Forex trading mein leverage ki buht ehmyeet hy levarge se hum forex trading mein kam balance se buht ziada profit earn kar sakty han aur forex trading mein ap agr apni investment se trading karty han tu ap apni marzi se levarge rakh sakty han aur agr ap forex trading bonus par trading karty han tu forex trading ap ko 1:50 ki leverage data hy is se ziada nhi

No announcement yet.

X

new posts

-

#76 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#77 Collapse

-

#78 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Ager ap ka capital 1000 usd kay as pas hai tu ap es sy bara leverage be use kar skaty hain. Jin kay deposit account 100 usd sy 500 usd tak hain tu woh apny trading account ka behtreen leverage 1:50 to 1:150 leverage tak rahk skaty hain.Yeh ap pay depend karta hai kay ap kitna risk laity hain or kitna leverage use kar rahy hain jab ap nay aik he trade ko open karna hai tu ap bara leverage b use kar kay achi earning kar skaty hain.اصل پيغام ارسال کردہ از: conca پيغام ديکھيےmera sub sa favrite levarges 1:100 hain aur main ja leverges he used karna like karta ho main na jab forex ko join kayea tha tab sa in leverges ko used kar raha ho is waja sa muje ja sub sa best leverges lagte hain is main zayda risk nahi hain -

#79 Collapse

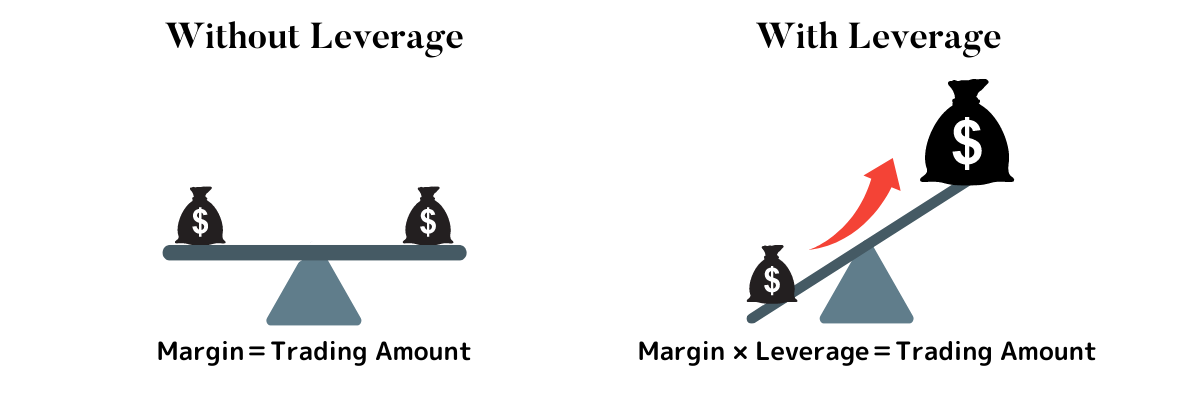

Leverage: the Forex market Trading Mein Ahem Tajziyaati Concept and OVERVIEW: the Forex market buying and selling mein leverage ka istemaal bohat aam hai aur ye ek ahem tajziyaati idea hai jo traders ko zyada munafa hasil karne ki taaqat deta hai. Leverage, buying and selling account mein maujood hone wali paise ki hadood se zyada trading ki ijazat deta hai. The Forex market market mein leverage ka intehai istemaal hota hai aur ye investors ko kam se kam paiso mein bhi bade maqasid tak pohanchne ki salahiyat deta hai. Lekin leverage ka istemaal karne ke sath sath khatrat bhi hoti hai, aur agar isko theek tarah se samjha aur istemaal na kya jaye, to isse nuqsaan bhi ho sakta hai. The Forex market trading mein leverage ki tashkeel do tareekon se hoti hai. Pehla tareeqa, "margin-based leverage" hai, jahan par dealer ko trading account mein mojood marboot rashi (margin) ke barabar leverage di jati hai. Maslan agar apke paas $1,000 ki marboot rashi hai aur dealer ne apko one hundred:1 leverage di hai, to ap $one hundred,000 ki buying and selling kar sakte hain. Dusra tareeqa, "notional-based totally leverage" hai, jahan par trader ko trading volume ke barabar leverage di jati hai. Agar apke bypass $1,000 ki marboot rashi hai aur broking ne apko 50:1 leverage di hai, to ap $50,000 ki buying and selling kar sakte hain. Leverage ki wajah se traders kam se kam paiso mein bhi bade maqasid tak pohanch sakte hain. Agar apke paas zyada paisa nahi hai lekin apko lagta hai ke ek forex pair ka qeemat barhegi, to ap leverage ka istemaal karke bade maqasid tak pohanch sakte hain. Lekin iske sath sath khatrat bhi hoti hai. Agar apko marketplace mein ulta ya surprising rukh milti hai, to leverage ka istemaal apko nuqsaan bhi pohancha sakta hai. Agar apke change mein nuqsaan ho raha hai aur apke leverage ki wajah se margin ke degree area of interest aa jate hain, to dealer apke exchange ko computerized taur par band kar sakta hai. Isi liye zaroori hai ke buyers leverage ka istemaal theek tareeqe se karen aur hamesha apne risk tolerance ke andar hi trade karen. Khatrat aur Nuqsaan: Leverage ke Sath-Sath: Leverage ka istemaal karne se pehle, buyers ko leverage ki samajh honi chahiye. Leverage ki samajh ke baghair, investors ghair mutawaqa dangers mein pad sakte hain. Apni trading method ko leverage ke hisab se regulate karna bhi zaroori hai. Agar apko leverage ka istemaal karne ka irada hai, to apko danger control aur prevent-loss orders par bhi tawajjo deni hogi. The Forex market trading mein leverage ek taqatwar tajziyaati concept hai. Ye investors ko kam se kam paiso mein bhi bade maqasid tak pohanchne ki salahiyat deta hai. Lekin iske sath sath khatrat bhi hotti hai. Agar leverage ka istemaal theek tareeqe se na kya jaye, to isse nuqsaan bhi ho sakta hai. Yehi wajah hai ke buyers ko leverage ki samajh honi chahiye aur iska istemaal mehfooz tareeqe se karna chahiye. Ek achha tareeqa leverage ka istemaal karne ka, apni trading approach ko leverage ke hisab se modify karna hai. Jab ap leverage ka istemaal karte hain, to apko apni alternate sizes aur hazard degrees ko barabar karne ki zaroorat hoti hai. Aapko apne chance tolerance aur buying and selling plan ko dhyan mein rakhkar leverage ka istemaal karna chahiye. Iske alawa, stop-loss orders bhi leverage ka istemaal karne mein madadgar hoti hain. Stop-loss orders apko nuqsaan se bachane mein madad karte hain aur apke trades ko ek had tak mehdood rakhte hain. Leverage ka Istemaal karne se Pehle: Financial Goals aur Risk Tolerance: Leverage ka istemaal karne se pehle, buyers ko apne financial desires aur threat tolerance ka gehwara hona chahiye. Aapko apne trading capital ko aur bhi elements ko samajhna chahiye, jaise ki market volatility, news events, aur technical analysis. Ye sab factors leverage ka istemaal karne mein ahem hoti hain. Aapko hamesha apne financial scenario ko samajhna chahiye aur apni buying and selling selections ko samajhdari se leni chahiye. Forex buying and selling mein leverage ka istemaal aam hai, lekin iska istemaal soch samajh kar karna zaroori hai. Traders ko leverage ki samajh honi chahiye aur iska istemaal apni buying and selling approach aur risk control ke sath karna chahiye. Isse buyers kam se kam paiso mein bhi bade maqasid tak pohanch sakte hain, lekin nuqsaan se bachne ke liye hamesha savdhani se kaam karna chahiye. In end, leverage foreign exchange trading mein ek ahem concept hai jo traders ko kam se kam paiso mein bade maqasid tak pohanchne ki salahiyat deta hai. Lekin leverage ka istemaal samajhdari se karna zaroori hai, kyunki isse nuqsaan ka bhi khatra hota hai. Traders ko leverage ki samajh honi chahiye aur apni trading strategy aur threat management ko leverage ke hisab se regulate karna chahiye. Jaise ki har tajziyaati device, leverage ka istemaal bhi samajh aur zimmedari ke sath hona chahiye.

The Forex market trading mein leverage ki tashkeel do tareekon se hoti hai. Pehla tareeqa, "margin-based leverage" hai, jahan par dealer ko trading account mein mojood marboot rashi (margin) ke barabar leverage di jati hai. Maslan agar apke paas $1,000 ki marboot rashi hai aur dealer ne apko one hundred:1 leverage di hai, to ap $one hundred,000 ki buying and selling kar sakte hain. Dusra tareeqa, "notional-based totally leverage" hai, jahan par trader ko trading volume ke barabar leverage di jati hai. Agar apke bypass $1,000 ki marboot rashi hai aur broking ne apko 50:1 leverage di hai, to ap $50,000 ki buying and selling kar sakte hain. Leverage ki wajah se traders kam se kam paiso mein bhi bade maqasid tak pohanch sakte hain. Agar apke paas zyada paisa nahi hai lekin apko lagta hai ke ek forex pair ka qeemat barhegi, to ap leverage ka istemaal karke bade maqasid tak pohanch sakte hain. Lekin iske sath sath khatrat bhi hoti hai. Agar apko marketplace mein ulta ya surprising rukh milti hai, to leverage ka istemaal apko nuqsaan bhi pohancha sakta hai. Agar apke change mein nuqsaan ho raha hai aur apke leverage ki wajah se margin ke degree area of interest aa jate hain, to dealer apke exchange ko computerized taur par band kar sakta hai. Isi liye zaroori hai ke buyers leverage ka istemaal theek tareeqe se karen aur hamesha apne risk tolerance ke andar hi trade karen. Khatrat aur Nuqsaan: Leverage ke Sath-Sath: Leverage ka istemaal karne se pehle, buyers ko leverage ki samajh honi chahiye. Leverage ki samajh ke baghair, investors ghair mutawaqa dangers mein pad sakte hain. Apni trading method ko leverage ke hisab se regulate karna bhi zaroori hai. Agar apko leverage ka istemaal karne ka irada hai, to apko danger control aur prevent-loss orders par bhi tawajjo deni hogi. The Forex market trading mein leverage ek taqatwar tajziyaati concept hai. Ye investors ko kam se kam paiso mein bhi bade maqasid tak pohanchne ki salahiyat deta hai. Lekin iske sath sath khatrat bhi hotti hai. Agar leverage ka istemaal theek tareeqe se na kya jaye, to isse nuqsaan bhi ho sakta hai. Yehi wajah hai ke buyers ko leverage ki samajh honi chahiye aur iska istemaal mehfooz tareeqe se karna chahiye. Ek achha tareeqa leverage ka istemaal karne ka, apni trading approach ko leverage ke hisab se modify karna hai. Jab ap leverage ka istemaal karte hain, to apko apni alternate sizes aur hazard degrees ko barabar karne ki zaroorat hoti hai. Aapko apne chance tolerance aur buying and selling plan ko dhyan mein rakhkar leverage ka istemaal karna chahiye. Iske alawa, stop-loss orders bhi leverage ka istemaal karne mein madadgar hoti hain. Stop-loss orders apko nuqsaan se bachane mein madad karte hain aur apke trades ko ek had tak mehdood rakhte hain. Leverage ka Istemaal karne se Pehle: Financial Goals aur Risk Tolerance: Leverage ka istemaal karne se pehle, buyers ko apne financial desires aur threat tolerance ka gehwara hona chahiye. Aapko apne trading capital ko aur bhi elements ko samajhna chahiye, jaise ki market volatility, news events, aur technical analysis. Ye sab factors leverage ka istemaal karne mein ahem hoti hain. Aapko hamesha apne financial scenario ko samajhna chahiye aur apni buying and selling selections ko samajhdari se leni chahiye. Forex buying and selling mein leverage ka istemaal aam hai, lekin iska istemaal soch samajh kar karna zaroori hai. Traders ko leverage ki samajh honi chahiye aur iska istemaal apni buying and selling approach aur risk control ke sath karna chahiye. Isse buyers kam se kam paiso mein bhi bade maqasid tak pohanch sakte hain, lekin nuqsaan se bachne ke liye hamesha savdhani se kaam karna chahiye. In end, leverage foreign exchange trading mein ek ahem concept hai jo traders ko kam se kam paiso mein bade maqasid tak pohanchne ki salahiyat deta hai. Lekin leverage ka istemaal samajhdari se karna zaroori hai, kyunki isse nuqsaan ka bhi khatra hota hai. Traders ko leverage ki samajh honi chahiye aur apni trading strategy aur threat management ko leverage ke hisab se regulate karna chahiye. Jaise ki har tajziyaati device, leverage ka istemaal bhi samajh aur zimmedari ke sath hona chahiye.

-

#80 Collapse

Ji Bhai jaan aapane bilkul durust kaha hai aur aapane jo yah sawal kiya hai aapka yah sawal bhi bahut achcha hai Pakistan forex form Pakistan mein number Van platform kar sakte hain Ghar baithkar Pakistan flex form ki jitni bhi tarif ki jaaye utani hi kam hai mere pass alfaaz Nahin hai ki main Pakistan ki tarif aapke samne kaise byan karun Pakistan flex form ke jarie of har hafte bahut achcha profit generate kar sakte hain aur vah profit aapko aapke install forex account mein Mil jata hai Jahan per aap trade lagate Hain trade ko Vin karke hi aap apna profit generate Karke withdrawal Laga sakte hain jo aapko aapke bank account mein show ho jata hai Euro cat gold silver vagaira per aap trade kar sakte hain index ke upar indicator ka istemal Karke bhi Ham trading Vin kar sakte hain aasani ke sath trader Vin hote hi humko Jo hamari amount lagi Hui hoti hai usse jyada hamen mil jaati hai jiski madad se Ham dobara FIR trade jyada dollar ki lagate Hain aur hamen jyada income aati hai Pakistan forex forum is best trading karta hon I am waiting for new members but they are still available in your country and they are not start pak istan for ex for rum Pakistan forex for me humein Kisi bhi nai update ya tabdili ki jarurat Nahin hai is per kam karne ke liye hamen iski privacy ko padh Lena chahie ya FIR iske Jo rules Hain unko acche se 3 se 4 martba humko padh Lena chahie aur is work ko Ham samajh Kar Hi achcha kam kar sakte hain pahle iski bare mein aap research kar le Google se kahin se bhi Pakistan flex form achcha platform hi sabit hoga Dear members thanks for your help me with out investment work available for a quick walk around the house and you can need to collect information about the work okie thanks main ek bar aapko fir se batane Laga Hun ki Pakistan fax form Pakistan mein top ranking number Van per maujud hai aapko bhi is platform ko join kar lena chahie yah sabse achcha platform hai yahan per aap bahut acchi si apni internet kar sakte hain jisse aap apne ghar ka kharcha Jo hai utha sakte hain agar aap student Hain fir bhi Koi masala nahin hai aap part time Ghar baithkar ek se do ghante Delhi ka iske upar kam Karke acche pocket Mani hasil kar sakte hain aapko kam yah karna hota hai ki daily ki aapko do SE panch post Karni Hoti hai Pakistan forex form per Pakistan fax form per aapko sawalon ke jawab dene hote hain ya mashvara Dena hota hai aapke mere is page ko padhne ka bahut bahut shukriya ok thanks take care -

#81 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Munazzam Leverage: Mazid Munafa, Kam Risk : the Forex market trading mein leverage ek ahem idea hai jo traders ko zyada munafa kamane ki qabliyat deta hai, lekin sath hello zyada nuqsan ka bhi khatra barhata hai. Mere liye, "Aap ka Favourite Leverage in the Forex market Trading" ke topic par baat karte hue, mild leverage sab se behtareen choice hai.Moderate leverage istemal karke trader ko kam hazard hota hai kyunki is mein nuqsan ka khatra kam hota hai. Is se dealer apne investments ko manage mein rakh sakte hain aur zyada loss se bach sakte hain. High leverage istemal karne se trader ka capacity profit to barh jata hai, lekin nuqsan hone ki sorat mein ye nuqsan bhi barha deta hai.Moderate leverage istemal karke dealer ko apni buying and selling method ko enforce karne ka moqa milta hai. Zyada leverage istemal karte waqt, dealer ko jald-bazi mein selections leni par sakt doubt hota hai, jabkay slight leverage istemal karne se dealer thandi dimagh se trading kar sakta hai.Leverage ka faisla karne se pehle, dealer ko apne monetary role ko samajhna zaroori hai. Agar koi trader naya hai ya fir confined capital ke sath change kar raha hai, to zyada leverage istemal karna volatile ho sakta hai. Is surat mein, moderate leverage istemal karke dealer apni monetary stability ko qaim rakh sakta hai. Moderate Leverage: Munafa aur Mazid Control : Forex market mein leverage ki tadad broker par depend karti hai. Kuch brokers zyada leverage dete hain jabkay kuch restrained leverage offer karte hain. Trader ko apne dealer ki phrases and conditions ko samajh kar hello leverage ka faisla lena chahiye.Aakhir mein, moderate leverage istemal karne se trader ko trading adventure mein mukhtalif tajawuzat ka samna karna pad sakta hai. Lekin, agar dealer ko sahi knowledge aur experience hai to woh leverage ka sahi tarike se istemal kar sakta hai. Isse dealer ko potential earnings hasil karne ka moqa milta hai aur nuqsanat se bachne ki bhi capability milti hai.Mujhe yakeen hai ke forex trading mein leverage istemal karne ka faisla dealer ki knowledge, enjoy, aur chance tolerance par depend karta hai. Mere liye, moderate leverage wo point hai jahan par munafa aur threat ka stability milta hai. Is se trading adventure ko mazeed manipulate aur stability milti hai. Lekin, leverage istemal karte waqt hamesha responsible tareeqay se kam karna chahiye taake nuqsanat se bacha ja sake.

Moderate Leverage: Munafa aur Mazid Control : Forex market mein leverage ki tadad broker par depend karti hai. Kuch brokers zyada leverage dete hain jabkay kuch restrained leverage offer karte hain. Trader ko apne dealer ki phrases and conditions ko samajh kar hello leverage ka faisla lena chahiye.Aakhir mein, moderate leverage istemal karne se trader ko trading adventure mein mukhtalif tajawuzat ka samna karna pad sakta hai. Lekin, agar dealer ko sahi knowledge aur experience hai to woh leverage ka sahi tarike se istemal kar sakta hai. Isse dealer ko potential earnings hasil karne ka moqa milta hai aur nuqsanat se bachne ki bhi capability milti hai.Mujhe yakeen hai ke forex trading mein leverage istemal karne ka faisla dealer ki knowledge, enjoy, aur chance tolerance par depend karta hai. Mere liye, moderate leverage wo point hai jahan par munafa aur threat ka stability milta hai. Is se trading adventure ko mazeed manipulate aur stability milti hai. Lekin, leverage istemal karte waqt hamesha responsible tareeqay se kam karna chahiye taake nuqsanat se bacha ja sake.

-

#82 Collapse

Leverage in Forex Trading:

forex trading ki dynamic world mein, aik istilaah jo aksar tawajah ka markaz banti hai woh hai" leverage". kisi bhi tajir ke liye leverage ko samjhna bohat zaroori hai jo ke foreign exchangei currency market mein successfully ke sath tashreef le jana chahtay hain. is mazmoon mein, hum delve intricacies ki pleverage, its mechanisms, advantages, and associated risks ka jaiza len ge.

How Leverage Works:

Explanation of Leverage Ratio,

Leverage involves borrowing capital lena shaamil hai taakay trading main position ka hajam is se barh kar badhaya ja sakay jo sirf –apne sarmaye se mumkin ho ga. leverage ratio is baat ka taayun karta hai ke kitni udhaar li gayi raqam tajir ke funds ke silsilay mein istemaal hoti hai. misaal ke tor par, 50:1 leverage ratio ka matlab hai ke tajir ke sarmaye ke har $ 1 ke liye, $ 50 ki market mein tijarat hoti hai .

Example Scenarios,

trader jahan $ 1, 000 wala tajir 50:1 leverage ka istemaal karte hue $ 50,000 ki position ko control kar sakta hai. agarchay yeh munafe ko barha sakta hai, lekin yeh nuqsanaat ko bhi berhata hai, jis se risk managment ko ahem banata hai.

Pros of Using Leverage:

Amplifying Profits,

leverage ke bunyadi fawaid mein se aik mumkina munafe ko badhaane ki salahiyat hai. nisbatan choti sarmaya kaari ke sath, tajir barri pozishnon ko control kar satke hain, aur inhen market ki naqal o harkat se faida uthany ke qabil banatay hain .

Small Initial Investment,

Leverage taajiron ko aik choti ibtidayi sarmaya kaari ke sath forex market mein daakhil honay ki ijazat deta hai. is rasai ne bohat se afraad ko apni taraf mutwajjah kya hai jin ke paas doosri soorat mein shirkat ke liye sarmaya nahi tha .

Risks Associated with Leverage:

Magnifying Losses,

taham, wohi tareeqa boosts profits ko berhata hai nuqsanaat ko bhi barha sakta hai. taajiron ko khatraat se aagah hona chahiye aur risk managment ki muaser hikmat amlyon ko istemaal karna chahiye . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#83 Collapse

What is leverage in Forex trading.

Leverage forex trading make ability Hai K large position ko control Karte land position ke sath market ko aur ismein ham capital ko dekhte hain smaller amount ke sath achieve karte hain Borrow karte hain market se

Ratio Concept:

yah hum expressed krte hai as a ratio, such as 50:1 or 100:1, indicating hai k kaise or kitny times mai hum trader's capital ko hum multiplied control krte position. For example, with 100:1 leverage, a trader jo control krta apni position ko $100,000 with $1,000

Amplifying Gains:

Leverage magnifies krta both potential profits and losses. While yah hume allows krta traders ko jo control krta larger positions jis k sth hum smaller investment, successful use se hum lead krte significant gains

Risk Magnification:

Trader use karte hain leverage ko enhance karte hain profit ki potential ko jo controlling kar diya larger position Jo smaller investment ke sath aur hum allow karte hain increase Karen explore kare price ki movement

Margin Requirement:

Leverage closely tired Kiya Jata Hai concept margin ko aur trader require karte hain deposit certain amount ke upar capital ke sath jisko ham margin kahate Hain aur yah open karte hain and maintain karte hain leverage position

Borrowed Capital:

Leverage involve karte hain borrowing karte hain capital ko broker ko increase karte hain size trading position ko aur Borrow Karte Mani ko use karte main supplementary trader ke apne capital

Common Leverage Levels:

Common leverage level Forex trading ki range mein 50:1 to 500:1 km regulation ke sath different religion pe impose karte hain limit core protect karte hain trader ko

Leverage and Profit Potential:

High leverage position impact Karti Hai market ki liquidity ko aur ham iske sath specially large volume may traders ko trade Karte open or close position close this significantly larger than hota actual capital

Market Liquidity Impact:

service provider ko broker me hum different broker ke sath ham offer Karte very karte hain leverage level or choose karte hain broker ko significantly impact karte hain tere ko explore karte hain leverage

Margin Calls:

Agar trade move kare again status ko to ham ismein receive karte hain margin call ko broker ke sath recording karte hain additional funds ko aur cover Karte potential Jo avoid karte hain position being automatically close kar dete market

Professional and Retail Traders:

Professional or detailed reader leverage ke sath hire institution per ham trader ko compare karte hain vah detail trader ke sath regulation ke sath impose karte hain lawyer average ki limit ko ham detail karte hain tere ko ki vah protect Karen exclusive risk per

Educational Importance:

Trader ko jarurat hai ki vah solid understanding ke sath leverage ko dekhe kyunki Yahan per mis use karke ham lead Karte significent financial losses education hamari risk management ko cruel banati Hai utilise Karte Hain ham leverage

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:34 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим