What is Bitcoin and how it work?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

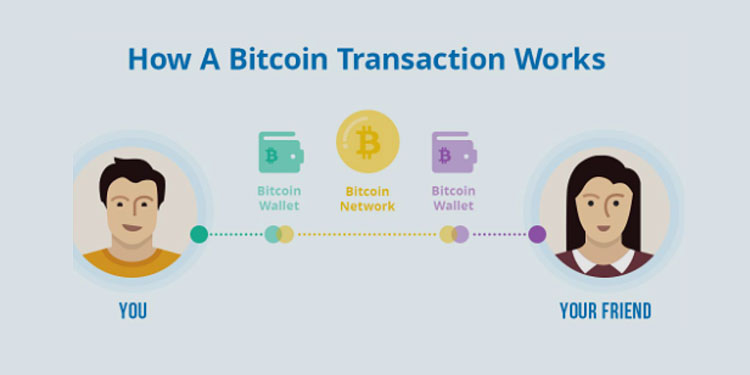

Assalamualaikum aj is thread me apko me Bitcoin ke bare me btao ga or me umeed karta ho ke jo information me apse share Karo ga wo apke knowledge or Experience me zaror izafa kare ge. What is Bitcoin? Bitcoin ( btc ) aik cripto currency hai, aik majazi currency hai jo raqam ke tor par kaam karne ke liye banai gayi hai aur kisi 1 shakhs, giroh, ya idaray ke control se bahar adaigi ki aik shakal hai, is terhan maliyati lain deen mein fareeq saalis ki shamoliat ki zaroorat ko daur karti hai. yeh kaan kano ko lain deen ki tasdeeq ke liye kiye gaye kaam ke liye inaam diya jata hai aur usay kayi aykschinjz par khareeda ja sakta hai .Butt coin ko 2009 mein aik gumnaam doylpr ya doylprz ke group ne satoshi nakamoto ke naam se muta-arif karaya tha. tab se yeh duniya ki sab se mashhoor cripto currency ban gayi hai. is ki maqboliat ne bohat si doosri cripto krnsyon ki taraqqi ko mutasir kya hai. yeh hareef ya to usay adaigi ke nizaam ke tor par tabdeel karne ki koshish karte hain ya deegar bock chains aur ubharti hui maliyati tiknalojiz mein ifadiyat ya hifazati token ke tor par istemaal hotay hain . Key Takeaway 2009 mein shuru kya gaya, bitcoin market lehaaz se duncaptalization keiya ki sab se barri crypto currency hai. Fiyat currency ke bar aks, Butt coin ko bock chain ke naam se jana jata lager system ka istemaal karte hue takhleeq, taqseem, tijarat aur zakheera kya jata hai .Butt coin aur is ke lager ko proof off work ( pow ) ittafaq raye se mehfooz kya jata hai, jo ke" kaan kinny" ka amal bhi hai jo system mein naye Butt coins muta-arif karwata hai. Butt coin ko mukhtalif crypto currency aykschinjz ke zariye khareeda ja sakta hai. Butt coin ki tareekh qeemat ke zakheera ke tor par hai. hungama khaiz riha yeh apni nisbatan kam Umar ke douran kayi taizi aur toot phoot ke chakron se guzra hai . Understanding Augst 2008 mein, bitcoin. org naam ka domain register sun-hwa. aaj, kam az kam, yeh domain whoisguard protected hai, yani usay register karne walay shakhs ki shanakht awaami maloomat nahi hai. october 2008 mein, satoshi nakamoto ka jhoota naam istemaal karne walay 1 shakhs ya group ne metzdowd. com par milng list ka elaan kya :" mein aik naye electronic cash system par kaam kar raha hon jo mukammal tor par paiir two pear hai, jis mein koi qabil aetmaad teesra fareeq nahi hai." bitcoin. org par shaya honay wala yeh ab ka mashhoor white paper, jis ka unwan hai" bitcoin : a peer-to-peer electronic cash system ", aaj bitcoin ke kaam karne ke liye migna karta ban jaye ga . -

#3 Collapse

Bitcoin aik decentralized digital currency hai jo 2008 mein ek anonymous person ya person ki group ke zariye banai gayi thi. Is currency ka istemaal karne ke liye kisi central hukumat ya fiance idaray ki zaroorat nahi hoti hai. Bitcoin aik peer to peer network jise blockchain kehte hain par tajweez kiya jata hai. Bitcoin ke khaas khasosiyat aur blockchain ki bunyad par financial ki duniya mein aik inqilabi tabdeeli layi gayi hai aur aik naye digital currency ke tareeqay ka aghaz hua hai. Bitcoin asal mein aik digital cash hai jo digital currency ke taur par kaam karta hai aur jisay blockchain technology par mushtamil hai. Is currency ko istemaal karne ke liye ek digital wallet ki zaroorat hoti hai, jo aksar mobile apps ya computer software ke zariye hasil hoti hai. Har ek Bitcoin transaction ko blockchain mein darj kiya jata hai jo ek public ledger hai jis mein tamam transactions ki maloomat maujood hoti hai. Bitcoin ki kamyabi ka basic step uski decentralization par tika hai. Iska matlab hai ke kisi bhi individual ya entity ke pass Bitcoin ki poori control nahi hoti hai. Bitcoin network par miners kehte hain un logon ko jo transactions verify karte hain aur blockchain ko maintain karte hain. Miners ko transactions verify karne ke badle Bitcoin rewards milti hain, jo Bitcoin ke creation ke sath sath circulation ko bhi badhati hai. Bitcoin ke transactions secure hote hain, kyun ke har transaction ko cryptographic signatures se protect kiya jata hai. Ye signatures transaction ki authenticity aur integrity ko barqarar rakhti hain. Bitcoin mein double-spending ko rokne ke liye bhi safeguards mojood hain. Bitcoin network par transactions ko confirm karne mein time lag sakta hai, lekin is ke sath sath ye bhi guarantee karta hai ke ek Bitcoin sirf aik hi bar kharch ho sakti hai. Bitcoin ke istemal se mukhtalif faide hain. Ye global currency hai jisay kisi bhi jagah par asaani se bheja ja sakta hai. Is ke transactions ke liye minimal ya koi bhi fee nahi hoti hai jo traditional banking systems mein hoti hai. Bitcoin ka istemal karne wale logon ko financial privacy aur control milta hai. Bitcoin ki value market demand aur supply ke mutabiq tay hoti hai aur is par speculations bhi hoti hain. Lekin Bitcoin ke istemal aur adopation ke challenges bhi hain. Iski volatility aur price fluctuations ka khatra hai. Is ke ilawa regulatory frameworks aur legal implications bhi is currency ke samne aate hain. Iske bawajood Bitcoin ne digital currency ki duniya mein aik revolution paida kiya hai aur iske technology ne financial systems ke liye naye darwaze khole hain. Bitcoin ki buying aur selling cryptocurrency exchanges ke through hoti hai. Ye exchanges online platforms hote hain jahan par Bitcoin aur dusri cryptocurrencies ko khareedne aur bechne ka option milta hai. Ye exchanges users ko Bitcoin ki trading karne ki service provide karte hain. Bitcoin khareedne ke liye aapko pehle ek cryptocurrency exchange par account banana hoga. Iske liye aksar aapko apna email address verify karna hota hai aur kuchh aur personal details submit karni hoti hain. Account verification ke baad aap apne bank account se funds deposit kar sakte hain. Funds deposit karne ke baad aap exchange par Bitcoin ki current price ke according order place kar sakte hain. Aap apne funds ke hisab se Bitcoin khareed sakte hain. Jab aapka order execute hota hai aapki Bitcoin aapke exchange account mein transfer ho jati hai.

Bitcoin ke istemal se mukhtalif faide hain. Ye global currency hai jisay kisi bhi jagah par asaani se bheja ja sakta hai. Is ke transactions ke liye minimal ya koi bhi fee nahi hoti hai jo traditional banking systems mein hoti hai. Bitcoin ka istemal karne wale logon ko financial privacy aur control milta hai. Bitcoin ki value market demand aur supply ke mutabiq tay hoti hai aur is par speculations bhi hoti hain. Lekin Bitcoin ke istemal aur adopation ke challenges bhi hain. Iski volatility aur price fluctuations ka khatra hai. Is ke ilawa regulatory frameworks aur legal implications bhi is currency ke samne aate hain. Iske bawajood Bitcoin ne digital currency ki duniya mein aik revolution paida kiya hai aur iske technology ne financial systems ke liye naye darwaze khole hain. Bitcoin ki buying aur selling cryptocurrency exchanges ke through hoti hai. Ye exchanges online platforms hote hain jahan par Bitcoin aur dusri cryptocurrencies ko khareedne aur bechne ka option milta hai. Ye exchanges users ko Bitcoin ki trading karne ki service provide karte hain. Bitcoin khareedne ke liye aapko pehle ek cryptocurrency exchange par account banana hoga. Iske liye aksar aapko apna email address verify karna hota hai aur kuchh aur personal details submit karni hoti hain. Account verification ke baad aap apne bank account se funds deposit kar sakte hain. Funds deposit karne ke baad aap exchange par Bitcoin ki current price ke according order place kar sakte hain. Aap apne funds ke hisab se Bitcoin khareed sakte hain. Jab aapka order execute hota hai aapki Bitcoin aapke exchange account mein transfer ho jati hai.  Bitcoin bechne ke liye bhi aapko exchange par account banana hota hai. Aap apne exchange account mein Bitcoin transfer karke use sell order ke through bech sakte hain. Jab aapka sell order execute hota hai, aapki Bitcoin sell ho jati hai aur aapki currency exchange account mein funds credit ho jate hain. Ye exchanges aksar market orders aur limit orders jaisi trading options bhi pradan karte hain. Market order mein aap current market price par instant buy/sell kar sakte hain, jabki limit order mein aap apni marzi ke price par buy/sell kar sakte hain aur order execution ke liye wait kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Bitcoin bechne ke liye bhi aapko exchange par account banana hota hai. Aap apne exchange account mein Bitcoin transfer karke use sell order ke through bech sakte hain. Jab aapka sell order execute hota hai, aapki Bitcoin sell ho jati hai aur aapki currency exchange account mein funds credit ho jate hain. Ye exchanges aksar market orders aur limit orders jaisi trading options bhi pradan karte hain. Market order mein aap current market price par instant buy/sell kar sakte hain, jabki limit order mein aap apni marzi ke price par buy/sell kar sakte hain aur order execution ke liye wait kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

in a forex chart. It is a pattern that traders use to identify potential entry and exit points. The pattern is formed when there is a clear resistance level and a series of higher lows. Traders often look for a breakout above the resistance level as an indication that the price will continue to rise.Characteristics of a Rising TriangleThe rising triangle pattern is characterized by a horizontal resistance level and a rising trendline. The resistance level is created by multiple highs that are roughly the same price level. The rising trendline is created by a series of higher lows. As the price approaches the resistance level, it becomes more likely that the price will break out and continue to rise.Trading Strategies Using a Rising TriangleTraders can use the rising triangle pattern to identify potential entry and exit points. If the price breaks out above the resistance level, traders may consider buying the currency pair. If the price fails to break out, traders may consider selling the currency pair or waiting for a clearer signal.It's important to note that the rising triangle pattern is not foolproof and can sometimes lead to false breakouts. Traders should always use other technical indicators and analysis to confirm their trading dsadool masalas ko masalas ke patteren ki tamam tagayuraat ke liye nuqta aaghaz ke tor par dekha ja sakta hai. jaisa ke naam se pata chalta hai, chart par do mutazaad trained lines bananay ke baad aik masalas dekha ja sakta hai. sadool aur dosray masalas patteren ke darmiyan farq yeh hai ke sadool masalas aik ghair janabdaar patteren hai aur kisi bhi simt mein jhuka nahi hai. agarchay masalas khud ghair janabdaar hai, yeh ab bhi mojooda rujhan ki simt ka haami hai aur tajir rujhan ki simt mein break out talaash karte hain. sadool masalas chart patteren sadool masalas tijarti hikmat e amli masalas break out trading ke liye pemaiesh ki aik mo-asar taknik faraham karte hain, aur is taknik ko deegar tagayuraat par bhi dhaal kar laago kya ja sakta hai. zail mein aud / usd chart sadool masalas ko zahir karta hai. oopri aur zaireen trained line ke darmiyan amoodi faaslay ko mapa ja sakta hai aur munasib hadaf ki passion goi karne ke liye istemaal kya ja sakta hai jab qeemat hamwar masalas se bahar ho jaye. yeh note karna zaroori hai ke kaamil sadool masalas talaash karna intehai nayaab hai aur taajiron ko namukammal namonon ko baatil karne mein ziyada jald baazi nahi karni chahiye. taajiron ko samjhna chahiye ke masalas ka tajzia kaamil namona talaash karne ke baray mein kam hai aur qeemat ke amal ke zariye yeh samajhney ke baray mein ke market kya baat kar rahi hai .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:40 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим