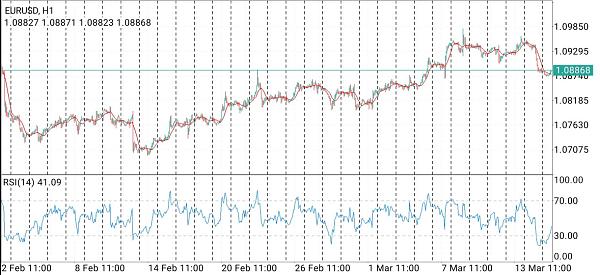

EUR/USD ne Thursday ko neeche ki taraf apni chal shuru ki, jiska hum bohot arsay se intezar kar rahe the. Magar ye koi guarantee nahi hai ke ye neeche ki taraf hi jaari rahega, kyun ke investors ko dollar kharidne ke liye bohot mauqay mojood thay, jo unho ne faida nahi uthaya. Is liye bullish bias jaari hai. Lekin, trend line ke neeche consolidation aur Thursday ko significant giravat humein umeed dilate hain. Kal ke macro data mein se, hum US ke reports on retail sales aur producer prices ko highlight kar sakte hain. Pehla report ek musbat izafa dikhaya, haalaanki thora kam forecast se. Dusra report forecasts ko paar kar gaya (0.6% versus 0.3%). Producer Price Index dollar ki izaafat ko trigger kar sakta hai, kyun ke producer prices ke barhne seinflation aane waale maheenon mein dobara tezi se barh sakti hai. In reports ko mila kar, ye zahir hota hai ke Federal Reserve current level par rate ko mazeed lamba waqt tak barqarar rakh sakta hai. 5-minute timeframe par ek bohot lamba lekin mukammal sell signal bana. Jaisa ke hum ne pehle bhi zikar kiya hai, market mein volatility hone par achay signals milte hain. Keemat poore European session ke doran qaim rahi, lekin US session ke shuru hone par, ye aakhirkaar 1.0940 ke level se bounce kiya aur 1.0888-1.0896 ke range ke neeche gir gaya. Is liye, shuruaati traders ko is signal se lagbhag 50 pips ke munafa mil sakta tha. Aur is waqt, behtar hai ke short positions ke saath bane rahen (ya naye positions kholen).

Trading tips Friday ke liye:Hourly chart par, EUR/USD ne neeche ki taraf chalna shuru kiya hai, aur hum sab kuch yahi umeed kar sakte hain ke is baar dollar buland ho. Hum ab bhi ummeed rakhte hain ke euro apni giravat ko dobara shuru karega, jo humari rai mein kafi arsay tak jaari rahegi. Hum samajhte hain ke bullish correction, jo ek maheena se zyada ka samay le raha tha, aakhirkaar khatam ho gaya hai. Agar aisa hai, to ek naya neeche ki taraf ka trend banega. Yaad rakhen ke euro abhi tak aise significant factors se mehroom hai jo uski growth ko support kar sakte hain.

5M chart par key levels hain 1.0568, 1.0611-1.0618, 1.0668, 1.0725, 1.0785-1.0797, 1.0855, 1.0888-1.0896, 1.0940, 1.0971-1.0981, 1.1011, 1.1043, 1.1091. Thursday ko, Eurozone ka calendar khali hai. US docket mein University of Michigan se consumer sentiment aur industrial production ke reports hain. Ye crucial reports nahi hain, lekin ye zaroori hai ke ye disappointing values na dikhayein taake dollar ki growth ko rukawat na aaye, jo abhi tareekh shuru ki hai.

Trading tips Friday ke liye:Hourly chart par, EUR/USD ne neeche ki taraf chalna shuru kiya hai, aur hum sab kuch yahi umeed kar sakte hain ke is baar dollar buland ho. Hum ab bhi ummeed rakhte hain ke euro apni giravat ko dobara shuru karega, jo humari rai mein kafi arsay tak jaari rahegi. Hum samajhte hain ke bullish correction, jo ek maheena se zyada ka samay le raha tha, aakhirkaar khatam ho gaya hai. Agar aisa hai, to ek naya neeche ki taraf ka trend banega. Yaad rakhen ke euro abhi tak aise significant factors se mehroom hai jo uski growth ko support kar sakte hain.

5M chart par key levels hain 1.0568, 1.0611-1.0618, 1.0668, 1.0725, 1.0785-1.0797, 1.0855, 1.0888-1.0896, 1.0940, 1.0971-1.0981, 1.1011, 1.1043, 1.1091. Thursday ko, Eurozone ka calendar khali hai. US docket mein University of Michigan se consumer sentiment aur industrial production ke reports hain. Ye crucial reports nahi hain, lekin ye zaroori hai ke ye disappointing values na dikhayein taake dollar ki growth ko rukawat na aaye, jo abhi tareekh shuru ki hai.

تبصرہ

Расширенный режим Обычный режим