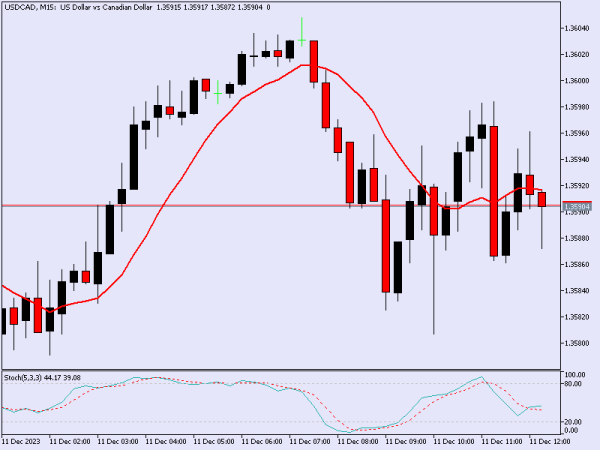

USD CAD M-15 Time Frame Chart :

hello dostoo, subah bakhair. lakhri rujat channel nazooli position mein muntaqil hota hai, baichnay walay ki taaqat ko zahir karta hai. munafe simt mein hai, jis ki wajah se 0. 88715 par track ke nichale kinare ki taraf jata hai. mein 0. 88953 ki satah se farokht karne par ghhor kar raha hon, jis ki belon ko mukhalfat karni parre gi. basorat deegar, is iqdaam ke 0. 89474 ki satah par gehri islaah mein tabdeel honay ke imkanaat barh jatay hain. hadaf haasil karne par, barah karam farokht ka intzaar karen, jo ke ghair munafe bakhash ho jaye ga kyunkay m15 ke sath tehreek ka utaar charhao khud bakhud khatam ho jaye ga, jis ke nateejay mein oopar ki taraf rujhan ulat jaye ga. aisi haalat mein aap neechay dehaat mein ghoom satke hain. channel ke oopri border par rule back ka intzaar karna aur phir wahan se market mein daakhil hona ziyada durust hai, jis se track ke zariye masool honay walay signal par amal-dar-aamad nah honay ki soorat mein laagat kam ho jaye gi .

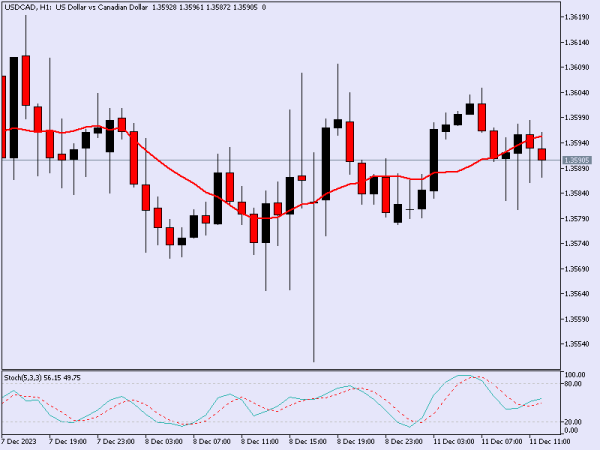

USD CAD H-1 Time Frame Chart :

mein senior period h1 ki taraf jata hon, jahan lakhri rujat channel day trading mein asasa ki ahem harkat ka taayun karta hai. channel m15 wazahaten,tashihain , aur zumaima. mein dono channels ke zariye market ki sorat e haal ka jaiza laita hon. market h1 channel ke oopri kinare se neechay trade kar rahi hai, aur m15 0. 88858 ki satah par hai. mein is sorat e haal ko mandi ke andaaz mein samjhta hon. do channels ka aik complex kharidne ke bajaye baichnay ka imkaan zahir karta hai, jo is soorat e haal mein churee ki terhan lagta hai. agar aap ghalti karte hain to aap ko nuqsaan ho sakta hai. agar bail 0. 88953 ki satah se oopar zam ho jatay hain, to h1 channel ke oopri hissay se 0. 89474 par farokht par ghhor karna ya is ki takmeel karna mumkin hoga. mojooda tijarti session mein dosra mandi ka hadaf 0. 88426 hai .

hello dostoo, subah bakhair. lakhri rujat channel nazooli position mein muntaqil hota hai, baichnay walay ki taaqat ko zahir karta hai. munafe simt mein hai, jis ki wajah se 0. 88715 par track ke nichale kinare ki taraf jata hai. mein 0. 88953 ki satah se farokht karne par ghhor kar raha hon, jis ki belon ko mukhalfat karni parre gi. basorat deegar, is iqdaam ke 0. 89474 ki satah par gehri islaah mein tabdeel honay ke imkanaat barh jatay hain. hadaf haasil karne par, barah karam farokht ka intzaar karen, jo ke ghair munafe bakhash ho jaye ga kyunkay m15 ke sath tehreek ka utaar charhao khud bakhud khatam ho jaye ga, jis ke nateejay mein oopar ki taraf rujhan ulat jaye ga. aisi haalat mein aap neechay dehaat mein ghoom satke hain. channel ke oopri border par rule back ka intzaar karna aur phir wahan se market mein daakhil hona ziyada durust hai, jis se track ke zariye masool honay walay signal par amal-dar-aamad nah honay ki soorat mein laagat kam ho jaye gi .

USD CAD H-1 Time Frame Chart :

mein senior period h1 ki taraf jata hon, jahan lakhri rujat channel day trading mein asasa ki ahem harkat ka taayun karta hai. channel m15 wazahaten,tashihain , aur zumaima. mein dono channels ke zariye market ki sorat e haal ka jaiza laita hon. market h1 channel ke oopri kinare se neechay trade kar rahi hai, aur m15 0. 88858 ki satah par hai. mein is sorat e haal ko mandi ke andaaz mein samjhta hon. do channels ka aik complex kharidne ke bajaye baichnay ka imkaan zahir karta hai, jo is soorat e haal mein churee ki terhan lagta hai. agar aap ghalti karte hain to aap ko nuqsaan ho sakta hai. agar bail 0. 88953 ki satah se oopar zam ho jatay hain, to h1 channel ke oopri hissay se 0. 89474 par farokht par ghhor karna ya is ki takmeel karna mumkin hoga. mojooda tijarti session mein dosra mandi ka hadaf 0. 88426 hai .

تبصرہ

Расширенный режим Обычный режим