Pips Value Calculation

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

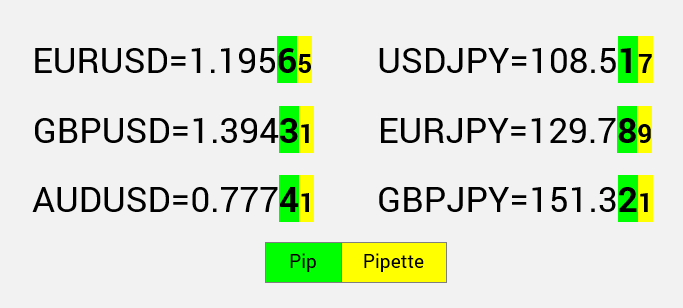

Forex trading mein pips ka calculation karana eham hai kyun ki isse price movements ko samajhna aur maapna hota hai. Forex mein pip ka matlab hota hai percentage in point ya price interest point. Ye currency pair ke liye price ka sabse chhota unit hota hai. Pips ka calculation currency pair ke decimal placement aur quote currency par depend karta hai. Pips ka calculation samjhane ke liye kuch hum apko scenarios samjhate hain: Char Decimal Place Currency Pairs Kai currency pairs ko char decimal places ke saath quote kiya jata hai, jaise ki EUR/USD, GBP/USD ya AUD/USD. Isme, pip wo hota hai jo chauthe decimal place ko represent karta hai. For example, agar EUR/USD exchange rate 1.2000 se 1.2001 ho jata hai, to iska matlab hai ki ye ek pip move hua hai. Do Decimal Place Currency Pairs Kuch currency pairs ko do decimal places ke saath quote kiya jata hai jaise ki USD/JPY ya USD/CHF. Isme, pip wo hota hai jo doosre decimal place ko represent karta hai. For example, agar USD/JPY exchange rate 110.50 se 110.51 ho jata hai, to ye ek pip move hua hai. Paanch Decimal Place Currency Pairs Kuch currency pairs, khas karke Japanese yen (JPY) ke saath jude wale pairs, teen decimal places ke saath quote kiye jate hain. Isme, pip wo hota hai jo doosre decimal place ko represent karta hai. For example, agar USD/JPY exchange rate 110.500 se 110.501 ho jata hai, to ye ek pip move hua hai. Pips Value Calculation Standard Lot Size Forex trading mein ek standard lot 100,000 units of the base currency ko represent karta hai. Standard lot mein trading karne par, pip value ka calculation asan hota hai. Ek currency pair ke liye pip value calculate karne ke liye, pip value ko exchange rate se divide karna hota hai. For example hum EUR/USD ka ek standard lot trade kar rahe hain, jiska pip value $10 hai. Agar exchange rate 1.2000 hai, to calculation hoga:Pip value = (0.0001 / 1.2000) * 100,000 = $8.33 Mini Lot Size Mini lot 10,000 units of the base currency ko represent karta hai. Pip value ka calculation standard lot ke jaisa hi hota hai, lekin pip value ko 10 se divide karte hain, kyunki lot size standard lot ka ek-tihaai hota hai. EUR/USD ke example mein, ek mini lot ke liye calculation yeh hoga:Pip value = (0.0001 / 1.2000) * 10,000 = $0.83 Micro Lot Size Micro lot 1,000 units of the base currency ko represent karta hai. Micro lot ke liye bhi pip value 100 se divide ki jati hai, kyunki lot size standard lot ka ek-sauvan hissa hota hai. EUR/USD ke liye, ek micro lot ke liye calculation yeh hoga:Pip value = (0.0001 / 1.2000) * 1,000 = $0.083

Pips ka calculation samjhane ke liye kuch hum apko scenarios samjhate hain: Char Decimal Place Currency Pairs Kai currency pairs ko char decimal places ke saath quote kiya jata hai, jaise ki EUR/USD, GBP/USD ya AUD/USD. Isme, pip wo hota hai jo chauthe decimal place ko represent karta hai. For example, agar EUR/USD exchange rate 1.2000 se 1.2001 ho jata hai, to iska matlab hai ki ye ek pip move hua hai. Do Decimal Place Currency Pairs Kuch currency pairs ko do decimal places ke saath quote kiya jata hai jaise ki USD/JPY ya USD/CHF. Isme, pip wo hota hai jo doosre decimal place ko represent karta hai. For example, agar USD/JPY exchange rate 110.50 se 110.51 ho jata hai, to ye ek pip move hua hai. Paanch Decimal Place Currency Pairs Kuch currency pairs, khas karke Japanese yen (JPY) ke saath jude wale pairs, teen decimal places ke saath quote kiye jate hain. Isme, pip wo hota hai jo doosre decimal place ko represent karta hai. For example, agar USD/JPY exchange rate 110.500 se 110.501 ho jata hai, to ye ek pip move hua hai. Pips Value Calculation Standard Lot Size Forex trading mein ek standard lot 100,000 units of the base currency ko represent karta hai. Standard lot mein trading karne par, pip value ka calculation asan hota hai. Ek currency pair ke liye pip value calculate karne ke liye, pip value ko exchange rate se divide karna hota hai. For example hum EUR/USD ka ek standard lot trade kar rahe hain, jiska pip value $10 hai. Agar exchange rate 1.2000 hai, to calculation hoga:Pip value = (0.0001 / 1.2000) * 100,000 = $8.33 Mini Lot Size Mini lot 10,000 units of the base currency ko represent karta hai. Pip value ka calculation standard lot ke jaisa hi hota hai, lekin pip value ko 10 se divide karte hain, kyunki lot size standard lot ka ek-tihaai hota hai. EUR/USD ke example mein, ek mini lot ke liye calculation yeh hoga:Pip value = (0.0001 / 1.2000) * 10,000 = $0.83 Micro Lot Size Micro lot 1,000 units of the base currency ko represent karta hai. Micro lot ke liye bhi pip value 100 se divide ki jati hai, kyunki lot size standard lot ka ek-sauvan hissa hota hai. EUR/USD ke liye, ek micro lot ke liye calculation yeh hoga:Pip value = (0.0001 / 1.2000) * 1,000 = $0.083  Pip value currency pair account currency aur traded lot size par depend kar sakta hai. Additionally, kuch brokers ke paas non-standard lot sizes ke liye alag-alag pip value conventions ho sakti hai. Pips ka calculation risk management aur potential profits ya losses ko determine karne ke liye mahatvapurna hai. Pip value ko samajh kar, traders apni position sizing ko assess kar sakte hain, stop-loss levels set kar sakte hain aur potential gains ya losses ko sahi tarike se calculate kar sakte hain. Yad rakhein jabki pips price movements ko measure karne ke liye upyogi hote hain, forex trading mein profit ya loss ke liye kisi bhi tarike ki guarantee nahi hoti hai. Isliye forex trading mein engage hone se pahle thorough research karna aur professional advice lena zaruri hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Pip value currency pair account currency aur traded lot size par depend kar sakta hai. Additionally, kuch brokers ke paas non-standard lot sizes ke liye alag-alag pip value conventions ho sakti hai. Pips ka calculation risk management aur potential profits ya losses ko determine karne ke liye mahatvapurna hai. Pip value ko samajh kar, traders apni position sizing ko assess kar sakte hain, stop-loss levels set kar sakte hain aur potential gains ya losses ko sahi tarike se calculate kar sakte hain. Yad rakhein jabki pips price movements ko measure karne ke liye upyogi hote hain, forex trading mein profit ya loss ke liye kisi bhi tarike ki guarantee nahi hoti hai. Isliye forex trading mein engage hone se pahle thorough research karna aur professional advice lena zaruri hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Assalamu Alaikum Dosto!

Forex Trading Pips

"Pips foreign exchange (Forex) market me measurement ki sab se choti unit hai. Yeh currency pair ke price ka chaar decimal place represent karta hai. Jaise ke agar EUR/USD exchange rate 1.1234 hai, to phir ek pip 0.0001 ke barabar hota hai. Aik pip ki qeemat currency pair aur lot size par munhasar hoti hai. Misal ke tor par, EUR/USD mei aik pip ki qeemat 100,000 units ki standard lot size ke liye aam taur par $10 hoti hai. Lekin, dusre currency pairs ya lot sizes ke liye aik pip ki qeemat choti ya bari bhi ho sakti hai.

Pips ka qeemat currency pair aur lot size ke mutabiq farq karti hai. Jaise ke EUR/USD ke pips ki qeemat 100,000 units ke standard lot size ke liye aam taur par $10 hoti hai. Lekin, dusre currency pairs ya lot sizes ke liye pips ki qeemat choti ya bari ho sakti hai.

Calculation

Forex traders ke liye pips ka bohat ahem role hai, kyunki inko profits aur losses calculate karne ke liye use kiya ja sakta hai. Maslan, agar ek trader 100,000 EUR ki qeemat USD par 1.1234 per khareedta hai aur ise 1.1235 par bechta hai, to uska profit 1 pip ya $10 hoga. Pips aik Forex trade ka risk calculate karne ke liye bhi ahem hote hain. Aik trade ka risk trader ki trading mei kisi bhi waqt hone wale nuqsan ki raqam hoti hai. Aik trade ka risk pip value ko trade ki size se multiply karke calculate kya ja sakta hai. Misal ke tor par, agar koi trader 100,000 EUR ki qeemat par USD 1.1234 par khareedta hai aur trade ka risk 10 pips hai, toh trade par zyada se zyada nuqsan $100 ho sakta hai.

PIPs Important Tips

Pips Forex trading ka aham hissa hai aur inka tareeqa samajhna kamiyabi ke liye zaroori hai. Pips ke bare mein kuch aur baton ko zehan mein rakhna zaroori hai:- Pips hamesha long positions ke liye positive aur short positions ke liye negative hote hain.

- Pips current price of the currency pair se calculate kiye jate hain jab trade khola jata hai.

- Pips trade par profit aur loss ke ilawa trade ki risk calculate karne ke liye bhi istemal kiye ja sakte hain.

- Pips ke qeemat currency pair aur lot size ke mutabiq farq karti hai.

PIPs & Risk Management

Pips ka tareeqa samajhna zaroori hai taa ke aap informed trading decisions le sakein. Yahan kuch tips pesh kiye gaye hain jin ka istemal aap pips ko apni fawaid ke liye istemal karne mein kar sakte hain:- Apni profit aur loss targets tay karne ke liye pips ka istemal karen. Maslan, agar aap EUR/USD trade kar rahe hain aur aapka profit target 10 pips hai, to aap apni trade ko 1.1244 par band kar denge.

- Apni har trade ki risk ko calculate karne ke liye pips ka istemal karen. Maslan, agar aap standard lot size ke saath EUR/USD trade kar rahe hain aur aapki har trade ki risk 10 pips hai, to aap har trade par sirf $100 risk lenge.

- "Pips" ka istemal kar ke alag-alag trading strategies ki munafa bakhshiyat ko tulna karne ke liye istemal kiya ja sakta hai. Maslan, agar aap do alag-alag trading strategies ka jayeza kar rahe hain, to aap har strategy ke trade par paida hone wale average number of pips ko tulna kar sakte hain.

Pips ka istemal samajh kar, aap behtar trading faislon ko le sakte hain aur apne kamyabi ke imkanon ko behtar kar sakte hain.

PIPs Roles In Forex Trading- Price Movement Measurement:

Pips ka istemal market ki movement ko measure karne ke liye hota hai. Traders ke liye yeh ek standardized unit hai jisse woh market ke changes ko quantify kar sakte hain. Pips ki calculation se traders ko pata chalta hai ke price kitna change hua hai aur woh is information ko apne trading strategies mein incorporate karte hain. - Profit aur Loss Calculation:

Pips ki calculation se traders apne trades ke profit aur loss ko calculate karte hain. Har pip ka value alag hota hai, aur is value ke zariye traders ye decide karte hain ke unka trade kitna profitable ya loss-making hai. Pip movement par depend karke traders apne trades ko monitor karte hain aur apne risk management strategies ko adjust karte hain. - Position Sizing:

Pips ka role position sizing mein bhi hota hai. Position sizing se murad ye hai ke trader decide karta hai ke woh ek trade mein kitna risk le sakta hai. Pip value ki calculation se trader ye determine karte hain ke har pip movement unke account ke kitne percentage ko affect karega. Is tarah, traders apne positions ko manage karte hain aur risk ko control mein rakhte hain. - Stop Loss aur Take Profit Levels:

Traders apne trades ke liye stop loss aur take profit levels set karte hain, jinke calculation mein pips ka istemal hota hai. Stop loss level ko set karne se traders decide karte hain ke woh kitna loss tolerate kar sakte hain, jabki take profit level unhe ye batata hai ke jab market itna move karega toh unka target achieve hoga. - Volatility aur Market Analysis:

Pips ka istemal market ki volatility aur analysis mein bhi hota hai. Market mein high volatility ke dauran pip movements zyada hote hain, aur ye traders ko indicate karta hai ke market mein potential opportunities hain ya phir risk factor zyada hai.

-

#4 Collapse

Pips Value Calculation in Forex Trading

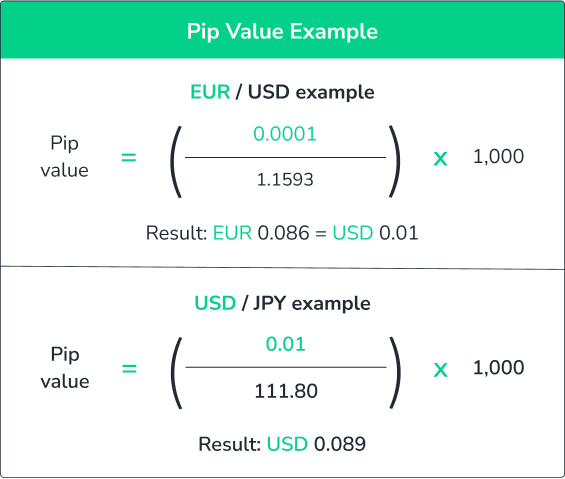

In forex trading, a pip (percentage in point) is a unit of measurement used to express the change in value between two currencies. It's the smallest price move that a currency pair can make based on market convention. Understanding how to calculate the value of a pip is crucial for managing risk and determining potential profits or losses.

1. What is a Pip?

A pip represents the smallest price change in a currency pair, and it usually corresponds to 0.0001 for most currency pairs. For example:- EUR/USD moves from 1.2500 to 1.2501: This is a 1-pip move.

- USD/JPY moves from 110.50 to 110.51: This is also a 1-pip move, but for JPY pairs, the pip value is different because they are quoted to two decimal places.

The pip value is calculated based on the size of your trade (position size), the currency pair being traded, and the exchange rate.

Formula for Pip Value Calculation: For most currency pairs (not involving JPY):

Pip Value=Pip SizeExchange Rate×Position Size\text{Pip Value} = \frac{\text{Pip Size}}{\text{Exchange Rate}} \times \text{Position Size}Pip Value=Exchange RatePip Size×Position Size- Pip Size is typically 0.0001 for most pairs.

- Exchange Rate is the current price of the currency pair.

- Position Size is the number of units of the base currency you are trading.

Example 1: EUR/USD- Pip Size = 0.0001

- Exchange Rate = 1.2500 (EUR/USD)

- Position Size = 10,000 units (1 micro lot)

So, for a 1 micro lot (10,000 units), each pip movement in EUR/USD would be worth 0.8 USD.

3. Pip Value for JPY Pairs

For currency pairs involving the Japanese yen (e.g., USD/JPY), the pip size is 0.01 instead of 0.0001. So, the calculation changes slightly.

Formula for JPY Pairs:

Pip Value=Pip SizeExchange Rate×Position Size\text{Pip Value} = \frac{\text{Pip Size}}{\text{Exchange Rate}} \times \text{Position Size}Pip Value=Exchange RatePip Size×Position Size

Example 2: USD/JPY- Pip Size = 0.01

- Exchange Rate = 110.50 (USD/JPY)

- Position Size = 10,000 units (1 micro lot)

So, for a 1 micro lot in USD/JPY, each pip movement is worth 0.90 JPY.

4. Pip Value Calculation for Other Currency Pairs (Non-USD Pairs)

If you are trading a currency pair where neither currency is USD (e.g., EUR/GBP, EUR/AUD), the pip value calculation may require converting it into your account currency, especially if your base currency is USD.

Formula for Non-USD Pairs:

Pip Value=Pip SizeExchange Rate×Position Size×Exchange Rate (for conversion)\text{Pip Value} = \frac{\text{Pip Size}}{\text{Exchange Rate}} \times \text{Position Size} \times \text{Exchange Rate (for conversion)}Pip Value=Exchange RatePip Size×Position Size×Exchange Rate (for conversion)

For example, if you are trading EUR/GBP with a GBP account, the pip value will need to be converted into GBP.

5. Using a Pip Calculator

Many brokers and online platforms offer pip calculators to simplify the process. These calculators ask for the currency pair, position size, and sometimes the account's base currency, and they automatically calculate the pip value for you.

Conclusion

Understanding pip value is essential for managing risk and controlling your positions in forex trading. The pip value helps traders determine how much profit or loss a movement in the market represents, based on their position size and the currency pair being traded. Make sure to calculate or use a pip calculator for accurate calculations in your trades!

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Forex trading mein pip value ka calculation kisi currency pair, trade size, aur account currency par depend karta hai. Aam tor par, ek pip ka matlab kisi currency pair ki chhoti si price movement hoti hai, jo zyadatar pairs ke liye 0.0001 aur JPY pairs ke liye 0.01 hoti hai. Pip value nikalne ke liye formula hai: Pip Value = (One Pip / Exchange Rate) × Lot Size. Agar EUR/USD ka rate 1.1000 hai aur aap 1 standard lot (100,000 units) trade kar rahe hain, toh ek pip ki value $10 hogi. Mini lot (10,000 units) ke liye pip value $1 aur micro lot (1,000 units) ke liye $0.10 hoti hai. Pip value trading strategy aur risk management mein bohot aham role ada karti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:06 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим