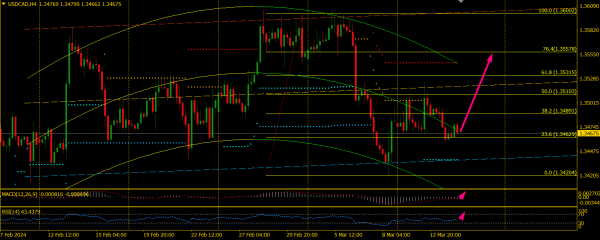

USD/CAD joray ki harkat mukhtalif factors par munhasir hoti hai, jese ke Amreki dollar ya Canadian dollar ki quwwat mein tabdiliyan. Kamzor Amreki dollar ya zyada mazboot Canadian dollar joray ki upri harkat ko rukawat bana sakti hai, jabke Canada ki oil exports par bharosa karte hue oil ke daamon mein tabdiliyan bhi Canadian dollar ki quwwat par asar dal sakti hain. In factors ke roshni mein, traders aur investors ko hoshiyari se kaam karna chahiye aur apne strategies ko mutabiq banaye rakhna chahiye. Maazi ka manzar yeh darust karta hai ke USD/CAD joray mein mazeed upri harkat ki sambhavna hai. Magar, traders ko market mein ahem levels aur taraqqiyan ko kareeb se nigrani mein rakhna zaroori hai. Maaloomat hasil rakhne aur narmi se kaam karne se, traders forex market ke dinamik manzar mein taezai se chhote kar sakte hain aur ubharne wale moqaat ka faida utha sakte hain. USD/CAD joray mein kamyabi ke aik ahem pehlu ki currency qeemat mein tabdiliyon par kaano band rakhna hai. Maali indicators, markazi bank policies, aur saiyasi waqiyat, sab Amreki dollar aur Canadian dollar ki quwwat par asar dal sakte hain. In taraqqiyat ke mutabiq amli tor par dekhtehue, traders ko market ki junubi jazbaton mein tabdiliyan ane ki sambhavnaon ko pehle hi dekh leni chahiye aur apni positions ko mutabiq bana lena chahiye.

Is ke ilawa, Canadian dollar ki quwwat ko shakal denay mein oil ke daamon mein tabdiliyan aham kirdaar ada karti hain. Duniya ke baray oil exporters mein se aik hone ke natayej mein, Canada ka currency oil ke daamon ke sath qareebi taluq rakhta hai. Is liye, traders ko USD/CAD joray ko trade karte waqt oil market dynamics aur unke Canadian dollar par ke asar ko dekhna chahiye. Funooni factors ko nigrani mein rakhne ke ilawa, technical analysis bhi mukhtasir price movements mein shamil hoti hai. Ahem support aur resistance levels ko pehchan'na, sath hi price action mein patterns aur trends ko pehchan'na, traders ko entry aur exit points ke bare mein mutakammil faislay karne mein madadgar sabit hota hai. Khatarnak management bhi kamyabi ke liye aik ahem pehlu hai USD/CAD joray mein. Risk ko bardasht ke mutabiq stop-loss orders laga kar aur position ke sizes ko manage karna nuqsaan ki sambhavnaon ko kam karne ke liye zaroori amal hai. Mazboot risk management principles ko amal mein lanay se, traders apna maal bacha sakte hain aur lambe arse tak munafa ko mehfooz rakh sakte hain.

تبصرہ

Расширенный режим Обычный режим