Re: Usd/cad

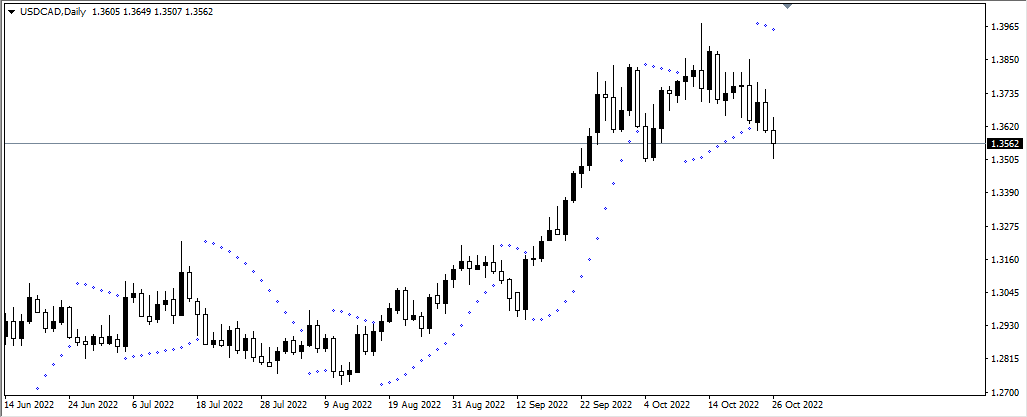

USD / CAD D1 Chart Technical Analysis

Sab ko slam, mein is pair par ghair janabdaar rehta hon aur muqarara support level ke qareeb qeemat ke ravayye ka mushahida karta hon. ab agar is support level se aik mom batii ban jati hai, to mein taraqqi ki bahaali ki tawaqqa karoon ga. doosri taraf, oopar ki harkat ka hawala muqami muzahmati satah ho ga, jo 1. 3542 par waqay hai. lehaza agar qeemat ishara kardah muzahmati satah se oopar ho jati hai, aur mein mazeed shumali harkat ki tawaqqa karoon ga. agarchay, oopar ki harkat ka hawala nuqta aam muzahmati satah ho ga, jo 1. 3515 par waqay hai. theek hai, muzahmat ki is satah ke qareeb. aur mein aik tijarti set up ki tashkeel ki tawaqqa karoon ga, jis se tijarat ki mazeed simt ka taayun karne mein madad miley gi. taham, agar qeemat 1. 3526 ki muqami support level se neechay mustahkam honay ka intizam karti hai, to mein mazeed junoob ki janib harkat ki tawaqqa karoon ga.

USD / CAD H4 Chart

H4 chart par qeemat flat channel ke andar chal rahi thi, is liye aap log aisa neechay ki taraf channel bana satke hain, aur jis ke andar qeemat waqay hai aur qeemat jis ki nichli had tak pahonch gayi hai, yeh 1. 3514 ka level hai. theek hai, is satah tak pounchanay ke baad, jore mein gravt ruk gayi aur qeemat ne oopar jane ki koshish ki. ab mein tawaqqa karta hon ke yeh jora channel ke oopri border aur 1. 3568 ki satah tak barh jaye ga, aur agar yeh is channel se oopar ki taraf nikalta hai, aur phir is channel se oopar ki taraf niklny ko aik ulat ke tor par tasawwur karna mumkin ho ga. aur mustaqbil mein, aur kuch kami ho sakti hai. lehaza agar qeemat channel ki oopri baondri se palat jati hai aur neechay jati hai, to hum is channel ki nichli had tak kam ho jatay hain .

USD / CAD D1 Chart Technical Analysis

Sab ko slam, mein is pair par ghair janabdaar rehta hon aur muqarara support level ke qareeb qeemat ke ravayye ka mushahida karta hon. ab agar is support level se aik mom batii ban jati hai, to mein taraqqi ki bahaali ki tawaqqa karoon ga. doosri taraf, oopar ki harkat ka hawala muqami muzahmati satah ho ga, jo 1. 3542 par waqay hai. lehaza agar qeemat ishara kardah muzahmati satah se oopar ho jati hai, aur mein mazeed shumali harkat ki tawaqqa karoon ga. agarchay, oopar ki harkat ka hawala nuqta aam muzahmati satah ho ga, jo 1. 3515 par waqay hai. theek hai, muzahmat ki is satah ke qareeb. aur mein aik tijarti set up ki tashkeel ki tawaqqa karoon ga, jis se tijarat ki mazeed simt ka taayun karne mein madad miley gi. taham, agar qeemat 1. 3526 ki muqami support level se neechay mustahkam honay ka intizam karti hai, to mein mazeed junoob ki janib harkat ki tawaqqa karoon ga.

USD / CAD H4 Chart

H4 chart par qeemat flat channel ke andar chal rahi thi, is liye aap log aisa neechay ki taraf channel bana satke hain, aur jis ke andar qeemat waqay hai aur qeemat jis ki nichli had tak pahonch gayi hai, yeh 1. 3514 ka level hai. theek hai, is satah tak pounchanay ke baad, jore mein gravt ruk gayi aur qeemat ne oopar jane ki koshish ki. ab mein tawaqqa karta hon ke yeh jora channel ke oopri border aur 1. 3568 ki satah tak barh jaye ga, aur agar yeh is channel se oopar ki taraf nikalta hai, aur phir is channel se oopar ki taraf niklny ko aik ulat ke tor par tasawwur karna mumkin ho ga. aur mustaqbil mein, aur kuch kami ho sakti hai. lehaza agar qeemat channel ki oopri baondri se palat jati hai aur neechay jati hai, to hum is channel ki nichli had tak kam ho jatay hain .

تبصرہ

Расширенный режим Обычный режим