Assalam o Alaikum! Dear man ap sab k sath "Head and Shoulders Pattern" k related apna knowledge aur experience share kerta hon. Dear forex market ko understand kerna bhot moahkil kam ha, is liye ager trader asa technical tools jis sa market ko asani aur zayada accuracy sa analyse kiya jasa skta ha, uska related knowledge complete kerna chaheye. Technical Tools man candlestick pattern, chart pattern, harmonic pattern, trend lines, indicators aur Metatrader-4/5 k technical tools han. In sab k related ager trader k pass knowledge ha to wo trader ak kmyab aur expert trader ha. Aur sab technical tools trader ko market analyse kerna man help kerta han aur market price chart man trade entry aur trade exit point ko find ker k deta han.

Head & Shoulders Pattern:

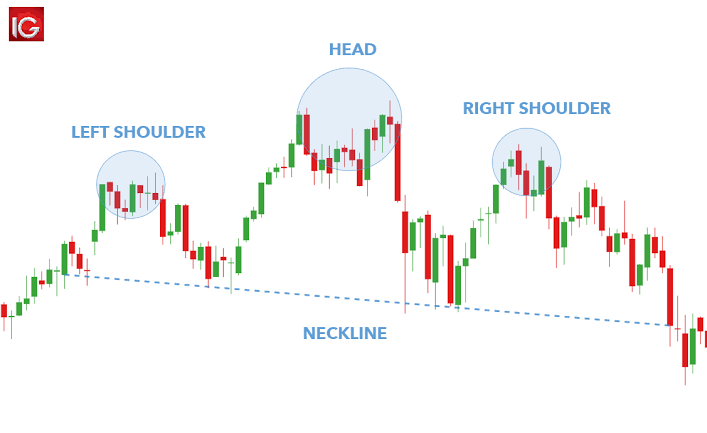

Head and Shoulders Pattern ak trend reversal pattern ha. Head and Shoulders Pattern man market three peaks banati ha. Jis man mid wali higher peak ko HEAD aur baqi two left aur right peak ko SHOULDERS kehta han. Head and Shoulders Pattern two types ka hota ha. Head and Shoulders Pattern ki teeno peaks ak he price level sa start hoti han. Head and Shoulders Pattern man teeno peaks ak common price level sa start hoti han ager in points ko ak line sa milaya jae to is line ko "Nectline kehta han. Aur jab b trader Haed and Shoulder Pattern per trade kerta ha fo wo market price k Nectline k breakout ka wait kerta han.

1. Bullish Head and Shoulders Pattern:

Bullish Head and Shoulders Pattern man teeno peaks (Head aur dono shoulders) neckline sa oper hon to isko Bullish Head and shoulders patterns kehta han.

Aur jab market price neckline ko nicha ki taraf breakout karan aur new candle neckline sa nicha candle ka open den to ye is pattern ki breakout ki confirmation ha. Aur is per trader ko Selll ki trade active kerni chaheye, aur "Stop loss" ko right shoulder per place kerna chaheye aur "Take Profit" ko next support levels per Tp-1, Tp-2 aur Tp-3 kr k place kerna chaheye.

2. Bearish Head and Shoulders Pattern:

Bearish Head and Shoulders Pattern man teeno peaks (Head aur dono shoulders) neckline sa nicha hon to isko Bearish Head and shoulders patterns kehta han.

Aur jab market price neckline ko oper ki taraf breakout karan aur new candle neckline sa oper candle ka open den to ye is pattern ki breakout ki confirmation ha. Aur is per trader ko Buy ki trade active kerni chaheye, aur "Stop loss" ko right shoulder per place kerna chaheye aur "Take Profit" ko next resistance levels per Tp-1, Tp-2 aur Tp-3 kr k place kerna chaheye.

Head & Shoulders Pattern:

Head and Shoulders Pattern ak trend reversal pattern ha. Head and Shoulders Pattern man market three peaks banati ha. Jis man mid wali higher peak ko HEAD aur baqi two left aur right peak ko SHOULDERS kehta han. Head and Shoulders Pattern two types ka hota ha. Head and Shoulders Pattern ki teeno peaks ak he price level sa start hoti han. Head and Shoulders Pattern man teeno peaks ak common price level sa start hoti han ager in points ko ak line sa milaya jae to is line ko "Nectline kehta han. Aur jab b trader Haed and Shoulder Pattern per trade kerta ha fo wo market price k Nectline k breakout ka wait kerta han.

1. Bullish Head and Shoulders Pattern:

Bullish Head and Shoulders Pattern man teeno peaks (Head aur dono shoulders) neckline sa oper hon to isko Bullish Head and shoulders patterns kehta han.

Aur jab market price neckline ko nicha ki taraf breakout karan aur new candle neckline sa nicha candle ka open den to ye is pattern ki breakout ki confirmation ha. Aur is per trader ko Selll ki trade active kerni chaheye, aur "Stop loss" ko right shoulder per place kerna chaheye aur "Take Profit" ko next support levels per Tp-1, Tp-2 aur Tp-3 kr k place kerna chaheye.

2. Bearish Head and Shoulders Pattern:

Bearish Head and Shoulders Pattern man teeno peaks (Head aur dono shoulders) neckline sa nicha hon to isko Bearish Head and shoulders patterns kehta han.

Aur jab market price neckline ko oper ki taraf breakout karan aur new candle neckline sa oper candle ka open den to ye is pattern ki breakout ki confirmation ha. Aur is per trader ko Buy ki trade active kerni chaheye, aur "Stop loss" ko right shoulder per place kerna chaheye aur "Take Profit" ko next resistance levels per Tp-1, Tp-2 aur Tp-3 kr k place kerna chaheye.

تبصرہ

Расширенный режим Обычный режим