T E C H N I C A L _ A N A L Y S I S U S D / C A D

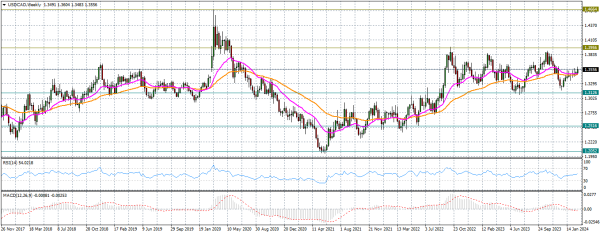

Chalte hain hum USD/CAD market ko tajziya karne. Mujhe umeed hai ke yeh hamare liye faida-mand hoga, aur paisay ke management ka khayal rakhna na bhoolein. USD/CAD mojooda waqt 1.3556 par trading ho raha hai. Trend ke lehaz se, qeemat ki harkat mazbooti se bearish rehti hai. Qeemat ne peechlay trend ko kamyaab tora hai, is liye qeemat mazboot ho sakti hai aur naye darkhwast ilaqe mein dakhil ho sakti hai. Is time frame mein Relative Strength Index (RSI) indicator musbat readings dikhata hai aur sirf 50 level ke oopar trading kar raha hai, jo ke kharid-darun ke liye qeemat ko 1.3956 level ki taraf daba sakta hai. Ussi waqt, is time frame mein moving average convergence divergence (MACD) indicator abhi bhi manfi range ke andar hai lekin apna sar ooncha rakhta hai, jo ke yeh darshata hai ke qeemat pehle maqsood ki taraf barhti rahegi. Ab qeemat 20 EMA aur 50 EMA ke oopar trading kar rahi hai, aur jab tak qeemat uss se oopar trading kar rahi hai, barhawa ki ek mauqa mojood hogi.

Zamana bakhair darust hai, agar aap yeh baat samajh gaye hain ke technical analysis ka kis tarah istemal karna chahiye. Technical analysis ke zariye hum price ki harkaton ko samajh sakte hain aur is se hamari trading decision ko optimize kar sakte hain. Lekin yaad rakhein ke technical analysis sirf ek hissa hai, aur dusre factors bhi market ke asrat ko mutasir karte hain jaise ke economic reports aur geopolitical events.

Is tarah ke analysis ka istemal karte waqt, hamesha apne trading plan aur risk management ko yaad rakhein. Aapko hamesha apne entry aur exit points ka tay karna chahiye, aur apne trading capital ko durust tareeqay se manage karna chahiye. Is ke ilawa, market mein hamesha badalaw aur surprises ho sakte hain, is liye hamesha flexible rehna zaroori hai aur apne strategy ko zaroor adjust karte rahein.

Chalte hain hum USD/CAD market ko tajziya karne. Mujhe umeed hai ke yeh hamare liye faida-mand hoga, aur paisay ke management ka khayal rakhna na bhoolein. USD/CAD mojooda waqt 1.3556 par trading ho raha hai. Trend ke lehaz se, qeemat ki harkat mazbooti se bearish rehti hai. Qeemat ne peechlay trend ko kamyaab tora hai, is liye qeemat mazboot ho sakti hai aur naye darkhwast ilaqe mein dakhil ho sakti hai. Is time frame mein Relative Strength Index (RSI) indicator musbat readings dikhata hai aur sirf 50 level ke oopar trading kar raha hai, jo ke kharid-darun ke liye qeemat ko 1.3956 level ki taraf daba sakta hai. Ussi waqt, is time frame mein moving average convergence divergence (MACD) indicator abhi bhi manfi range ke andar hai lekin apna sar ooncha rakhta hai, jo ke yeh darshata hai ke qeemat pehle maqsood ki taraf barhti rahegi. Ab qeemat 20 EMA aur 50 EMA ke oopar trading kar rahi hai, aur jab tak qeemat uss se oopar trading kar rahi hai, barhawa ki ek mauqa mojood hogi.

Zamana bakhair darust hai, agar aap yeh baat samajh gaye hain ke technical analysis ka kis tarah istemal karna chahiye. Technical analysis ke zariye hum price ki harkaton ko samajh sakte hain aur is se hamari trading decision ko optimize kar sakte hain. Lekin yaad rakhein ke technical analysis sirf ek hissa hai, aur dusre factors bhi market ke asrat ko mutasir karte hain jaise ke economic reports aur geopolitical events.

Is tarah ke analysis ka istemal karte waqt, hamesha apne trading plan aur risk management ko yaad rakhein. Aapko hamesha apne entry aur exit points ka tay karna chahiye, aur apne trading capital ko durust tareeqay se manage karna chahiye. Is ke ilawa, market mein hamesha badalaw aur surprises ho sakte hain, is liye hamesha flexible rehna zaroori hai aur apne strategy ko zaroor adjust karte rahein.

تبصرہ

Расширенный режим Обычный режим