Usd/jpy

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

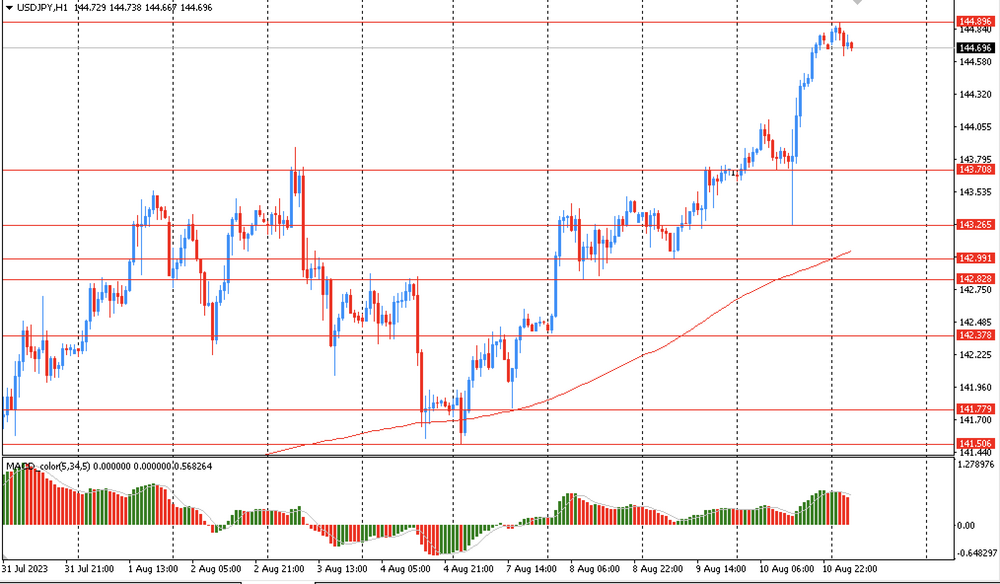

USDJPY ANALYSISH-1 Time Frame H-1 Time Frame Chart par lineari tawanai channel ghanto ka chart uttar disha mein point kar raha hai. M15 par safar bhi usi rukh mein hai. Dono channels ke darmiyan koi bhi ikhtilaf nahi hai, jo aala taraf uthne ki harkat ko zor denay ka nishaan hai. Khareedari mujhe ab bohot ahem hai. 141.781 par channel ke qareebi tahat se, main dakhil hone ka maqam tasawwur kar raha hoon. Maqboliyat se, market 143.892 tak barh rahi hai - channel ke ooper ki hadi, jahan market rukaygi. Market channel ke ooper ki hadi ke qareeb rehti hai aik taweel muddat tak. Hum ne channel ke neechay girne ka ihtimal bhi dekha. Neechay jana kam karna hai, neechay jatay waqt khareedari mein na aana. Sale ki taraf girawat trend ke khilaf hai, aur agar koi pullback nahi hai, to tarraqi jari rahegi. Is liye maine market mein dobara dakhil hone ka tariqa apna liya. Mujhe lagta hai ke yeh tariqa taqatwar khiladiyon ke liye munasib hai, jo buland uth sakte hain aur bear ko todkar aage barh sakte hain. M-15 Time Frame Chart M15 chart ki upri taraf linear regression channel ki inclination, mujhe yeh batata hai ke market mein mazboot buyers hain jo sellers par pressure dal rahe hain aur kharidne ki maqdar hai. Main galat bhi ho sakta hoon, lekin yeh ghor trend ke khilaaf kharidna (aur mere case mein bech karne ki koshish) bade nuksan ka kaaran ho sakta hai. Isliye, stop loss set karke aap apne nuksan ko seemit kar sakte hain agar market trading plan ko follow na kare, aur stop loss entry point 143.066 se zyada nahi hona chahiye. Mere case mein, main tab tak intezaar karoonga jab tak ke price channel ke neeche hisse tak nahi girta, jo ke 143.066 level hai. Main is point ke aas-paas kharidne ke entry points dhoondne ki koshish karunga, aur upper target 143.560 calculate karunga. Traders upri kinare par price pahunchne par ek sell-off ki umeed rakhte hain. Kharidte waqt, ek correction ka intezar karenge. -

#3 Collapse

H-1 Time Frame H-1 Time Frame Chart par lineari tawanai channel ghanto ka chart is updated with points, according to the chart. Safar bhi usi rukh mein hai M15 par. Aala taraf uthne ki harkat ko zor denay ka nishaan hai, dono channels ke darmiyan koi bhi ikhtilaf nahi hai. Mujhe ab bohot ahem hai khareedari. Main dakhil hone ka maqam tasawwur kar raha hoon, 141.781 par channel ke qareebi tahat se. Market 143.892 in Maqboliyat is open for business; the market is open for business because of channel ke ooper ki hadi. Aik taweel muddat tak market channel ke ooper ki hadi ke qareeb rehti hai. Ihtimal bhi dekha hum ne channel ke neechay girne. Neechay jatay waqt khareedari mein na aana, neechay jana kam karna hai. Sale's trend-following behavior is as follows, and if a pullback doesn't occur, tarraqi jari rahegi. Market mein dobara dakhil hone ka tariqa apna liya is liye maine. Jo buland uth sakte hain aur bear ko todkar aage barh sakte hain, mujhe lagta hai ki yeh tariqa taqatwar khiladiyon ke liye munasib hai. M-15 Time Frame Chart Market mein mazboot buyers hain jo sellers par pressure dal rahe hain aur kharidne ki maqdar hai, mujhe yeh batata hai ke M15 chart ki upri taraf linear regression channel ki inclination. Yeh ghor trend ke khilaaf kharidna (or mere case mein bech karne ki koshish) bade nuksan ka kaaran ho sakta hai, but main galat bhi ho sakta hoon. If the market trading strategy is followed and the stop loss entry point 143.066 is not reached, then stop loss set karke aap apne nuksan ko seemit kar sakte hain. In this particular instance, the main tab did not have the intezaar feature while the price channel's neeche hisse was at the 143.066 level. The primary entrance point is at the main point, and the upper objective is 143.560 when calculating the pivot point. The price is dropping and there is a sell-off, according to traders. Ek correction ka intezar karenge, Kharidte Waqt.

M-15 Time Frame Chart Market mein mazboot buyers hain jo sellers par pressure dal rahe hain aur kharidne ki maqdar hai, mujhe yeh batata hai ke M15 chart ki upri taraf linear regression channel ki inclination. Yeh ghor trend ke khilaaf kharidna (or mere case mein bech karne ki koshish) bade nuksan ka kaaran ho sakta hai, but main galat bhi ho sakta hoon. If the market trading strategy is followed and the stop loss entry point 143.066 is not reached, then stop loss set karke aap apne nuksan ko seemit kar sakte hain. In this particular instance, the main tab did not have the intezaar feature while the price channel's neeche hisse was at the 143.066 level. The primary entrance point is at the main point, and the upper objective is 143.560 when calculating the pivot point. The price is dropping and there is a sell-off, according to traders. Ek correction ka intezar karenge, Kharidte Waqt.

-

#4 Collapse

USD JPY Analysis H-1 TIME-FRAMES The US dollar, jo ke Tuesday ko aakhri data ke mutabiq haar raha tha jabke saaf maloom hua ke U.S. mazdoori market thandi ho rahi hai, yen ke khilaf barhna jari rakhta hai. US Federal Reserve qarz uthane ke kharch ko barhaegi. 146.84 had paar karne ke baad, USD/JPY ab 145.68 par trade ho raha hai, jis mein 0.13% kami hai. Labor Department ne maamooli maaloomaat ke mutabiq, doosre din yani Tuesday ko her be-rozgar shakhs ke liye 1.51 job maujood thin, jo September 2021 se kam rate hai, June ke mukabley mein 1.54 se kami hai. U.S. maaliyat ke mayoosi statistics ke natayej mein, US Treasury yields kam hue. In ke mazboot taaluqaat ki bina par, US 10-year Treasury yield ne dono bunyadi variables ko 4.102% tak giraya, jo USD/JPY jod ko kamzor karne ka zariya bana. Isi tarah, dollar ki performance mein kami ayi, jis ki index 0.43% kam hokar 103.041 level par pohnchi . H-4 Time Frame Outlook USD/JPY mein Wednesday ki kami se 146.00 support ke neeche ek rasta dhoondh raha hai. USD/JPY currency pair ab bhi ek taraqqi pasand lehja rakhti hai, lekin 145.95 ke trend line ke neeche girne se pullback hone ki ijaazat ho sakti hai, June 30 ki rozana barhne se madad mil sakti hai jo 145.07 ke aaspaas raah dikhayega. Warna, agli manzil 146.00 ke darje ko kharch kar degi. Agar yeh aakhri hadbandi paar ho to saalana 147.37 ke darje ko test kiya jayega. Main is par yaqeen rakhta hoon ke USD/JPY ke aaj ke harkatein galat theen. Dusri taraf, jab November mein band hua to 147.36 tak pohanchne par tijarat volume buland maqam tak pohanch gaya. Izafa bohat lamhaqi tha, lekin jald hi apni urooj se neeche utar gaya aur 145.66 par aa gaya. Maazi ke trend ka silsila jari nahi hai, lekin zyada gehray 145.35/146.70 -

#5 Collapse

USD/JPY H1 TIME FRAME AT TECHNICAL ANALYSIS,, Aoa Ummid karta hon Ap Sab khariat Say Hon gy jab ham Ess US dollar, jo ke Tuesday ko aakhri data ke mutabiq haar raha tha jabke saaf maloom hua ke U.S. mazdoori market thandi ho rahi hai, yen ke khilaf barhna jari rakhta hai. US Federal Reserve qarz uthane ke kharch ko barhaegi. 146.84 had paar karne ke baad, USED/JPY ab 145.68 par trade ho raha hai, jis mein 0.13% kami hai. Labor Department ne maamooli maaloomaat ke mutabiq, doosre din yani Tuesday ko her be-rozgar shakhs ke liye 1.51 job maujood thin, jo September 2021 se kam Rate hai, June ke mukabley mein 1.54 se kami hai. U.S. maaliyat ke mayoosi statistics ke natayej mein, US Treasury yields kam hue. In ke mazboot taaluqaat ki bina par, US 10-year Treasury yield ne dono bunyadi variables ko 4.102% tak giraya, jo USD/JPY jod ko kamzor karne ka zariya bana. Isi tarah, dollar ki performance mein kami ayi, jis ki index 0.43% kam hokar 103.041 ka Sath market Mein trading ho gi.... H4 TIME FRAME Outlook,,, Dear Ess USD/JPY mein Wednesday ki kami se 146.00 support ke neeche ek rasta dhoondh raha hai. USD/JPY currency pair ab bhi ek taraqqi Pasand lehja rakhti hai, lekin 145.95 ke trend line ke neeche girne se pullback hone ki ijaazat ho sakti hai, June 30 ki rozana barhne se madad mil sakti hai jo 145.07 ke aaspaas raah dikhayega. Warna, agli manzil 146.00 ke darje ko Khar h kar degi. Agar yeh aakhri hadbandi paar ho to saalana 147.37 ke darje ko test kiya jayega. Main is par yaqeen rakhta hoon ke USED/JPY ke aaj ke harkatein galat theen. Dusri taraf, jab November mein band hua to 147.36 tak pohanchney par tijarat volume buland maqam tak pohanch gaya. Izafa bohat lamhaqi tha, lekin jald hi apni urooj se Neeche utar gaya aur 145.66 par aa gaya. Maazi ke trend say hi Zroori hy

- Mentions 0

-

سا0 like

-

#6 Collapse

USD JPY ANALYSIS H1 Time Frame Outlook 1st September ​2023, ko 16:00 server time par inkar ka samna karne ke baad, sellers ne h1 time frame mein 144.38-144.80 ke levels par mojud support area ko phir bhi nahi toda. Jab keemat badhi, to woh dono aqua line yaani moving average 50, jo ke 145.75 ke level par tha, aur aqua line yaani moving average 200, jo ke 145.90 ke level par tha, dono ko todh saki. Is Saturday, maine socha hai ke agar keemat 146.17-146.30 ke price range ke resistance zone ko todhti hai, toh hum phir se kharidne ka order lagayein ge. Munafa lagbhag 72 pips hoga. "Bas ab humain intezar karna hai ke upar ki taraf tezi se phir se chalna shuru ho aur 146.60 ke level tak pohnchay, agar yeh tezi barqarar rehti hai, wala bhi seller squad ki taraf se pressure ka intezaam hua tha, jis ne shuru se lekar jumeraat ke dopahar tak ki koshish ki. Agar keemat is rukawat ko tor sakti hai, to isay keh sakte hain ke trend agle dino mein upar ki taraf chalne ka aik imkan hai. Pichle kai hafton ke trading sessions mein, hum dekh sakte hain ke market abhi tak thora sa upar ki taraf ishara kar raha hai, lekin yeh future mein mazeed izafa hone ki mumkinat ko rokne mein nahi rok sakta, is liye agle haftay market ki keemat chusti se dekhni chahiye. Umeed hai ke bull trend agle haftay bhi jari rahega. Har trader ko money management ke sakht tareeqay se amal karna chahiye taa ke trading ke nuksanat ko kam kiya ja sake aur unke accounts ko high volatility ke daur mein margin calls ke shikar hone se bachaya ja sake."

- Mentions 0

-

سا0 like

-

#7 Collapse

USD/JPY yani United States Dollar aur Japanese Yen ka exchange rate hai. 1. "USD/JPY rate aj kal kya hai?" 2. "Kya tum mujhe bata sakte ho ke USD/JPY kyun barh raha hai?" 3. "USD/JPY ka rate 110 tak pohanch gaya hai!" 4. "Maine apne USD yen mein convert kiye hain." 5. "USD/JPY ka trend dekha? Kya upar ja raha hai ya neeche?" 6. "Forex market main USD/JPY trading karne ka koi strategy suggest karo." 7. "USD/JPY ka rate kam ho raha hai, kya main ab yen khareedun?" 8. "USD/JPY exchange rate ki stability ka kya scene hai?" 9. "USD/JPY ki trading hours kya hain?" 10. "Maine USD/JPY par long position le li hai."11. "USD/JPY pair main forex trading kar ke kya profit ho sakta hai?" 12. "Kya tumhein pata hai ke USD/JPY ke recent economic events kaise affect kar rahe hain?" 13. "Mujhe USD/JPY ka daily chart dekh kar trading decision leni hai." 14. "USD/JPY ki volatility kitni hai?" 15. "USD/JPY ka rate kis tarah se news headlines ko follow karta hai?" 16. "USD/JPY ke liye stop-loss aur take-profit levels kaise set karun?" 17. "USD/JPY ka rate kis tarah se interest rates se linked hai?" 18. "Mujhe USD/JPY ke liye technical analysis tools ki zarurat hai." 19. "Kya USD/JPY trading main fundamental analysis ka bhi role hota hai?" 20. "USD/JPY pair ke liye trading ke liye kaunse time frames behtar hain?" 21. "Kya tumhein koi reliable USD/JPY trading signals provider ka pata hai?" 22. "USD/JPY ke liye risk management kaise ki jati hai?" 23. "USD/JPY trading main leverage ka istemal kar sakta hoon ya nahi?" 24. "USD/JPY pair ke liye current economic outlook kya hai?" 25. "Kya USD/JPY ko influence karne wale geopolitical events hain?" 26. "Mujhe USD/JPY trading ke liye kis tarah ka broker chahiye?" 27. "USD/JPY mein scalping strategy kaam karti hai ya nahi?" 28. "USD/JPY ke liye trading ke liye kis tarah ka risk-reward ratio theek hai?" 29. "Kya USD/JPY ka rate weekends par bhi change hota hai?" 30. "USD/JPY trading mein emotional control kitna important hai?" 31. "USD/JPY ke historical data se kya insights mil sakte hain?" 32. "USD/JPY ka rate Dollar Index ke sath kis tarah se correlated hai?" 33. "Mujhe USD/JPY trading ke liye kuch tips do." 34. "Kya USD/JPY ke liye carry trade strategy apply ki ja sakti hai?" 35. "USD/JPY ke liye economic calendar follow karna kyun zaroori hai?" 36. "USD/JPY pair ka daily trading volume kya hai?" 37. "USD/JPY ke liye short-term aur long-term trading strategies me kya antar hai?" 38. "USD/JPY ke liye trading mein news sources kya hain?" 39. "USD/JPY ka rate kis tarah se interest rate differentials par depend karta hai?"

40. "USD/JPY trading ke liye demo account kaise helpful hai?" 41. "USD/JPY mein technical indicators ka istemal kaise kiya jata hai?" 42. "USD/JPY ke liye sentiment analysis kis tarah se ki jati hai?" 43. "USD/JPY mein carry trade strategy kaam karti hai ya nahi?" 44. "Kya USD/JPY trading mein weekend gap ka khatra hota hai?" 45. "USD/JPY ke liye trading mein leverage ka istemal karne se kya precautions lene chahiye?" 46. "USD/JPY trading main swap rates ka kya role hota hai?" 47. "USD/JPY ke liye economic indicators ka importance kya hai?" 48. "USD/JPY mein trading karne ke liye kaunse time zones important hain?" 49. "USD/JPY ke liye trading strategies mein kis tarah ka risk management plan hona chahiye?" 50. "Kya USD/JPY trading main expert advisors ka istemal kiya ja sakta hai?" Yeh kuch common sentences hain jo USD/JPY trading ko Pakistani chat language main discuss karne mein madadgar ho sakte hain. Trading ke behtareen understanding aur success ke liye zaroori hai ke aap market ko acche se samajhein aur trading strategies ko dhyan se apply karein.

-

#8 Collapse

USD JPY PAIR ANALYSIS H4 TIME-FRAMES H4 time period ke andar, USD/JPY ka aagey tarraki karne ka andaza hai, lekin upper control line ko chooay bina, ye thora bezaar wazan ka lagta hai. Mein seller aur buyer ki taraf se koi karwai nahi dekh raha hoon kyunki pichli candle non-trending thi. Ye coordinate Fibonacci ke 23.6 ke qareeb settled hai. Daily chart par bulls 147.70 par mazboot hain jo ke bara resistance lagta hai kyunki yahan kuch bottoms hain. Wahi to, down float line aur kuch MA ab bhi bearish hain is keemat ke liye, is liye humein dakhil hona chahiye jab keemaat mojooda resistance ko paar karde. Magar bottoms jo 146.50-147.75 ke aas paas hain, unhone yeh guarantee nahi ki ke sellers apne positions kholenge. Daily chart ke hisab se, USD/JPY bearish float mein trade kar raha hai, jabke keemat ab cloud ke neeche hai, jisse girawat ki taraf ishara hai. Is se ye matlab hai ke aap ek choti position mein dakhil ho sakte hain. MACD indicator ki ikhtilaf support zone ke andar hai. Aakhri trading session ke doran, prospects ne phir bhi dakhil karne ki koshish ki, mukhya support level ko chhoo kar, aur ab 147.40-147.65 par trade ho raha hai. Mai aik taqatwar tijarat kaari ka ishara kar raha hoon ke ab maujoodi darjey se mushtamil rehne ka intezar hai, agar 147.00 ke peechle darjey ko toot dia jata hai toh ek naye kamzor wave ki taraf aage badha jayega aur coordination ke ek jari hone ke taur par maujooda raftar mein izafa hoga, jiska asar support line ke qareeb darjey 147.30-147.56 ke neeche ke rukh par hoga. Aik doosri soorat-e-haal mein, qeemat adjust ho sakti hai aur 147.63-147.64 ke resistance darjey ko dobara test karne ke liye izafa kar sakti hai. Faisla karne se pehle, bazaar ke trends ki aam raftar ko madde nazar rakhein. -

#9 Collapse

H-1 Time Frame H-1 Time Frame Chart par lineari tawanai channel ghanto ka chart is updated with points, according to the chart. Safar bhi usi rukh mein hai M15 par. Aala taraf uthne ki harkat ko zor denay ka nishaan hai, dono channels ke darmiyan koi bhi ikhtilaf nahi hai. Mujhe ab bohot ahem hai khareedari. Main dakhil hone ka maqam tasawwur kar raha hoon, 141.781 par channel ke qareebi tahat se. Market 143.892 in Maqboliyat is open for business; the market is open for business because of channel ke ooper ki hadi. Aik taweel muddat tak market channel ke ooper ki hadi ke qareeb rehti hai. Ihtimal bhi dekha hum ne channel ke neechay girne. Neechay jatay waqt khareedari mein na aana, neechay jana kam karna hai. Sale's trend-following behavior is as follows, and if a pullback doesn't occur, tarraqi jari rahegi. Market mein dobara dakhil hone ka tariqa apna liya is liye maine. Jo buland uth sakte hain aur bear ko todkar aage barh sakte hain, mujhe lagta hai ki yeh tariqa taqatwar khiladiyon ke liye munasib hai. H4 TIME-FRAMES Hello Ess Wednesday's pivotal level of 146.00 support for the USD/JPY is now holding. The USD/JPY currency pair is at an important turning point, with a retreat occurring at 145.95 and a price target of 145.07, respectively, after a trend line pullback at 145.95 on June 30. Agli manzil 145.00 ke darje ko Khar h kar degi, warning. If that were the case, then the test result would have been 147.37 if that had been the case. The main thing to remember is that the USED/JPY exchange rate is what matters most. Dusri taraf, when November's band was 147.36, the tijarat volume buland maqam was also pohanched. Jald hi apni urooj se Neeche utar gaya aur 145.66 par aa gaya, Izafa bohat lamhaqi tha. Zroori hy maazi ke trend say hello.If the 147.00 ke peechle darjey ko toot dia jata hai toh ek naye kamzor wave ki taraf aage badha jayega and coordination ke ek jari hone ke taur par maujooda raftar mein izafa hoga, then jiska asar support line ke qareeb darjey 147.30-147. Aik doosri soorat-e-haal mein, qeemat adjust ho sakti hai as well as 147.63-147.64 ke resistance darjey ko dobara test karne ke liye ke sakti hai. Aam raftar ko madde nazar rakhein, bazaar ke trends ki, faisla karne se pehle.Upper control line ko chooay bina, ye thora bezaar wazan ka lagta hai. H4 time period ke andar, USD/JPY ka aagey tarraki karne ka andaza hai. When the pichli candle is not trending, neither the vendor nor the buyer may make a sale. The 23.6th Fibonacci number is the qareeb that has been resolved. Bulls on the daily chart are at 147.70 par, while the bottoms are at the resistance level. Wahi to, the down float line and the MA are both bearish, and the down float line and the MA are both bearish if the mojooda resistance is reached. Unhoney yeh assurance nahi ki ke sellers apne positions kholenge, magar bottoms jo 146.50-147.75 ke aas paas hain.

H4 TIME-FRAMES Hello Ess Wednesday's pivotal level of 146.00 support for the USD/JPY is now holding. The USD/JPY currency pair is at an important turning point, with a retreat occurring at 145.95 and a price target of 145.07, respectively, after a trend line pullback at 145.95 on June 30. Agli manzil 145.00 ke darje ko Khar h kar degi, warning. If that were the case, then the test result would have been 147.37 if that had been the case. The main thing to remember is that the USED/JPY exchange rate is what matters most. Dusri taraf, when November's band was 147.36, the tijarat volume buland maqam was also pohanched. Jald hi apni urooj se Neeche utar gaya aur 145.66 par aa gaya, Izafa bohat lamhaqi tha. Zroori hy maazi ke trend say hello.If the 147.00 ke peechle darjey ko toot dia jata hai toh ek naye kamzor wave ki taraf aage badha jayega and coordination ke ek jari hone ke taur par maujooda raftar mein izafa hoga, then jiska asar support line ke qareeb darjey 147.30-147. Aik doosri soorat-e-haal mein, qeemat adjust ho sakti hai as well as 147.63-147.64 ke resistance darjey ko dobara test karne ke liye ke sakti hai. Aam raftar ko madde nazar rakhein, bazaar ke trends ki, faisla karne se pehle.Upper control line ko chooay bina, ye thora bezaar wazan ka lagta hai. H4 time period ke andar, USD/JPY ka aagey tarraki karne ka andaza hai. When the pichli candle is not trending, neither the vendor nor the buyer may make a sale. The 23.6th Fibonacci number is the qareeb that has been resolved. Bulls on the daily chart are at 147.70 par, while the bottoms are at the resistance level. Wahi to, the down float line and the MA are both bearish, and the down float line and the MA are both bearish if the mojooda resistance is reached. Unhoney yeh assurance nahi ki ke sellers apne positions kholenge, magar bottoms jo 146.50-147.75 ke aas paas hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

USD/JPY H1 TIME FRAME AT TECHNICAL ANALYSIS,, Ummid Aoa Karta Hon According to Tuesday's aakhri statistics, which included the US dollar, the ap Sab khariat Say Hon gy jab ham Ess US dollar, yen ke khilaf barhna jari rakhta hue. Qarz uthane ke kharch ko barhaegi US Federal Reserve in this regard. USED/JPY ab 145.68 par trade ho raha hai, jis mein 0.13% kami hai, 146.84 had paar karne ke baad. Doosre din yani Tuesday ko her be-rozgar shakhs ke liye 1.51 job maujood thin, jo September 2021 se kam Rate hai, June ke mukabley mein 1.54 se kami hai, according to the Labor the department that mutabiq. US Treasury yields are rising, according to U.S. maaliyat ke mayoosi data. US 10-year Treasury yield ne dono bunyadi variables aku 4.102% tak giraya, jo USD/JPY jod ko kamzor karne ka zariya bana, in ke mazboot taaluqaat ki bina par. Isi tarah, the dollar's performance has been good; the 103.041 stock market's trading has been good. H4 TIME-FRAMES Dear Ess The USD/JPY is now holding above its crucial support level of 146.00 from Wednesday. With a retreat occurring at 145.95 and a price target of 145.07, respectively, following a trend line pullback at 145.95 on June 30, the USD/JPY currency pair is at a crucial turning point. Warning: Agli manzil 145 ke darje ko Khar h kar degi. 147.37 would have been the test's outcome if that had been the case, if that were the case. The US Dollar to Japanese Yen Exchange Rate should always be considered the most important factor. When November's band was 147.36, Dusri Taraf additionally pohanched the tijarat loudness buland maqam. Izafa bohat lamhaqi tha, Jald hi apni urooj se Neeche utar gaya, at 145.66 par aa gaya. Hello, Zroori hy maazi ke trend.If the coordination ke ek jari hone ke taur par maujooda raftar mein izafa hoga and the 147.00 ke peechle darjey ko toot dia jata hai then jiska asar support line ke qareeb darjey 147.30-147. In addition to the 147.63-147.64 ke resistance darjey ko dobara test karne ke liye ke sakti hai, aik doosri soorat-e-haal mein, qeemat adjust ho sakti hai. Faisla karne se pehle, bazaar ke trends ki, aam raftar ko madde nazar rakhein.The upper control line is open, and there is now a bezaar wazan in progress. USD/JPY's exchange rate for the H4 time period is andaza. Both the merchant and the customer are prohibited from making a sale when the pichli candle is not trending. The qareeb that has been solved is the 23.6th Fibonacci number. Bulls are at 147.70 par on the daily chart, and bottoms are at the resistance level. The down float line and the MA are both bearish, and if the mojooda resistance is met, both the down float line and the MA will turn bearish. Unhoney yeh assurance nahi ki ke sellers apne positions kholenge; magar bottoms jo 146.50-147.75 ke aas paas hain.

H4 TIME-FRAMES Dear Ess The USD/JPY is now holding above its crucial support level of 146.00 from Wednesday. With a retreat occurring at 145.95 and a price target of 145.07, respectively, following a trend line pullback at 145.95 on June 30, the USD/JPY currency pair is at a crucial turning point. Warning: Agli manzil 145 ke darje ko Khar h kar degi. 147.37 would have been the test's outcome if that had been the case, if that were the case. The US Dollar to Japanese Yen Exchange Rate should always be considered the most important factor. When November's band was 147.36, Dusri Taraf additionally pohanched the tijarat loudness buland maqam. Izafa bohat lamhaqi tha, Jald hi apni urooj se Neeche utar gaya, at 145.66 par aa gaya. Hello, Zroori hy maazi ke trend.If the coordination ke ek jari hone ke taur par maujooda raftar mein izafa hoga and the 147.00 ke peechle darjey ko toot dia jata hai then jiska asar support line ke qareeb darjey 147.30-147. In addition to the 147.63-147.64 ke resistance darjey ko dobara test karne ke liye ke sakti hai, aik doosri soorat-e-haal mein, qeemat adjust ho sakti hai. Faisla karne se pehle, bazaar ke trends ki, aam raftar ko madde nazar rakhein.The upper control line is open, and there is now a bezaar wazan in progress. USD/JPY's exchange rate for the H4 time period is andaza. Both the merchant and the customer are prohibited from making a sale when the pichli candle is not trending. The qareeb that has been solved is the 23.6th Fibonacci number. Bulls are at 147.70 par on the daily chart, and bottoms are at the resistance level. The down float line and the MA are both bearish, and if the mojooda resistance is met, both the down float line and the MA will turn bearish. Unhoney yeh assurance nahi ki ke sellers apne positions kholenge; magar bottoms jo 146.50-147.75 ke aas paas hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим