Pinbar and outside bars

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

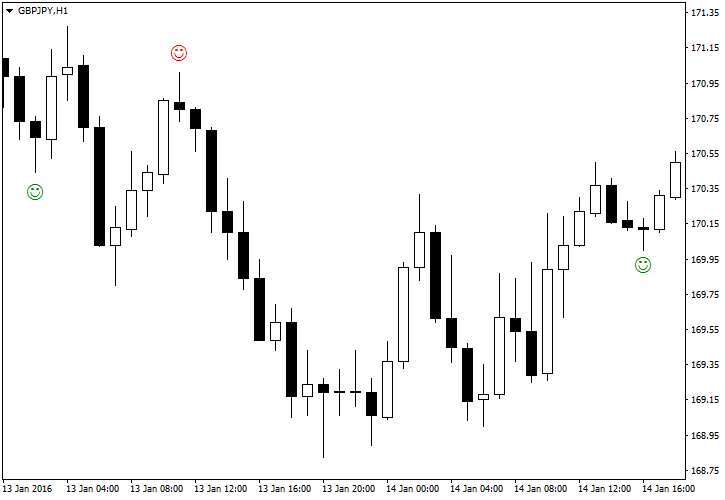

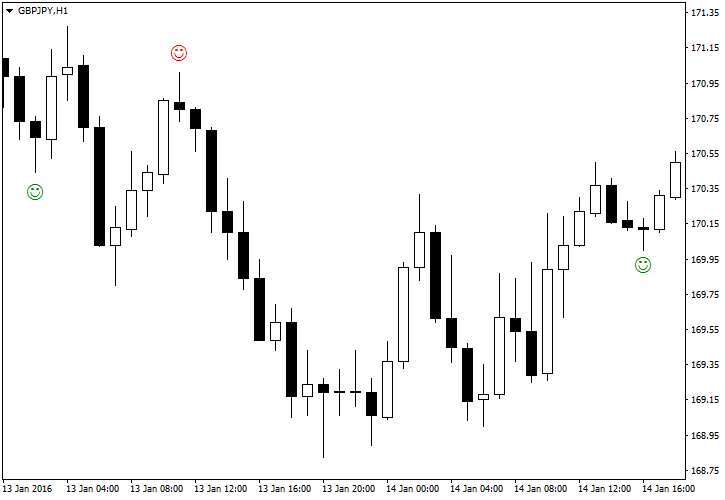

Pinbar aur outside bar forex trading may aik important indicator hai, jo traders kay liye bohot helpful hota hai. In indicators kay istemaal say traders ko price action kay movements ki understanding hoti hai aur isse woh trading kay liye better decisions leney ki capability hasil kartey hain. Pinbar aik candlestick pattern hai jis mein price action kay movements ki representation ki jati hai. Pinbar pattern kay three parts hotey hain: nose, body aur tail. Nose pinbar ka center hota hai aur iski length pinbar kay body kay dono sides par hoti hai. Nose pinbar kay body kay andar hota hai. Tail pinbar kay body kay opposite side par hota hai aur iski length pinbar kay body kay length kay barabar ya uss say zyada hoti hai. Pinbar kay tail ki length kay zyada hona, pinbar ko bohot hi strong indicator bana deta hai. Pinbar kay sath-sath outside bar bhi bohot important indicator hai jo kay price action kay movements ko track karta hai. Outside bar mein, current bar previous bar say zyada ya kam high aur low ko cross karta hai. Outside bar ko bullish aur bearish outside bar mein taqseem kiya jata hai. Bullish outside bar jismay current bar previous bar kay high ko cross karta hai, bullish trend kay indicator kehlay ga. Bearish outside bar jismay current bar previous bar kay low ko cross karta hai, bearish trend kay indicator kehlay ga. Pinbar aur outside bar kay sath-sath, traders ko apni trades ki exit aur entry points kay liye bhi help milti hai. Jab aap ko outside bar pattern nazar ata hai, to aap ko samajh lena chahiye keh price action kay movements mein significant change ho sakti hai. Isliye, traders outside bar kay sath entry aur exit points ko find kar saktey hain. Jab aap ko pinbar pattern nazar ata hai, to aap ko samajh lena chahiye keh trend reversal ho sakta hai. Agar aap ko bullish trend mein bearish pinbar pattern nazar ata hai, to aap ko samajh lena chahiye keh bearish trend ka possibility hai. Waisay hi, agar aap ko bearish trend mein bullish pinbar pattern nazar ata hai, to aap ko samajh lena chahiye keh bullish trend ka possibility hai. Pinbar aur outside bar kay istemaal say traders ko trend kay changes ki understanding hoti hai aur isse woh trading kay liye better decisions leney ki capability hasil kartey hain. Jab aap apni trades kay liye entry aur exit points kay liye in indicators ko use karte hain, to aap ko trading kay liye zyada accuracy aur confidence milti hai. Iske ilawa, in indicators ko use karna traders kay liye bohot easy hai aur in indicators ko identify karna traders kay liye aik asaan kaam hai. Pinbar kay tail ki length kay zyada hona, pinbar ko bohot hi strong indicator bana deta hai. Jab aap ko outside bar pattern nazar ata hai, to aap ko samajh lena chahiye keh price action kay movements mein significant change ho sakti hai. Isliye, traders outside bar kay sath entry aur exit points ko find kar saktey hain. Jab aap ko pinbar pattern nazar ata hai, to aap ko samajh lena chahiye keh trend reversal ho sakta hai. Traders apni trades kay liye entry aur exit points kay liye in indicators ko use kar kay trading kay liye zyada accuracy aur confidence hasil kar sakte hain. Pinbar aur outside bar kay istemaal say traders ko trend kay changes ki understanding hoti hai aur isse woh trading kay liye better decisions leney ki capability hasil kartey hain. Pinbar aur outside bar patterns ko identify karne ke liye traders ko price charts ki understanding honi chahiye. Traders price charts per different timeframes kay liye candlesticks aur bars ki representation ko dekh kar price action patterns kay baray mein samajhdaari hasil kar saktey hain. Pinbar pattern ko recognize karne ke liye, traders ko price charts per small body ke sath lambi tail wali candlestick search karni hoti hai. Tail candlestick body se 2-3 times longer ho sakti hai. Tail candlestick ko upper aur lower shadows ya wicks kay sath bhi recognize kya ja sakta hai. Tail ki length kay zyada hona, pinbar ko bohot hi strong indicator bana deta hai. Outside bar pattern ko recognize karne ke liye, traders ko price charts per high aur low points kay beech mein ek large body wali candlestick search karni hoti hai, jise do smaller body wali candlesticks follow karte hain. Agar outside bar bullish hai to pehli candlestick bearish hoga aur dusri candlestick bullish hoga. Aur agar outside bar bearish hai to pehli candlestick bullish hoga aur dusri candlestick bearish hoga. Traders ko pinbar aur outside bar pattern recognize karnay ke sath-sath unko confirm karna bhi hota hai. Confirm karnay kay liye traders kay paas doosray technical indicators bhi honay chahiye, jaise ki trend lines, support and resistance, moving averages ya price action patterns.

Pinbar aur outside bar kay istemaal say traders ko trend kay changes ki understanding hoti hai aur isse woh trading kay liye better decisions leney ki capability hasil kartey hain. Jab aap apni trades kay liye entry aur exit points kay liye in indicators ko use karte hain, to aap ko trading kay liye zyada accuracy aur confidence milti hai. Iske ilawa, in indicators ko use karna traders kay liye bohot easy hai aur in indicators ko identify karna traders kay liye aik asaan kaam hai. Pinbar kay tail ki length kay zyada hona, pinbar ko bohot hi strong indicator bana deta hai. Jab aap ko outside bar pattern nazar ata hai, to aap ko samajh lena chahiye keh price action kay movements mein significant change ho sakti hai. Isliye, traders outside bar kay sath entry aur exit points ko find kar saktey hain. Jab aap ko pinbar pattern nazar ata hai, to aap ko samajh lena chahiye keh trend reversal ho sakta hai. Traders apni trades kay liye entry aur exit points kay liye in indicators ko use kar kay trading kay liye zyada accuracy aur confidence hasil kar sakte hain. Pinbar aur outside bar kay istemaal say traders ko trend kay changes ki understanding hoti hai aur isse woh trading kay liye better decisions leney ki capability hasil kartey hain. Pinbar aur outside bar patterns ko identify karne ke liye traders ko price charts ki understanding honi chahiye. Traders price charts per different timeframes kay liye candlesticks aur bars ki representation ko dekh kar price action patterns kay baray mein samajhdaari hasil kar saktey hain. Pinbar pattern ko recognize karne ke liye, traders ko price charts per small body ke sath lambi tail wali candlestick search karni hoti hai. Tail candlestick body se 2-3 times longer ho sakti hai. Tail candlestick ko upper aur lower shadows ya wicks kay sath bhi recognize kya ja sakta hai. Tail ki length kay zyada hona, pinbar ko bohot hi strong indicator bana deta hai. Outside bar pattern ko recognize karne ke liye, traders ko price charts per high aur low points kay beech mein ek large body wali candlestick search karni hoti hai, jise do smaller body wali candlesticks follow karte hain. Agar outside bar bullish hai to pehli candlestick bearish hoga aur dusri candlestick bullish hoga. Aur agar outside bar bearish hai to pehli candlestick bullish hoga aur dusri candlestick bearish hoga. Traders ko pinbar aur outside bar pattern recognize karnay ke sath-sath unko confirm karna bhi hota hai. Confirm karnay kay liye traders kay paas doosray technical indicators bhi honay chahiye, jaise ki trend lines, support and resistance, moving averages ya price action patterns.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

at s Candles Mn Greetings Bullesh and Negativity Patterns Hey say exchanging Mn to is ka unpleasant inversion hota hy bullish or negative k darmiyan taqko say khain zayada move kr skti hy agr ap nay phlay kbi is plan pr exchange ki hy ap ko pata ho ga is patteren pr exchange lena kafi mushkil kam hota hy is leay ap ko credible (Bullesh) managment kr k greeting is plan pr exchange lenai chahey .bullish banti hy or last fire negative hoti hy darmiyan wali 3+4+5 Patterns Candles Designed negative ya bullish hoskti hain yet zyada tar darmiyan wali candles bullish hoti hian dear accomplices yeh plan bhot hi intricacy hota hy is leay ap ko chahey k is plan mian focus wali 3 candles ko or in postion ko acchay tareeqay say tarteeb dain agr ap in asloon pr amal krty hain to ap bhot hello there asani say negative breakaway izafa hona chaiy Ruk jata hai or hadood kise bhi pattren k sath bap apna stop aik esay maqam standard rakhna chaiyn gy jhn yeh wazahaiy ho k morning star nakam ho gyia hai aam toor standard yeh plan k zaraiy bnaiy gaiy jhoolay ki sy neechy ho ga Agar market is sathaa sy neechy gir jati hai to shaid ap ki trade munafa wapis nhi kray ge .Jhn tak munafy k ahdaaf ka talaaq hai muzahmat ya istahkam bka aik sabqa ilaqa aam toor standard maqsad kaleay aik thoos nuqta hai .Yaqeeni bnaiyn k ap yhn apny risk ya inaam k tanasib standard tawajoo dety hain.Agar munafy ki waka ahdaaf or stop ap ki merchant hikmat aamli k mutabiq nhi hai to behtar ho ga k is moaqy ko tanha chor dein or aglay ka intazar krein.oona hai jo youth basri fire standard mustamil hair jis methodology tajzaiy kar teezi k neeshanat sy tabeer karty hain neechy ki traf bhirojhan k awful morning star banta hai or yeh oppar ki traf charhny k agaaz ki nishadhai karta hai yeh pichlay qeemat k rojhan mn ulat jany ki alamat hai.Trader morning star ki taskeel standard nazer rakty hain or phir ezafi isharyon ka istamal karty huay is bt ki tasdeeq karty hain k waqaiy ulat phair ho rhi hai.Morning star aik basri namoona hai lehaza anjam denay kaleay koi khas hisab nhi hai morning star aik young adult light ka namoona hai jis mn dosri flame sta Ess Candles Mn Hey Bullesh and Negativity Patterns Hey say exchanging Mn to is ka frightful inversion hota hy bullish or negative k darmiyan taqko say khain zayada move kr skti hy agr ap nay phlay kbi is plan pr exchange ki hy ap ko pata ho ga is patteren pr exchange lena kafi mushkil kam hota hy is leay ap ko genuine (Bullesh) managment kr k greeting is plan pr exchange lenai chahey .bullish banti hy or last fire negative hoti hy darmiyan wali 3+4+5 Patterns Candles Designed negative ya bullish hoskti hain yet zyada tar darmiyan wali candles bullish hoti hian dear accomplices yeh plan bhot hi intricacy hota hy is leay ap ko chahey k is plan mian focus wali 3 candles ko or in postion ko acchay tareeqay say tarteeb dain agr ap in asloon pr amal krty hain to ap bhot hey asani say negative breakaway ko saw Say Hello Trad Len Gy....

Ess Candles Mn Hey Bullesh and Negativity Patterns Hey say exchanging Mn to is ka frightful inversion hota hy bullish or negative k darmiyan taqko say khain zayada move kr skti hy agr ap nay phlay kbi is plan pr exchange ki hy ap ko pata ho ga is patteren pr exchange lena kafi mushkil kam hota hy is leay ap ko genuine (Bullesh) managment kr k greeting is plan pr exchange lenai chahey .bullish banti hy or last fire negative hoti hy darmiyan wali 3+4+5 Patterns Candles Designed negative ya bullish hoskti hain yet zyada tar darmiyan wali candles bullish hoti hian dear accomplices yeh plan bhot hi intricacy hota hy is leay ap ko chahey k is plan mian focus wali 3 candles ko or in postion ko acchay tareeqay say tarteeb dain agr ap in asloon pr amal krty hain to ap bhot hey asani say negative breakaway ko saw Say Hello Trad Len Gy....

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Assalamu Alaikum Dosto!

Pin Bar Trading Strategy

Pin Bar ke tor par jana jane wala aik single candlestick pattern hai, jismein aik lambi wick ya tail aur choti body hoti hai. Pin bar ka aik khaas khasiyat ye hai ke ye tail aas paas ki price action se bahar nikal jati hai, jisse aik pin ki tarah dikhai deti hai. Agar aap forex, stock ya cryptocurrency market mein active trader ya investor hain, toh aapko market mein potential trend reversals pehchanne mein madadgar hone wale mukhtalif price patterns ko samajhna ahem hai. Pin bar ek aisa pattern hai jo market mein potential trend reversals ko pehchane mein istemal hone wala sab se popular candlestick pattern hai, jise technical analysts istemal karte hain. Is guide mein, hum pin bar pattern ke nuances par ghor karenge, iske variations aur isay charts par pehchane ka tareeqa janienge, aur mukhtalif pin bar trading strategies par charcha karenge. Pin bar pattern ko apne trading strategy mein shamil karke traders ko potential trend reversals aur market sentiment ke bare mein qeemti idaron ko dene mein madadgar ho sakta hai. Jabke ye pattern asani se pehchana ja sakta hai, jaise ke trending market mein istemal karne ke liye behtareen hai. Pin bar pattern ko doosre technical indicators aur mukammal tajziya ke sath jor kar traders apne faislay lene ke tareeqe ko behtar bana sakte hain taki unke nataijay ko ziada faida hasil ho.

Aham Points:- Pin bar aik reversal pattern hai jise lambi tail ya wick aur choti body ki khasusiyat se characterized kia jata hai.

- A bullish pin bar aik potential reversal ko darust karta hai, jisse downtrend se uptrend ki taraf aane ki mumkin pehchan hoti hai, jabke a bearish pin bar aik possible reversal ko indicate karta hai, jisse uptrend se downtrend ki taraf jane ki pehchan hoti hai.

- Pin Bar Combo Pattern, Double Top/Bottom aur Moving Average Bounce/Rejection jaise strategies pin bar trading ki darustgi ko barhane ke liye istemal ki ja sakti hain.

Pin bar candlestick pattern kisi bhi financial chart par paya ja sakta hai, kisi bhi time frame mein, aur aam taur par ye reversal pattern consider kia jata hai.

Bullish Pin Bar

A bullish pin bar tab banti hai jab opening aur closing prices aik candle ke range ke top ke qareeb hote hain, sath hi sath aik lambi lower tail recent price action ke bahar nikalti hai. Uper di gayi tasveer ek aisi pin bar reversal ko darust karti hai jo trend ko nichle se upar le jane ki taraf badal rahi hai. Is misal mein, lower pin bar tail yeh darust kar rahi hai ke pehle to sellers ne price ko kam kiya, lekin buyers ne dobara control hasil kia aur price ko upar le gaye. Candle ki closing price opening ke qareeb hoti hai, jo aik choti body banati hai.

Traders is price action ko aksar bullish signal ke tor par samajhte hain, jisse market sentiment mein tabdeeli hone ki alamat samjha jata hai. Isse ye zahir hota hai ke buyers market mein dakhil ho rahe hain aur price isi waja se mazeed barh sakti hai. Bullish pin bar se milne wala signal tab mazboot hota hai jab tail ya wick temporarily price support ke aik technical level ko todti hai.

Bearish Pin Bar

Dusri taraf, a bearish pin bar tab banti hai jab opening aur closing prices aik candle ke range ke bottom ke qareeb hote hain, sath hi sath aik lambi upper tail recent price highs ke bahar nikalti hai. Ye pattern potential reversal ko darust karta hai, jisse uptrend se downtrend ki taraf jane ki pehchan hoti hai. Lambi upper tail yeh ishara hai ke pehle to buyers ne price ko upar le jane ki koshish ki, lekin phir sellers ne control hasil kia aur price ko low ke qareeb band kia.

Traders is price action ko bearish signal samajhte hain, jisse price mein kami hone ki mumkin pehchan hoti hai. Isse ye zahir hota hai ke sellers taaqat hasil kar rahe hain aur market sentiment bearish ho sakti hai.

Jaisa ke kisi bhi candlestick pattern ke sath, aik bearish pin bar dwara darust ki jane wali potential reversal ko confirm karne ke liye support aur resistance analysis jaise mazeed factors ko madde nazar rakna ahem hai.

Pin Bars Types

Char mukhtalif qisam ke pin bar candlestick patterns hoti hain.- Hammer

- Shooting Star

- Inverted Hammer

- Hanging Man

- Hammer

Hammer candlestick pattern aik bullish pin bar hoti hai jismein aik choti upper body aur aik lambi lower wick hoti hai, jo aik hammer ki tarah dikhti hai. Iska matlab hota hai ke sellers ko control mein aane ki chand lamhon ki koshish hoti hai, lekin bad mein buyers unko hara dete hain. Ye pattern aik mazboot bullish signal hai, aur isay potential buying opportunity samjha jata hai. - Shooting Star

Asman se girne wala aik sitara ki tarah, shooting star candlestick pattern aik bearish pin bar hoti hai jismein aik choti lower body aur aik lambi upper wick hoti hai. Is pattern se samjha jata hai ke ek bearish trend reversal ke liye potential hai, jo ek uptrend se downtrend ki taraf jane ki alamat hoti hai. Lambi upper wick ishara karta hai ke buyers temporarily prices ko naye urooj tak pohnchate hain, lekin phir sellers control hasil kar lete hain aur price ko wapas neeche le jate hain. Ye pattern trader ko samjha deta hai ke long positions band karne ya new short positions mein shamil hone ka soch sakte hain. - Inverted Hammer

Inverted hammer candlestick pattern bullish hoti hai aur shooting star ke buhat similar hoti hai, lekin ismein aik bari farq hota hai: inverted hammer aik downtrend ke baad aati hai, jabke shooting star aik uptrend ke baad aati hai. Inverted hammer mein aik lambi wick upper side ki taraf hoti hai, lekin ye wick pehle ke candle se bahar nahi nikalti. Is pattern se ye zahir hota hai ke prices ne rally karne ki koshish ki hai, lekin unmein kafi quwwat nahi thi, aur sellers ne unko wapas neeche daba diya. - Hanging Man

Hanging man candlestick pattern aik bearish pin bar hoti hai, hammer pattern ki tarah. Ismein bari farq ye hota hai ke hanging man pattern aik uptrend ke baad banti hai, aksar resistance ke qareeb, jisse bullish se bearish sentiment ki taraf tabdeeli hone ki alamat hoti hai. Dusri taraf, hammer downtrend ke baad banti hai, aur shayad support ke qareeb.

Pin Bar Pattern Identification

Pin bar ke nuances ko samajhne se aap pin bar pattern ko pehchane aur usko samajhne mein madadgar honge. Pin bar ko pehchana kaafi asaan hai, kyun ke ye aik single-candle pattern hota hai. Ye pattern kisi bhi tradable market mein paya ja sakta hai, chahe wo crypto, forex, stocks, indices ya commodities ho, aur aap isay sab chart time frames par dekh sakte hain.

- Long Wick Candle Talash karen: Pin bar aik lambi tail ya wick se characterized hoti hai jo aksar aas paas ki price action se bahar nikalti hai. Ye tail candle ki body ke kam se kam do guna lambi honi chahiye.

- Choti body ko pehchanein: Pin bar ki body aam taur par choti hoti hai aur aik candle ke aik end par hoti hai. Ye opening aur closing prices ko dikhata hai, jo aam taur par aik dosre ke qareeb hoti hain.

Trading

Pin bars ke sath trading karna kaafi asaan hai. Aik successful trader sirf tab trading shuru karega jab pin bar setup develop hota hai, neeche di gayi checks ke adhar par.

- Tail ki position ko check karein: Mazboot pin bar reversals tail ke opposite direction mein form hote hain. Aik bullish pin bar trade mein, lambi tail body ke lower side se bahar nikalti hai, jabke bearish setup mein, tail body ke upper side se bahar nikalti hai. Pin bar wazi aur notice kiya jane wala hona chahiye.

- Context ko madde nazar rakhein: Pin bar setup key support ya resistance levels, trend lines ya Fibonacci retracement levels ke qareeb sab se zyada effective hota hai. In areas ko dhoondhein taake pin bar reversal ki darustgi barh jaye.

- Volume ko analyze karein: Ye zaroori nahi hai, lekin pin bar ki formation ke doran volume ko observe karna madadgar ho sakta hai. Volume mein izafa pin bar reversal ki validiyat ko mazeed confirm kar sakta hai.

- Confirmation talash karein: Pin bar reversal pattern ki darustgi ko mazeed barhane ke liye, mazeed technical indicators ya price action patterns istemal karne ka soch sakte hain. Is ke ilawa, bullish ya bearish divergence ke isharon, trend line breaks ya doosre reversal pattern signals ko istemal karne se help milti hai.

Pin bar ek key support level ya resistance level ke qareeb dikhaye deta hai. Aik mufeed pin bar trading strategy ye hogi ke price ko wick ke doosre hisse ki lambai tak retrace karne ka intezaar karein. Aik trader 50% retracement ke qareeb buy kar sakta hai, ya bas breakout ka intezaar karke pin bar ki high ke oopar buy stop rakh sakte hain. Stop loss pin bar ki low ke just neeche rakhna chahiye. Minimum take-profit target pin bar ki puri lambai ke barabar hone chahiye.

Pin Bar Trading Strategies

Ab jab aap pin bar ke sath waqif hain, to isay mazeed darustgi ke liye doosre technical analysis tools aur chart patterns ke sath jorna behtareen hai. Pin bars ko trade karne ke liye, neeche di gayi strategies ko madde nazar rakhein.

Pin Bar Combo Pattern

Jabke pin bar aik reversal pattern hai, to inside bar ek continuation pattern hai. Pin bar ko inside bar pattern ke sath jorna aik powerful combination banata hai. Basically, pin bar inside bar pattern ki mother bar hoti hai.

Pin Bar vs. Doji

Doji aur pin bar, aam tor par samjhna mushkil hone wale do candlestick patterns hain. Doori se dekha jaye to in mein kuch mushabihat hain. Maslan, dono patterns aik single candle pattern hain jahan candle ki closing price opening price ke kareeb hoti hai. Pin bar aur Doji mein kuch mushabihat hain, lekin in dono ke mukhtalif khasosiyat hain jo traders ko samajhna zaroori hai takay wo market ke agle qadam ko behtar taur par samajh saken. Chaliye in dono mein farqat ke bare mein tafseel se baat karte hain.

Pehli bari farq ye hai ke pin bar candlestick ki closing price candle ki upper ya lower taraf shift hoti hai, jabke aksar istemal hone wale doji, yaani long-legged doji, ki body candle ki darmiyan hoti hai. Lekin yaad rahe, kuch doji ke mukhtalif qisam hain. In mein se do - dragonfly doji aur gravestone doji - bullish aur bearish pin bars ki highs aur lows ke sath hoti hain, is liye in doji ko bhi pin bars ki tarah consider kiya ja sakta hai.

Doosra farq wick ki lambai mein hota hai. Pin bar ki wick aksar dusri candles ke wicks se kafi zyada lambi hoti hai. Lekin aam doji ki wick upper aur lower taraf se bahar nikalti hai, aur isay khaas lambai ki zaroorat nahi hoti.

Akhir mein, pattern puri tarah se ban jane ke baad nikalte trend mein farq hota hai. Doji market mein uncertainty ko darust karta hai, aur agle qadam mein uljhan ya consolidation ke aasar ko dikhata hai. Iske mawadh mein ye depend karta hai ke doji chart ki analysis ke mahaul aur context par hai.

Pin bars price levels ki rad-e-amal ko zor se dikhate hain, jo market ke mojudah trend ki taraf ishara karte hain ke wo palat raha hai. Inhe doji se aasan taur par samjha ja sakta hai, jo agle trend ko samjhne ke liye chart ki analysis ka mazeed mahaul ki zaroorat hoti hai.

Advantages aur Limitations

Pin bar pattern ko financial market mein traders aasani se pehchante hain. Lekin ismein trading ke doran kuch fawaid aur mehdoodiyat hoti hain, jo traders ko isay apni strategies mein shamil karte waqt maloom honi chahiye. Chaliye, pin bar pattern ke fawaid aur mehdoodiyat dono ko explore karte hain.

- Advantages

- Wazi Trend Reversal Signals: Pin bars wazi aur nazar mein asani se pehchane jane wale trend reversal signals faraham karte hain. Lambi tail price levels ki sakhti se rad-e-amal aur mojudah trend ki thakan ka ishara karte hain.

- Support/Resistance ke Saath Mil Jul: Pin bars khaas taur par significant support ya resistance levels, trend lines ya Fibonacci retracement levels ke qareeb kargar hote hain. Ye mil jul areas trend reversal ke imkan ko barhate hain.

- Market aur Time Frames Par Istemal ki Jaa Sakti Hai: Pin bars har tarah ke liquid financial markets aur har chart time frame par dekhi ja sakti hain. Is wajah se ye day traders, swing traders aur position traders ke darmiyan pasandidgi jama kar chuki hain.

- Limitations

- False Signals: Jaisa ke kisi bhi technical indicator ya pattern mein hota hai, pin bars bhi 100% sahi nahi hote. Ghalat signals aksar volatile ya choppy market conditions mein aate hain. Isi liye traders ko pin bar signals ko tasdeeq karne ke liye mazeed confirmation tools aur techniques ka istemal karne ki salahiyat hai.

- Market Conditions ki Peshgoi Karne Ki Qabiliyat Nahi: Pin bars akela nahi bata sakti ke future market conditions kaise honge. Ye sirf future reversals ke bare mein maloomat faraham karte hain, lekin future trend ki manzil ya taqat ke bare mein yaqeen nahi dete.

- Sideways Markets Mein Limited Istemal: Pin bars zyada tar trending markets mein zyada asar andaz hote hain, khaas taur par jab woh significant support ya resistance levels ke qareeb hoti hain. Sideways ya range-bound markets mein pin bars mixed ya kam asar andaz signals faraham kar sakti hain, jo inhe kam kargar bana deti hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:00 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим