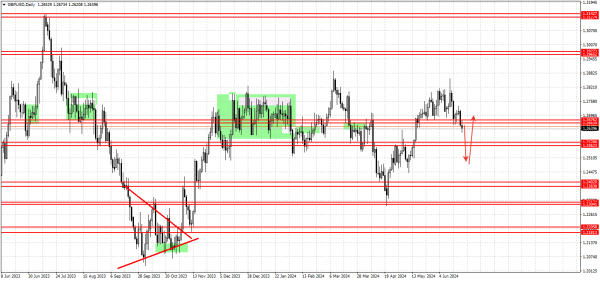

**GBPUSD D1**

Main Pound Dollar pair ko madde nazar rakhta hoon. Jab yeh jora is sabz consolidation rectangle mein tha, tab Bank of England ke monetary policy tightening cycle khatm hone ke bare mein kuch bhi maloom nahi tha. Bank of England phir bhi sab se zyada Hawkish bank rahi, jo interest rates ko buland rakhne ka irada rakhti thi. Us waqt Euro/dollar pair gir raha tha, lekin yeh pair range mein trade kar raha tha. Jab maloom hua ke Bank of England apne monetary policy tightening cycle ko khatam kar rahi hai aur wazeh taur par ishara kiya ke jald hi monetary policy ko halka kia jayega, tab yeh pair girne laga, aur selling volume barh gaya, lekin yahan par izaafa hai.

Yeh theek nahi tha ke pair kyun izaafa kar raha tha, kyun ke jab yeh range mein trade kar raha tha, tab Bank of England ke faislay ka intezar tha, aur us faislay ke baad, pair izaafa karna shuru kar diya. Yeh bilkul samajh nahi aya ke kyun, phir maine samjha ke yeh bas seller ke stops ko trigger kar raha hai. Is ke baad, yeh range ke nichle hadood ke qareeb wapis aya. Jaise he maine samjha tha, range ke nichle hadood ke qareeb selling volume barhna shuru ho gaya. Pair 1.23041 ke support se neeche gir gaya, lekin is support se bounce back ho gaya. Yahan par mahangai mein kami shuru ho gayi, lekin phir jab yeh pehle se barh gaya, to wazeh ho gaya ke mahangai tham gayi hai, mazeed girawat nahi hui. Federal Reserve rate cut nahi karegi, aur pair wapis ho gaya.

Aur asal mein, yeh theek nahi tha ke yeh yeh un unchayon par trade kar raha tha. Is ke ilawa, yeh pehle ke unchayon ko bhi update kar diya, kyun ke UK mein mahangai maqsad ke level par pohanch chuki hai. Amuman, is pair ke yeh levels par rehne ka koi wajah nahi hai. Main samjhata hoon ke girawat mazeed jari rahegi takay 1.25623 ke support tak pohanche. Main samajhta hoon ke pair mazeed neeche ja sakta hai 1.25017 ke levels tak, phir palat jayega aur range mein trade karega jab tak mahangai ke data jaari na ho jaye, jo pair ke movement ko zahir kar sakta hai.

Main Pound Dollar pair ko madde nazar rakhta hoon. Jab yeh jora is sabz consolidation rectangle mein tha, tab Bank of England ke monetary policy tightening cycle khatm hone ke bare mein kuch bhi maloom nahi tha. Bank of England phir bhi sab se zyada Hawkish bank rahi, jo interest rates ko buland rakhne ka irada rakhti thi. Us waqt Euro/dollar pair gir raha tha, lekin yeh pair range mein trade kar raha tha. Jab maloom hua ke Bank of England apne monetary policy tightening cycle ko khatam kar rahi hai aur wazeh taur par ishara kiya ke jald hi monetary policy ko halka kia jayega, tab yeh pair girne laga, aur selling volume barh gaya, lekin yahan par izaafa hai.

Yeh theek nahi tha ke pair kyun izaafa kar raha tha, kyun ke jab yeh range mein trade kar raha tha, tab Bank of England ke faislay ka intezar tha, aur us faislay ke baad, pair izaafa karna shuru kar diya. Yeh bilkul samajh nahi aya ke kyun, phir maine samjha ke yeh bas seller ke stops ko trigger kar raha hai. Is ke baad, yeh range ke nichle hadood ke qareeb wapis aya. Jaise he maine samjha tha, range ke nichle hadood ke qareeb selling volume barhna shuru ho gaya. Pair 1.23041 ke support se neeche gir gaya, lekin is support se bounce back ho gaya. Yahan par mahangai mein kami shuru ho gayi, lekin phir jab yeh pehle se barh gaya, to wazeh ho gaya ke mahangai tham gayi hai, mazeed girawat nahi hui. Federal Reserve rate cut nahi karegi, aur pair wapis ho gaya.

Aur asal mein, yeh theek nahi tha ke yeh yeh un unchayon par trade kar raha tha. Is ke ilawa, yeh pehle ke unchayon ko bhi update kar diya, kyun ke UK mein mahangai maqsad ke level par pohanch chuki hai. Amuman, is pair ke yeh levels par rehne ka koi wajah nahi hai. Main samjhata hoon ke girawat mazeed jari rahegi takay 1.25623 ke support tak pohanche. Main samajhta hoon ke pair mazeed neeche ja sakta hai 1.25017 ke levels tak, phir palat jayega aur range mein trade karega jab tak mahangai ke data jaari na ho jaye, jo pair ke movement ko zahir kar sakta hai.

تبصرہ

Расширенный режим Обычный режим