LEVERAGE AND ITS TYPES:

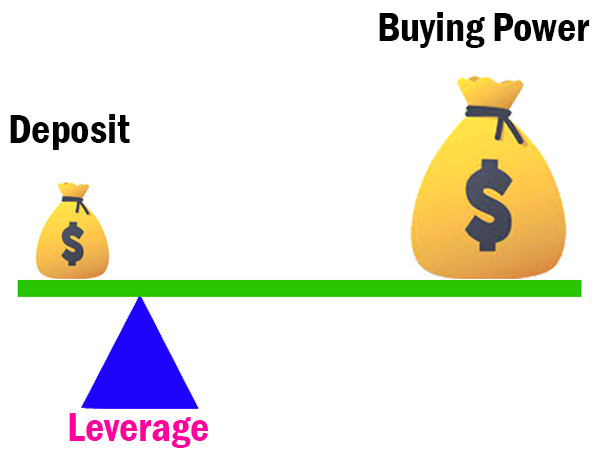

Forex trading mein leverage ka istemaal hota hai ta k traders kam paise se bhi bady positions control kar sakein. Leverage ap ko apne invest kiye gaye amount se zyada position khareedne ya bechne ki opportunity deta hai.

Leverage forex trading mein ek important concept hai. Yeh traders ko kam paise se bady positions handle karne ki opportunity deta hai, lekin is me risk bhi hota hai.

Types of Leverage:

1.Margin-Based Leverage:

Yeh sab se common type hai. Ap apne trading account mein margin deposit karty hain, aur broker baki ke paise provide karta hai ta k ap larger positions le sakein.

2.Real Leverage:

Yeh apki actual investment amount aur borrowed amount ke ratio ko describe karta hai. For example, agar apne $1000 invest kiye hain aur broker ne $4000 provide kiye hain toh apki real leverage 1:4 hogi.

3.Effective Leverage:

Yeh ap ki open positions aur equity ke ratio ko describe karta hai. Agar ap ne $10,000 ka trade kiya hai aur ap ki equity $2,000 hai tuh effective leverage 5:1 hogi.

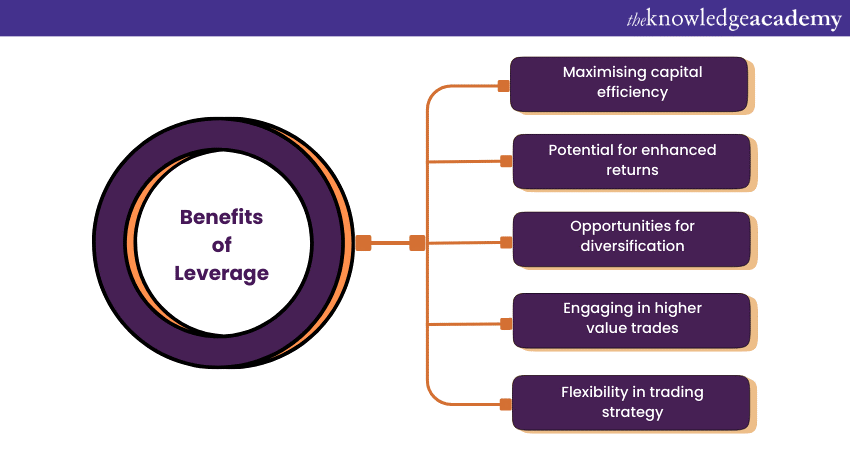

Leverage ka istemaal kar k ap apne profits ko amplify kar sakty hain, lekin is ke sath hi loss bhi badh sakta hai. Agar market against chali gayi toh apko jayada nuksan ho sakta hai, aur ap apni invested amount se zyada bhi khota sakty hain.

Isliye, leverage ka istemaal karne se pehle market conditions ko dhyan se analyze karna aur risk management strategies ka istemaal karna zaroori hai. Nuksan se bachne ke liye stop-loss orders ka bhi istemaal kiya ja sakta hai.

Forex trading mein leverage ka istemaal hota hai ta k traders kam paise se bhi bady positions control kar sakein. Leverage ap ko apne invest kiye gaye amount se zyada position khareedne ya bechne ki opportunity deta hai.

Leverage forex trading mein ek important concept hai. Yeh traders ko kam paise se bady positions handle karne ki opportunity deta hai, lekin is me risk bhi hota hai.

Types of Leverage:

1.Margin-Based Leverage:

Yeh sab se common type hai. Ap apne trading account mein margin deposit karty hain, aur broker baki ke paise provide karta hai ta k ap larger positions le sakein.

2.Real Leverage:

Yeh apki actual investment amount aur borrowed amount ke ratio ko describe karta hai. For example, agar apne $1000 invest kiye hain aur broker ne $4000 provide kiye hain toh apki real leverage 1:4 hogi.

3.Effective Leverage:

Yeh ap ki open positions aur equity ke ratio ko describe karta hai. Agar ap ne $10,000 ka trade kiya hai aur ap ki equity $2,000 hai tuh effective leverage 5:1 hogi.

Leverage ka istemaal kar k ap apne profits ko amplify kar sakty hain, lekin is ke sath hi loss bhi badh sakta hai. Agar market against chali gayi toh apko jayada nuksan ho sakta hai, aur ap apni invested amount se zyada bhi khota sakty hain.

Isliye, leverage ka istemaal karne se pehle market conditions ko dhyan se analyze karna aur risk management strategies ka istemaal karna zaroori hai. Nuksan se bachne ke liye stop-loss orders ka bhi istemaal kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим