AUDUSD Technical Analysis Subah bakhair, aaj hum AUDUSD ka technical analysis karenge aur is currency pair ki taqat-o-kamzoriyon ka jaiza lenge. AUDUSD, ya Australian Dollar aur US Dollar ka currency pair, forex market mein ahem hota hai aur iski analysis karne ke liye mukhtalif tools aur indicators istemal kiye jate hain. Is technical analysis mein hum dekhein ge ke market ki halat kaisi hai aur agle kuch dino mein kis tarah ka movement mumkin hai.

Ichimoku Kinko Hyo Indicator Sab se pehle, hum Ichimoku Kinko Hyo indicator ka istemal karte hain, jo market trends, support aur resistance levels ke liye ahem hota hai. Ichimoku cloud, ya Kumo, market ke future movements ko predict karne mein madadgar hoti hai. Agar price cloud ke upar hai, to ye bullish trend ka signal hai, jabke agar price cloud ke neeche hai, to ye bearish trend ka signal hai.

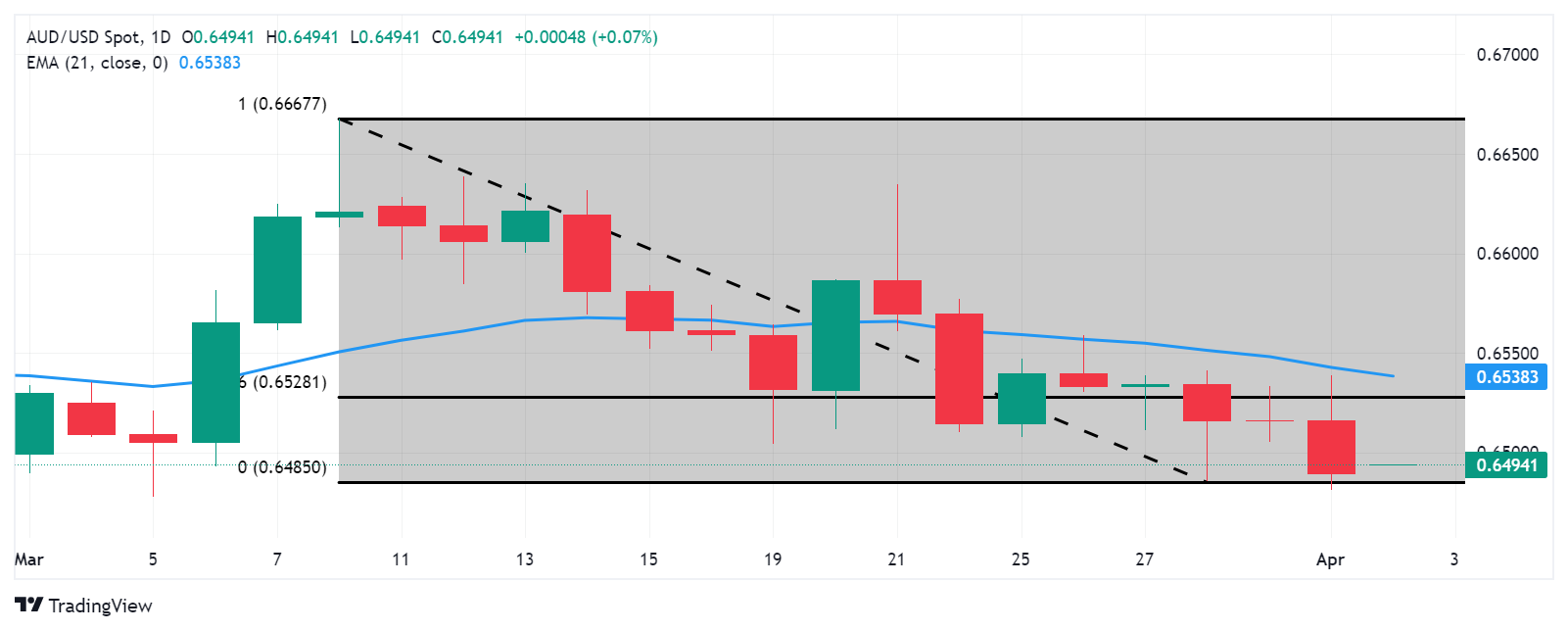

Moving Averages Doosra important indicator hai moving averages, jaise ke SMA (Simple Moving Average) aur EMA (Exponential Moving Average). Moving averages current price ke sath comparison mein use hota hai aur trend ka pata lagane mein madad karta hai. Agar short-term moving average long-term moving average ko cross karta hai, to ye bullish ya bearish signal generate ho sakta hai.

RSI Relative Strength Index RSI bhi ek ahem indicator hai jo market ki overbought ya oversold conditions ko indicate karta hai. Agar RSI 70 se zyada hai, to ye overbought hai aur agar 30 se kam hai, to ye oversold hai. Isse traders ko potential reversal points ka pata lag jata hai.

Fibonacci Retracement Fibonacci retracement bhi ek useful tool hai jo support aur resistance levels ko determine karne mein madad karta hai. Isse traders future price movements ka estimate kar sakte hain.

Is technical analysis ke tehat, hum dekhte hain ke AUDUSD ka price abhi kis level par hai aur agle kuch dino mein kis tarah ka movement mumkin hai. Hum market ke har aspect ko madahil karte hue apne trading strategies ko improve karte hain aur high-probability trading opportunities ko identify karte hain.

Overall, AUDUSD ka technical analysis kar ke traders ko market ke mukhtalif dynamics aur potential entry/exit points ke bare mein maloomat milti hai, jo unhe behtar trading decisions lene mein madad deti hai. Traders ko market ke mukhtalif factors aur indicators ka istemal kar ke apne trading strategies ko optimize karna chahiye taake woh market ke changes ko effectively navigate kar sakein.

Ichimoku Kinko Hyo Indicator Sab se pehle, hum Ichimoku Kinko Hyo indicator ka istemal karte hain, jo market trends, support aur resistance levels ke liye ahem hota hai. Ichimoku cloud, ya Kumo, market ke future movements ko predict karne mein madadgar hoti hai. Agar price cloud ke upar hai, to ye bullish trend ka signal hai, jabke agar price cloud ke neeche hai, to ye bearish trend ka signal hai.

Moving Averages Doosra important indicator hai moving averages, jaise ke SMA (Simple Moving Average) aur EMA (Exponential Moving Average). Moving averages current price ke sath comparison mein use hota hai aur trend ka pata lagane mein madad karta hai. Agar short-term moving average long-term moving average ko cross karta hai, to ye bullish ya bearish signal generate ho sakta hai.

RSI Relative Strength Index RSI bhi ek ahem indicator hai jo market ki overbought ya oversold conditions ko indicate karta hai. Agar RSI 70 se zyada hai, to ye overbought hai aur agar 30 se kam hai, to ye oversold hai. Isse traders ko potential reversal points ka pata lag jata hai.

Fibonacci Retracement Fibonacci retracement bhi ek useful tool hai jo support aur resistance levels ko determine karne mein madad karta hai. Isse traders future price movements ka estimate kar sakte hain.

Is technical analysis ke tehat, hum dekhte hain ke AUDUSD ka price abhi kis level par hai aur agle kuch dino mein kis tarah ka movement mumkin hai. Hum market ke har aspect ko madahil karte hue apne trading strategies ko improve karte hain aur high-probability trading opportunities ko identify karte hain.

Overall, AUDUSD ka technical analysis kar ke traders ko market ke mukhtalif dynamics aur potential entry/exit points ke bare mein maloomat milti hai, jo unhe behtar trading decisions lene mein madad deti hai. Traders ko market ke mukhtalif factors aur indicators ka istemal kar ke apne trading strategies ko optimize karna chahiye taake woh market ke changes ko effectively navigate kar sakein.

تبصرہ

Расширенный режим Обычный режим