AUD/USD:

Australian Dollar 0.6450 Ke Neeche Rehta Hai, Ma'ashiyati Laaparwahiyo Ke Darmiyan:

Asia ke early hours mein, Australian dollar US dollar ke muqable mein 0.6450 ke qaribi daakhil kiye baghair rehta hai. Yeh is baat ka daleel hai ke ek Australian dollar ka qeemat 0.6450 US dollar ke neeche hi qaim hai. Hafton ke intehai rujhaan se, Federal Reserve afseer ki bayanat ne zyada pur-umeed tone ikhtiyar kiya hai, jo ke US dollar ki taqat par e'temaad barhata hai. Aise jazbaat aam tor par US currency ko pasand karte hain, aur aise dosri currencies jaise ke Australian dollar par neechay ki taraf dabaav daal sakte hain. Australian ma'ashi haalat ke baray mein fikar baqi hai, jo uske currency ke dabaav mein kamiyabi ka sabab bani hai. Khaas tor par dhyan diya jata hai ke mehngaai ka maqami rafth, jo ke qeemat mein susti ka aks dikhaata hai. Buland rozgar market ke ba-wajood jismen unchi rozeedari hoti hai, wahan Reserve Bank of Australia (RBA) ke liye bhi interest rate khatam karne ka tajwez hai taake mazeed ma'ashi afzaish ho. Interest rates ko kam karna qarz uthane aur kharch karne ko sabit kar sakta hai, is tarah ma'ashi taraqqi ko paida kar sakti hai. Magar aise iqdaam bhi ho sakte hain jo investors ke liye Australian dollar ki kashish ko kam kar sakte hain, aur isay dosri currencies ke muqable mein depreciate kar sakte hain.

Technical Tahlil & Trading Strategy:

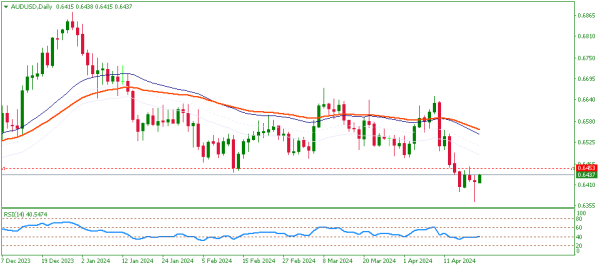

Pichle haftay mein AUD/USD currency pair ne taqat dikhayi, zyadatar ek daily support level par banaye gaye bullish pin bar ki wajah se. Abhi mojooda daily candle ko lagta hai ke yeh bullish candle se raftar le rahi hai. Magar, yeh ahem hai ke pin bar se pehle aane wali ek bearish candle, jo ek upper wick ke sath thi, bullish nazariyah ko mushkilat ka samna kar rahi hai. Jab tak yeh bearish candle tora nahi jata, khareedne ka signal darust nahi samjha jaa sakta. Mazeed, Relative Strength Index (RSI) darmiyan hai aur 50.00 ke mark se neeche trade ho raha hai, jaise ke chart mein zahir hai. Yeh dono simat mein wazeh raftar ki kami ka aalaamat hai.

Ummid hai ke US dollar index 105.83 par rukawat ka samna kare aur is ke upar trade jaari rahe. Is liye, samjhdar taur par yeh hai ke bullish positions ka tajziyah karne se pehle 0.6453 ke daraje ko guzarne ka tasdeeq ka intezar karna chahiye. Agar AUD/USD pair kam ho jaata hai aur bullish pin bar ke neeche mukammal ho jata hai, toh yeh ek signal faraham karega ke bechnay ki positions ko kholna gawahi faraham kar sakti hai.

Mukhtasir taur par, jabke pichle haftay mein AUD/USD taqat dikhaya, toh conflicting signals ki maujoodgi ki wajah se ehtiyaat zaroori hai, jaise ke bearish candle formation aur RSI ka seedha raasta. Bullish momentum ka tasdeeq 0.6453 ke upar ya bullish pin bar ke neeche girne ki tasdeeq wazeh trading mauqay faraham kar sakti hai.

Australian Dollar 0.6450 Ke Neeche Rehta Hai, Ma'ashiyati Laaparwahiyo Ke Darmiyan:

Asia ke early hours mein, Australian dollar US dollar ke muqable mein 0.6450 ke qaribi daakhil kiye baghair rehta hai. Yeh is baat ka daleel hai ke ek Australian dollar ka qeemat 0.6450 US dollar ke neeche hi qaim hai. Hafton ke intehai rujhaan se, Federal Reserve afseer ki bayanat ne zyada pur-umeed tone ikhtiyar kiya hai, jo ke US dollar ki taqat par e'temaad barhata hai. Aise jazbaat aam tor par US currency ko pasand karte hain, aur aise dosri currencies jaise ke Australian dollar par neechay ki taraf dabaav daal sakte hain. Australian ma'ashi haalat ke baray mein fikar baqi hai, jo uske currency ke dabaav mein kamiyabi ka sabab bani hai. Khaas tor par dhyan diya jata hai ke mehngaai ka maqami rafth, jo ke qeemat mein susti ka aks dikhaata hai. Buland rozgar market ke ba-wajood jismen unchi rozeedari hoti hai, wahan Reserve Bank of Australia (RBA) ke liye bhi interest rate khatam karne ka tajwez hai taake mazeed ma'ashi afzaish ho. Interest rates ko kam karna qarz uthane aur kharch karne ko sabit kar sakta hai, is tarah ma'ashi taraqqi ko paida kar sakti hai. Magar aise iqdaam bhi ho sakte hain jo investors ke liye Australian dollar ki kashish ko kam kar sakte hain, aur isay dosri currencies ke muqable mein depreciate kar sakte hain.

Technical Tahlil & Trading Strategy:

Pichle haftay mein AUD/USD currency pair ne taqat dikhayi, zyadatar ek daily support level par banaye gaye bullish pin bar ki wajah se. Abhi mojooda daily candle ko lagta hai ke yeh bullish candle se raftar le rahi hai. Magar, yeh ahem hai ke pin bar se pehle aane wali ek bearish candle, jo ek upper wick ke sath thi, bullish nazariyah ko mushkilat ka samna kar rahi hai. Jab tak yeh bearish candle tora nahi jata, khareedne ka signal darust nahi samjha jaa sakta. Mazeed, Relative Strength Index (RSI) darmiyan hai aur 50.00 ke mark se neeche trade ho raha hai, jaise ke chart mein zahir hai. Yeh dono simat mein wazeh raftar ki kami ka aalaamat hai.

Ummid hai ke US dollar index 105.83 par rukawat ka samna kare aur is ke upar trade jaari rahe. Is liye, samjhdar taur par yeh hai ke bullish positions ka tajziyah karne se pehle 0.6453 ke daraje ko guzarne ka tasdeeq ka intezar karna chahiye. Agar AUD/USD pair kam ho jaata hai aur bullish pin bar ke neeche mukammal ho jata hai, toh yeh ek signal faraham karega ke bechnay ki positions ko kholna gawahi faraham kar sakti hai.

Mukhtasir taur par, jabke pichle haftay mein AUD/USD taqat dikhaya, toh conflicting signals ki maujoodgi ki wajah se ehtiyaat zaroori hai, jaise ke bearish candle formation aur RSI ka seedha raasta. Bullish momentum ka tasdeeq 0.6453 ke upar ya bullish pin bar ke neeche girne ki tasdeeq wazeh trading mauqay faraham kar sakti hai.

تبصرہ

Расширенный режим Обычный режим