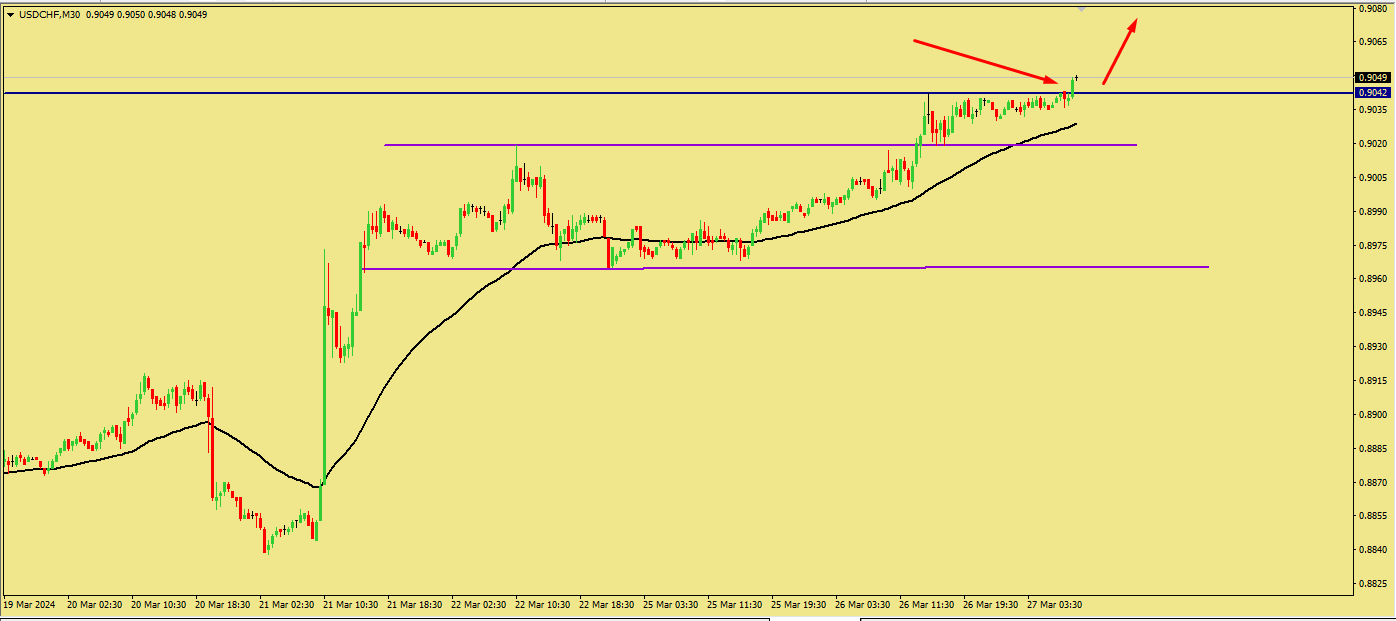

usd/chf price overview:

buyers ki kamiyabi bechnay walay ke upar bechnay ki raftar ke jari rehne par mabni hai. Mojooda qeemat 0.35913 se lambi position kholna mumkin hai, lekin afzal hai ke hali qeemat se thori darwazi shuruwat ka nishana rakha jaye. Is position ko shuru karne ke liye mashroot hadoodi satah ki manzil ki rehnumai, market ke jazbat, takneeki tajziya aur khatarnaak idaray ka intezar hai.

Kharidoron ki mumkin kamiyabi ko sahih taur par samajhne ke liye mojooda bazaar ke halat aur ahem tajziyat ka jaiza lena zaroori hai. Takneeki tajziya ke asbab jese trendlines, moving averages aur oscillators bazaar ke dynamics aur qeemat ki hosakne wali harkat mein qeemti idaray faraham kar sakte hain. Is ke ilawa, trading volume aur investor jazbat ko nigrani mein rakhna bullish trend ki taqat ko tasdeeq karne aur kharidar ki kamiyabi ke imkanat ko tasleem karne mein madad faraham kar sakta hai.Khatarnaak idaray trading mein ahem kirdar ada karte hain. Lambi position shuru karne se pehle, traders ko wazeh khatarnaak hadoodi satah, jese ke stop-loss satah aur nafayat ke maqasid tay karna chahiye. Sahi khatarnaak idaray ke tariqon ko amal mein laane se, traders apni kamiyon ko kam kar sakte hain aur kamiyabi ke imkanat ko zyada kar sakte hain.Is ke ilawa, bazaar ko mutasir karne wale asasi asbab ke baray mein mutaalba rakhna, jese ke maaliyat darusti ka ijlas, saiyasi waqiat, aur markazi bankon ki siyasiyat, qabil-e-ehtiyat hai. Ye asbab currency ke muqaddar ko mutasir kar sakte hain aur bazaar ki overall raftar par asar daal sakte hain.

Amal mein, thori qeemat ke neeche lambi position rakhna traders ko mumkin hai ke woh behtar qeemat par bazaar mein shamil ho sakein, nafayat ke imkanat ko barhate hue pehli khatraat ko kam karte hue. Magar, waqt bohot ahem hai, aur traders ko qeemat ki harkat ko qareeb se dekhna chahiye taake behtareen dakhil ho sakein.Ye yaad rakhna zaroori hai ke trading mein asli khatraat shamil hote hain, aur kamiyabi ke koi yaqeeni daleel nahi hoti. Bazaaron mein izafi ya ghaflati hoti hai, aur sab se ache tajziyat bhi nuqsaan ka sabab ban sakti hain. Isliye, traders hamesha mukammal tajziya karna chahiye, ehtiyaat bartana chahiye, aur barhne wale bazaar ke haalaat ke mutabiq apni strategies ko mukhtalif tajziyat par mabni karna chahiye.

Akhri guftagu mein, halat ke mojooda bazaar mahol mein kharidor ki kamiyabi ke haqiqat ko izhar karna mumkin ho sakta hai, lekin traders ko ehtiyaat baratna, mukammal tajziya karna, aur kamiyabi ke imkanaat ko zyada karne ke liye khatarnaak idaray ke mojooda tajziya aur idaray ke tariqon ka amal karna chahiye.

buyers ki kamiyabi bechnay walay ke upar bechnay ki raftar ke jari rehne par mabni hai. Mojooda qeemat 0.35913 se lambi position kholna mumkin hai, lekin afzal hai ke hali qeemat se thori darwazi shuruwat ka nishana rakha jaye. Is position ko shuru karne ke liye mashroot hadoodi satah ki manzil ki rehnumai, market ke jazbat, takneeki tajziya aur khatarnaak idaray ka intezar hai.

Kharidoron ki mumkin kamiyabi ko sahih taur par samajhne ke liye mojooda bazaar ke halat aur ahem tajziyat ka jaiza lena zaroori hai. Takneeki tajziya ke asbab jese trendlines, moving averages aur oscillators bazaar ke dynamics aur qeemat ki hosakne wali harkat mein qeemti idaray faraham kar sakte hain. Is ke ilawa, trading volume aur investor jazbat ko nigrani mein rakhna bullish trend ki taqat ko tasdeeq karne aur kharidar ki kamiyabi ke imkanat ko tasleem karne mein madad faraham kar sakta hai.Khatarnaak idaray trading mein ahem kirdar ada karte hain. Lambi position shuru karne se pehle, traders ko wazeh khatarnaak hadoodi satah, jese ke stop-loss satah aur nafayat ke maqasid tay karna chahiye. Sahi khatarnaak idaray ke tariqon ko amal mein laane se, traders apni kamiyon ko kam kar sakte hain aur kamiyabi ke imkanat ko zyada kar sakte hain.Is ke ilawa, bazaar ko mutasir karne wale asasi asbab ke baray mein mutaalba rakhna, jese ke maaliyat darusti ka ijlas, saiyasi waqiat, aur markazi bankon ki siyasiyat, qabil-e-ehtiyat hai. Ye asbab currency ke muqaddar ko mutasir kar sakte hain aur bazaar ki overall raftar par asar daal sakte hain.

Amal mein, thori qeemat ke neeche lambi position rakhna traders ko mumkin hai ke woh behtar qeemat par bazaar mein shamil ho sakein, nafayat ke imkanat ko barhate hue pehli khatraat ko kam karte hue. Magar, waqt bohot ahem hai, aur traders ko qeemat ki harkat ko qareeb se dekhna chahiye taake behtareen dakhil ho sakein.Ye yaad rakhna zaroori hai ke trading mein asli khatraat shamil hote hain, aur kamiyabi ke koi yaqeeni daleel nahi hoti. Bazaaron mein izafi ya ghaflati hoti hai, aur sab se ache tajziyat bhi nuqsaan ka sabab ban sakti hain. Isliye, traders hamesha mukammal tajziya karna chahiye, ehtiyaat bartana chahiye, aur barhne wale bazaar ke haalaat ke mutabiq apni strategies ko mukhtalif tajziyat par mabni karna chahiye.

Akhri guftagu mein, halat ke mojooda bazaar mahol mein kharidor ki kamiyabi ke haqiqat ko izhar karna mumkin ho sakta hai, lekin traders ko ehtiyaat baratna, mukammal tajziya karna, aur kamiyabi ke imkanaat ko zyada karne ke liye khatarnaak idaray ke mojooda tajziya aur idaray ke tariqon ka amal karna chahiye.

تبصرہ

Расширенный режим Обычный режим