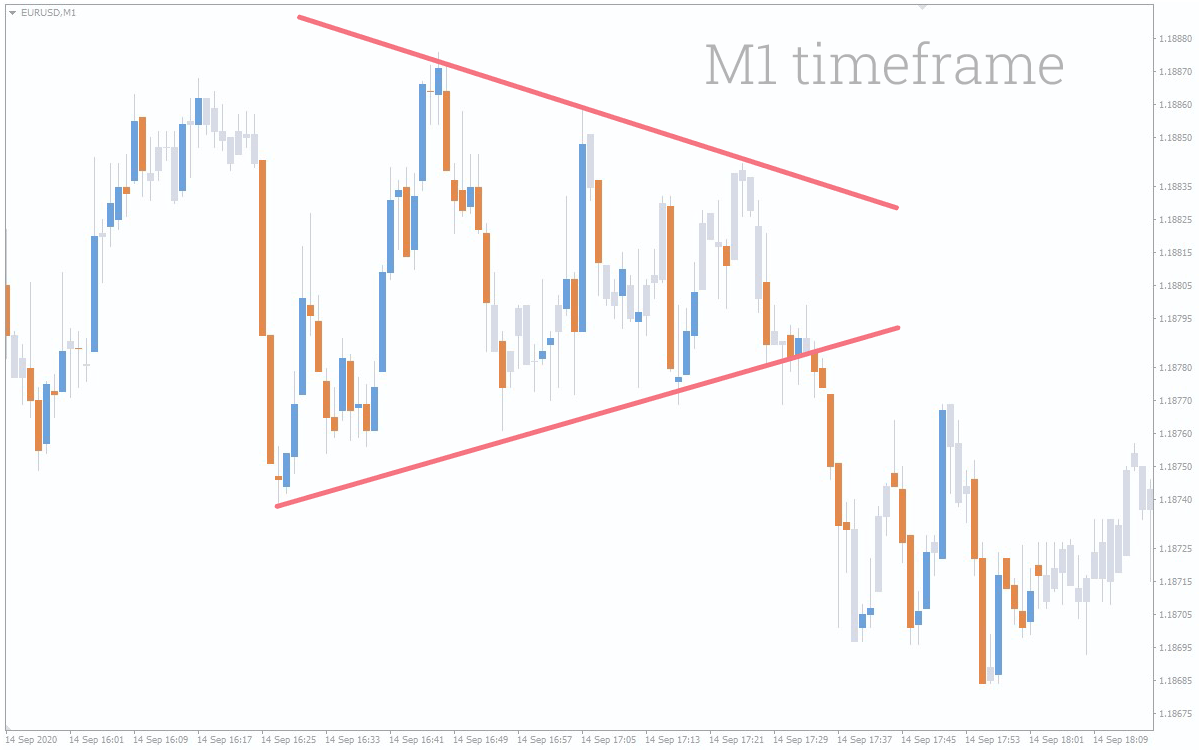

EUR/USD technical outlook:

EUR/USD chart pay current price range 1.0831 se, mazeed izafa ho sakta hai. 1.0815 par trade abhi tak toot nahi gaya hai aur qareebi mustaqbil mein yeh range toot jaye gi. Jab humein 1.0845 ke range ka tootna milay ga, jahan trade mojood hai, yeh rate barhne ka signal hoga. Mumkin hai keh humein local support level 1.0817 par range ko test karne ka mauqa mile, phir izafa jari rahega. 1.0815 se trading se izafa mazeed ho sakta hai. Agar hum mojooda price range se 1.0845 ke trading range ko tor kar uss ke oopar ruk jate hain, to yeh rate barhne ka signal hoga. Kab mumkin ho ga ke 1.0820 ke range mein trade ko test kiya jaye aur yahan se mazid istiqlal mumkin ho.

Is development ke sath, aaj kharidarun ka momentum barqarar rakhne ke zyada imkanat hain, jin ka nishana 1.08975 ya 1.09323 ke resistance levels par ho sakta hai, jaise ke meri tajziyaat dikhate hain. In resistance levels ke qareeb, do mumkin scenarios samne aa sakte hain. Sarayi scenario mein ek ulta mombati ka aghaz, jo neeche ki taraf ki movement ki dobara shuruaat ka signal de sakta hai. Aise sorat mein, main umeed karta hoon ke 1.0858 ke support level ki taraf ek inteqal hosakta hai. Agar keemat is support ke neeche mil jaye, to mazeed kamiyan 1.0800 ya 1.0730 ke support levels ki taraf ho sakti hain. In support levels par, main trading setups ka aghaz hone ka intezar karta hoon, jo agle trading rukh ka tay karte hain.

EUR/USD pair mein dekhi gayi kamzor ma'ashi fa'alat aur mehdood trading range ne market mein mojood ehtiyaat bhari junoon ko numaya kiya. North America ke bareek holidays ki wajah se aham markets band thay, jis se trading volumes aur liquidity mein wazeh kami aayi, jo currency pair mein dekhi gayi tang range-bound trading mein hissa daal rahi thi.

EUR/USD chart pay current price range 1.0831 se, mazeed izafa ho sakta hai. 1.0815 par trade abhi tak toot nahi gaya hai aur qareebi mustaqbil mein yeh range toot jaye gi. Jab humein 1.0845 ke range ka tootna milay ga, jahan trade mojood hai, yeh rate barhne ka signal hoga. Mumkin hai keh humein local support level 1.0817 par range ko test karne ka mauqa mile, phir izafa jari rahega. 1.0815 se trading se izafa mazeed ho sakta hai. Agar hum mojooda price range se 1.0845 ke trading range ko tor kar uss ke oopar ruk jate hain, to yeh rate barhne ka signal hoga. Kab mumkin ho ga ke 1.0820 ke range mein trade ko test kiya jaye aur yahan se mazid istiqlal mumkin ho.

Is development ke sath, aaj kharidarun ka momentum barqarar rakhne ke zyada imkanat hain, jin ka nishana 1.08975 ya 1.09323 ke resistance levels par ho sakta hai, jaise ke meri tajziyaat dikhate hain. In resistance levels ke qareeb, do mumkin scenarios samne aa sakte hain. Sarayi scenario mein ek ulta mombati ka aghaz, jo neeche ki taraf ki movement ki dobara shuruaat ka signal de sakta hai. Aise sorat mein, main umeed karta hoon ke 1.0858 ke support level ki taraf ek inteqal hosakta hai. Agar keemat is support ke neeche mil jaye, to mazeed kamiyan 1.0800 ya 1.0730 ke support levels ki taraf ho sakti hain. In support levels par, main trading setups ka aghaz hone ka intezar karta hoon, jo agle trading rukh ka tay karte hain.

EUR/USD pair mein dekhi gayi kamzor ma'ashi fa'alat aur mehdood trading range ne market mein mojood ehtiyaat bhari junoon ko numaya kiya. North America ke bareek holidays ki wajah se aham markets band thay, jis se trading volumes aur liquidity mein wazeh kami aayi, jo currency pair mein dekhi gayi tang range-bound trading mein hissa daal rahi thi.

تبصرہ

Расширенный режим Обычный режим