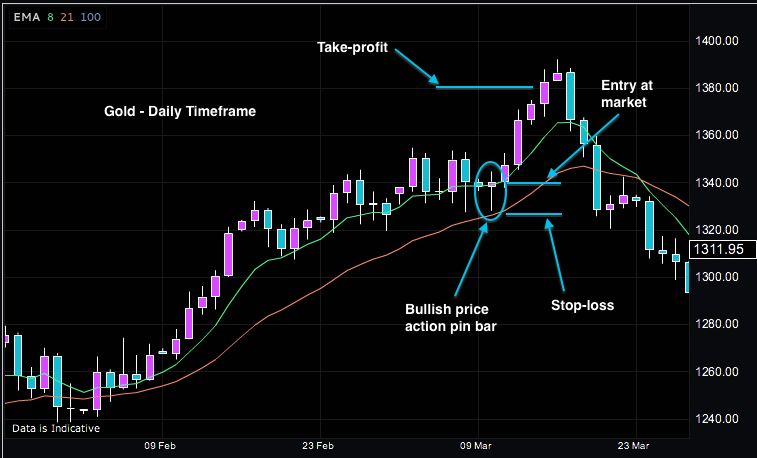

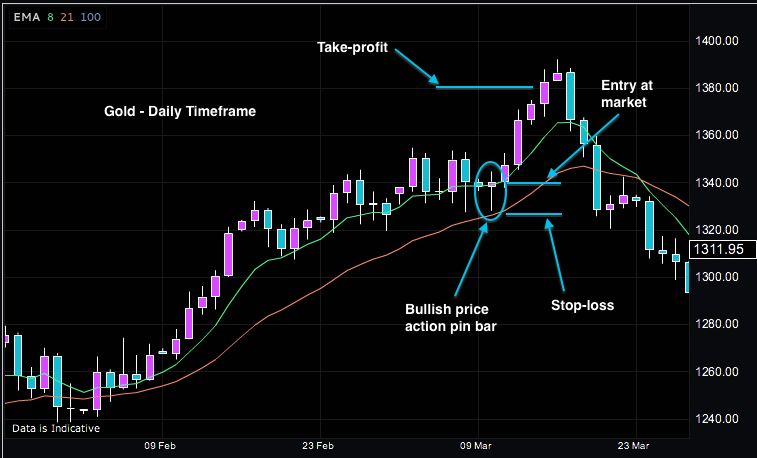

GOLD per Time Chart ANALYSIS in Forex Trading : Forex trading mein GOLD ki trading kaafi popular hai aur isay kai traders apni trading strategies mein shamil karte hain. GOLD, jo aik qeemti dhancha hai, global market mein maqbool hai aur uski keemat kayi factors par depend karti hai. GOLD per time chart analysis aur overview, forex traders ko is market ke tahqiqati tajurbay aur khabardariyat se munasib faida uthane mein madad deta hai.GOLD per time chart analysis, market trend aur price action ki tajurbe se bhari hui technique hai. Ye traders ko GOLD ki qeemat, uski movement, aur potential trading opportunities ke baray mein maloomat pradan karta hai. GOLD ka time chart, jisay bade arsay tak dekha jata hai, traders ko market ka overall picture deta hai aur samajhne mein madad karta hai ke kya GOLD ki keemat barh rahi hai ya ghat rahi hai.  GOLD per time chart analysis ke liye kuch mukhtalif charting tools aur indicators istemal kiye jate hain. In mein shaamil hain moving averages, trend lines, Fibonacci retracements aur RSI (Relative Strength Index). Ye tools aur indicators, price patterns aur market trends ko samajhne mein aur future price movements ko predict karne mein madad dete hain.GOLD per time chart analysis ke doran, traders GOLD ke price levels, support aur resistance areas, aur potential reversal points jaise important levels ko dekhte hain. Ye levels traders ko entry aur exit points ke tajurbe se bhari hui trade setups pradan karte hain. Chart analysis ke saath-saath, traders news aur economic indicators par bhi tawajjo dete hain jo GOLD ki qeemat par asar andaz hotay hain, jaise GDP data, central bank decisions, aur geopolitical events.GOLD per time chart overview ki madad se traders, GOLD ke long-term trends, volatility aur seasonality par tafseeli nazar rakh sakte hain. Is overview mein, traders monthly, weekly aur daily charts par tawajjo dete hain, jisse unhe GOLD ki price movement aur trading patterns ka samajh aur analysis karna asaan ho jata hai. OVERVIEW of GOLD in Forex Trading: GOLD per time chart analysis aur overview ke istemal se traders apni trading strategies aur trading decisions ko behtar bana sakte hain. Ye analysis aur overview traders ko market ke ups aur downs ke samay par trading opportunities aur risk management ki smajh dete hain. Traders ko GOLD ki market dynamics aur behavior samajhne mein madad milti hai, jisse unki trading performance ko sudhara ja sakta hai.

GOLD per time chart analysis ke liye kuch mukhtalif charting tools aur indicators istemal kiye jate hain. In mein shaamil hain moving averages, trend lines, Fibonacci retracements aur RSI (Relative Strength Index). Ye tools aur indicators, price patterns aur market trends ko samajhne mein aur future price movements ko predict karne mein madad dete hain.GOLD per time chart analysis ke doran, traders GOLD ke price levels, support aur resistance areas, aur potential reversal points jaise important levels ko dekhte hain. Ye levels traders ko entry aur exit points ke tajurbe se bhari hui trade setups pradan karte hain. Chart analysis ke saath-saath, traders news aur economic indicators par bhi tawajjo dete hain jo GOLD ki qeemat par asar andaz hotay hain, jaise GDP data, central bank decisions, aur geopolitical events.GOLD per time chart overview ki madad se traders, GOLD ke long-term trends, volatility aur seasonality par tafseeli nazar rakh sakte hain. Is overview mein, traders monthly, weekly aur daily charts par tawajjo dete hain, jisse unhe GOLD ki price movement aur trading patterns ka samajh aur analysis karna asaan ho jata hai. OVERVIEW of GOLD in Forex Trading: GOLD per time chart analysis aur overview ke istemal se traders apni trading strategies aur trading decisions ko behtar bana sakte hain. Ye analysis aur overview traders ko market ke ups aur downs ke samay par trading opportunities aur risk management ki smajh dete hain. Traders ko GOLD ki market dynamics aur behavior samajhne mein madad milti hai, jisse unki trading performance ko sudhara ja sakta hai.  To conclude, GOLD per time chart analysis aur overview forex traders ko GOLD ki qeemat, market trend aur potential trading opportunities ke baray mein tajurbe se bhari hui maloomat pradan karta hai. Ye techniques traders ko GOLD ki trading strategies ko behtar banane aur trading decisions ko samajhdar tareeqay se lenay mein madad dete hain. GOLD per time chart analysis aur overview, traders ke liye qeematdar tools hain jo unhein market volatility aur risk management ke samay par faida uthane mein madad karte hain.

To conclude, GOLD per time chart analysis aur overview forex traders ko GOLD ki qeemat, market trend aur potential trading opportunities ke baray mein tajurbe se bhari hui maloomat pradan karta hai. Ye techniques traders ko GOLD ki trading strategies ko behtar banane aur trading decisions ko samajhdar tareeqay se lenay mein madad dete hain. GOLD per time chart analysis aur overview, traders ke liye qeematdar tools hain jo unhein market volatility aur risk management ke samay par faida uthane mein madad karte hain.

GOLD per time chart analysis ke liye kuch mukhtalif charting tools aur indicators istemal kiye jate hain. In mein shaamil hain moving averages, trend lines, Fibonacci retracements aur RSI (Relative Strength Index). Ye tools aur indicators, price patterns aur market trends ko samajhne mein aur future price movements ko predict karne mein madad dete hain.GOLD per time chart analysis ke doran, traders GOLD ke price levels, support aur resistance areas, aur potential reversal points jaise important levels ko dekhte hain. Ye levels traders ko entry aur exit points ke tajurbe se bhari hui trade setups pradan karte hain. Chart analysis ke saath-saath, traders news aur economic indicators par bhi tawajjo dete hain jo GOLD ki qeemat par asar andaz hotay hain, jaise GDP data, central bank decisions, aur geopolitical events.GOLD per time chart overview ki madad se traders, GOLD ke long-term trends, volatility aur seasonality par tafseeli nazar rakh sakte hain. Is overview mein, traders monthly, weekly aur daily charts par tawajjo dete hain, jisse unhe GOLD ki price movement aur trading patterns ka samajh aur analysis karna asaan ho jata hai. OVERVIEW of GOLD in Forex Trading: GOLD per time chart analysis aur overview ke istemal se traders apni trading strategies aur trading decisions ko behtar bana sakte hain. Ye analysis aur overview traders ko market ke ups aur downs ke samay par trading opportunities aur risk management ki smajh dete hain. Traders ko GOLD ki market dynamics aur behavior samajhne mein madad milti hai, jisse unki trading performance ko sudhara ja sakta hai.

GOLD per time chart analysis ke liye kuch mukhtalif charting tools aur indicators istemal kiye jate hain. In mein shaamil hain moving averages, trend lines, Fibonacci retracements aur RSI (Relative Strength Index). Ye tools aur indicators, price patterns aur market trends ko samajhne mein aur future price movements ko predict karne mein madad dete hain.GOLD per time chart analysis ke doran, traders GOLD ke price levels, support aur resistance areas, aur potential reversal points jaise important levels ko dekhte hain. Ye levels traders ko entry aur exit points ke tajurbe se bhari hui trade setups pradan karte hain. Chart analysis ke saath-saath, traders news aur economic indicators par bhi tawajjo dete hain jo GOLD ki qeemat par asar andaz hotay hain, jaise GDP data, central bank decisions, aur geopolitical events.GOLD per time chart overview ki madad se traders, GOLD ke long-term trends, volatility aur seasonality par tafseeli nazar rakh sakte hain. Is overview mein, traders monthly, weekly aur daily charts par tawajjo dete hain, jisse unhe GOLD ki price movement aur trading patterns ka samajh aur analysis karna asaan ho jata hai. OVERVIEW of GOLD in Forex Trading: GOLD per time chart analysis aur overview ke istemal se traders apni trading strategies aur trading decisions ko behtar bana sakte hain. Ye analysis aur overview traders ko market ke ups aur downs ke samay par trading opportunities aur risk management ki smajh dete hain. Traders ko GOLD ki market dynamics aur behavior samajhne mein madad milti hai, jisse unki trading performance ko sudhara ja sakta hai.  To conclude, GOLD per time chart analysis aur overview forex traders ko GOLD ki qeemat, market trend aur potential trading opportunities ke baray mein tajurbe se bhari hui maloomat pradan karta hai. Ye techniques traders ko GOLD ki trading strategies ko behtar banane aur trading decisions ko samajhdar tareeqay se lenay mein madad dete hain. GOLD per time chart analysis aur overview, traders ke liye qeematdar tools hain jo unhein market volatility aur risk management ke samay par faida uthane mein madad karte hain.

To conclude, GOLD per time chart analysis aur overview forex traders ko GOLD ki qeemat, market trend aur potential trading opportunities ke baray mein tajurbe se bhari hui maloomat pradan karta hai. Ye techniques traders ko GOLD ki trading strategies ko behtar banane aur trading decisions ko samajhdar tareeqay se lenay mein madad dete hain. GOLD per time chart analysis aur overview, traders ke liye qeematdar tools hain jo unhein market volatility aur risk management ke samay par faida uthane mein madad karte hain.

تبصرہ

Расширенный режим Обычный режим