BLIND TRADING:-

"Blind trading" aam taur par ishaaron, strategy ya market ki shartein sahi se samajhay baghair kisi bhi financial market mein trading ko refer karta hai. Ye ek risky tareeqa hai jahan traders faislay bina relevant malumat ko madde nazar rakhe, sirf intehai ya kismet par bharosa karke lete hain. Blind trading ko forex (foreign exchange) market mein amooman nahi pasand kya jata hai, kyun ki is se maali nuqsaan hone ke imkaanat bohot zyada barh jati hain.

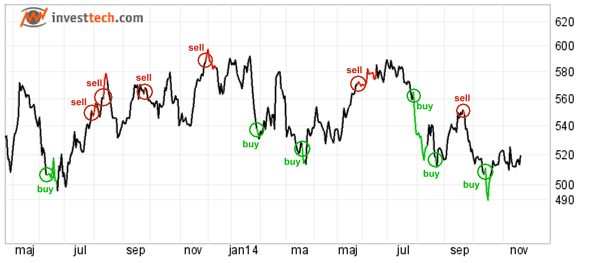

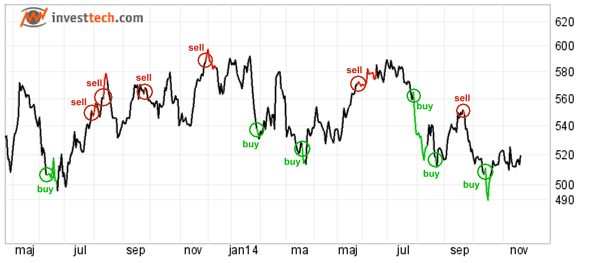

Forex market mein kamyabi hasil karne ke liye aam taur par market trends, technical aur fundamental analysis, risk management, aur achi tarah se define ki gayi trading strategy ka dhyan se istemal hota hai. Traders aksar charts, indicators, aur economic news ka istemal karte hain takay woh maqool faislay kar sakein.

Agar aap forex trading mein dilchaspi rakhte hain, toh zaroori hai ke aap apne aap ko market, risk management principles, aur mukhtalif trading strategies ke bare mein malumat hasil karen. Blind trading ko lambay arsay tak kamyab hone ke liye manzoor nahi kiya jata, isay bachne ke bajaye, apne aap ko malumat aur hunar mein mustahkem karne par tawajju den.

BLIND TRADING KI GUIDELINES:-

"Blind trading" aam taur par ishaaron, strategy ya market ki shartein sahi se samajhay baghair kisi bhi financial market mein trading ko refer karta hai. Ye ek risky tareeqa hai jahan traders faislay bina relevant malumat ko madde nazar rakhe, sirf intehai ya kismet par bharosa karke lete hain. Blind trading ko forex (foreign exchange) market mein amooman nahi pasand kya jata hai, kyun ki is se maali nuqsaan hone ke imkaanat bohot zyada barh jati hain.

Forex market mein kamyabi hasil karne ke liye aam taur par market trends, technical aur fundamental analysis, risk management, aur achi tarah se define ki gayi trading strategy ka dhyan se istemal hota hai. Traders aksar charts, indicators, aur economic news ka istemal karte hain takay woh maqool faislay kar sakein.

Agar aap forex trading mein dilchaspi rakhte hain, toh zaroori hai ke aap apne aap ko market, risk management principles, aur mukhtalif trading strategies ke bare mein malumat hasil karen. Blind trading ko lambay arsay tak kamyab hone ke liye manzoor nahi kiya jata, isay bachne ke bajaye, apne aap ko malumat aur hunar mein mustahkem karne par tawajju den.

BLIND TRADING KI GUIDELINES:-

- Shuruwat Mein Chhote Invest Se Shuru Karein: Forex trading mein shuruwat mein chhota paisa lagayein aur dheere dheere apne experience aur confidence ke sath investment ko barhayein.

- Tajwezat Aur Market News Ka Dhyan Rakhein: Forex market mein hone wale tajwezat aur market news ko regularly monitor karein. Economic calendars ka istemal karein takay aap future market movements ka andaza laga sakein.

- Demo Account Istemal Karein: Apne strategies ko test karne ke liye demo account ka istemal karein. Isse aap real money use kiye bina trading ko practice kar sakte hain.

- Risk Aur Reward Ko Samjhein: Har trade mein risk aur reward ka moolyaan karein. Apne trades ke liye stop-loss aur take-profit levels tay karein. Yeh aapko nuksanat se bachane mein aur munafa kamane mein madad karenge.

- Emotions Par Control Banayein: Trading mein emotions par control rakhna bahut zaroori hai. Ghabrahat ya hawasat mein trading na karein, aur hamesha apne tajwezat ko logic aur analysis par base karein.

- Educate Yourself: Forex market mein constant learning ka amal zaroori hai. Market trends, technical analysis, aur fundamental factors ke bare mein updated rahiye.

- Trading Journal Banayein: Apne har trade ka record rakhein. Isse aap apne mistakes ko identify kar sakte hain aur future mein behtar trading decisions lene mein madad milegi.

- Diversification Ka Khayal Rakhein: Apne portfolio ko diversify karein taake aap ek hi currency pair ya instrument par depend na rahein.

- Professional Advice: Agar aap beginner hain toh professional advice hasil karna faydemand ho sakta hai. Financial advisors ya experienced traders se consult karein.

- Sabr Aur Istiqamat: Forex trading mein kamyabi hasil karne ke liye sabr aur istiqamat bahut zaroori hai. Market mein ups and downs hote hain, lekin consistent efforts aur analysis se aap apne trading skills ko behtar bana sakte hain.

تبصرہ

Расширенный режим Обычный режим