USDCAD Ka Tadbeer

Rozana Ke Time Frame Chart Ka Manzar Nigari:

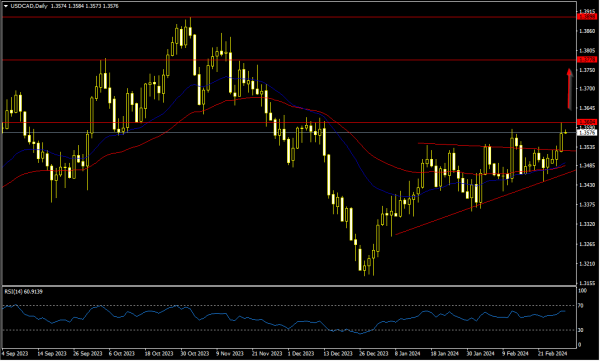

Jab daam dono trend lines ke raaste mein barh raha tha, jo ke aap figure mein dekh sakte hain, to maine apni taazi technical analysis mein USDCAD ke hawaale se kaha ke market ki harkat aik uljhan wale zone mein hai. Ab jab sab kuch ikhtitaam par aaya hai, to USDCAD ka daam aik hi raaste mein barh raha hai. Kal, daam nay buland tareen rukh ikhtiyaar kiya aur USDCAD nay upper trend line ko tor diya. Magar, isne 1.3604 ke mukhaalif rukh ko bhi imtehaan kiya, is wajah se daam gir gaya aur USDCAD nay aik pin bar candle bana liya. RSI indicator ka qeemat 60 hai aur isay overbought level ko test karna hai, is liye USDCAD jald hi apna bullish rukh dobara ikhtiyar karega, mustaqbil ke daam mein izafa hone ki umeed mein. 1.3604 ke baad agle mukhaalif darje 1.3778 aur 1.3898 ke daam darje hain.

USDCAD Ka Tadbeer

Rozana Time Frame Chart Ka Manzar Nigari:

USDCAD ka daam apni manzoom raftar se aage barh raha hai, jo ke dikhawaal kar raha hai ke is daur mein daam ki izzat aur numayish hai. Yeh tehreekat daam ko 1.3604 ke darje tak pahuncha chuki hai, jahan daam ka qeemat gir gaya aur USDCAD nay aik pin bar candle bana liya. Yeh girawat wazeh karti hai ke daam ne us se pehlay takmeel ki hui rukh ko tor diya hai aur ab behtar numayishon ka intezar hai. RSI indicator ki qeemat 60 hai aur isay overbought level par pahunchna hai, is ke natije mein USDCAD ki bullish raftar jald dobara shuru hogi aur daam mazeed izafa karne ki umeed hai. 1.3604 ke baad, agle mukhaalif darje 1.3778 aur 1.3898 ke daam darje hain, jo ke mazeed urooj ki taraf ishaara karte hain.

Is taaziyat aur tajziyat ki roshni mein, market participants ko maqami aur dunyawi siyasat ke tajziyaat ka intezar hai, jo ke USDJPY ke muqabil mein aik mukhtalif roshni daal sakti hain. Daam ki tarz e harkat ke aham pehloo ko ghor se dekha jaye to, traders ko is ke asaraat aur jazoobiyaat ke mutaabiq apne tajziyaat ko darust karne ki zaroorat hai. Mazeed haalat ka tabadla hone par, daam ko binaik tawajjuh se dekha jana chahiye, taake traders apni strategies ko tarteeb de sakein aur behtar faisle kar sakein.

Overall, USDCAD ki rukh ka husool asar ki muddat aur mustaqbil ke amoor par mabni hai, jis mein market players ko hoshyari aur tajziyat ke mutabiq amal karne ki zaroorat hai. Ahem satah daraz ko ghor se dekhne ke saath, traders ko apni positions ko moseeqi aur istedad ke mutabiq tabdeel karne ki salahiyat bhi zaroorat hai, taake wo mukhtalif raftar ki naye sooraton se tayyar ho sakein.

Rozana Ke Time Frame Chart Ka Manzar Nigari:

Jab daam dono trend lines ke raaste mein barh raha tha, jo ke aap figure mein dekh sakte hain, to maine apni taazi technical analysis mein USDCAD ke hawaale se kaha ke market ki harkat aik uljhan wale zone mein hai. Ab jab sab kuch ikhtitaam par aaya hai, to USDCAD ka daam aik hi raaste mein barh raha hai. Kal, daam nay buland tareen rukh ikhtiyaar kiya aur USDCAD nay upper trend line ko tor diya. Magar, isne 1.3604 ke mukhaalif rukh ko bhi imtehaan kiya, is wajah se daam gir gaya aur USDCAD nay aik pin bar candle bana liya. RSI indicator ka qeemat 60 hai aur isay overbought level ko test karna hai, is liye USDCAD jald hi apna bullish rukh dobara ikhtiyar karega, mustaqbil ke daam mein izafa hone ki umeed mein. 1.3604 ke baad agle mukhaalif darje 1.3778 aur 1.3898 ke daam darje hain.

USDCAD Ka Tadbeer

Rozana Time Frame Chart Ka Manzar Nigari:

USDCAD ka daam apni manzoom raftar se aage barh raha hai, jo ke dikhawaal kar raha hai ke is daur mein daam ki izzat aur numayish hai. Yeh tehreekat daam ko 1.3604 ke darje tak pahuncha chuki hai, jahan daam ka qeemat gir gaya aur USDCAD nay aik pin bar candle bana liya. Yeh girawat wazeh karti hai ke daam ne us se pehlay takmeel ki hui rukh ko tor diya hai aur ab behtar numayishon ka intezar hai. RSI indicator ki qeemat 60 hai aur isay overbought level par pahunchna hai, is ke natije mein USDCAD ki bullish raftar jald dobara shuru hogi aur daam mazeed izafa karne ki umeed hai. 1.3604 ke baad, agle mukhaalif darje 1.3778 aur 1.3898 ke daam darje hain, jo ke mazeed urooj ki taraf ishaara karte hain.

Is taaziyat aur tajziyat ki roshni mein, market participants ko maqami aur dunyawi siyasat ke tajziyaat ka intezar hai, jo ke USDJPY ke muqabil mein aik mukhtalif roshni daal sakti hain. Daam ki tarz e harkat ke aham pehloo ko ghor se dekha jaye to, traders ko is ke asaraat aur jazoobiyaat ke mutaabiq apne tajziyaat ko darust karne ki zaroorat hai. Mazeed haalat ka tabadla hone par, daam ko binaik tawajjuh se dekha jana chahiye, taake traders apni strategies ko tarteeb de sakein aur behtar faisle kar sakein.

Overall, USDCAD ki rukh ka husool asar ki muddat aur mustaqbil ke amoor par mabni hai, jis mein market players ko hoshyari aur tajziyat ke mutabiq amal karne ki zaroorat hai. Ahem satah daraz ko ghor se dekhne ke saath, traders ko apni positions ko moseeqi aur istedad ke mutabiq tabdeel karne ki salahiyat bhi zaroorat hai, taake wo mukhtalif raftar ki naye sooraton se tayyar ho sakein.

تبصرہ

Расширенный режим Обычный режим