Lekin trend abhi "bullish" hai aur isey pura karne ke liye 1.2372 par aakhri kamzori ki breakthrough chahiye hogi. Is case mein, pair "bearish" trend mein transition karne ki signs dikhayega, jo ki ek kaafi majbooth uthaan ke baad adhik logic lagta hai. Lekin abhi ke liye, "bullish" trend bana hua hai aur bears apni positions ko mazbooti se sthapit nahi kar pa rahe hain.

US mein Budh ke raat ko, pichhle FOMC meeting ke minutes jaari kiye gaye. Report mein kaha gaya ki regulator aane wale information par adharit faisley karta rahega. FOMC ke sadasyon ki lagbhag sabhi ne sehmati se saaf kiya ki monetary policy ko sirf unsatisfactory inflation dynamics ke case mein hi tight kiya jaana chahiye. Har policymaker ko yeh bhi bharosa nahi hai ki sufficient restrictive policy se inflation ko 2% tak laaya ja sakta hai. Kisi bhi FOMC member ne interest rate mein badhane ya ghatane ke liye vote nahi kiya. Is tarah, Fed ne fir se "darwaza khula chhod diya" lekin future ke faislon ke baare mein koi signal nahi diya. US mein October mein inflation kam hui, jo "hawkish" sentiment ko aur bhi kamzor kar sakta hai.

Technical Outlook

Pound ki khareedari karein jab wo 1.2562 (chart par hari line) tak pahunchega aur take profit 1.2604 (chart par mote hari line) par karein. Growth hogi, lekin European session ke dauraan ki tarah tezi nahi hogi.

Khareedne ke samay, yaad rakhein ki MACD line zero ke upar ho ya zero se oonchi ho. Pound ko 1.2524 ke do consecutive price tests ke baad bhi khareed sakte hain, lekin MACD line oversold area mein honi chahiye, kyunki tabhi market 1.2562 aur 1.2604 par reverse hoga.

Bechne ke liye, pound ko 1.2524 (chart par laal line) tak pahunchne par bechein aur take profit 1.2474 par karein. Dabav badhega ek nakamyab consolidation ke baad jo naye daily high ke upar hoga.

Bechne ke samay, yaad rakhein ki MACD line zero ke neeche ho ya zero se neeche aaye. Pound ko 1.2562 ke do consecutive price tests ke baad bhi bech sakte hain, lekin MACD line overbought area mein honi chahiye, kyunki tabhi market 1.2524 aur 1.2474 par reverse hoga.

تبصرہ

Расширенный режим Обычный режим