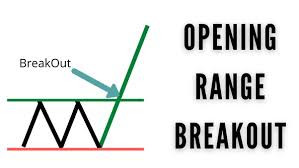

Opening Range Breakouts

Opening range ek crypto asset ki high aur low ko describe karta hai, jo trading day ke market opening price ke thode samay pehle hoti hai. Day traders is day price range ke baare mein chintit hote hain kyun ki ye din ke market sentiments, price actions, aur price trends ko darust dikhata hai.

Crypto market mein trading ke saath aane wale market volatility aur price actions ki wajah se, non-random price movements hone ki tend hoti hai. Isliye opening range breakout strategy traders ko unke entry aur exit points ko define karne ka mauka deta hai jo unhone banayi hui strategy par adharit hai. Lekin trading mein koi bhi exact points ya areas stop loss rakhne ke liye nahi hote.

Opening Range Breakout Kaise Karein

Technical analyst ke roop mein opening range breakout strategy ko trade karna trading ko asaan banata hai, khaaskar jab ye strategy ko dusre trading tools ke saath execute kiya jata hai. Opening range breakout traders ko trading karte waqt entry aur exit points ko define karne mein madad karta hai.

Kuch key steps jo opening range breakout ko trade karne mein madad karen:

Step 1: Timeframe Select

Har trader ke liye koi best trading timeframe nahi hota; ye sab unke preferences aur unke skills ko develop karte waqt kis tarah se range trading aur trading ke doosre pahluon mein kaam karta hai, par depend karta hai. Scalpers jaise kuch traders 5-minute chart pattern, 15-minute, ya 30-minute chart ka istemal karte hain; ye sab munafa kamane aur risk exposures ko kam karne ke liye stop loss order ke saath jude hue hote hain. Jis timeframe ka aap istemal karna chahein, wahi ORB strategy ke liye kaam karega.

Step 2: Criteria Decide Karein

Decide karein ki aapko kis tarah ke opening range breakout ke liye accha karan ya bias dhundhna chahiye jo ban raha hai. Traders kabhi-kabhi range high, range low, range size, aur high ya high relative volume ke liye dekhte hain. Ye criteria aapko ek trade mein enter karne ke liye ek achha karan denge jo potential breakout ki taraf hai.

Step 3: Strong Breakout Identify Karein

ORB strategy ko trade karte waqt strong aur successful breakouts identify karna bahut zaroori hai. Ye ek successful trade mein madad karega aur opening range breakout ka istemal entry aur exit points ko identify karne mein madad karega. High-volume node strategy ka istemal ek successful breakout ko identify karne ke liye ek achha tareeqa hai, jisme statistics ye confirm karte hain ki high-volume node ke aas-paas 50% price reconsolidation hoti hai, jo ek successful breakout ki taraf le ja sakti hai.

Step 4: Step-by-step Trade Execution

Upar diye gaye sabhi steps ko follow karke ek high probable opening range breakout ko identify karne ke baad, humein apne entry points ko identify karna hai. Ye hume risk-to-reward ratio ko weigh karne ka achha mauka dega.

Next, humein stop loss order determine karna hai taki aapka portfolio excessive risk mein na ho aur profit potential maximize ho, jise aapke calculations ya long ya short position ke liye next supply zone ke basis par set kiya ja sakta hai.

ORB Trading Strategy Key Takeaways

Opening range breakout ko trade karna ek trader ke liye rewarding ho sakta hai jo crypto market ka accha gyaan rakhta hai aur sahi strategy ko amal mein la sakta hai. Opening range breakout par upar diye gaye discussion ke saath, kuch key takeaways hain jo aapko dhyan dena chahiye:

Opening range ek crypto asset ki high aur low ko describe karta hai, jo trading day ke market opening price ke thode samay pehle hoti hai. Day traders is day price range ke baare mein chintit hote hain kyun ki ye din ke market sentiments, price actions, aur price trends ko darust dikhata hai.

Crypto market mein trading ke saath aane wale market volatility aur price actions ki wajah se, non-random price movements hone ki tend hoti hai. Isliye opening range breakout strategy traders ko unke entry aur exit points ko define karne ka mauka deta hai jo unhone banayi hui strategy par adharit hai. Lekin trading mein koi bhi exact points ya areas stop loss rakhne ke liye nahi hote.

Opening Range Breakout Kaise Karein

Technical analyst ke roop mein opening range breakout strategy ko trade karna trading ko asaan banata hai, khaaskar jab ye strategy ko dusre trading tools ke saath execute kiya jata hai. Opening range breakout traders ko trading karte waqt entry aur exit points ko define karne mein madad karta hai.

Kuch key steps jo opening range breakout ko trade karne mein madad karen:

Step 1: Timeframe Select

Har trader ke liye koi best trading timeframe nahi hota; ye sab unke preferences aur unke skills ko develop karte waqt kis tarah se range trading aur trading ke doosre pahluon mein kaam karta hai, par depend karta hai. Scalpers jaise kuch traders 5-minute chart pattern, 15-minute, ya 30-minute chart ka istemal karte hain; ye sab munafa kamane aur risk exposures ko kam karne ke liye stop loss order ke saath jude hue hote hain. Jis timeframe ka aap istemal karna chahein, wahi ORB strategy ke liye kaam karega.

Step 2: Criteria Decide Karein

Decide karein ki aapko kis tarah ke opening range breakout ke liye accha karan ya bias dhundhna chahiye jo ban raha hai. Traders kabhi-kabhi range high, range low, range size, aur high ya high relative volume ke liye dekhte hain. Ye criteria aapko ek trade mein enter karne ke liye ek achha karan denge jo potential breakout ki taraf hai.

Step 3: Strong Breakout Identify Karein

ORB strategy ko trade karte waqt strong aur successful breakouts identify karna bahut zaroori hai. Ye ek successful trade mein madad karega aur opening range breakout ka istemal entry aur exit points ko identify karne mein madad karega. High-volume node strategy ka istemal ek successful breakout ko identify karne ke liye ek achha tareeqa hai, jisme statistics ye confirm karte hain ki high-volume node ke aas-paas 50% price reconsolidation hoti hai, jo ek successful breakout ki taraf le ja sakti hai.

Step 4: Step-by-step Trade Execution

Upar diye gaye sabhi steps ko follow karke ek high probable opening range breakout ko identify karne ke baad, humein apne entry points ko identify karna hai. Ye hume risk-to-reward ratio ko weigh karne ka achha mauka dega.

Next, humein stop loss order determine karna hai taki aapka portfolio excessive risk mein na ho aur profit potential maximize ho, jise aapke calculations ya long ya short position ke liye next supply zone ke basis par set kiya ja sakta hai.

ORB Trading Strategy Key Takeaways

Opening range breakout ko trade karna ek trader ke liye rewarding ho sakta hai jo crypto market ka accha gyaan rakhta hai aur sahi strategy ko amal mein la sakta hai. Opening range breakout par upar diye gaye discussion ke saath, kuch key takeaways hain jo aapko dhyan dena chahiye:

- Range ka size determine karne ke liye, previous trading session ke closing candle ki high ya low aur new trading session ke opening candle ki high ya low ke beech ki doori ko measure karein.

- Opening range breakout strategy ko trade karte waqt breakout identify hote hi, potential breakout chart ki disha mein hota hai. Uptrend ki disha mein breakout hone par bullish price trend hota hai, jabki downtrend ki disha mein breakout hone par bearish price trend hota hai.

- Early range breakout mein trade enter karein jab price action opening range se bahar nikal jaaye. Hamesha breakout ki disha mein trade karein, chahe wo uptrend ho ya downtrend, taki breakout ko counter-trading na kiya jaye, kyun ki ye funds ke nuksan ka karan ho sakta hai. Initial range ke beech mein ek stop loss set karein aur trade ko kam se kam price move ke liye open rakhein.

تبصرہ

Расширенный режим Обычный режим