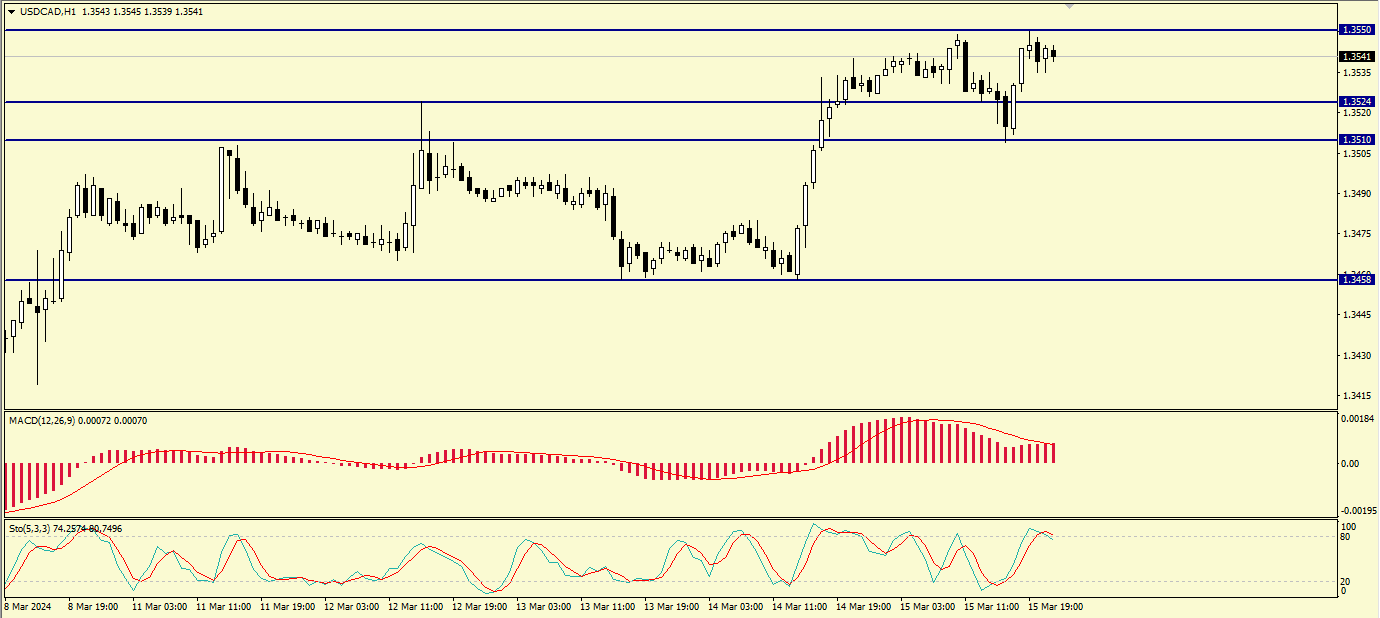

Hello traders. Aaj hum USD/CAD ka aik acha tajziya share karne ja rahe hain taake aap bhi is se faida utha sakein. Halqa-e-bazaar USD/CAD ka mojooda price 1.3541 ke area mein chal raha hai. Chart abhi mukammal nahi hai. Magar, hum abhi aik urooj rukh ko pehchaan sakte hain. Is chart par zyada khareedari ke chances hain. Relative Strength Index (RSI) 54.1922 par hai jo ke bullish territory mein hai aur aik bullish momentum ko dikhata hai. Halqa mein khareedaron ka stable nazar aa raha hai. Is ke ilawa, Moving Average Convergence Divergence (MACD) indicator chart mein aik urooj rukh ki taraf ishara kar raha hai. Mazeed, USD/CAD ke price ne 50-EMA line ko cross nahi kiya hai, jo kehta hai ke bullish trend abhi taqatwar hai, is liye hum chhoti trading par tawajjuh de sakte hain. USD/CAD ke liye ahem resistance level 1.3549 hai. Agar market price 1.3549 resistance level ko tor deti hai, to woh ooper ja sakti hai, jaise ke maine chart par mark kiya hai.

Magar, agar price zone 1.4121 kamiyabi se tor di jati hai, to USD/CAD apni bullish movement ko aage barha sakti hai resistance sector 1.4654 ki taraf. Doosri taraf, USD/CAD ke liye ahem support level 1.3512 hai. Agar market price yahan se neeche jaati hai aur 1.3512 support level ko cross karti hai, to market price neeche ja sakti hai, aur market neeche ja sakta hai, jaise ke maine chart par mark kiya hai. Magar, agar price zone 1.3512 kamiyabi se tor di jati hai, to USD/CAD apni bearish movement ko aage barha sakti hai support sector 1.3482 ki taraf. Bara waqt ke frame forex market ke baray mein sahi signals deta hai. Is liye, main umeed karta hoon ke USD/CAD ka market price is hafte 1.3459 zone ko tor dega. Baad mein yeh aik continuation pattern bhi bana sakta hai.

Moujooda market sentiment ke mutabiq, USD/CAD ke buyers peechle haftay se faida utha rahe thay. Unhone abhi tak 1.3549 ke level tak nahi pohancha hai. Is liye, hume is ke mutabiq trading karni chahiye aur apne trades mein stop loss ka istemal karna chahiye. Hume mustaqil aur discipline se rehna chahiye aur unke trading plan ka intiqal karna chahiye, halaanki jazbat ke aur naqabil-e-yaqeen douron mein bhi.

USD/CAD trading ko online brokers aur trading apps jese mukhtalif platforms ke zariye kiya ja sakta hai. Yaad rakhiye ke online trading systems traders ko USD/CAD exchange rate ka tajziya karne aur maqool trading decisions lene mein madad karne ke liye mukhtalif tools aur resources faraham karte hain. Yaad rakhiye ke trading apps traders ke liye USD/CAD exchange rate ko nazarandaz karne aur on-the-go trades ko anjam dene ka aasan tareeqa faraham karte hain.

USD/CAD pair ki trading ka aik fawaaid yeh hai ke is ki spreads aur trading costs aam currency pairs ke muqable mein kam hoti hain. Is ke ilawa, traders ko USD/CAD trading ke sath kisi bhi raat ke financing charges ya doosre fees ke bare mein waqif hona chahiye. USD/CAD trading ko mukhtalif trading instruments ke zariye kiya ja sakta hai, jaise ke spot forex, options, aur futures contracts.

Umeed hai ke USD/CAD market buyers ko mazeed chances dega. Aur wo jald hi 1.3582 ke level ko cross kar lenge. Is ke ilawa, yaad rakhiye ke spot forex trading mein abhi moujooda market sentiment ke khilaf na jaayein. Aur incoming news ya fundamental analysis par zaroor nazar rakhein. Warna, hum apna investement aur capital kho sakte hain. Is liye, dono technical aur fundamental analysis par dhyan dijiye.

Magar, agar price zone 1.4121 kamiyabi se tor di jati hai, to USD/CAD apni bullish movement ko aage barha sakti hai resistance sector 1.4654 ki taraf. Doosri taraf, USD/CAD ke liye ahem support level 1.3512 hai. Agar market price yahan se neeche jaati hai aur 1.3512 support level ko cross karti hai, to market price neeche ja sakti hai, aur market neeche ja sakta hai, jaise ke maine chart par mark kiya hai. Magar, agar price zone 1.3512 kamiyabi se tor di jati hai, to USD/CAD apni bearish movement ko aage barha sakti hai support sector 1.3482 ki taraf. Bara waqt ke frame forex market ke baray mein sahi signals deta hai. Is liye, main umeed karta hoon ke USD/CAD ka market price is hafte 1.3459 zone ko tor dega. Baad mein yeh aik continuation pattern bhi bana sakta hai.

Moujooda market sentiment ke mutabiq, USD/CAD ke buyers peechle haftay se faida utha rahe thay. Unhone abhi tak 1.3549 ke level tak nahi pohancha hai. Is liye, hume is ke mutabiq trading karni chahiye aur apne trades mein stop loss ka istemal karna chahiye. Hume mustaqil aur discipline se rehna chahiye aur unke trading plan ka intiqal karna chahiye, halaanki jazbat ke aur naqabil-e-yaqeen douron mein bhi.

USD/CAD trading ko online brokers aur trading apps jese mukhtalif platforms ke zariye kiya ja sakta hai. Yaad rakhiye ke online trading systems traders ko USD/CAD exchange rate ka tajziya karne aur maqool trading decisions lene mein madad karne ke liye mukhtalif tools aur resources faraham karte hain. Yaad rakhiye ke trading apps traders ke liye USD/CAD exchange rate ko nazarandaz karne aur on-the-go trades ko anjam dene ka aasan tareeqa faraham karte hain.

USD/CAD pair ki trading ka aik fawaaid yeh hai ke is ki spreads aur trading costs aam currency pairs ke muqable mein kam hoti hain. Is ke ilawa, traders ko USD/CAD trading ke sath kisi bhi raat ke financing charges ya doosre fees ke bare mein waqif hona chahiye. USD/CAD trading ko mukhtalif trading instruments ke zariye kiya ja sakta hai, jaise ke spot forex, options, aur futures contracts.

Umeed hai ke USD/CAD market buyers ko mazeed chances dega. Aur wo jald hi 1.3582 ke level ko cross kar lenge. Is ke ilawa, yaad rakhiye ke spot forex trading mein abhi moujooda market sentiment ke khilaf na jaayein. Aur incoming news ya fundamental analysis par zaroor nazar rakhein. Warna, hum apna investement aur capital kho sakte hain. Is liye, dono technical aur fundamental analysis par dhyan dijiye.

تبصرہ

Расширенный режим Обычный режим