Basic Structure of a Swap

Forex mein, swap account aik maali taawun hai jo do parties ko doosri currencies mein cash flows ya interest rate payments ki mubadalaat karne ki ijaazat deta hai. Ye tajaweez traders, investors, aur karobarion dwara apni tabdiliyat ka samna karne ke liye istemaal hoti hai. Swap ki bunyadi tameer notional amount ke darmiyan raqm mubadalaat karne ki maeeshat hai, jo aam taur par principal amount ke tor par jaani jati hai. Is muamale mein notional amount ki har currency mein qeemat maloom karne wale exchange rate aur interest rate ka farq ahem asools hain. Forex swap ka asal maqsad teen gunah hai. Pehle to ye ek risk management ka zariya hai, jis se shakhs muntazir buray tabdiliyon ke khilaaf apne aap ko bacha sakta hai. Dusra, traders aksar swap accounts ko tehqiqat mein istemaal karte hain, muntazir hone wale tabdiliyat ya currency ke qeemat mein izafa se faida uthate hue. Forex swaps cost optimization ke liye istemaal kiye ja sakte hain, jo ke kam interest rate wali currency mein qarz lene ki izazat deta hai.

Types of Forex Swaps

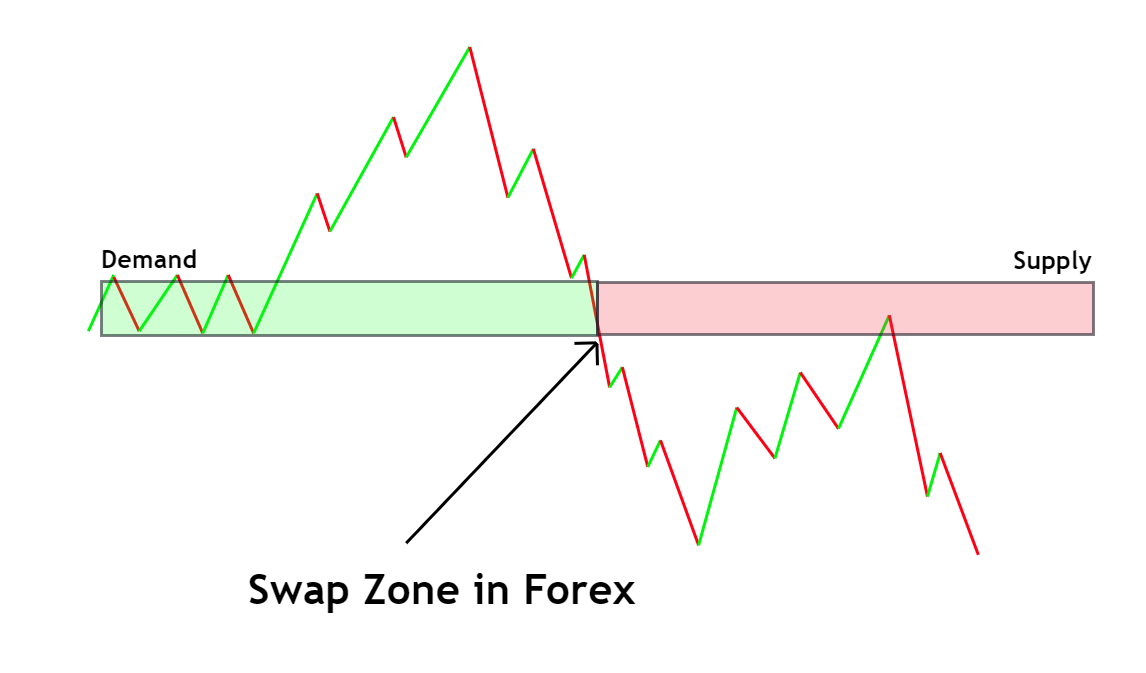

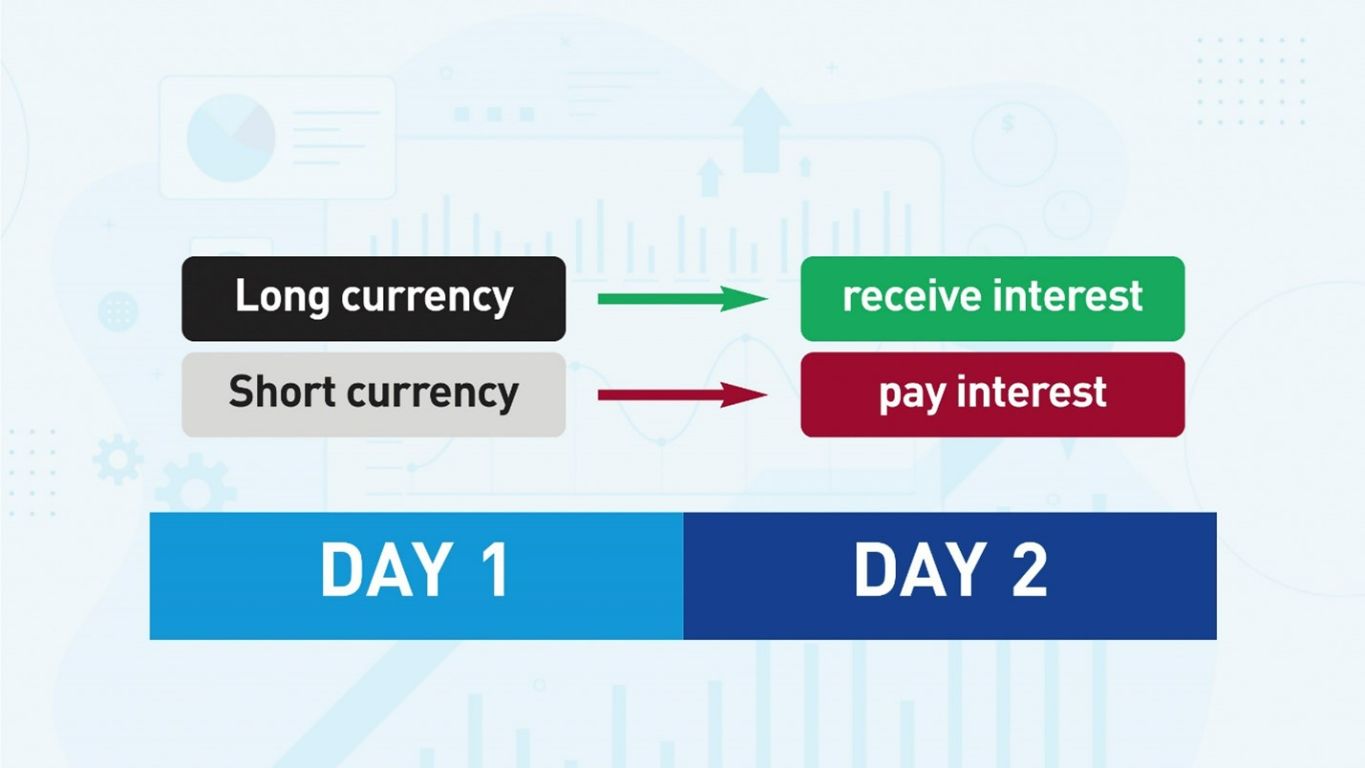

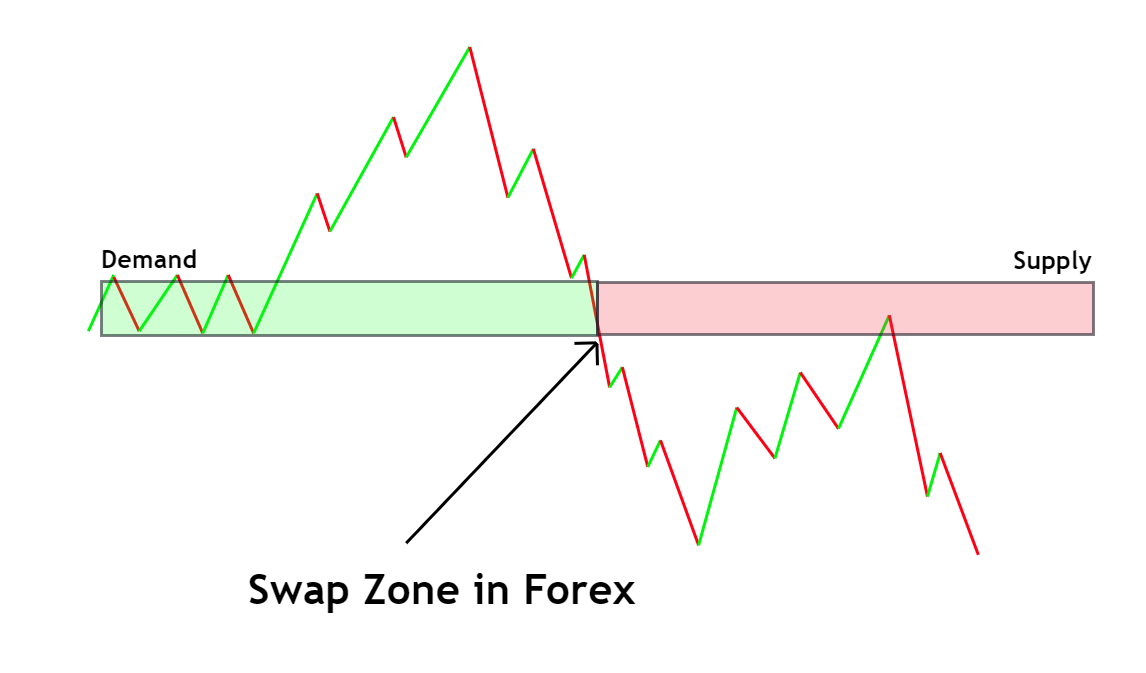

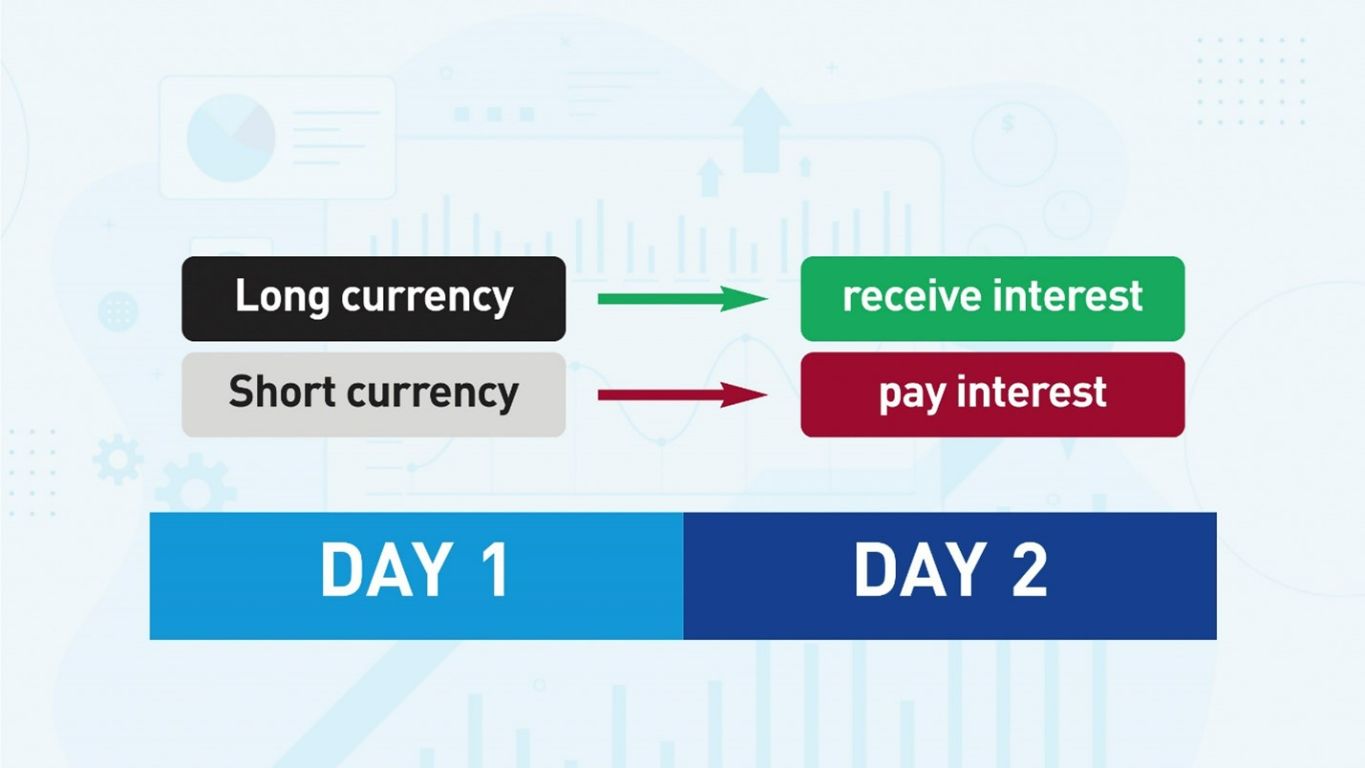

Do qisam ki forex swaps hoti hain: interest rate swaps aur currency swaps. Interest rate swaps mein interest rate cash flows ko ek hi currency mein badalne ka mamla hota hai, jo ke interest rate risk ko samajhne mein madad karta hai. Dusri taraf, currency swaps mein cash flows ko mukhtalif currencies mein tabdeel karna shamil hai, jo ke unn logon ke liye faydemand hota hai jo ek currency mein qarz lena chahte hain jabke doosri currency mein aamdani ya kharche hain. Swap rates ka hisaab mein aik formula shamil hai jo interest rate differential, notional amount, aur dinon ki tadad ko mad e nazar rakhta hai. Lekin, iske ilawa, traders aur investors ke liye asal ghor o fikar ye hai ke raat bhar ek position ko rakhne se juda gain ya cost ka samna karna pad sakta hai. Is amal ko rollover kehte hain, jisme settlement date ko agle value date tak barha jata hai aur trader ko interest rate differentials ke mutabiq ya to faida hota hai ya nuqsan hota hai.

Market Risk

Forex swaps ke faide ke bawajood, isme shaamil hone wale logon ke liye kuch khatraat hain jo wo mad e nazar rakhein. Market risk tab paida hota hai jab currency rates aur interest rates mein izafa ho, jabke credit risk wo risk hai jo do parties ke darmiyan wafaat ke asool par mabni hota hai. Iske ilawa, liquidity risk bhi ek factor ban sakta hai, khaas kar un currency pairs ke liye jo kam trading volume ke saath aate hain. Regulatory tabdilat, jese ke central bank policies mein tabdilat, forex swap transactions ki dilchaspi aur karobar ke liye asaan ya mushkil bana sakti hain. Forex mein swap account ek mutawwir maali instrument ko darust karta hai jo risk management, tehqiqati maqasid, aur cost optimization mein mukhlis hai. Jab ke iski mechanics interest rate differentials aur exchange rates jese technical tajaweezat ko shamil karte hain, traders aur investors ko forex swaps ke mazmon riskat aur mumkin faiday ko samajh kar is raaste mein mubtila hona chahiye. Tehqiqati risk management aur market shiraa'it ka acha ilm forex swaps ko trading ya invest karnay ke liye kisi bhi maaliye ya tanazur mein kamiyabi ke liye bohat zaroori hai.

Forex mein, swap account aik maali taawun hai jo do parties ko doosri currencies mein cash flows ya interest rate payments ki mubadalaat karne ki ijaazat deta hai. Ye tajaweez traders, investors, aur karobarion dwara apni tabdiliyat ka samna karne ke liye istemaal hoti hai. Swap ki bunyadi tameer notional amount ke darmiyan raqm mubadalaat karne ki maeeshat hai, jo aam taur par principal amount ke tor par jaani jati hai. Is muamale mein notional amount ki har currency mein qeemat maloom karne wale exchange rate aur interest rate ka farq ahem asools hain. Forex swap ka asal maqsad teen gunah hai. Pehle to ye ek risk management ka zariya hai, jis se shakhs muntazir buray tabdiliyon ke khilaaf apne aap ko bacha sakta hai. Dusra, traders aksar swap accounts ko tehqiqat mein istemaal karte hain, muntazir hone wale tabdiliyat ya currency ke qeemat mein izafa se faida uthate hue. Forex swaps cost optimization ke liye istemaal kiye ja sakte hain, jo ke kam interest rate wali currency mein qarz lene ki izazat deta hai.

Types of Forex Swaps

Do qisam ki forex swaps hoti hain: interest rate swaps aur currency swaps. Interest rate swaps mein interest rate cash flows ko ek hi currency mein badalne ka mamla hota hai, jo ke interest rate risk ko samajhne mein madad karta hai. Dusri taraf, currency swaps mein cash flows ko mukhtalif currencies mein tabdeel karna shamil hai, jo ke unn logon ke liye faydemand hota hai jo ek currency mein qarz lena chahte hain jabke doosri currency mein aamdani ya kharche hain. Swap rates ka hisaab mein aik formula shamil hai jo interest rate differential, notional amount, aur dinon ki tadad ko mad e nazar rakhta hai. Lekin, iske ilawa, traders aur investors ke liye asal ghor o fikar ye hai ke raat bhar ek position ko rakhne se juda gain ya cost ka samna karna pad sakta hai. Is amal ko rollover kehte hain, jisme settlement date ko agle value date tak barha jata hai aur trader ko interest rate differentials ke mutabiq ya to faida hota hai ya nuqsan hota hai.

Market Risk

Forex swaps ke faide ke bawajood, isme shaamil hone wale logon ke liye kuch khatraat hain jo wo mad e nazar rakhein. Market risk tab paida hota hai jab currency rates aur interest rates mein izafa ho, jabke credit risk wo risk hai jo do parties ke darmiyan wafaat ke asool par mabni hota hai. Iske ilawa, liquidity risk bhi ek factor ban sakta hai, khaas kar un currency pairs ke liye jo kam trading volume ke saath aate hain. Regulatory tabdilat, jese ke central bank policies mein tabdilat, forex swap transactions ki dilchaspi aur karobar ke liye asaan ya mushkil bana sakti hain. Forex mein swap account ek mutawwir maali instrument ko darust karta hai jo risk management, tehqiqati maqasid, aur cost optimization mein mukhlis hai. Jab ke iski mechanics interest rate differentials aur exchange rates jese technical tajaweezat ko shamil karte hain, traders aur investors ko forex swaps ke mazmon riskat aur mumkin faiday ko samajh kar is raaste mein mubtila hona chahiye. Tehqiqati risk management aur market shiraa'it ka acha ilm forex swaps ko trading ya invest karnay ke liye kisi bhi maaliye ya tanazur mein kamiyabi ke liye bohat zaroori hai.

تبصرہ

Расширенный режим Обычный режим