USD/CAD Forum Analysis, Forecast

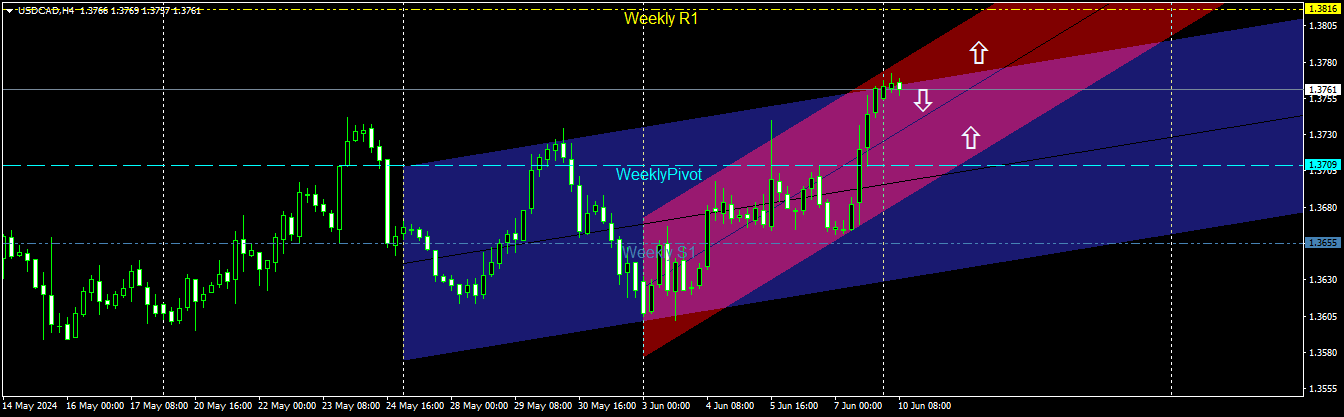

Uper di gayi 4-hour chart reference ko dekhte hue agar USD/CAD market ke trend par tawajjo di jaye, to lagta hai market ab bhi stable hai aur 1.3742 zone ke uper ruk gaya hai. Ye is baat ko wazeh karta hai ke market mein ek trend situation hai jo ab bhi uptrend ki taraf hai aur technically bullish trend ke continuation ka moqa hai. Agar price structure travel pattern ya candlestick jo weekly time frame par bani hai ko dekha jaye, to ye ek bullish candlestick bana sakti hai. Kal ke price movement ko dekha jaye to ab bhi trading aise situation mein hai jo uper ki taraf ja rahi hai kyunki is subah closing position opening price se zyada thi jo hafte ke aaghaz mein thi.

Price movement ko dekhte hue jo ke bullish lagta hai, mujhe lagta hai agle hafte ki trading mein candlestick movement buyers ke control mein rehne ka moqa rakhti hai aur 1.3792 price zone tak jaane ka moqa hai kyunki technically price movement uptrend side par travel karti nazar aati hai. Agle hafte ke aaghaz mein kuch arsa ke liye prices downward correction ka samna kar sakti hain kyunki Saturday raat ko high price increase hua tha. Uske baad, ek aur bullish moqa khulne ka imkaan hai kyunki candlestick position 100 period simple moving average zone ko touch kar gayi hai.

Agle hafte agar price bullish reh sakti hai, to iska matlab hai ke month end tak market buyers ke control mein rahegi. Agar aap mojooda market trend ka faida uthana chahte hain, to profit hasil karne ke moqe khul sakte hain halaanke loss ka moqa bhi hai. Yeh tasavvur kiya gaya hai ke buyers market ko control karne aur higher areas tak pahunchne ki koshish karenge. Agle hafte ke USD/CAD market ke trading plan mein, main Buy trading option ko chunoonga jab tak price 1.3742 zone ke uper hai. Overall, agle hafte price travel ka moqa lagta hai ke bullish trend ke sath chal raha hai.

Uper di gayi 4-hour chart reference ko dekhte hue agar USD/CAD market ke trend par tawajjo di jaye, to lagta hai market ab bhi stable hai aur 1.3742 zone ke uper ruk gaya hai. Ye is baat ko wazeh karta hai ke market mein ek trend situation hai jo ab bhi uptrend ki taraf hai aur technically bullish trend ke continuation ka moqa hai. Agar price structure travel pattern ya candlestick jo weekly time frame par bani hai ko dekha jaye, to ye ek bullish candlestick bana sakti hai. Kal ke price movement ko dekha jaye to ab bhi trading aise situation mein hai jo uper ki taraf ja rahi hai kyunki is subah closing position opening price se zyada thi jo hafte ke aaghaz mein thi.

Price movement ko dekhte hue jo ke bullish lagta hai, mujhe lagta hai agle hafte ki trading mein candlestick movement buyers ke control mein rehne ka moqa rakhti hai aur 1.3792 price zone tak jaane ka moqa hai kyunki technically price movement uptrend side par travel karti nazar aati hai. Agle hafte ke aaghaz mein kuch arsa ke liye prices downward correction ka samna kar sakti hain kyunki Saturday raat ko high price increase hua tha. Uske baad, ek aur bullish moqa khulne ka imkaan hai kyunki candlestick position 100 period simple moving average zone ko touch kar gayi hai.

Agle hafte agar price bullish reh sakti hai, to iska matlab hai ke month end tak market buyers ke control mein rahegi. Agar aap mojooda market trend ka faida uthana chahte hain, to profit hasil karne ke moqe khul sakte hain halaanke loss ka moqa bhi hai. Yeh tasavvur kiya gaya hai ke buyers market ko control karne aur higher areas tak pahunchne ki koshish karenge. Agle hafte ke USD/CAD market ke trading plan mein, main Buy trading option ko chunoonga jab tak price 1.3742 zone ke uper hai. Overall, agle hafte price travel ka moqa lagta hai ke bullish trend ke sath chal raha hai.

تبصرہ

Расширенный режим Обычный режим