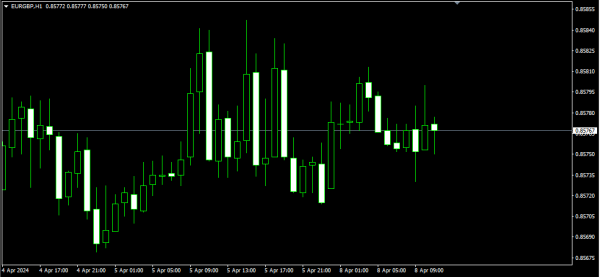

EUR/GBP pair ki H1 chart par tajziya karna, ek mustaqil downtrend ka pata chalta hai, jo apni girawat ko 0.85861 ke buland darajat se nigrani kiya. Maamooli tor par trading range ke andar dair se dair tak thahra, halanke nedam 0.85670 ke aas paas reh gaya. Magar aik ahem taraqqi ka pehlu zahir hua jab 0.85522 ke support ko toorna hua. Iss darje ke neeche, aik nami bhar volume ka ahem ikhataam hua, jo aik sambhalne wale trend ki taraf ishara karta hai. Ab, bechne wale se koi ahem rukawat ka na hona sath hi mojudah volume mein izafah, yeh darust nazar ata hai ke aik surat-e-haal ka shuru hona mumkin hai jo ke resistance zone 0.85861 ke as paas hai. Phir bhi, yeh zaroori hai ke is harkat ko zyada choti surat-e-haal ke andaaz mein samjha jaye, jo ke bara downtrend ke tahat aik durust phase ho sakta hai. Yeh surat-e-haal jald hi 0.85861 ki taraf rawana ho sakta hai, mojooda momentum aur kisi ahem farokht dabaw ki kami ke zariye faraham kiya jata hai. Magar, itni zyada hosla afzai hone par bhi, yeh zaroori hai ke is upward movement ko aam downtrend ke context mein dekha jaye. Is liye, jabke nazdeeki manzar main bullish raay hai, traders ke liye ihtiyaat baratne aur mukhalif isharay ka tawaja dene ka muaamla zaroori hai.

Agar jodi haqeeqatan resistance level tak pohanchay, to traders ko apni positions dobara dekhne ka ghoor se sochna chahiye, khaaskar kisi mukhtalif trend ya khareedne ki taqat mein thakawat ki alaamat par nazar rakh kar. Is tarah, jabke ek temporary rebound mumkin hai, chaukasi walay traders ko mukhtalif trend par dhyan dena aur apni strategies ko mutabiq karne ka ehtiyaat barqarar rakhna chahiye. Ikhtitami tor par, EUR/GBP jodi ka hal hilne ke daromadar mein ik short-term correction ki taraf ishara deti hai. Maqsood ki haraj ka is waqt barhna, ek temporary uptick ki surat mein maujood hai jo resistance 0.85861 tak pahunch sakti hai. Magar, isay ammari market sentiment mein tabdili ki bajaye ik tactics move ke tor par dekha jana chahiye. Jaise hamesha, hoshmand risk management aur market ke dynamics ka aagah hona in scenario ko mukammal tor par samajhne mein ahemiyat rakhta hai.

Agar jodi haqeeqatan resistance level tak pohanchay, to traders ko apni positions dobara dekhne ka ghoor se sochna chahiye, khaaskar kisi mukhtalif trend ya khareedne ki taqat mein thakawat ki alaamat par nazar rakh kar. Is tarah, jabke ek temporary rebound mumkin hai, chaukasi walay traders ko mukhtalif trend par dhyan dena aur apni strategies ko mutabiq karne ka ehtiyaat barqarar rakhna chahiye. Ikhtitami tor par, EUR/GBP jodi ka hal hilne ke daromadar mein ik short-term correction ki taraf ishara deti hai. Maqsood ki haraj ka is waqt barhna, ek temporary uptick ki surat mein maujood hai jo resistance 0.85861 tak pahunch sakti hai. Magar, isay ammari market sentiment mein tabdili ki bajaye ik tactics move ke tor par dekha jana chahiye. Jaise hamesha, hoshmand risk management aur market ke dynamics ka aagah hona in scenario ko mukammal tor par samajhne mein ahemiyat rakhta hai.

تبصرہ

Расширенный режим Обычный режим