technical overview on gold.

hello dear friends good morning mujhe umeed hai ap ab thek hongy aj ham gold ky bary main bat karen gay aur apna technical overview bhi btayen gay jis say ap ko aik overall move ka pta chal saky ga aur ap is pair main aik move ko pakr kar acha margin hasil kar sakty hain jes jesy december nazdeek aa raha hai aur wesy hi gold ki move buy main jana start ho gai hai ager ap main say kuh experienced trader hain tu unka pata hi ho ga ky gold december main buy ki tarf jata hai ju ky kaf time say asa hi ho raha hai aur ap dekh sakty gold ny kal bhi kaif ziada buy ki tarf move kia hai.

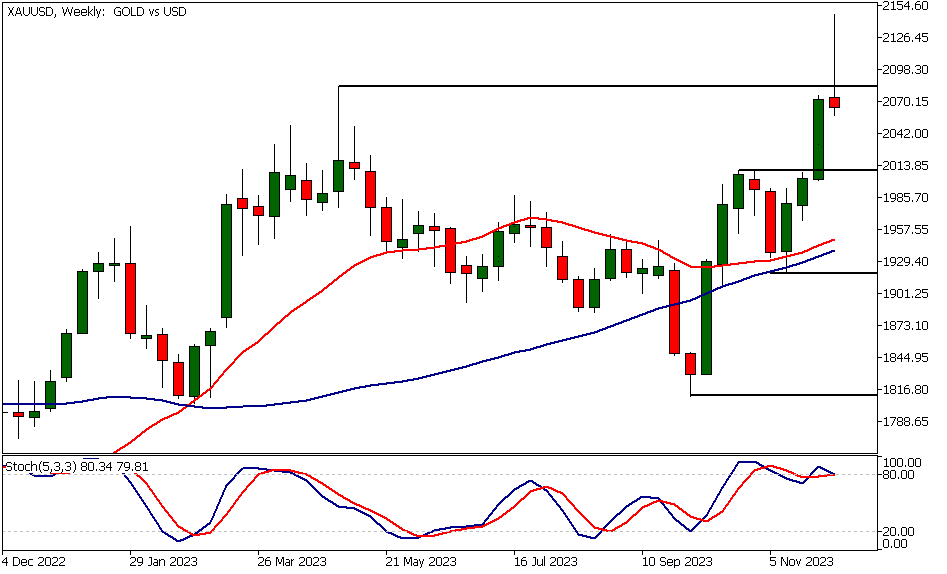

aj bhi ham gold ko buy ki targ hi dekhen gay mager ham is main ham ko thora sa wait karna ho ga jesy hi gold correction karta hai aur uss ky bad is main buy ki jesy hi move banti hai tab ham is main buy ki move ko pakr kar acha profit hasil kar sakty hain main ap ko gold ka chart bhi share kar daita hn ap us ko dekh kar samjh kar trade kar sakty hain ju ky ap ky lie kafi faida day ka ja sakti hai.

gold analysis:

ap gold ky chart main dekh sakty hain gold ny pehle apni support ko touch kia ju ky 2005.14 ju ky pehle resistance thi break hony ky bad wo support bani aur gold ny usko break karny ky bad retest kia ha apna pehla target 2017 ko touch kia hai aur kal ky din gold ny apni iss resistance ko bhi break kar diya hai aur us ky bad kafi ziada up gea hai aur ager aj ky din ki bat karen tu gold apni 2017 wali support tak aa sakta hai jesy he gold wahn tak ata hai hamen aik buy ki formation ju kyhamne yeh btaye ky gold phir say up jany ki nishani day raha hai tu phir say gold ko buy kar sakty hain apna risk mangement ko dekhty hoay ap is main enter ho kar aik acha gain hasil kar sakty hain.

fundamental outlook:

aj kafi ziada news ka data hai jis say market again fast ho sakty hain ap news site main ja ka dekh sakty hain is lie aj ap ko bohut soch samjh kar trade karna ho ga agr apka technical analysis acha aur ap aik trend ko follow karty hoay kam kar rahy hain toh ap ko koi bhi preshani nahi ho gi news data bhi ziada tar trend aur technical ko hi follow karta hai is lie ap ko apna technical ko dekh kar news data dekhna chahye phir ap ki trade ziada win rahy ge mujhe umeed hai ap ko aj ky mere analysis samjh main aa gay hongy jis say ap ko kuch sekhny ko milyga.

hello dear friends good morning mujhe umeed hai ap ab thek hongy aj ham gold ky bary main bat karen gay aur apna technical overview bhi btayen gay jis say ap ko aik overall move ka pta chal saky ga aur ap is pair main aik move ko pakr kar acha margin hasil kar sakty hain jes jesy december nazdeek aa raha hai aur wesy hi gold ki move buy main jana start ho gai hai ager ap main say kuh experienced trader hain tu unka pata hi ho ga ky gold december main buy ki tarf jata hai ju ky kaf time say asa hi ho raha hai aur ap dekh sakty gold ny kal bhi kaif ziada buy ki tarf move kia hai.

aj bhi ham gold ko buy ki targ hi dekhen gay mager ham is main ham ko thora sa wait karna ho ga jesy hi gold correction karta hai aur uss ky bad is main buy ki jesy hi move banti hai tab ham is main buy ki move ko pakr kar acha profit hasil kar sakty hain main ap ko gold ka chart bhi share kar daita hn ap us ko dekh kar samjh kar trade kar sakty hain ju ky ap ky lie kafi faida day ka ja sakti hai.

gold analysis:

ap gold ky chart main dekh sakty hain gold ny pehle apni support ko touch kia ju ky 2005.14 ju ky pehle resistance thi break hony ky bad wo support bani aur gold ny usko break karny ky bad retest kia ha apna pehla target 2017 ko touch kia hai aur kal ky din gold ny apni iss resistance ko bhi break kar diya hai aur us ky bad kafi ziada up gea hai aur ager aj ky din ki bat karen tu gold apni 2017 wali support tak aa sakta hai jesy he gold wahn tak ata hai hamen aik buy ki formation ju kyhamne yeh btaye ky gold phir say up jany ki nishani day raha hai tu phir say gold ko buy kar sakty hain apna risk mangement ko dekhty hoay ap is main enter ho kar aik acha gain hasil kar sakty hain.

fundamental outlook:

aj kafi ziada news ka data hai jis say market again fast ho sakty hain ap news site main ja ka dekh sakty hain is lie aj ap ko bohut soch samjh kar trade karna ho ga agr apka technical analysis acha aur ap aik trend ko follow karty hoay kam kar rahy hain toh ap ko koi bhi preshani nahi ho gi news data bhi ziada tar trend aur technical ko hi follow karta hai is lie ap ko apna technical ko dekh kar news data dekhna chahye phir ap ki trade ziada win rahy ge mujhe umeed hai ap ko aj ky mere analysis samjh main aa gay hongy jis say ap ko kuch sekhny ko milyga.

تبصرہ

Расширенный режим Обычный режим