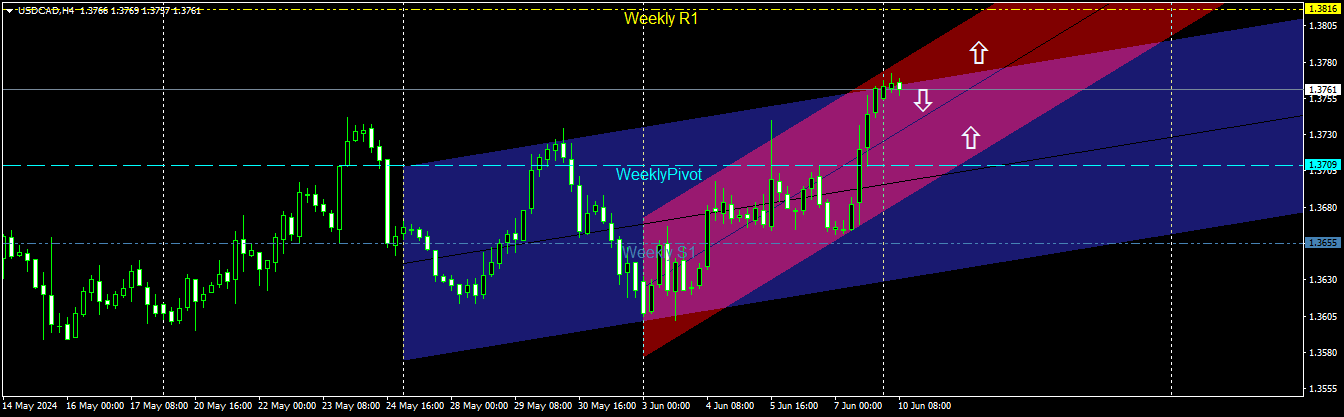

Agar aap 4 ghante ke chart reference ka dhyaan den, toh UsdCad market mein trend abhi bhi stable lag raha hai, 1.3742 zone ke upar rok kar. Yeh darshaata hai ke ek trend ka mahaul hai jo abhi bhi uptrend ki taraf jaane ka tend hai aur technically bullish trend ka jari rehne ka mauka hai. Agar aap price structure travel pattern ya weekly time frame par bane candlesticks ke according technical taur par dekhein, toh yeh ek bullish candlestick bana sakta hai. Mainey kal ki price movement dekhi, toh yeh abhi bhi ek situation mein trade kar raha hai jo upar jaane ki tend hai kyun ke subah ke closing position ne iss haftay ke shuru mein opening price se zyada dekha.

Dekhte hue ke price movement bullish hone ki taraf lagta hai, mujhe lagta hai ke agley haftay ke trading mein candlestick movement ab bhi buyers ke control mein chal raha hoga aur 1.3792 price zone tak udne ka mauka hai kyun ke technical taur par price movement Uptrend side par jaari lagta hai. Agley haftay ke shuru mein thodi dair ke liye price mein neeche ki correction ho sakti hai kyun ke shanivaar raat ko price mein zyada izafa hua tha. Uske baad, ek aur bullish mauka ho sakta hai jo ki 100 period simple moving average zone ko chhu sakta hai.

Aur agar agley haftay price bullish reh sakta hai, toh yeh yeh darshaata hai ke market ka safar maheene ke ant tak buyers ke control mein hai. Agar aap maujooda market trend ka faida uthana chahte hain, toh aap nuksan ke mauke ke bawajood bhi munafa haasil karne ki azaadi hai. Yeh paish kiya jaata hai ke buyers market ko control karna chaahenge aur unhein uncha areas tak pohochne ki koshish karein. Agley haftay ke liye UsdCad market par trading plan, toh maine Buy trading option chuna jab tak price 1.3742 zone ke upar jaaye. Overall, agley haftay ke price travel ke liye mauka lagta hai ke bullish trend ke saath jaari rahega.

Dekhte hue ke price movement bullish hone ki taraf lagta hai, mujhe lagta hai ke agley haftay ke trading mein candlestick movement ab bhi buyers ke control mein chal raha hoga aur 1.3792 price zone tak udne ka mauka hai kyun ke technical taur par price movement Uptrend side par jaari lagta hai. Agley haftay ke shuru mein thodi dair ke liye price mein neeche ki correction ho sakti hai kyun ke shanivaar raat ko price mein zyada izafa hua tha. Uske baad, ek aur bullish mauka ho sakta hai jo ki 100 period simple moving average zone ko chhu sakta hai.

Aur agar agley haftay price bullish reh sakta hai, toh yeh yeh darshaata hai ke market ka safar maheene ke ant tak buyers ke control mein hai. Agar aap maujooda market trend ka faida uthana chahte hain, toh aap nuksan ke mauke ke bawajood bhi munafa haasil karne ki azaadi hai. Yeh paish kiya jaata hai ke buyers market ko control karna chaahenge aur unhein uncha areas tak pohochne ki koshish karein. Agley haftay ke liye UsdCad market par trading plan, toh maine Buy trading option chuna jab tak price 1.3742 zone ke upar jaaye. Overall, agley haftay ke price travel ke liye mauka lagta hai ke bullish trend ke saath jaari rahega.

تبصرہ

Расширенный режим Обычный режим